Toronto Housing Market Cools: Sales Plummet 23%, Prices Dip 4%

Table of Contents

Reasons Behind the Toronto Housing Market Slowdown

Several interconnected factors contribute to the recent slowdown in the Toronto housing market. Understanding these reasons is crucial for navigating this evolving landscape.

Increased Interest Rates

The Bank of Canada's aggressive interest rate hikes are a primary driver of the cooling market. These increases have significantly impacted mortgage affordability, reducing purchasing power for many potential homebuyers.

- The Bank of Canada has raised interest rates by X% since [Start Date], leading to a substantial increase in mortgage payments.

- Borrowers with variable-rate mortgages have seen immediate increases in their monthly payments, while those with fixed-rate mortgages will face higher rates upon renewal.

- This increase in interest rates translates to a Y% reduction in the average home buyer's purchasing power, effectively shrinking the pool of potential buyers.

Economic Uncertainty

Beyond interest rates, broader economic uncertainty plays a significant role. Inflation, recessionary fears, and potential job losses are impacting consumer confidence, making potential homebuyers more hesitant to commit to large purchases.

- Inflation remains stubbornly high, eroding purchasing power and impacting household budgets.

- Concerns about a potential recession are leading to a more cautious approach to major financial commitments like buying a home.

- Uncertainty in the job market, with potential job losses in certain sectors, further dampens buyer confidence in the Toronto real estate market.

High Inventory Levels

Increased housing inventory is another key factor. A higher number of properties on the market increases competition among sellers, leading to price adjustments and longer selling times.

- The number of homes for sale in Toronto has increased by Z% compared to the same period last year, reflecting a significant rise in inventory.

- This increase is particularly noticeable in the [Type of Property] segment of the market.

- The higher inventory levels directly correlate with a decrease in average sale prices, providing more leverage to buyers in negotiations.

Impact on Toronto Home Buyers and Sellers

The cooling Toronto housing market presents distinct implications for both buyers and sellers.

Opportunities for Buyers

The current market shift offers several advantages for buyers in Toronto.

- Lower prices and reduced competition provide opportunities to negotiate better deals and secure properties at more favorable prices compared to the previous seller's market.

- Buyers have more time to consider their options and make informed decisions without the pressure of intense competition.

- The current market conditions allow for more strategic home-buying strategies, potentially leading to significant savings.

Challenges for Sellers

Sellers in Toronto face a more challenging environment.

- Sellers need to price their properties competitively to attract buyers in a less active market.

- Selling times are likely to be longer compared to the previous seller's market.

- Effective marketing and professional presentation are crucial to stand out and attract potential buyers.

Future Outlook for the Toronto Housing Market

Predicting the future of the Toronto housing market requires considering various factors.

Predictions and Forecasts

Experts offer mixed predictions. Some anticipate a continued cooling trend, while others foresee stabilization or even a potential rebound in the coming months or years.

- [Source 1] predicts a further X% price decrease in the next year.

- [Source 2] anticipates a market stabilization in the next quarter.

- [Source 3] suggests a potential rebound in the market driven by [Reason].

Long-Term Trends

Long-term trends, such as population growth and infrastructure development, will continue to influence the Toronto housing market.

- Toronto's continued population growth will likely exert upward pressure on housing demand in the long term.

- Infrastructure investments, such as the expansion of public transit, could influence housing prices in specific areas.

Conclusion

The Toronto housing market is undeniably cooling, with a significant drop in sales and prices driven by increased interest rates, economic uncertainty, and higher inventory levels. This shift presents opportunities for buyers seeking more favorable conditions but challenges sellers who need to adapt to a less active market. While the short-term outlook remains uncertain, long-term factors suggest ongoing influence on Toronto real estate. Stay updated on the Toronto housing market by following reputable real estate news sources, subscribing to market analysis reports, and seeking the advice of experienced real estate professionals. Monitor the Toronto real estate trends closely to make informed decisions in this dynamic market. Learn more about navigating the Toronto housing market cooldown by connecting with a local expert.

Featured Posts

-

Counting Crows Snl Appearance A Defining Moment

May 08, 2025

Counting Crows Snl Appearance A Defining Moment

May 08, 2025 -

Spk Dan Kripto Piyasalarina Dair Oenemli Aciklama

May 08, 2025

Spk Dan Kripto Piyasalarina Dair Oenemli Aciklama

May 08, 2025 -

Investing In 2025 Micro Strategy Stock Compared To Bitcoin

May 08, 2025

Investing In 2025 Micro Strategy Stock Compared To Bitcoin

May 08, 2025 -

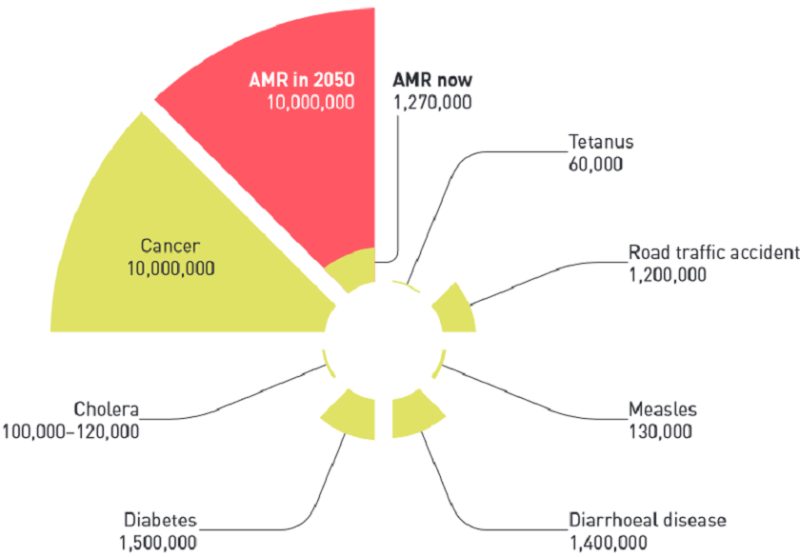

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025

Latest Posts

-

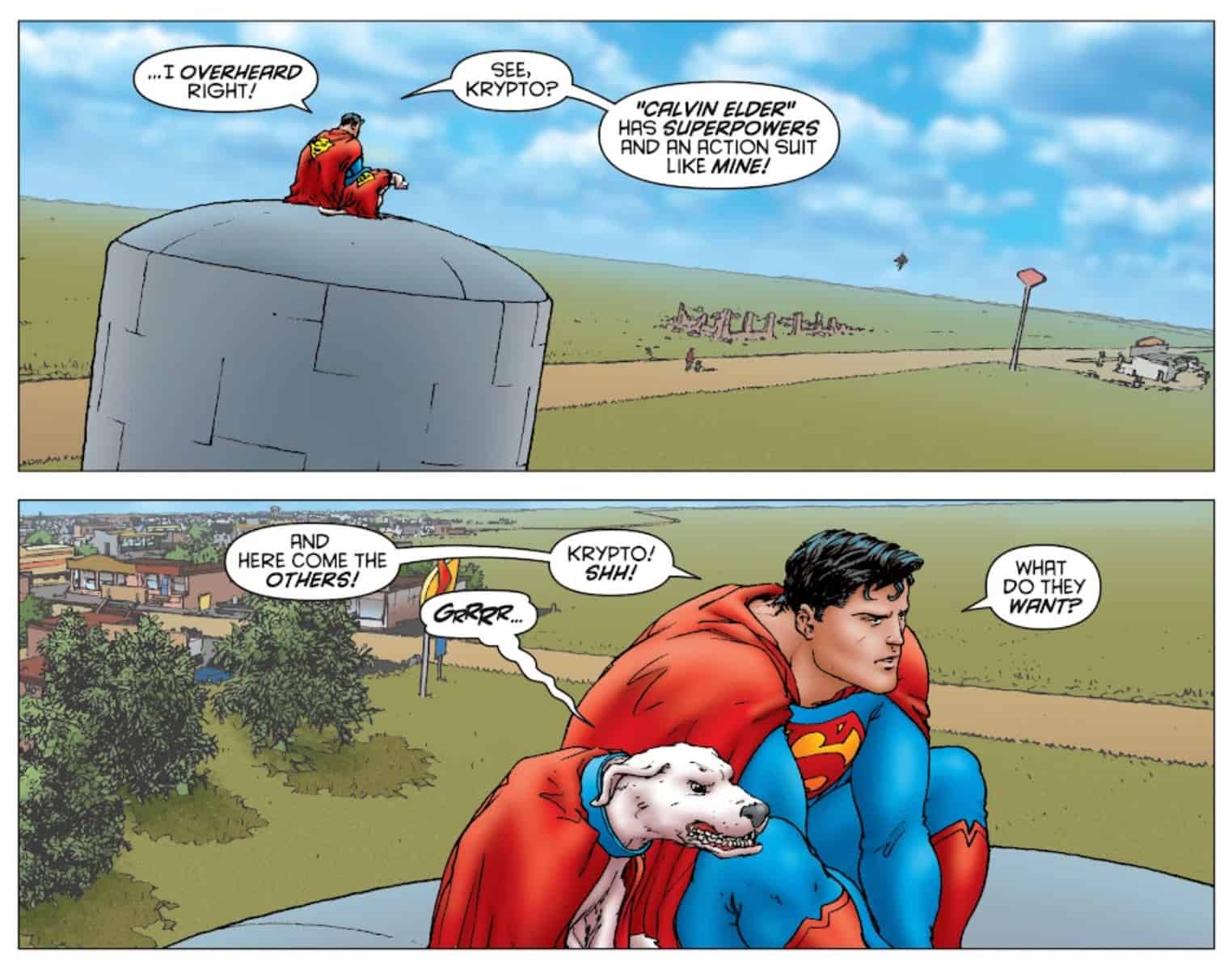

Exploring The Mythology Krypto And The Dc Universe

May 08, 2025

Exploring The Mythology Krypto And The Dc Universe

May 08, 2025 -

Dcs Krypto The Last Dog Of Krypton Production And Marketing Strategies

May 08, 2025

Dcs Krypto The Last Dog Of Krypton Production And Marketing Strategies

May 08, 2025 -

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025 -

Exclusive Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025

Exclusive Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025 -

Darkseids Legion A Devastating Attack On Superman In Dcs July 2025 Comics

May 08, 2025

Darkseids Legion A Devastating Attack On Superman In Dcs July 2025 Comics

May 08, 2025