Billions In Crypto Options Expire: Bitcoin And Ethereum Face Volatility

Table of Contents

Understanding Crypto Options Expiry and its Impact

Crypto options, similar to traditional options, are contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a predetermined price (strike price) on or before a specific date (expiration date). The expiry of these options significantly impacts market price because a large number of contracts need to be settled. This settlement process involves buyers and sellers fulfilling their contractual obligations, leading to a surge in buying or selling pressure depending on the market sentiment.

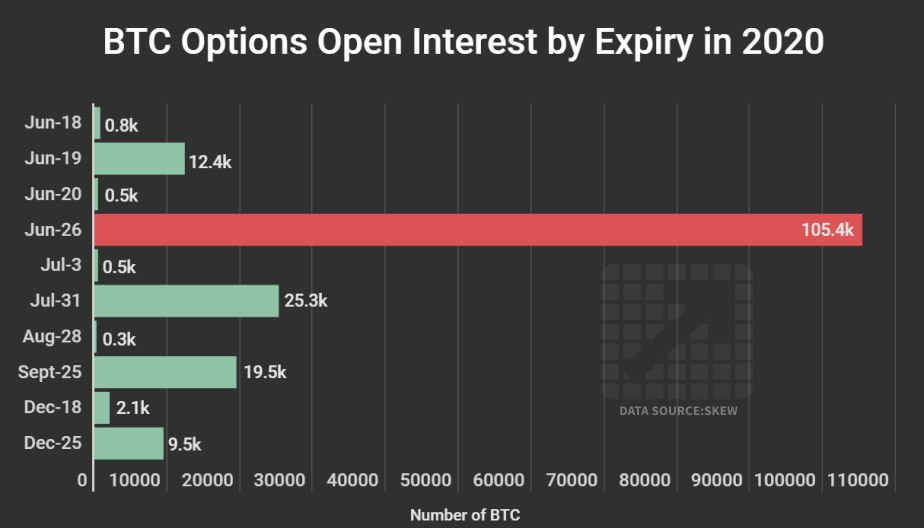

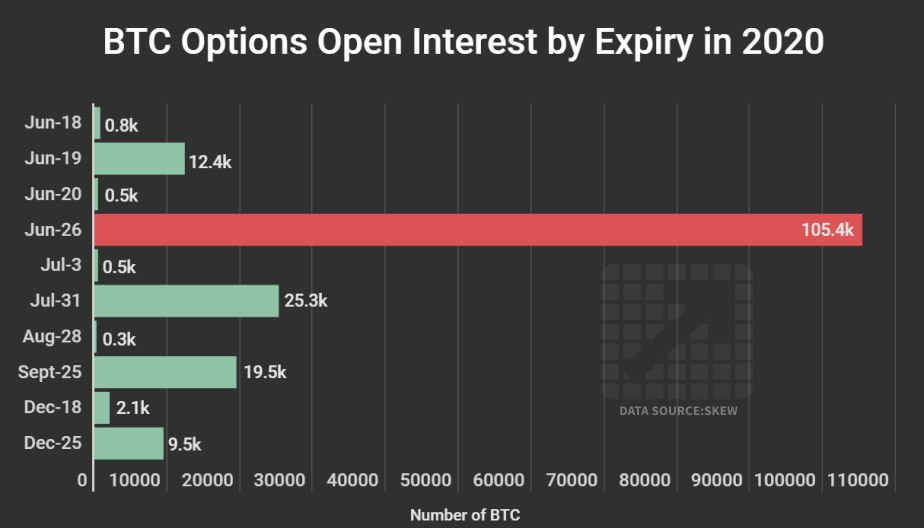

Open interest, which represents the total number of outstanding options contracts, is a key indicator of potential market movement. High open interest suggests a substantial number of contracts that could be exercised near the expiry date, potentially leading to significant price swings.

- Calls vs. Puts: Call options profit when the cryptocurrency price rises above the strike price at expiry, while put options profit when the price falls below it.

- Large Open Interest and Volatility: A large open interest significantly increases the potential for volatility as a massive number of contracts need to be settled simultaneously. This can create sudden and substantial price movements.

- Potential for Price Manipulation: While not always the case, large holders can influence prices around expiry by strategically exercising or letting options expire, creating artificial upward or downward pressure.

Bitcoin's Exposure during Options Expiry

Bitcoin, being the dominant cryptocurrency, is highly sensitive to market events like options expiries. The current market conditions for Bitcoin, including its recent price action and overall sentiment, will significantly influence its response to this large options expiry. Analyzing the open interest specifically in Bitcoin options contracts is crucial for predicting potential price movements.

Historical data from previous Bitcoin options expiries reveals a pattern of increased volatility surrounding the expiry dates. Studying these past events allows for a better understanding of how Bitcoin might react this time.

- On-chain Metrics: Monitoring on-chain metrics like whale activity (large transactions) can provide insights into potential market manipulation or large-scale buying/selling pressure around the expiry.

- Support and Resistance Levels: Identifying key support and resistance levels on Bitcoin's price chart helps gauge potential price ranges during the volatile period.

- Macroeconomic Factors: Global economic factors, such as inflation rates or regulatory changes, can significantly influence Bitcoin's price volatility and its reaction to the options expiry.

Ethereum's Vulnerability during this Options Expiry

Ethereum, while second to Bitcoin in market capitalization, also faces significant exposure to this options expiry. Its correlation with Bitcoin means that Ethereum's price often moves in tandem with Bitcoin's. However, Ethereum-specific news and developments can also impact its price independently. Analyzing these factors is vital in assessing Ethereum's vulnerability.

- Ethereum Development: The ongoing development of Ethereum's scaling solutions (like sharding) and its role in the DeFi ecosystem will influence investor sentiment and potentially mitigate or exacerbate the impact of the options expiry.

- Support and Resistance Levels: Identifying Ethereum's support and resistance levels helps predict its potential price movements during the volatile period.

- DeFi Activity: The level of activity within the decentralized finance (DeFi) ecosystem built on Ethereum can impact its price significantly and interact with the volatility from the options expiry.

Strategies for Navigating the Volatility

Navigating the increased volatility during this options expiry requires careful risk management. It's crucial to remember that this is not financial advice.

- Diversification: Diversifying your crypto portfolio across different assets can help mitigate losses if one cryptocurrency experiences a sharp price drop.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This can reduce the impact of short-term volatility.

- Hedging: Sophisticated investors might consider hedging strategies to protect against potential losses, but these strategies carry their own risks.

- Staying on the Sidelines: For less risk-tolerant investors, waiting for the volatility to subside might be the most prudent strategy.

- Stop-Loss Orders: Setting stop-loss orders can help automatically limit potential losses if the price moves against your position.

- Only Invest What You Can Afford to Lose: This fundamental rule of investing is paramount, especially during periods of heightened uncertainty.

Conclusion: Billions in Crypto Options Expiry: Preparing for Market Volatility

The upcoming expiry of billions of dollars worth of cryptocurrency options presents a significant event with the potential to significantly impact Bitcoin and Ethereum prices. The increased volatility expected underscores the importance of understanding the risks associated with crypto investments. This article highlighted the mechanics of crypto options, analyzed the potential impact on Bitcoin and Ethereum, and offered strategies for managing risk during this period.

Stay informed about the crypto market and continue researching the impact of future crypto options expiry events on Bitcoin and Ethereum prices. Share this article with others interested in crypto volatility and Bitcoin/Ethereum price movements to help spread awareness of this important market event.

Featured Posts

-

Fixing Ps 5 Game Stuttering A Step By Step Tutorial

May 08, 2025

Fixing Ps 5 Game Stuttering A Step By Step Tutorial

May 08, 2025 -

Understanding The Dynamics Of New Business Hot Spots Across The Nation

May 08, 2025

Understanding The Dynamics Of New Business Hot Spots Across The Nation

May 08, 2025 -

First Trailer Released Mark Hamill Stars In Stephen Kings The Long Walk Adaptation

May 08, 2025

First Trailer Released Mark Hamill Stars In Stephen Kings The Long Walk Adaptation

May 08, 2025 -

Bitcoin In Son Durumu Ne Guencel Degeri Ve Analizi

May 08, 2025

Bitcoin In Son Durumu Ne Guencel Degeri Ve Analizi

May 08, 2025 -

Grayscales Xrp Etf Filing And The Subsequent Outperformance Of Xrp Against Bitcoin

May 08, 2025

Grayscales Xrp Etf Filing And The Subsequent Outperformance Of Xrp Against Bitcoin

May 08, 2025

Latest Posts

-

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025 -

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025 -

9 4000 2 360

May 08, 2025

9 4000 2 360

May 08, 2025