Bitcoin Golden Cross: A Cyclical Pattern And Its Implications

Table of Contents

Understanding the Bitcoin Golden Cross

In technical analysis, a Golden Cross is a bullish signal formed by the intersection of two moving averages. It's considered a potential indicator of an upcoming price increase. Specifically, for the Bitcoin Golden Cross, we're looking at the relationship between the 50-day moving average (MA) and the 200-day moving average (MA).

- 50-Day Moving Average (MA): This represents the average closing price of Bitcoin over the past 50 days. It's a shorter-term indicator, more sensitive to recent price fluctuations.

- 200-Day Moving Average (MA): This represents the average closing price of Bitcoin over the past 200 days. It's a longer-term indicator, reflecting the overall trend.

A Bitcoin Golden Cross occurs when the shorter-term 50-day MA crosses above the longer-term 200-day MA. This crossover suggests that the short-term trend is turning bullish, potentially signaling a period of upward price movement.

[Insert simple chart illustrating a Golden Cross here. The chart should clearly show the 50-day MA crossing above the 200-day MA.]

Keywords: Bitcoin Golden Cross, 50-day MA, 200-day MA, moving average, technical analysis, cryptocurrency trading, chart patterns

Historical Performance of Bitcoin Golden Crosses

Analyzing past Bitcoin Golden Crosses reveals mixed results. While some instances have indeed preceded significant price increases, others have not resulted in substantial upward movements. It's crucial to remember that past performance is not indicative of future results. The reliability of the Golden Cross as a predictive tool is limited.

The success of a Golden Cross often depends on broader market conditions. A Golden Cross occurring during a period of generally bullish market sentiment might yield stronger results than one occurring during a bearish trend. Let's examine some examples:

- Example 1: (Insert Date) – A Golden Cross occurred, followed by a [Percentage]% increase in Bitcoin's price over the subsequent [Timeframe].

- Example 2: (Insert Date) – A Golden Cross occurred, followed by a [Percentage]% increase in Bitcoin's price, but this was influenced by [Contributing Factor, e.g., positive regulatory news].

- Example 3: (Insert Date) – A Golden Cross occurred, yet the price increase was minimal, possibly due to [Contrasting Factor, e.g., overall market downturn].

Keywords: Bitcoin price prediction, historical data analysis, cryptocurrency price trends, market cycles, bull market, bear market

Factors Influencing the Implications of a Bitcoin Golden Cross

Several factors beyond the Golden Cross itself can significantly influence its implications:

-

Macroeconomic Factors: Inflation rates, interest rate hikes, and overall economic stability all impact investor sentiment and the price of Bitcoin. High inflation, for instance, might drive investors towards Bitcoin as a hedge against inflation, potentially amplifying the effects of a Golden Cross.

-

Regulatory Developments: Government regulations concerning cryptocurrencies directly impact market confidence. Positive regulatory announcements can bolster investor sentiment, while negative news can trigger sell-offs, potentially negating the bullish signal of a Golden Cross.

-

Bitcoin Adoption and Network Effects: Increased adoption by businesses and institutions strengthens the Bitcoin network, potentially driving up demand and price. This growth in adoption can enhance the positive impact of a Golden Cross.

-

Other Technical Indicators: Relying solely on the Golden Cross is risky. Traders should consider other technical indicators (RSI, MACD, Bollinger Bands) and fundamental analysis to gain a more comprehensive understanding of the market before making investment decisions.

-

Bullet points:

- Impact of regulatory announcements: Positive news can boost the effect of a Golden Cross; negative news can diminish it.

- Influence of institutional investment: Large-scale institutional buying can significantly increase Bitcoin's price, magnifying the Golden Cross’s effect.

- Effect of widespread media coverage: Positive media attention can increase investor interest, thus amplifying the Golden Cross’s impact.

Keywords: Bitcoin adoption, regulatory landscape, macroeconomic factors, institutional investors, Bitcoin news, market sentiment

False Signals and Limitations

It's crucial to acknowledge that the Bitcoin Golden Cross isn't foolproof. There have been instances where a Golden Cross occurred, yet the predicted price increase didn't materialize. This highlights the limitations of relying solely on this single indicator.

- Risk management: Diversify your portfolio. Never invest more than you can afford to lose.

- Trading strategy: Combine technical analysis (like the Golden Cross) with fundamental analysis for a more comprehensive approach.

- Technical indicators: Use a range of indicators, not just the Golden Cross, to confirm trading signals.

- Cryptocurrency investment: Understand the risks involved in cryptocurrency trading.

Keywords: Risk management, trading strategy, technical indicators, cryptocurrency investment, false signals

Conclusion

The Bitcoin Golden Cross is a valuable technical indicator offering insights into potential price movements. However, its historical performance isn't always a perfect predictor. Understanding the context surrounding a Golden Cross, encompassing macroeconomic conditions and broader market sentiment, is essential for informed decision-making. Therefore, while the Bitcoin Golden Cross can be a useful tool, it shouldn't be the sole basis for your investment strategy. Remember to conduct thorough research and consider diversifying your portfolio before making any investment decisions related to the Bitcoin Golden Cross or any other cryptocurrency. Learn more about utilizing the Bitcoin Golden Cross and other technical indicators for informed trading strategies.

Featured Posts

-

Psg Nantes Mac 0 0 Berabere Bitti

May 08, 2025

Psg Nantes Mac 0 0 Berabere Bitti

May 08, 2025 -

Unveiling A Rogue One Legend A New Star Wars Series

May 08, 2025

Unveiling A Rogue One Legend A New Star Wars Series

May 08, 2025 -

Grbovic Kompromis Je Kljucan Za Formiranje Prelazne Vlade

May 08, 2025

Grbovic Kompromis Je Kljucan Za Formiranje Prelazne Vlade

May 08, 2025 -

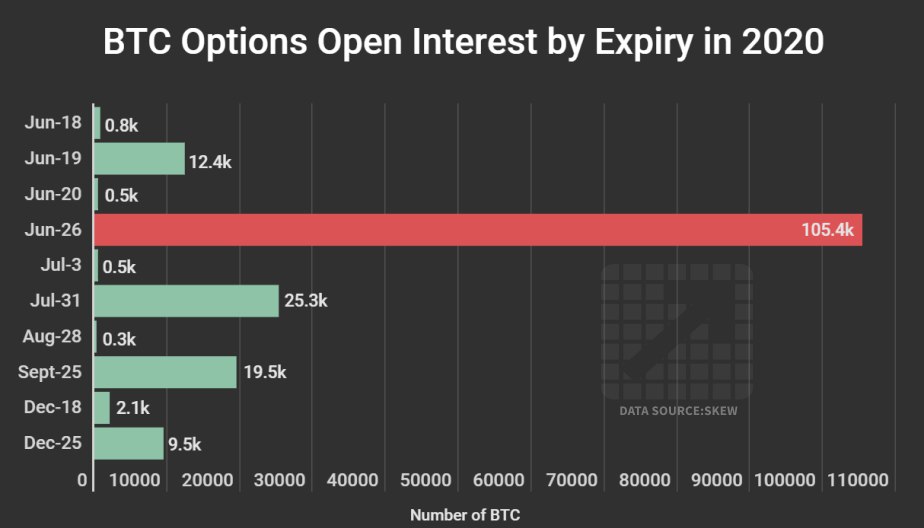

Billions In Crypto Options Expire Bitcoin And Ethereum Face Volatility

May 08, 2025

Billions In Crypto Options Expire Bitcoin And Ethereum Face Volatility

May 08, 2025 -

The Night Counting Crows Changed Snls Role In Their Success

May 08, 2025

The Night Counting Crows Changed Snls Role In Their Success

May 08, 2025

Latest Posts

-

Altcoins 5880 Projected Rally Why Crypto Whales Are Betting Big

May 08, 2025

Altcoins 5880 Projected Rally Why Crypto Whales Are Betting Big

May 08, 2025 -

Best Krypto Stories Of All Time A Comprehensive List

May 08, 2025

Best Krypto Stories Of All Time A Comprehensive List

May 08, 2025 -

5880 Price Surge Predicted Is This New Xrp The Next Big Crypto Investment

May 08, 2025

5880 Price Surge Predicted Is This New Xrp The Next Big Crypto Investment

May 08, 2025 -

Is Supermans Dcu Debut Coming Sooner Than Expected

May 08, 2025

Is Supermans Dcu Debut Coming Sooner Than Expected

May 08, 2025 -

Unforgettable Krypto Stories A Readers Guide

May 08, 2025

Unforgettable Krypto Stories A Readers Guide

May 08, 2025