Bitcoin Market Reversal: Binance Buying Volume Dominates Selling

Table of Contents

Binance's Dominant Role in the Recent Bitcoin Market Reversal

Binance, the world's largest cryptocurrency exchange by trading volume, has played a dominant role in the recent Bitcoin market reversal. Its influence on Bitcoin price movements is undeniable, and understanding its role is critical to analyzing this market shift. The sheer scale of Binance trading volume compared to other major exchanges like Coinbase and Kraken is striking. This dominance translates directly into significant market impact.

-

Analyzing Binance's trading volume compared to other major exchanges: Data shows that Binance consistently handles a larger percentage of global Bitcoin trading volume than its competitors. This high volume amplifies any shift in buying or selling pressure, making it a key indicator of market sentiment. Independent research firms consistently rank Binance at the top, solidifying its position as a market leader.

-

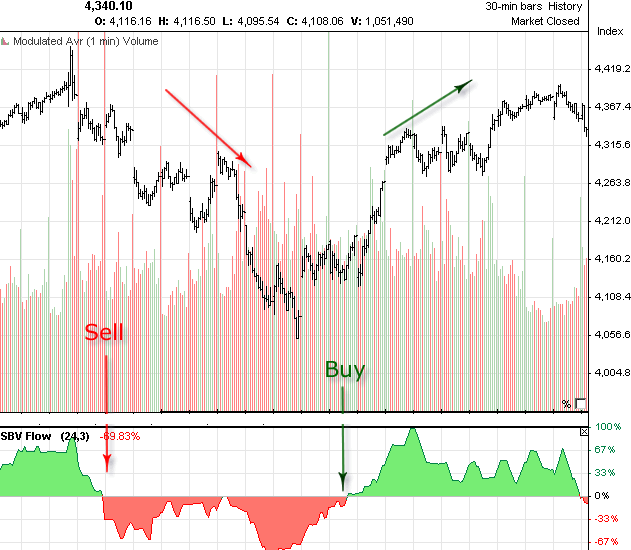

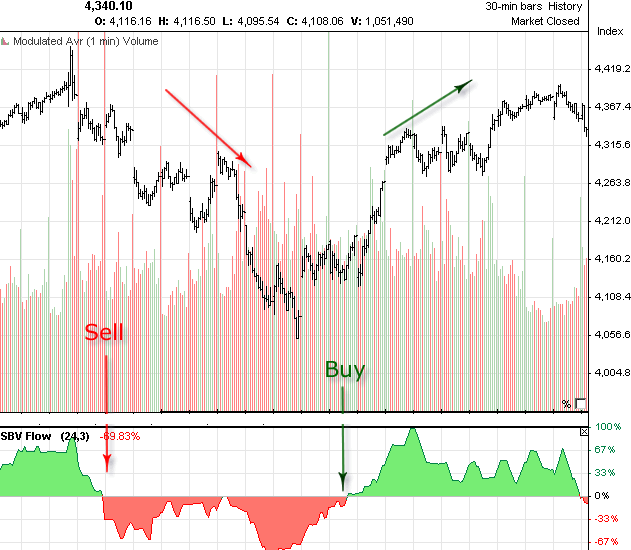

Graphical representation of buying vs. selling volume on Binance: [Insert a chart or graph here visually representing Binance's buying and selling volume for Bitcoin over a specific period. Ensure the source is clearly cited.] This visual representation will clearly demonstrate the disparity between buying and selling activity, highlighting the dominance of buying volume on Binance.

-

Significant price changes correlated with Binance’s trading activity: We can observe a strong correlation between periods of high buying volume on Binance and subsequent increases in Bitcoin's price. Conversely, periods of high selling volume often precede price drops. This correlation further underscores Binance’s influence on Bitcoin price.

Factors Contributing to Increased Buying Volume on Binance

Several factors contribute to the increased buying pressure observed on Binance. Understanding these factors is crucial for predicting future trends in the Bitcoin market.

-

The role of institutional investors: The entry of institutional investors into the cryptocurrency market, particularly through regulated channels, is a significant catalyst. These large players often execute trades in substantial volumes, influencing market dynamics on exchanges like Binance.

-

Impact of positive regulatory news or announcements: Positive developments in regulatory frameworks for cryptocurrencies can boost investor confidence, leading to increased buying activity. Favorable announcements or policy changes in major jurisdictions often translate into higher trading volumes on major exchanges.

-

Influence of retail investors and their trading behavior: Retail investor sentiment plays a considerable role. Positive news, social media trends, and even celebrity endorsements can drive retail buying frenzies, further adding to the volume on platforms like Binance.

-

Effect of macroeconomic factors on Bitcoin's price: Macroeconomic factors like inflation, economic uncertainty, and geopolitical events can also influence Bitcoin's price. Investors often view Bitcoin as a hedge against inflation, leading to increased demand during periods of economic instability. This increased demand is often reflected in the trading volume on exchanges like Binance.

Analyzing the Implications of This Market Reversal

The observed Bitcoin market reversal, driven largely by Binance's trading activity, has several potential implications.

-

Potential short-term price targets for Bitcoin: Based on current market data and technical analysis, [insert a cautiously worded short-term price prediction]. It's crucial to remember that price predictions are inherently uncertain.

-

Possibility of a sustained bullish trend: The sustained high buying volume on Binance could indicate a shift towards a sustained bullish trend. However, this is not guaranteed, and market volatility can quickly reverse the situation.

-

Potential risks and downside scenarios: While a bullish trend is possible, it’s critical to acknowledge potential risks. Regulatory uncertainty, macroeconomic headwinds, and sudden shifts in investor sentiment could trigger a market correction.

-

Cautious predictions based on the current market data: Given the current data, a cautious optimistic outlook might be warranted. However, continuous monitoring of the market is crucial, as the situation can change rapidly.

Technical Analysis of the Bitcoin Market Reversal

[Insert a technical analysis section with charts and indicators. This section should discuss relevant chart patterns, support and resistance levels, and any significant technical indicators that support or contradict the observed market reversal. Clearly cite sources for all data.] Technical analysis offers an additional layer of insight into the dynamics of the Bitcoin market reversal. This analysis should complement the fundamental analysis conducted earlier.

Conclusion

This analysis of the Bitcoin market reversal highlights the significant impact of Binance's trading volume on recent price movements. While the factors driving this shift are complex and multifaceted, the data strongly suggests a surge in buying pressure, potentially signaling a bullish trend. However, market volatility remains a key consideration. The interplay between institutional investors, retail traders, regulatory developments, and macroeconomic factors significantly impacts the Bitcoin price, especially when observed through the lens of Binance's dominant trading volume.

Call to Action: Stay informed about this evolving situation by following our regular updates on the Bitcoin market. Understanding the dynamics of Bitcoin trading volume, particularly on major exchanges like Binance, is crucial for navigating the complexities of the cryptocurrency market and making informed investment decisions. Keep monitoring the Bitcoin market reversal and Binance’s influence to capitalize on future opportunities. Remember to always conduct thorough research before making any investment decisions in the volatile cryptocurrency market.

Featured Posts

-

Arsenal Ps Zh Polnaya Istoriya Vstrech V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Polnaya Istoriya Vstrech V Evrokubkakh

May 08, 2025 -

Sonos And Ikeas Symfonisk Collaboration Officially Over Impact And Alternatives

May 08, 2025

Sonos And Ikeas Symfonisk Collaboration Officially Over Impact And Alternatives

May 08, 2025 -

El Legado Historico Del Real Betis

May 08, 2025

El Legado Historico Del Real Betis

May 08, 2025 -

El Betis Un Equipo Historico

May 08, 2025

El Betis Un Equipo Historico

May 08, 2025 -

Zdravstveno Stanje Papeza Zadnje Informacije In Analiza

May 08, 2025

Zdravstveno Stanje Papeza Zadnje Informacije In Analiza

May 08, 2025

Latest Posts

-

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Suggests So

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Suggests So

May 08, 2025 -

Ethereum Price Analysis 2 700 Target In Sight As Accumulation Phase Concludes

May 08, 2025

Ethereum Price Analysis 2 700 Target In Sight As Accumulation Phase Concludes

May 08, 2025 -

Ethereum Price Prediction Could 2 700 Be Next As Wyckoff Accumulation Ends

May 08, 2025

Ethereum Price Prediction Could 2 700 Be Next As Wyckoff Accumulation Ends

May 08, 2025 -

Trump Medias Crypto Etf Venture A Partnership With Crypto Com

May 08, 2025

Trump Medias Crypto Etf Venture A Partnership With Crypto Com

May 08, 2025 -

Impact Of Trump Media And Crypto Coms Etf Partnership On The Crypto Market

May 08, 2025

Impact Of Trump Media And Crypto Coms Etf Partnership On The Crypto Market

May 08, 2025