Is $2,700 The Next Ethereum Price Target? Wyckoff Accumulation Suggests So

Table of Contents

Understanding Wyckoff Accumulation in Ethereum

The Wyckoff method is a technical analysis technique used to identify market phases, specifically accumulation and distribution. It focuses on identifying the behavior of large market players (smart money) and how they manipulate price and volume to accumulate or distribute assets. Applying this to Ethereum's price chart involves looking for specific patterns indicative of accumulation before a significant price move.

How does it apply to Ethereum? By identifying periods of sideways trading with relatively low volume, often characterized by a series of higher lows and lower highs, traders can pinpoint potential accumulation phases. This suggests that large players are quietly buying ETH, creating a base for a future price increase.

- Characteristics of the Wyckoff accumulation phase:

- Sideways price consolidation.

- Relatively low trading volume compared to previous periods of higher volatility.

- Gradual increase in buying pressure, shown by higher lows.

- Testing of key support levels, followed by bounces.

- Occasional strong selling pressure (distribution) to shake out weak holders.

- Identifying potential support and resistance levels: Wyckoff analysis uses support and resistance levels to identify potential price targets. By observing how price reacts to these levels, traders can gauge the strength of the accumulation.

- Examples of past Wyckoff accumulation phases in Ethereum's price history: Analyzing past price charts of ETH can reveal instances where Wyckoff accumulation patterns were evident, followed by substantial price increases. These historical examples can be used to validate the methodology and identify similar patterns in current market conditions.

Evidence Supporting a $2,700 Ethereum Price Target

Several factors point towards a potential $2,700 Ethereum price target. Let's examine the technical indicators, on-chain data, and market sentiment supporting this prediction.

Technical Indicators

Several key technical indicators suggest a bullish outlook for Ethereum.

-

RSI (Relative Strength Index): A reading below 30 often signals oversold conditions, potentially indicating a buying opportunity. Recent RSI readings for ETH have been approaching this level, suggesting a potential bounce.

-

MACD (Moving Average Convergence Divergence): A bullish crossover of the MACD lines can signal an upcoming price increase. Such crossovers have been observed in ETH charts, further supporting a bullish outlook.

-

Moving Averages: The convergence of short-term and long-term moving averages often signals a change in trend. The convergence of these averages in ETH charts could signify the start of an upward trend. (Include charts and visuals here)

-

Specific examples: For instance, a recent RSI reading of 28, coupled with a bullish MACD crossover and the convergence of the 50-day and 200-day moving averages, strongly suggests a potential upward trend.

On-Chain Data

On-chain data provides further evidence supporting the $2,700 Ethereum price target prediction.

-

Active Addresses: A rise in the number of active Ethereum addresses indicates increased network activity and potentially higher demand for ETH.

-

Exchange Reserves: A decrease in ETH held on exchanges suggests that investors are holding onto their coins rather than selling, reflecting bullish sentiment.

-

Transaction Volume: Increased transaction volume indicates higher activity on the Ethereum network, which often precedes price increases.

-

Specific data points: For example, a significant increase in active addresses alongside a decline in exchange reserves and a surge in transaction volume would strongly support the bullish prediction.

Market Sentiment and News

Positive market sentiment and upcoming developments surrounding Ethereum contribute to the bullish outlook.

-

Ethereum's Growing Ecosystem: The constant development and expansion of the Ethereum ecosystem, including the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), continues to drive demand for ETH.

-

Upcoming Upgrades: Anticipated upgrades to the Ethereum network, such as the Shanghai upgrade, can positively impact price by improving scalability and efficiency.

-

Institutional Adoption: Growing institutional adoption of Ethereum further contributes to the bullish sentiment.

-

Key news items: For example, positive news regarding regulatory clarity for cryptocurrencies or successful completion of major network upgrades could significantly boost the price of ETH.

Potential Risks and Challenges

Despite the positive indicators, several risks and challenges could hinder Ethereum's price from reaching $2,700.

-

Overall Market Downturn: A broader cryptocurrency market downturn could negatively impact Ethereum's price, regardless of its fundamental strength.

-

Regulatory Uncertainty: Increased regulatory scrutiny or unfavorable regulatory changes could negatively impact the price of ETH.

-

Competition from Other Cryptocurrencies: Competition from other cryptocurrencies with similar functionalities could affect Ethereum's market share and price.

-

Specific risk factors: For example, a sudden market crash or unexpected negative regulatory news could significantly impact the price, even with strong technical indicators.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment. Always conduct thorough due diligence before making any investment decisions.

Conclusion

The confluence of technical indicators, on-chain data, and positive market sentiment strongly suggests a potential $2,700 Ethereum price target based on Wyckoff accumulation analysis. While we've highlighted bullish indicators, it's crucial to acknowledge the inherent risks in the cryptocurrency market. The increase in active addresses, the decline in exchange reserves, and the bullish signals from the RSI, MACD, and moving averages all contribute to the possibility of Ethereum reaching $2700. However, factors such as broader market downturns and regulatory uncertainty must be considered.

While no prediction is guaranteed, the evidence presented suggests a strong possibility of Ethereum reaching $2,700. Stay informed about Ethereum price movements and continue researching the $2700 Ethereum price target and Wyckoff accumulation analysis to make informed investment decisions. Further research on Ethereum price prediction and crypto price prediction strategies is recommended before making any investment decisions. Remember to conduct thorough due diligence and consider your personal risk tolerance before investing in any cryptocurrency, including Ethereum.

Featured Posts

-

Will Trumps Next Speech Send Bitcoin Soaring Above 100 000 A Price Prediction Analysis

May 08, 2025

Will Trumps Next Speech Send Bitcoin Soaring Above 100 000 A Price Prediction Analysis

May 08, 2025 -

Ripples Xrp Surges Analysis Of The Presidents Trump Related Article

May 08, 2025

Ripples Xrp Surges Analysis Of The Presidents Trump Related Article

May 08, 2025 -

Nereden Izlenir Lyon Psg Lig 1 Maci Canli Yayin Bilgileri

May 08, 2025

Nereden Izlenir Lyon Psg Lig 1 Maci Canli Yayin Bilgileri

May 08, 2025 -

Saturday April 12 2025 Official Lotto And Lotto Plus Numbers

May 08, 2025

Saturday April 12 2025 Official Lotto And Lotto Plus Numbers

May 08, 2025 -

Biggest Oscars Snubs Of All Time Controversial Decisions That Still Sting

May 08, 2025

Biggest Oscars Snubs Of All Time Controversial Decisions That Still Sting

May 08, 2025

Latest Posts

-

Ahtsab Edaltwn Ka Khatmh Wfaqy Hkwmt Ka Fyslh Awr As Ke Athrat

May 08, 2025

Ahtsab Edaltwn Ka Khatmh Wfaqy Hkwmt Ka Fyslh Awr As Ke Athrat

May 08, 2025 -

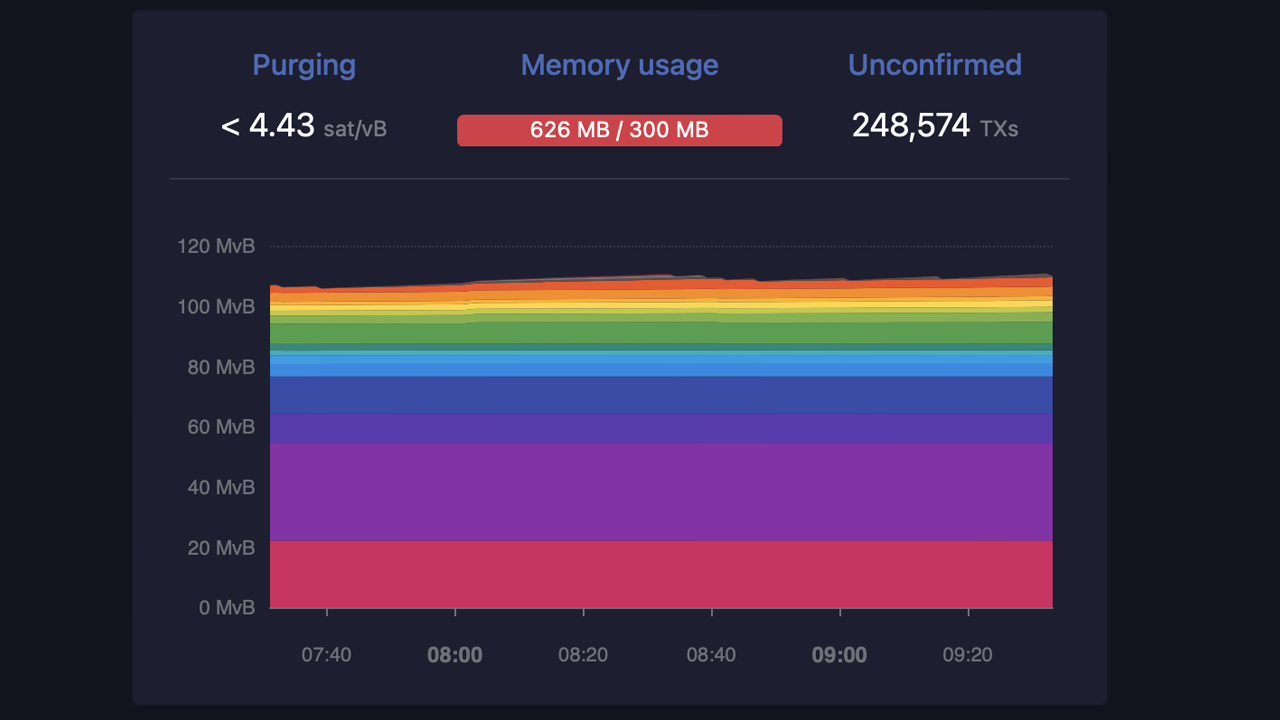

Bitcoin Mining Why The Recent Increase

May 08, 2025

Bitcoin Mining Why The Recent Increase

May 08, 2025 -

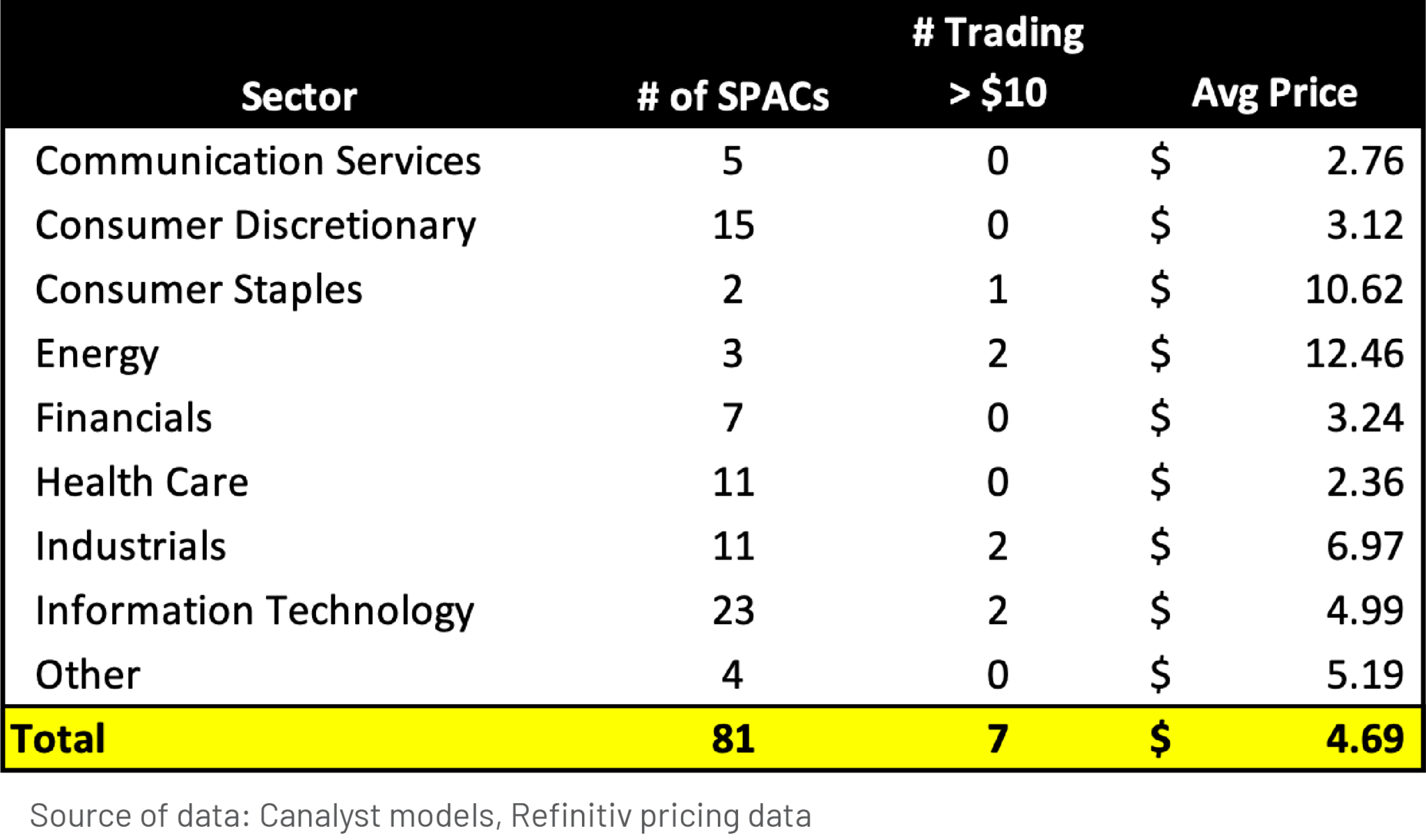

Micro Strategys Competitor A Deep Dive Into The Latest Spac Investment Frenzy

May 08, 2025

Micro Strategys Competitor A Deep Dive Into The Latest Spac Investment Frenzy

May 08, 2025 -

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025 -

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025