Bitcoin Or MicroStrategy Stock: A Smart Investment Strategy For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin's Price Volatility and Long-Term Growth Prospects

Bitcoin's price history is a rollercoaster, marked by dramatic swings. However, its potential for long-term growth continues to attract significant attention. Several factors could drive Bitcoin's price upward in the coming years.

- Increased Institutional Adoption: More and more institutional investors are allocating funds to Bitcoin, adding legitimacy and increasing demand.

- Regulatory Clarity: As governments worldwide grapple with regulating cryptocurrencies, clearer guidelines could lead to greater market stability and investor confidence.

- Technological Advancements: Developments like the Lightning Network are improving Bitcoin's scalability and transaction speed, making it more practical for everyday use.

- Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, historically has preceded periods of price appreciation. The next halving is expected to further impact Bitcoin's scarcity and potentially drive up its price.

Bitcoin's market capitalization and dominance within the cryptocurrency market are key indicators to watch. However, it's crucial to understand that price predictions are speculative.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries inherent risks:

- Extreme Price Volatility: Bitcoin's price can fluctuate dramatically in short periods, leading to significant losses.

- Security Risks: Loss of private keys or hacks of cryptocurrency exchanges can result in the loss of funds.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty and potential legal challenges.

Mitigating these risks requires a cautious approach:

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to reduce overall risk.

- Dollar-Cost Averaging: Invest a fixed amount of money regularly, regardless of price fluctuations, to reduce the impact of volatility.

- Secure Storage: Use reputable cryptocurrency wallets and exchanges to protect your Bitcoin holdings.

Analyzing MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Corporate Strategy and Bitcoin Adoption

MicroStrategy, a business intelligence company, made a bold move by accumulating a substantial amount of Bitcoin as a corporate treasury reserve asset. This strategy reflects their belief in Bitcoin's long-term value. Their decision has significantly impacted their financial performance, creating both opportunities and challenges.

- Advantages: Exposure to Bitcoin's potential growth, diversification of assets, potential for significant capital appreciation.

- Disadvantages: Dependence on Bitcoin's price, potential for significant losses if Bitcoin's price declines, increased volatility in financial reports.

MicroStrategy's core business model remains in the business intelligence sector. Their long-term vision incorporates Bitcoin as a strategic asset, but it's essential to assess their performance in both areas.

Assessing the Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique combination of risks and rewards:

- Risks: High dependence on Bitcoin's price, competition in the business intelligence market, potential for decreased profitability if Bitcoin's value drops.

- Rewards: Exposure to Bitcoin's growth potential through an established company, potential for capital appreciation in both the stock and Bitcoin holdings.

Consider key financial metrics such as MicroStrategy's P/E ratio, market share in the business intelligence sector, and its dividend yield (if applicable) before investing.

Comparing Bitcoin and MicroStrategy Stock: A Comparative Analysis

Investment Strategies: Direct Bitcoin vs. Indirect Exposure through MicroStrategy

Investing directly in Bitcoin offers maximum exposure to its price movements, but with higher risk. Investing in MicroStrategy stock provides indirect exposure to Bitcoin, but with added exposure to the company’s business performance.

| Feature | Direct Bitcoin Investment | MicroStrategy Stock Investment |

|---|---|---|

| Risk Level | High | Moderate to High |

| Exposure to BTC | Direct, 100% | Indirect, dependent on MicroStrategy's holdings |

| Exposure to MSTR | None | Direct |

| Liquidity | Relatively high (depending on exchange) | High (traded on major stock exchanges) |

Diversification and Risk Management Considerations

Diversification is key to any successful investment strategy. Consider your risk tolerance and overall portfolio when deciding whether to include Bitcoin or MicroStrategy stock.

- Asset Allocation: Determine the appropriate percentage of your portfolio to allocate to cryptocurrencies and stocks.

- Risk Tolerance: Assess your comfort level with volatility and potential losses before investing.

- Portfolio Diversification: Ensure your portfolio includes a range of assets to reduce overall risk.

Conclusion: Making an Informed Investment Decision: Bitcoin or MicroStrategy Stock for 2025?

Both Bitcoin and MicroStrategy stock offer unique investment opportunities, but each carries significant risks. Bitcoin presents higher volatility but direct exposure to the cryptocurrency's growth. MicroStrategy stock offers a more moderate approach with a combination of business intelligence exposure and Bitcoin holdings, but with dependence on both.

Before investing in either Bitcoin or MicroStrategy stock, conduct thorough research, assess your risk tolerance, and consider your financial goals. Develop a well-informed investment strategy that aligns with your personal circumstances. Create your Bitcoin investment strategy carefully, and assess your MicroStrategy stock investment potential within a diversified portfolio to build your 2025 investment portfolio successfully. Remember that this information is for educational purposes and not financial advice.

Featured Posts

-

Cowherd On Tatums Performance Celtics Game 1 Post Game Analysis

May 08, 2025

Cowherd On Tatums Performance Celtics Game 1 Post Game Analysis

May 08, 2025 -

Ethereum Price Rebound A Technical Indicator Analysis

May 08, 2025

Ethereum Price Rebound A Technical Indicator Analysis

May 08, 2025 -

Trumps Xrp Backing A Catalyst For Institutional Investment

May 08, 2025

Trumps Xrp Backing A Catalyst For Institutional Investment

May 08, 2025 -

Bank Of England Is A Half Point Interest Rate Cut The Right Move

May 08, 2025

Bank Of England Is A Half Point Interest Rate Cut The Right Move

May 08, 2025 -

Canadian Dollars High Value Economic Implications And Necessary Reforms

May 08, 2025

Canadian Dollars High Value Economic Implications And Necessary Reforms

May 08, 2025

Latest Posts

-

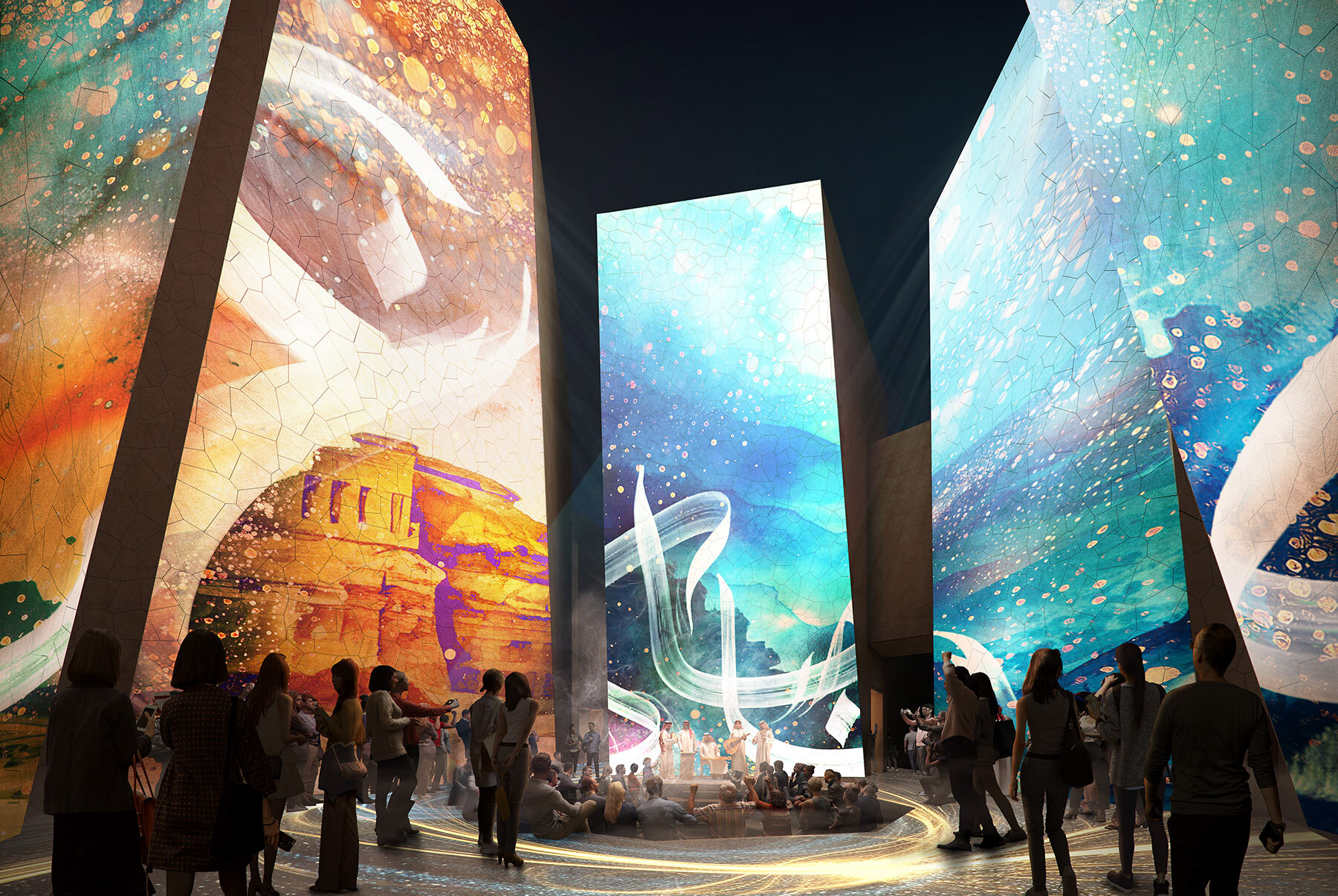

Sufian Applauds Gcci President For Successful Expo 2025 Organization

May 08, 2025

Sufian Applauds Gcci President For Successful Expo 2025 Organization

May 08, 2025 -

Gcci Presidents Expo 2025 Efforts Earn Sufians Praise

May 08, 2025

Gcci Presidents Expo 2025 Efforts Earn Sufians Praise

May 08, 2025 -

Boston Celtics Nba Finals Merchandise Shop Official Gear At Fanatics

May 08, 2025

Boston Celtics Nba Finals Merchandise Shop Official Gear At Fanatics

May 08, 2025 -

Sufian Commends Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025

Sufian Commends Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025 -

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Nba Finals

May 08, 2025

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Nba Finals

May 08, 2025