Trump's XRP Backing: A Catalyst For Institutional Investment?

Table of Contents

The Trump Effect: Speculation and Market Sentiment

The influence of celebrity endorsements on asset prices is well-documented. Think of the impact endorsements have had on everything from sneakers to stocks. Applying this "Trump effect" to XRP introduces a compelling narrative. Trump's association with XRP, even if unsubstantiated, could significantly boost the cryptocurrency's price through increased speculation and FOMO (fear of missing out). Imagine the headlines: "Trump backs XRP!" This could trigger a surge in buying pressure, driving the XRP price upward in the short term. However, this surge might also be followed by volatility, as speculative bubbles often burst. Long-term price stability would depend on underlying factors, including XRP's adoption and utility.

- Celebrity endorsement crypto: The crypto market is ripe for the influence of high-profile figures. Past examples showcase how celebrity endorsements can rapidly inflate asset prices.

- XRP speculation: The uncertainty surrounding any potential Trump involvement creates fertile ground for speculation, driving up trading volume and potentially price.

- FOMO XRP: The potential for substantial gains could incite a rapid influx of investors driven by FOMO, exacerbating price fluctuations.

- Trump crypto influence: The mere association with a powerful figure like Trump can significantly influence public perception and drive investor sentiment.

Regulatory Uncertainty and Institutional Adoption

Institutional investors are inherently risk-averse. The current regulatory landscape surrounding XRP, including ongoing legal battles with the SEC, significantly impacts their willingness to invest. A potential Trump endorsement could, however, alter this dynamic in several ways. It could influence regulatory discussions and potentially shape future legislation, either positively or negatively. A positive influence might lessen regulatory uncertainty, attracting institutional investment. Conversely, increased scrutiny might result from this association, leading to increased regulatory pressure and potentially deterring investors.

- XRP regulation: The regulatory uncertainty surrounding XRP is a major barrier to widespread institutional adoption.

- Institutional crypto adoption: Institutional investors need clarity and regulatory certainty before committing large sums to crypto assets.

- Regulatory uncertainty XRP: The current legal ambiguity surrounding XRP presents a significant risk for institutional investors.

- Trump regulatory impact: Trump's potential involvement could influence regulatory outcomes, either positively or negatively impacting XRP's appeal to institutional investors.

- Potential benefits: Reduced risk perception due to perceived political support.

- Potential drawbacks: Increased regulatory scrutiny and potential for stricter regulations targeting XRP.

Technical Analysis and Fundamental Value of XRP

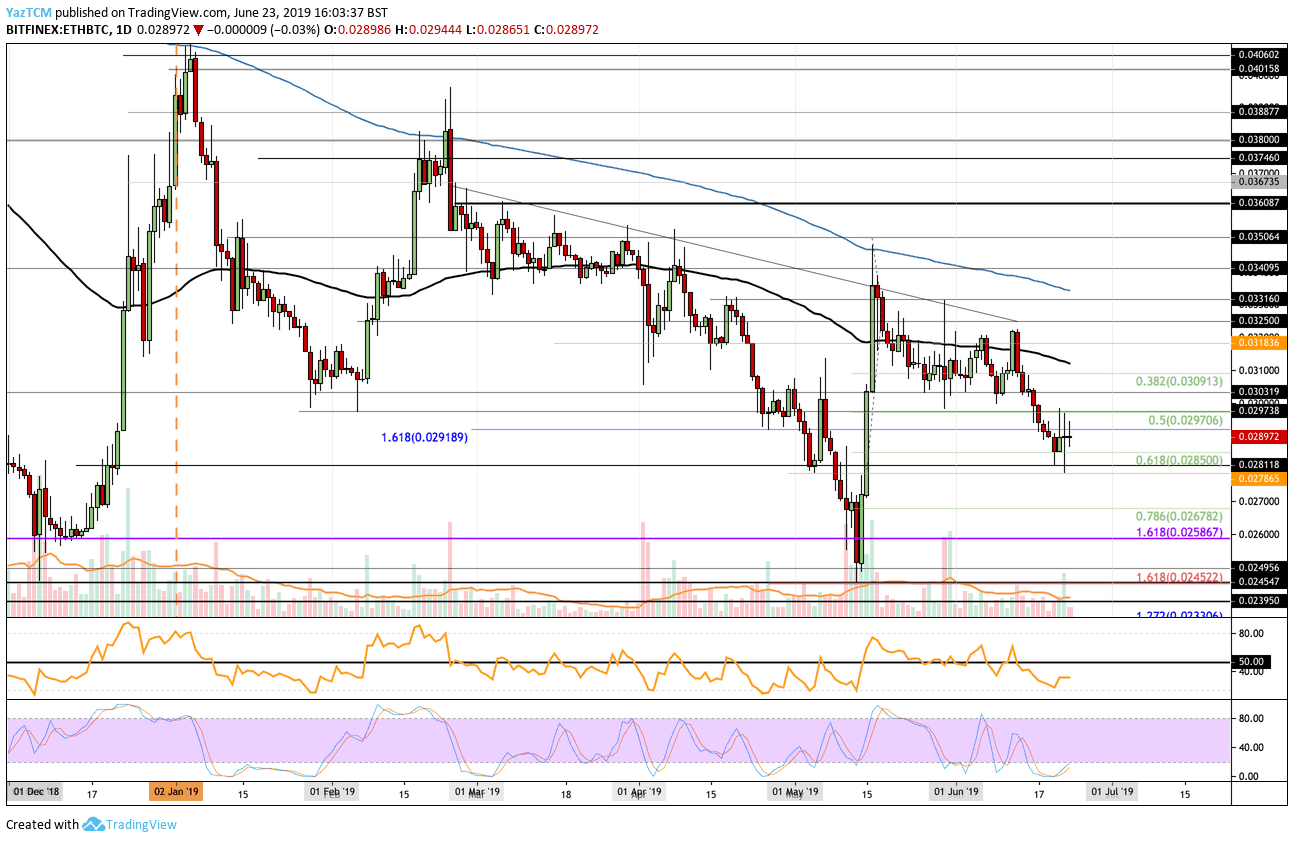

XRP's underlying technology, primarily its use within RippleNet for cross-border payments, provides its fundamental value proposition. Analyzing XRP's current XRP market cap, trading volume, and price history – using tools like XRP price charts – is crucial for understanding its intrinsic worth. The question remains: Does the potential "Trump effect" align with XRP's fundamental value? Analyzing technical indicators and comparing them to its historical performance gives a more holistic view. We must consider whether the speculative boost is justified by the underlying technology and its real-world applications.

- XRP technology: RippleNet and its potential for revolutionizing cross-border payments form the core of XRP's value proposition.

- RippleNet: The efficiency and cost-effectiveness of RippleNet are key factors driving XRP's utility.

- XRP market cap: Analyzing XRP's market capitalization offers insights into its overall value and market position.

- XRP price chart: Visualizing price trends through charts and graphs provides context for assessing the potential for short-term gains and long-term stability.

- XRP fundamental analysis: A deep dive into XRP's technology, utility, and market position is crucial for evaluating its true worth.

Potential Risks and Considerations for Institutional Investors

Despite the potential for gains, investing in XRP, especially based on speculation tied to a political figure, carries significant risk. The cryptocurrency market is notoriously volatile, and any perceived endorsement could be followed by a sharp correction. The possibility of market manipulation and regulatory crackdowns should also be carefully considered. Due diligence is paramount. Investors must analyze competing cryptocurrencies and XRP's long-term viability within the evolving crypto landscape.

- XRP risks: Investing in XRP involves significant financial risk due to market volatility and regulatory uncertainty.

- Crypto market volatility: The crypto market is notoriously volatile, susceptible to rapid price swings.

- Investment risks XRP: Investors should be aware of the numerous risks associated with investing in cryptocurrencies, including potential loss of capital.

- Due diligence XRP: Thorough research and due diligence are essential before investing in XRP or any other cryptocurrency.

Conclusion

The impact of Trump's perceived backing of XRP on institutional investment remains uncertain. While a Trump endorsement could generate short-term price volatility and market excitement, institutional decisions hinge on a comprehensive analysis of XRP's fundamental value, the regulatory landscape, and inherent risks. Due diligence and a sound understanding of the cryptocurrency market are crucial for any investor considering XRP. To stay informed about future developments regarding Trump XRP and the crypto market, continue your research. Remember, always conduct thorough research before investing in Trump XRP or any other cryptocurrency.

Featured Posts

-

Taiwan Dollar Surge A Catalyst For Economic Overhaul

May 08, 2025

Taiwan Dollar Surge A Catalyst For Economic Overhaul

May 08, 2025 -

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Movies

May 08, 2025

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Movies

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025 -

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025 -

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025

Latest Posts

-

What Fueled The Recent Increase In Bitcoin Mining

May 08, 2025

What Fueled The Recent Increase In Bitcoin Mining

May 08, 2025 -

Micro Strategy Vs Bitcoin Predicting Investment Returns In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Predicting Investment Returns In 2025

May 08, 2025 -

Analysis The Unexpected Surge In Bitcoin Mining This Week

May 08, 2025

Analysis The Unexpected Surge In Bitcoin Mining This Week

May 08, 2025 -

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Analysis

May 08, 2025

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Analysis

May 08, 2025 -

Bitcoin Mining Activity Spikes Reasons Behind The Rise

May 08, 2025

Bitcoin Mining Activity Spikes Reasons Behind The Rise

May 08, 2025