Bitcoin Price At A Crossroads: Crucial Support And Resistance Levels

Table of Contents

Identifying Key Bitcoin Support Levels

What are Support Levels?

Support levels in Bitcoin trading represent price points where buying pressure is strong enough to prevent further price declines. They act as a "floor," temporarily halting downward momentum. Think of them as a safety net for the price. These levels are crucial for Bitcoin investors, as a break below them can signal a more significant downtrend. Support levels are often psychological (round numbers like $20,000, $30,000) or based on previous price lows where buyers stepped in, creating a strong base. Analyzing past price action is key to identifying potential support areas.

Current Crucial Bitcoin Support Levels

Currently, analyzing recent price action reveals several potential support levels for Bitcoin. (Note: This analysis is based on current market conditions and may change rapidly. Always conduct your own research before making investment decisions.)

- $25,000: This level has historically shown strong buyer support. A break below this could trigger further selling pressure.

- $20,000: A psychologically significant level, acting as a major support zone. A breach here could indicate a more bearish market sentiment.

- $18,000: A lower support level, potentially acting as a last line of defense before a more significant price drop.

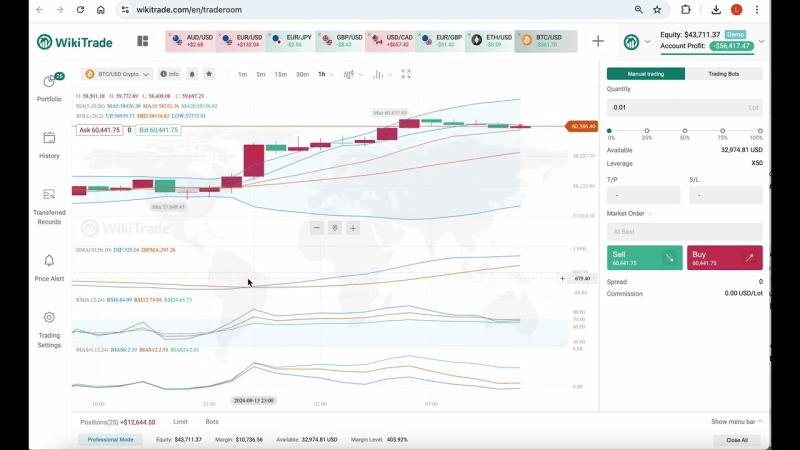

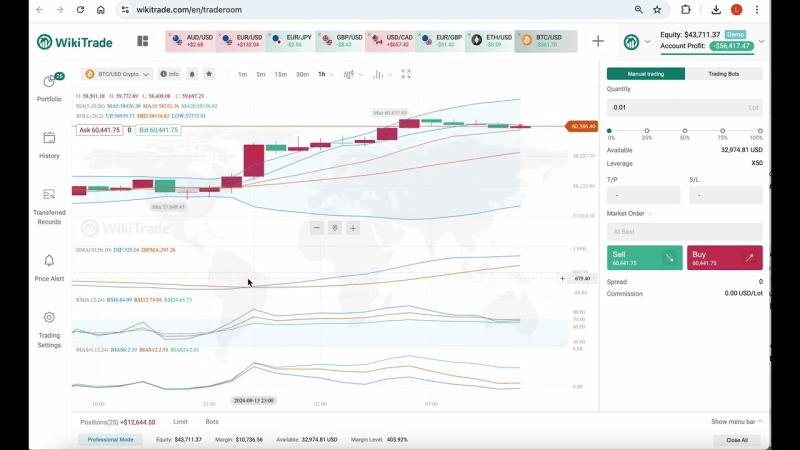

(Insert Chart Here: A chart showing the identified support levels on a Bitcoin price chart)

Indicators like the 20-day and 50-day moving averages can help confirm these support areas. A bounce off these moving averages could indicate a potential short-term price reversal. Similarly, a Relative Strength Index (RSI) reading near oversold conditions could also signal a potential support level.

Understanding Support Level Breakdowns

When a support level is breached, it indicates a weakening of buyer sentiment and a stronger bearish trend. This can trigger stop-loss orders, leading to further price declines. For short-term predictions, a breakdown might suggest further losses until the next support level is reached. Long-term implications depend on other factors, like macroeconomic conditions and overall market sentiment. A significant support level breakdown could signal a more extended bear market.

Analyzing Key Bitcoin Resistance Levels

What are Resistance Levels?

Resistance levels, in contrast to support levels, represent price points where selling pressure is strong enough to prevent further price increases. They act as a "ceiling," temporarily halting upward momentum. These levels are formed by previous price highs where sellers overwhelmed buyers, creating a barrier to further price appreciation. Psychological resistance levels (e.g., previous all-time highs) are also significant. Just like support, understanding past price action is crucial for identifying potential resistance areas.

Current Crucial Bitcoin Resistance Levels

Based on recent price action, several key resistance levels can be identified for Bitcoin:

- $30,000: This level represents a significant hurdle, and a break above it could signal a bullish trend.

- $35,000: A stronger resistance level, potentially representing a key psychological barrier.

- $40,000: This level acted as strong support before, and now acts as a strong resistance. A break above indicates a significant shift in market sentiment.

(Insert Chart Here: A chart showing the identified resistance levels on a Bitcoin price chart)

Similar to support levels, moving averages and RSI can help confirm these resistance areas. A break above the moving averages, coupled with an RSI above overbought levels, could signal a strong breakout.

Understanding Resistance Level Breakouts

A breakout above a resistance level suggests a strengthening of bullish sentiment and the potential for further price appreciation. This can trigger buy orders, leading to increased upward momentum. Short-term predictions following a breakout might point to gains until the next resistance level is encountered. Long-term implications depend on the sustainability of the breakout and the overall market conditions. A significant resistance level breakout could signal the beginning of a sustained bull market.

Factors Influencing Bitcoin's Price Trajectory

Macroeconomic Factors

Global macroeconomic factors significantly impact Bitcoin's price. Inflation, interest rate hikes, and recessionary fears can all influence investor risk appetite, affecting demand for Bitcoin as a hedge asset or a risk-on investment.

Regulatory Developments

Government regulations and policies surrounding cryptocurrencies greatly influence Bitcoin's value. Favorable regulations can boost investor confidence, while stricter regulations can dampen enthusiasm and lead to price corrections.

Adoption and Market Sentiment

Increased adoption of Bitcoin by institutional and retail investors positively correlates with price appreciation. Conversely, negative market sentiment, fueled by news events or regulatory uncertainty, can trigger price declines.

Technological Advancements

Bitcoin upgrades and technological innovations, such as the Lightning Network, can also influence its price. Improvements in scalability and transaction speed can enhance Bitcoin's utility and potentially drive demand.

Conclusion: Bitcoin Price Outlook and Next Steps

In summary, analyzing Bitcoin's current price reveals several crucial support and resistance levels. Breaching these levels could signal significant shifts in the market. The interplay between these levels, coupled with macroeconomic factors, regulatory changes, adoption rates, and technological advancements, will shape Bitcoin's future trajectory. It's crucial to remember that the cryptocurrency market is highly volatile. While this analysis offers valuable insights, it’s not a guaranteed prediction. Always conduct thorough research, understand the risks involved, and consider consulting with a financial advisor before making any investment decisions regarding Bitcoin. The Bitcoin price at a crossroads presents both opportunities and risks, so stay informed about Bitcoin price action and market analysis to navigate this exciting landscape. Explore resources like reputable cryptocurrency news sites and trading platforms to deepen your understanding of Bitcoin trading and analysis.

Featured Posts

-

Andor Season 2 Will It Surpass The First Season Diego Luna Hints At Major Changes

May 08, 2025

Andor Season 2 Will It Surpass The First Season Diego Luna Hints At Major Changes

May 08, 2025 -

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025 -

The Closure Of Anchor Brewing Company What Next For San Franciscos Iconic Brewery

May 08, 2025

The Closure Of Anchor Brewing Company What Next For San Franciscos Iconic Brewery

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025 -

The Vaticans Financial Troubles Pope Franciss Unfinished Reform

May 08, 2025

The Vaticans Financial Troubles Pope Franciss Unfinished Reform

May 08, 2025

Latest Posts

-

Bitcoin In Buguenkue Durumu Fiyat Hacim Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Hacim Ve Gelecek Tahminleri

May 08, 2025 -

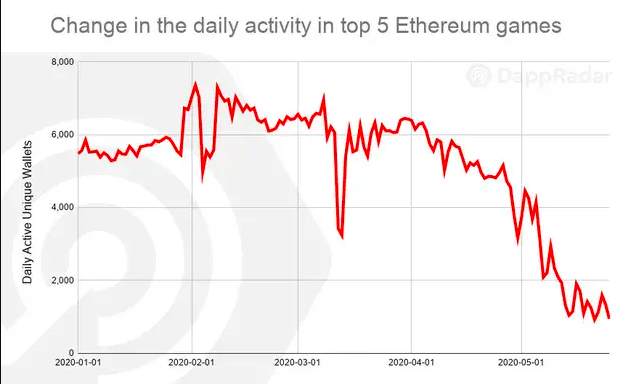

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025 -

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators Point To Institutional Accumulation

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators Point To Institutional Accumulation

May 08, 2025 -

Reliable Crypto News Essential For Informed Investment Decisions

May 08, 2025

Reliable Crypto News Essential For Informed Investment Decisions

May 08, 2025