Bitcoin Price Prediction 2024: Impact Of Trump's Economic Policies

Table of Contents

Trump's Potential Economic Policies and Their Impact on Bitcoin

A Trump administration's economic policies could significantly influence Bitcoin's price trajectory in 2024. Let's analyze some key areas:

Fiscal Policy and Inflation

A Trump presidency might involve increased government spending and potential tax cuts, mirroring his previous term. This could lead to:

- Increased money supply: A surge in government spending could inflate the money supply, potentially devaluing the US dollar.

- Potential devaluation of the dollar: A weaker dollar often drives investors towards alternative assets, including Bitcoin, as a hedge against inflation.

- Bitcoin as a safe haven asset: In times of economic uncertainty, Bitcoin's decentralized nature and limited supply could increase its appeal as a store of value. This could push Bitcoin prices higher.

Regulatory Environment

Trump's stance on cryptocurrency regulation remains unclear, but his past actions offer some clues. A potential return could result in:

- Potential for clearer regulations: While not necessarily favorable, clearer regulations could attract institutional investors who currently hesitate due to uncertainty.

- Increased institutional adoption: A more defined regulatory framework could boost confidence among institutional investors, leading to increased investment in Bitcoin.

- Impact of SEC rulings: The Securities and Exchange Commission's actions under a Trump administration could significantly impact the market, potentially creating a more favorable or unfavorable environment for cryptocurrencies.

- Potential for a more favorable regulatory environment: Compared to a more interventionist approach, a less regulated environment could lead to higher Bitcoin prices driven by market forces.

Trade Policies and Global Economic Uncertainty

Trump's protectionist trade policies and potential for trade wars could introduce significant global economic uncertainty. This could impact Bitcoin in the following ways:

- Impact of global economic uncertainty on Bitcoin demand: During times of global economic turmoil, Bitcoin's perceived safety and decentralization could make it a more attractive asset.

- Safe haven status: Investors might flock to Bitcoin as a safe haven, driving up its price.

- Correlation with traditional markets: While Bitcoin often acts independently, it is still influenced by traditional market trends. Global economic uncertainty stemming from trade disputes could negatively affect Bitcoin's price.

Market Sentiment and Investor Behavior Towards Bitcoin Under a Trump Presidency

Investor sentiment is crucial in shaping Bitcoin's price. A Trump presidency could bring:

Uncertainty and Volatility

The uncertainty surrounding a Trump administration might:

- Increased volatility: Short-term price swings would likely become more pronounced as investors react to policy announcements and economic data.

- Short-term price swings: Expect sharper ups and downs in Bitcoin's price, making it a riskier investment in the short term.

- Long-term price predictions: While difficult to predict, long-term trends could be influenced by the overall success or failure of Trump's economic policies.

- Potential for "Trump Bump" or "Trump Dump": Depending on the market's reaction, we might see a significant price increase ("Trump Bump") or decrease ("Trump Dump") immediately following a Trump victory.

Institutional Adoption and Investment

Trump's economic policies and regulatory approach could also significantly impact institutional adoption:

- Increased institutional adoption: Clearer regulations, regardless of their nature, could encourage more institutional investment, thereby driving Bitcoin's price up.

- Impact on Bitcoin price: Large-scale institutional buying could substantially increase demand and push Bitcoin's price higher.

- Potential for regulatory clarity driving institutional investments: Reduced uncertainty could incentivize larger financial institutions to enter the Bitcoin market.

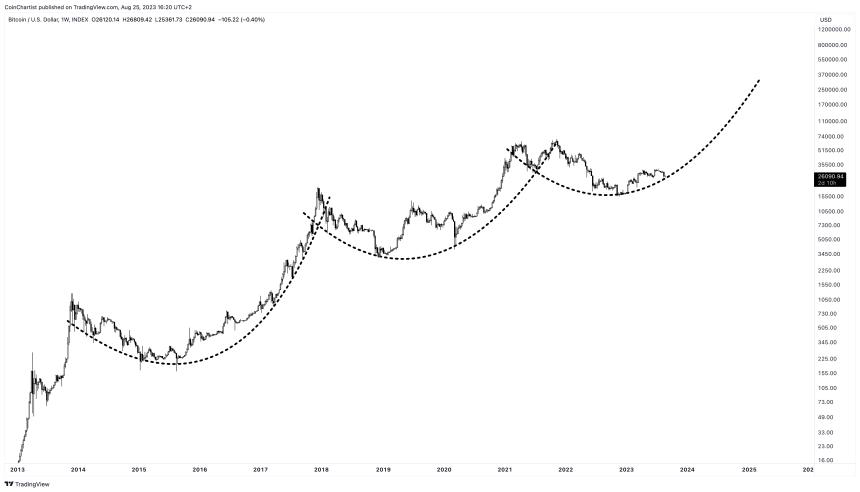

Potential Bitcoin Price Scenarios in 2024 Based on Trump's Influence

Predicting Bitcoin's price is inherently speculative, but let's explore potential scenarios based on Trump's influence:

Bullish Scenario

In a bullish scenario, favorable economic factors and a positive regulatory environment could drive significant Bitcoin price growth:

- Increased adoption: Widespread acceptance of Bitcoin as a payment method and store of value.

- Positive market sentiment: Optimism about the future of Bitcoin and the cryptocurrency market.

- Favorable regulatory changes: Clear, supportive regulations that encourage institutional investment.

- Specific price targets (with disclaimers): It's purely speculative, but a bullish scenario could see Bitcoin reaching $100,000 or more by the end of 2024. This is purely hypothetical and depends on numerous factors beyond Trump's influence.

Bearish Scenario

Conversely, a bearish scenario would involve negative economic conditions and unfavorable regulations:

- Negative market sentiment: Pessimism surrounding Bitcoin and the overall market.

- Regulatory headwinds: Strict regulations that stifle innovation and limit adoption.

- Economic downturn: A global recession or significant economic slowdown could negatively impact Bitcoin's price.

- Specific price targets (with disclaimers): A bearish scenario could see Bitcoin dropping below $20,000, but this is highly speculative and depends on multiple interacting factors.

Neutral Scenario

A neutral scenario would entail a balanced impact, with relatively moderate price fluctuations:

- Balanced market forces: No single dominant factor driving the price significantly upwards or downwards.

- Cautious investor sentiment: Investors remain somewhat hesitant, leading to moderate trading volume.

- Moderate price fluctuation: Price movement remains within a relatively narrow range.

- Specific price range (with disclaimers): A neutral scenario might see Bitcoin trading between $30,000 and $60,000, but this prediction is highly speculative and subject to significant change.

Conclusion: Bitcoin Price Prediction 2024: The Verdict on Trump's Impact

The potential impact of a Trump presidency (or a Trump-influenced administration) on Bitcoin's price in 2024 is multifaceted and complex. His economic policies, particularly regarding fiscal spending, regulation, and international trade, could significantly influence market sentiment, institutional investment, and ultimately, Bitcoin's price. However, it's crucial to reiterate that any Bitcoin price prediction 2024 is inherently speculative. Numerous other factors – technological advancements, geopolitical events, and overall market trends – will play a role. Therefore, it's vital to conduct thorough research and remain informed about Bitcoin's market dynamics and upcoming political events to formulate your own informed opinion on Bitcoin's future price. Share your thoughts and predictions in the comments section below!

Featured Posts

-

Hurun Report 2025 Elon Musk Retains Top Spot Despite Massive Net Worth Decrease

May 09, 2025

Hurun Report 2025 Elon Musk Retains Top Spot Despite Massive Net Worth Decrease

May 09, 2025 -

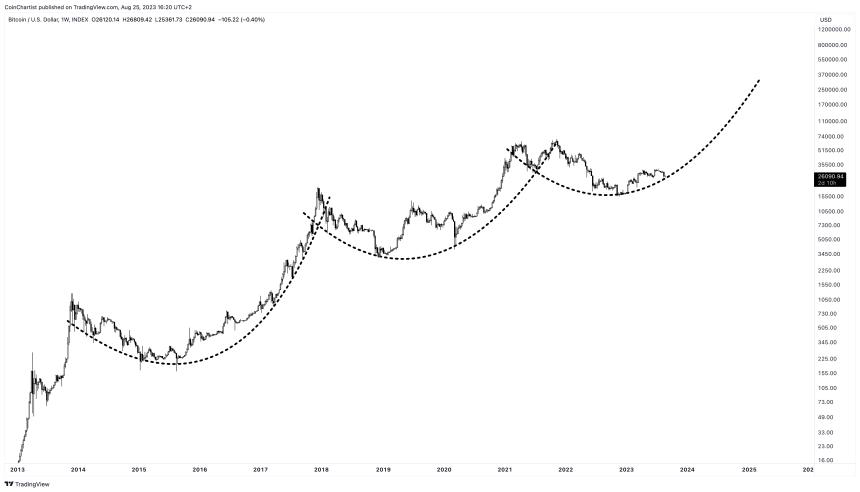

Harry Styles And Snl The Fallout From A Bad Impression

May 09, 2025

Harry Styles And Snl The Fallout From A Bad Impression

May 09, 2025 -

Strands Nyt Answers For Wednesday March 12 Game 374

May 09, 2025

Strands Nyt Answers For Wednesday March 12 Game 374

May 09, 2025 -

Tesla Stock Slump Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025

Tesla Stock Slump Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025 -

Will Androids Design Changes Sway Young Consumers

May 09, 2025

Will Androids Design Changes Sway Young Consumers

May 09, 2025