Bitcoin Price Prediction: Evaluating The $100,000 Target After Trump's Speech

Table of Contents

Trump's Speech and its Ripple Effect on Bitcoin

Trump's recent comments on Bitcoin, while not explicitly endorsing or condemning the cryptocurrency, sparked considerable market reaction. He alluded to the potential of digital currencies but also highlighted concerns regarding regulation and potential risks. The immediate aftermath saw a significant surge in trading volume, with the Bitcoin price initially experiencing a modest increase before consolidating.

- Positive Impacts: Increased mainstream attention to Bitcoin, potentially attracting new investors.

- Negative Impacts: Uncertainty surrounding future regulatory actions, creating volatility and potential for short-term price drops. Concerns about manipulation from large players could also influence investor sentiment.

- Neutral Impacts: For some, Trump’s ambiguous stance created a wait-and-see attitude, leading to only a minor, temporary price shift.

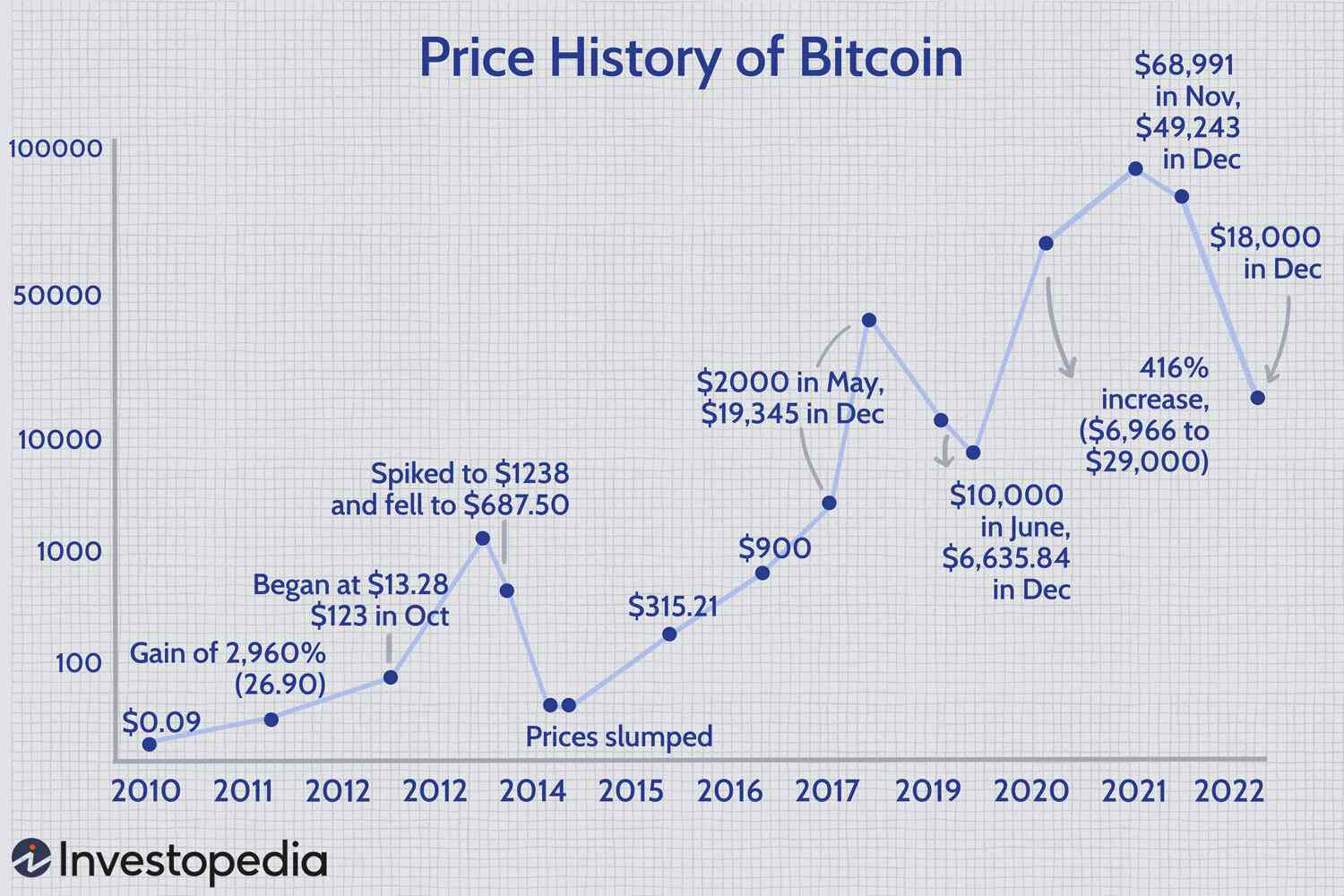

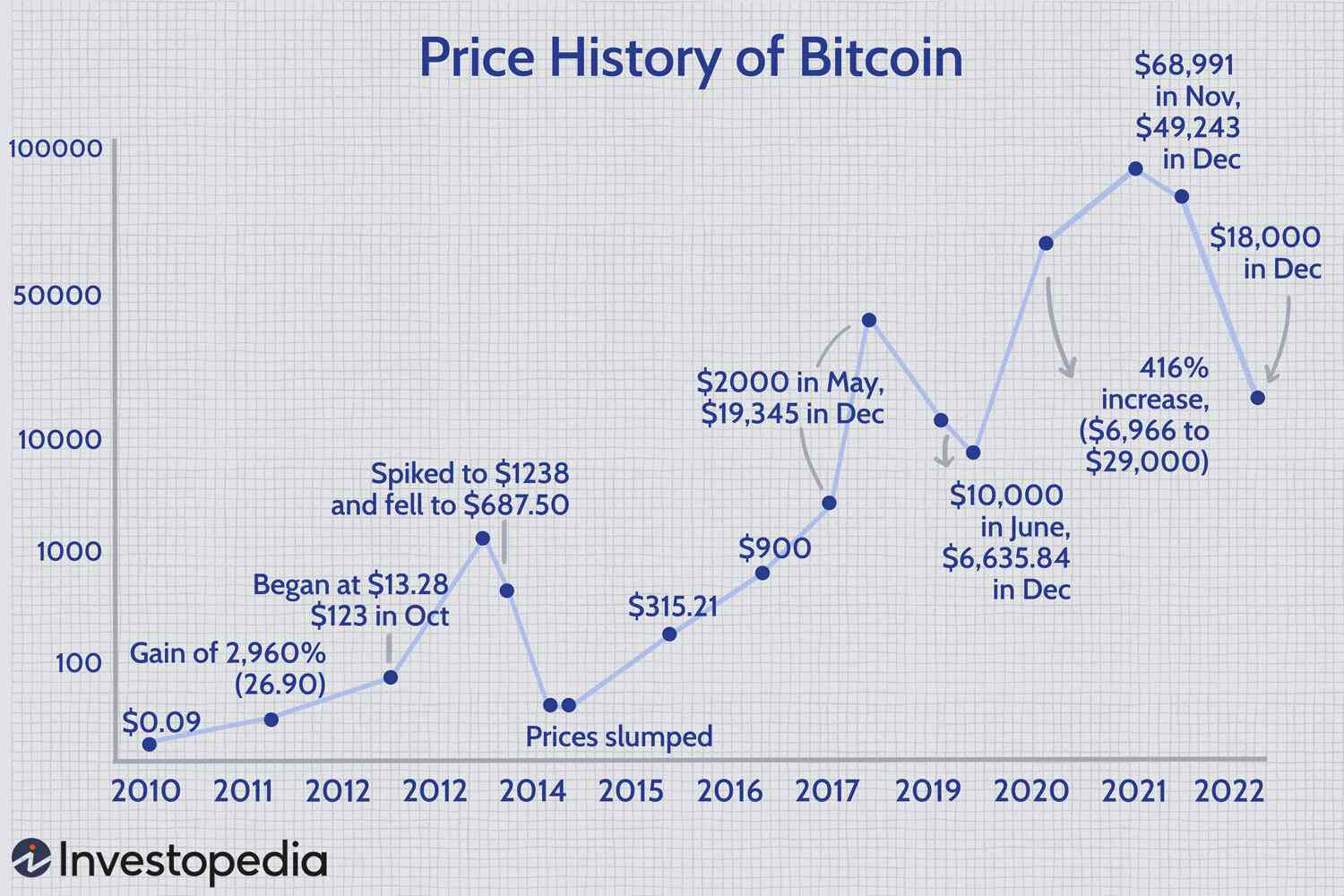

[Insert relevant chart or graph showing Bitcoin price movement following Trump's speech]

Keywords: Bitcoin price, Trump Bitcoin, Cryptocurrency regulation, Market volatility

Factors Influencing the $100,000 Bitcoin Price Prediction

Several key factors contribute to the ongoing discussion surrounding the $100,000 Bitcoin price prediction. Let's examine some of the most significant:

Adoption Rate and Institutional Investment

The increasing adoption of Bitcoin by institutional investors is a powerful driver of price appreciation. As more large financial institutions allocate capital to Bitcoin, the demand increases, pushing prices higher.

- Examples of Institutional Investors: BlackRock, Fidelity, and other major players have shown growing interest in Bitcoin and related products.

- Impact of ETF Approvals: The potential approval of Bitcoin Exchange-Traded Funds (ETFs) could dramatically increase accessibility and liquidity, potentially fueling significant price growth.

- Correlation Analysis: Historical data shows a strong correlation between increased institutional investment and Bitcoin's price appreciation.

Macroeconomic Factors and Global Uncertainty

Geopolitical instability and economic uncertainty often drive investors towards Bitcoin as a safe haven asset and a hedge against inflation.

- Bitcoin as a Hedge Against Inflation: Bitcoin's fixed supply makes it an attractive alternative to traditional assets during periods of high inflation.

- Global Uncertainty Driver: Times of economic or political uncertainty often lead to increased demand for Bitcoin, as investors seek to protect their wealth.

- Performance During Downturns: Analysis shows that Bitcoin has exhibited periods of growth even during previous economic downturns.

Technological Advancements and Network Upgrades

Technological advancements, particularly scaling solutions like the Lightning Network, are crucial for Bitcoin's long-term viability and potential price growth.

- Impact of the Lightning Network: The Lightning Network significantly reduces transaction fees and improves scalability, making Bitcoin more efficient for everyday use.

- Future Upgrades: Ongoing development and potential future upgrades can further enhance Bitcoin's functionality and attract more users.

- Innovation and Market Cap: A direct correlation exists between technological innovation within the Bitcoin ecosystem and its overall market capitalization.

Keywords: Bitcoin adoption, Institutional investors, Bitcoin ETF, Macroeconomic factors, Inflation hedge, Bitcoin scaling, Lightning Network

Potential Obstacles to Reaching $100,000

Despite the bullish factors, significant obstacles could hinder Bitcoin's ascent to $100,000.

Regulatory Hurdles and Government Intervention

Government regulation remains a significant uncertainty. Varying regulatory approaches worldwide create a complex landscape that could impact Bitcoin's growth.

- Examples of Regulatory Approaches: Some countries have embraced Bitcoin and cryptocurrencies, while others have imposed strict regulations or outright bans.

- Stricter Regulations: The potential for stricter global regulations could limit Bitcoin's adoption and price growth.

- Historical Impact of Regulatory Uncertainty: Past instances of regulatory uncertainty have resulted in significant volatility in Bitcoin's price.

Market Manipulation and Security Concerns

The risk of market manipulation and security vulnerabilities is ever-present. Maintaining robust security measures and investor confidence is crucial.

- Examples of Market Manipulation: Several instances of suspected market manipulation have occurred in the cryptocurrency market, impacting price stability.

- Robust Security Measures: Strengthening security protocols and raising awareness about potential risks is vital to maintaining investor trust.

- Impact of Security Breaches: Past security breaches in exchanges have negatively affected investor confidence and short-term price.

Keywords: Bitcoin regulation, Government intervention, Market manipulation, Bitcoin security

Conclusion

Trump's speech, while not explicitly defining Bitcoin's future, introduced a layer of uncertainty that the market is still processing. While the potential for Bitcoin to reach $100,000 is driven by factors like increased institutional adoption, technological advancements, and its role as a hedge against inflation, considerable obstacles like regulatory hurdles and security concerns remain. Ultimately, the path to $100,000 Bitcoin is not straightforward. A balanced perspective considers both the bullish and bearish factors. While the future price remains uncertain, staying informed about Bitcoin price predictions and market trends is crucial. Continue following our analysis for further updates on Bitcoin price predictions and make informed decisions about your cryptocurrency investments. Keywords: Bitcoin price prediction, $100,000 Bitcoin, Bitcoin investment

Featured Posts

-

Sensex Today Live Stock Market Updates Nifty Above 23 800

May 09, 2025

Sensex Today Live Stock Market Updates Nifty Above 23 800

May 09, 2025 -

Fentanyl Crisis A Lever In Us China Trade Negotiations

May 09, 2025

Fentanyl Crisis A Lever In Us China Trade Negotiations

May 09, 2025 -

Mans 3 K Babysitting Bill Turns Into A 3 6 K Daycare Nightmare

May 09, 2025

Mans 3 K Babysitting Bill Turns Into A 3 6 K Daycare Nightmare

May 09, 2025 -

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025 -

Aeroport Permi Informatsiya O Vozobnovlenii Raboty Posle Snegopada

May 09, 2025

Aeroport Permi Informatsiya O Vozobnovlenii Raboty Posle Snegopada

May 09, 2025