Bitcoin Price Rebound: Investing Strategies And Predictions

Table of Contents

Understanding the Bitcoin Price Rebound

The cryptocurrency market, particularly Bitcoin, is known for its price fluctuations. However, understanding the factors driving a potential Bitcoin price rebound is crucial for investors. Several key elements contribute to the possibility of a resurgence in Bitcoin's value.

Factors Contributing to a Potential Rebound:

-

Increased Institutional Adoption: Major corporations like Grayscale and MicroStrategy have made significant investments in Bitcoin, signaling a growing acceptance of Bitcoin as a legitimate asset class. This institutional interest brings stability and credibility to the market, influencing the Bitcoin price rebound. The influx of institutional capital can significantly impact the overall market capitalization and price.

-

Growing Adoption of Bitcoin as a Hedge Against Inflation: With persistent inflationary pressures in many global economies, Bitcoin's limited supply and decentralized nature are increasingly viewed as a hedge against inflation. Investors are seeking alternative assets to protect their purchasing power, leading to increased demand for Bitcoin and contributing to a Bitcoin price rebound.

-

Technological Advancements and Network Upgrades: The ongoing development and implementation of technologies like the Lightning Network aim to enhance Bitcoin's scalability and transaction speed. These upgrades improve the usability and efficiency of the Bitcoin network, attracting more users and bolstering its long-term value potential and contributing to a Bitcoin price rebound.

-

Regulatory Clarity in Certain Jurisdictions: As governments worldwide grapple with regulating cryptocurrencies, some jurisdictions are adopting more progressive approaches, offering clarity and encouraging investment. A clearer regulatory environment can reduce uncertainty and attract further investment, supporting a Bitcoin price rebound.

-

Positive Market Sentiment and Reduced Selling Pressure: A shift in market sentiment, marked by reduced selling pressure and increased buying interest, is a strong indicator of a potential Bitcoin price rebound. Analyzing on-chain metrics, such as network activity and transaction volume, can provide insights into the prevailing market sentiment.

-

Analyze on-chain metrics like network activity and transaction volume for further insights into market sentiment. Tracking these metrics helps gauge the level of user engagement and potential for price movement.

-

Consider macroeconomic factors, such as inflation rates and interest rate changes, which can heavily impact Bitcoin's price. Understanding the broader economic context is essential for assessing Bitcoin's potential.

Investing Strategies for a Bitcoin Price Rebound

Navigating the volatility of the Bitcoin market requires a well-defined investment strategy. Several approaches can help investors mitigate risk and capitalize on potential price rebounds.

Dollar-Cost Averaging (DCA):

-

Explanation: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the current Bitcoin price. This strategy mitigates the risk of investing a lump sum at a market high.

-

Benefits: DCA reduces emotional decision-making often associated with market timing. It's ideal for long-term investors with a higher risk tolerance.

-

DCA mitigates emotional decision-making often associated with market timing. By avoiding impulsive buys or sells based on short-term price fluctuations, investors can maintain a disciplined approach.

-

Ideal for long-term investors with a higher risk tolerance. While not guaranteed to yield the highest returns, DCA helps manage risk over the long term.

Technical Analysis:

-

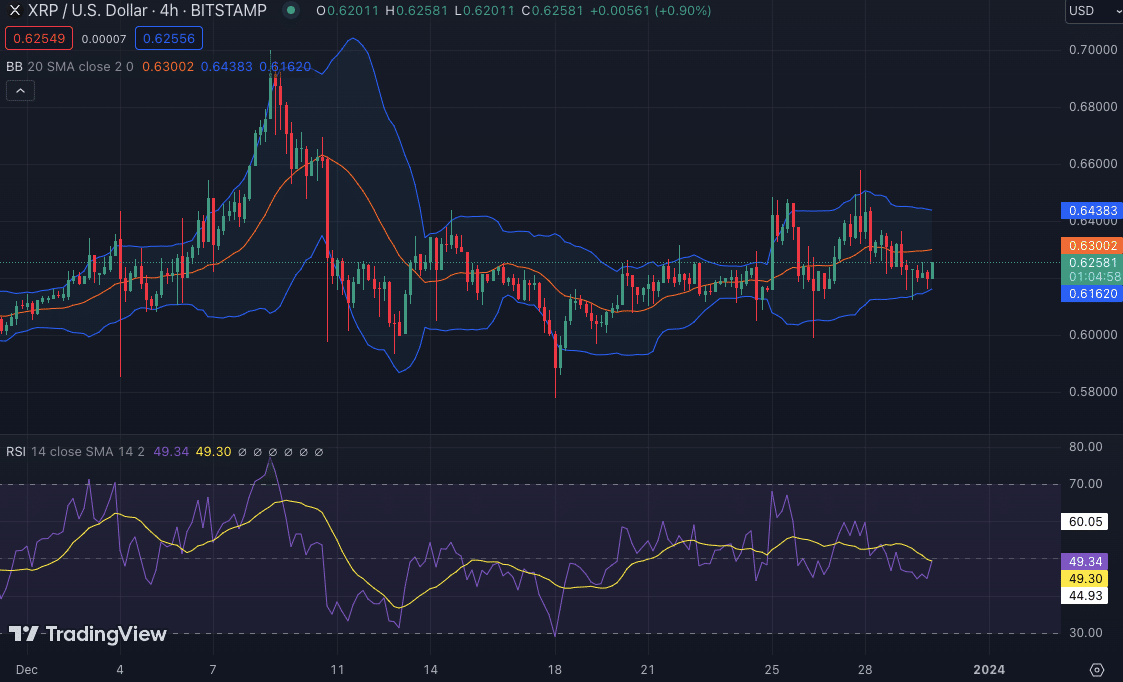

Explanation: Technical analysis uses chart patterns, indicators (e.g., RSI, MACD), and support/resistance levels to identify potential entry and exit points for Bitcoin investments.

-

Benefits: It helps to identify potential price trends and trading opportunities.

-

Requires understanding of technical indicators and chart patterns. Learning to interpret these tools requires dedicated study and practice.

-

Combine with fundamental analysis for a more holistic approach. A balanced approach that considers both technical and fundamental factors provides a more comprehensive view of the market.

Fundamental Analysis:

-

Explanation: Fundamental analysis assesses the underlying value of Bitcoin by considering factors such as adoption rate, technological advancements, and regulatory landscape.

-

Benefits: It provides a long-term perspective on Bitcoin's potential.

-

Focuses on intrinsic value rather than short-term price fluctuations. This approach helps investors to make decisions based on the long-term prospects of Bitcoin.

-

Useful for long-term investors with a lower risk tolerance. Fundamental analysis is suited to investors who prioritize long-term growth over short-term gains.

Bitcoin Price Predictions and Market Outlook

Predicting the precise Bitcoin price is inherently speculative. Numerous factors influence future price movements. It's crucial to approach any prediction with caution and skepticism.

Factors Influencing Predictions:

-

Adoption rates in emerging markets. Increased adoption in developing countries could drive significant demand.

-

Regulatory developments globally. Clearer and more favorable regulations can positively impact the Bitcoin price.

-

Technological innovations within the Bitcoin ecosystem. Continued development and adoption of new technologies can boost Bitcoin's utility and value.

-

Macroeconomic conditions. Global economic factors, such as inflation and interest rates, significantly influence cryptocurrency markets.

-

Consult multiple sources for predictions and avoid relying on a single forecast. Diversifying information sources helps create a more balanced view.

-

Develop your own informed opinion based on your research and risk tolerance. Ultimately, your investment decisions should be based on your personal assessment of the market.

-

Remember that past performance is not indicative of future results. Past price movements don't guarantee future price trends.

Conclusion

The potential for a Bitcoin price rebound is real, driven by various factors including increased institutional adoption and growing recognition of its value as a store of value. However, the cryptocurrency market remains volatile. Successful investing requires careful consideration of various strategies like dollar-cost averaging and both technical and fundamental analysis. While price predictions are inherently uncertain, a comprehensive understanding of market trends and risk management is crucial. By carefully evaluating the factors influencing the Bitcoin price rebound and employing suitable investment strategies, you can navigate this exciting market and potentially capitalize on future opportunities. Remember to always conduct thorough research and consider your personal risk tolerance before investing in Bitcoin or any other cryptocurrency. Start researching your Bitcoin price rebound strategy today!

Featured Posts

-

Mondays Market Reaction Deciphering Scholar Rocks Stock Performance

May 08, 2025

Mondays Market Reaction Deciphering Scholar Rocks Stock Performance

May 08, 2025 -

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025 -

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025 -

Vesprem Prodolzhi So Pobednichkata Seri A 10 Pobedi Po Red

May 08, 2025

Vesprem Prodolzhi So Pobednichkata Seri A 10 Pobedi Po Red

May 08, 2025 -

Arsenal News Collymores Assessment Of Artetas Management

May 08, 2025

Arsenal News Collymores Assessment Of Artetas Management

May 08, 2025

Latest Posts

-

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 09, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 09, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Skills

May 09, 2025

Cowherds Persistent Attacks On Jayson Tatums Skills

May 09, 2025 -

Alshmrany Yhll Tsryhat Jysws Hwl Antqalh Lfryq Flamnghw

May 09, 2025

Alshmrany Yhll Tsryhat Jysws Hwl Antqalh Lfryq Flamnghw

May 09, 2025 -

Jysws Wflamnghw Alshmrany Yelq Ela Alsfqt Almrtqbt Fydyw Hsry

May 09, 2025

Jysws Wflamnghw Alshmrany Yelq Ela Alsfqt Almrtqbt Fydyw Hsry

May 09, 2025 -

Lakers Vs Celtics Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum

May 09, 2025

Lakers Vs Celtics Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum

May 09, 2025