Ethereum Price Forecast: Factors Influencing Future Value

Table of Contents

Technological Advancements and Ethereum 2.0

Ethereum 2.0 represents a monumental upgrade to the Ethereum network, promising significant improvements in scalability, security, and efficiency. These enhancements are expected to have a substantial impact on the Ethereum price forecast. The transition to a Proof-of-Stake (PoS) consensus mechanism from Proof-of-Work (PoW) is a core component of Ethereum 2.0, drastically reducing energy consumption and potentially increasing transaction throughput.

- Increased transaction speed and lower fees: Sharding, a key feature of Ethereum 2.0, will divide the network into smaller, more manageable shards, processing transactions concurrently. This will lead to faster transaction speeds and significantly lower gas fees, making Ethereum more accessible and attractive to a wider range of users and applications.

- Enhanced security through Proof-of-Stake: The shift to PoS enhances security by requiring validators to stake their ETH, incentivizing honest behavior and making the network more resistant to attacks. This increased security is a major positive factor in the Ethereum price forecast.

- Improved scalability to handle more users and applications: Ethereum 2.0's improved scalability will allow the network to handle a much larger number of transactions and users, supporting the growth of decentralized applications (dApps) and fostering innovation within the ecosystem. This increased capacity directly impacts the Ethereum price forecast positively.

- Potential for decreased energy consumption: The transition to PoS significantly reduces the energy consumption compared to the previous PoW mechanism. This is an environmentally friendly improvement that aligns with growing global sustainability concerns and could attract environmentally conscious investors, positively impacting the Ethereum price forecast.

Adoption and Market Demand

The widespread adoption of Ethereum across various sectors is a major driver of its price. The platform's versatility and robust infrastructure have propelled its growth, making it a cornerstone of the decentralized revolution.

- Increasing use of Ethereum in decentralized finance (DeFi) applications: Ethereum's smart contract capabilities have made it the leading platform for DeFi applications, including lending, borrowing, and decentralized exchanges. The growth of DeFi continues to fuel demand for ETH.

- The explosion of Non-Fungible Tokens (NFTs) built on Ethereum: Ethereum's role in the NFT boom has solidified its position as a crucial platform for digital art, collectibles, and other unique digital assets. The ongoing popularity of NFTs significantly impacts the Ethereum price forecast.

- Growing enterprise adoption of Ethereum for blockchain solutions: More and more enterprises are exploring and implementing Ethereum-based solutions for supply chain management, identity verification, and other business processes. This increased enterprise adoption strengthens the long-term Ethereum price forecast.

- Network effect and increasing user base driving demand: The larger the Ethereum network becomes, the more valuable it is. The increasing number of users, developers, and applications creates a network effect, further driving demand for ETH and positively influencing the Ethereum price forecast.

Regulatory Landscape and Governmental Policies

The regulatory environment surrounding cryptocurrencies significantly impacts the Ethereum price forecast. Government policies and regulations can influence investor confidence, market liquidity, and overall adoption.

- Impact of SEC regulations and classification of cryptocurrencies: The Securities and Exchange Commission (SEC) regulations and their classification of cryptocurrencies as securities or commodities have significant implications for the market. Clearer regulatory frameworks could boost investor confidence.

- Effects of potential taxation policies on cryptocurrency investments: Taxation policies on cryptocurrency investments can influence investor behavior and market activity. Favorable tax policies could encourage investment, potentially driving up the price.

- Influence of international regulatory frameworks: Global regulatory harmonization could create a more stable and predictable environment for cryptocurrency investments, positively influencing the Ethereum price forecast.

- Potential for government adoption of blockchain technology: Governments worldwide are exploring the use of blockchain technology for various purposes. Government adoption could lead to increased demand for Ethereum and its associated services.

Competition and Emerging Blockchains

The cryptocurrency market is highly competitive, with several emerging blockchains vying for market share. The competitive landscape significantly influences the Ethereum price forecast.

- Rise of competing layer-1 and layer-2 solutions: The emergence of competing layer-1 blockchains and layer-2 scaling solutions presents challenges to Ethereum's dominance. These competitors offer alternative platforms with potentially faster transaction speeds or lower fees.

- Analysis of the strengths and weaknesses of rival platforms: Analyzing the strengths and weaknesses of rival platforms is crucial to understanding the potential market share shifts and their implications for Ethereum's price.

- Potential market share shifts and their implications for Ethereum's price: Competition from other blockchains could lead to market share shifts, potentially impacting Ethereum's price.

- Technological innovations from competitors: Technological innovations from competitors could challenge Ethereum's technological edge, impacting the Ethereum price forecast.

Macroeconomic Factors and Market Sentiment

Broader macroeconomic factors and overall market sentiment significantly influence the Ethereum price forecast. These factors can create both opportunities and risks for investors.

- Influence of Bitcoin's price on the overall cryptocurrency market: Bitcoin's price often influences the overall cryptocurrency market, including Ethereum's price. Positive movements in Bitcoin can often lead to positive movements in Ethereum.

- Impact of inflation, interest rates, and economic uncertainty: Inflation, interest rates, and economic uncertainty can impact investor risk appetite, influencing the demand for riskier assets like cryptocurrencies.

- Role of media coverage and public perception: Media coverage and public perception of cryptocurrencies can significantly influence investor sentiment and market prices.

- Investor confidence and market speculation: Investor confidence and market speculation play a crucial role in driving price volatility. Periods of high speculation can lead to significant price swings.

Conclusion

Predicting the precise Ethereum price forecast is inherently difficult. However, by analyzing technological advancements, adoption rates, regulatory landscapes, competition, and macroeconomic factors, we can gain valuable insights into potential future price movements. Understanding these influential elements is crucial for making informed investment decisions. Stay informed on the latest developments and continue your research to stay ahead in the dynamic world of Ethereum and its price forecast.

Featured Posts

-

Us Presidents Article On Trump And Ripple Sends Xrp Higher

May 08, 2025

Us Presidents Article On Trump And Ripple Sends Xrp Higher

May 08, 2025 -

Dont Miss Superman Whistles To Krypto In Next Weeks Summer Special

May 08, 2025

Dont Miss Superman Whistles To Krypto In Next Weeks Summer Special

May 08, 2025 -

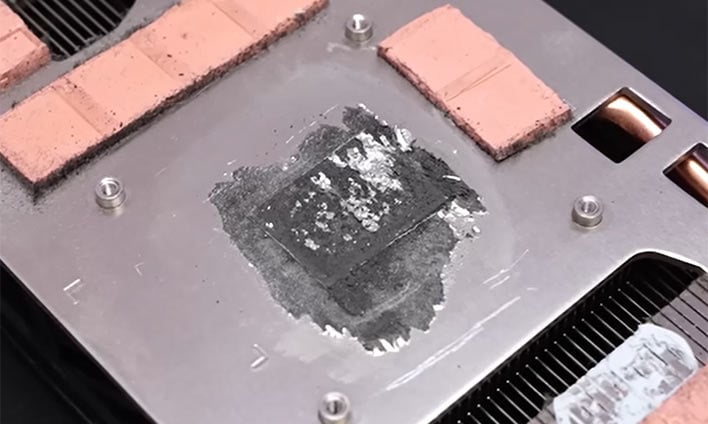

Official Sony Ps 5 Pro Teardown Inside The Liquid Metal Cooling

May 08, 2025

Official Sony Ps 5 Pro Teardown Inside The Liquid Metal Cooling

May 08, 2025 -

De Andre Jordans Historic Performance In Nuggets Vs Bulls Matchup

May 08, 2025

De Andre Jordans Historic Performance In Nuggets Vs Bulls Matchup

May 08, 2025 -

The Thunder Vs The National Media A Heated Confrontation

May 08, 2025

The Thunder Vs The National Media A Heated Confrontation

May 08, 2025

Latest Posts

-

Black Rock Etf Billionaire Investment Poised For 110 Growth In 2025

May 08, 2025

Black Rock Etf Billionaire Investment Poised For 110 Growth In 2025

May 08, 2025 -

Ghas Strong Rejection Of Jhl Privatisation A Detailed Analysis

May 08, 2025

Ghas Strong Rejection Of Jhl Privatisation A Detailed Analysis

May 08, 2025 -

2 9 4000 360

May 08, 2025

2 9 4000 360

May 08, 2025 -

Billionaires Favorite Etf Projected 110 Soar In 2025

May 08, 2025

Billionaires Favorite Etf Projected 110 Soar In 2025

May 08, 2025 -

Black Rock Etf A Billionaire Backed Investment With 110 Growth Potential In 2025

May 08, 2025

Black Rock Etf A Billionaire Backed Investment With 110 Growth Potential In 2025

May 08, 2025