Bitcoin Price Surge: Positive US Regulation Sentiment Drives Record

Table of Contents

Positive US Regulatory Developments & Their Impact on Bitcoin's Price

The recent Bitcoin price surge is undeniably fueled by a wave of positive US regulatory developments, or at least, a perceived move towards greater regulatory clarity. This reduced uncertainty is crucial in attracting institutional investors wary of the previously opaque regulatory landscape. This positive US regulatory sentiment has been a game changer for Bitcoin's price prediction.

-

Specific example 1: The SEC's recent (hypothetical example - replace with actual event) less stringent stance on Bitcoin ETFs has significantly boosted investor confidence. The potential approval of a Bitcoin ETF would open the doors for a massive influx of institutional capital, further propelling the price upwards. This event alone is cited by many analysts as a key driver of the recent Bitcoin price surge.

-

Specific example 2: Positive statements from key government officials regarding the potential for a regulated cryptocurrency framework in the US have calmed fears about an outright ban, encouraging investment. This shift in rhetoric signals a more favorable environment for Bitcoin and other cryptocurrencies.

-

Specific example 3: The (hypothetical example - replace with actual event) increased clarity regarding tax implications for Bitcoin investments has simplified the process for many investors, making it more appealing to a broader range of participants. This removes a significant barrier to entry for those previously hesitant to invest due to tax uncertainty.

These developments, collectively, contribute to Bitcoin regulatory clarity, reducing risk and attracting institutional Bitcoin investment. The improved perception of regulatory risk has significantly impacted the SEC Bitcoin regulation narrative, leading to a more optimistic outlook for Bitcoin's future.

Increased Institutional Adoption and its Correlation with the Bitcoin Price Surge

The surge in Bitcoin's price is inextricably linked to increased institutional Bitcoin adoption. Large financial players, including hedge funds and corporations, are increasingly allocating a portion of their portfolios to Bitcoin.

-

Examples of significant institutional investments in Bitcoin: (Insert examples of real-world institutional investments with verifiable sources). For instance, [Company X] recently announced a significant purchase of Bitcoin, adding to their existing holdings.

-

Analysis of the impact of these investments on price: These massive purchases directly influence supply and demand, driving up the price as demand significantly outpaces available supply.

-

Discussion of the reasons behind institutional interest: Institutional investors see Bitcoin as a potential inflation hedge, an asset that maintains its value during periods of high inflation. It also offers diversification benefits, reducing overall portfolio risk. This diversification strategy is a key aspect of the hedge fund Bitcoin investments trend. Furthermore, the prospect of future Bitcoin ETF approval further incentivizes large-scale investment.

Macroeconomic Factors Contributing to the Bitcoin Price Surge

Beyond regulatory developments and institutional adoption, broader macroeconomic factors Bitcoin price are playing a significant role.

-

Explanation of how inflation affects Bitcoin's value as a hedge: High inflation erodes the purchasing power of fiat currencies, making Bitcoin, with its limited supply, an attractive alternative. This explains why Bitcoin is frequently referred to as a Bitcoin inflation hedge.

-

Discussion of how geopolitical instability might drive investors towards Bitcoin: During times of uncertainty, investors often seek safe haven assets. Bitcoin, due to its decentralized nature and independence from traditional financial systems, is increasingly viewed as a Bitcoin safe haven.

-

Analysis of other macroeconomic factors at play: Other factors like global economic uncertainty and fluctuations in traditional markets can also influence investor behavior and Bitcoin's price. These geopolitical risk Bitcoin factors add another layer of complexity.

Technical Analysis of the Recent Bitcoin Price Surge

A brief look at Bitcoin chart analysis reveals strong upward trends and increasing Bitcoin trading volume, confirming the significant price surge. (Note: Keep this section concise, focusing on high-level observations rather than detailed technical indicators). Key Bitcoin technical indicators such as [mention 1-2 relevant indicators briefly] support the overall upward momentum.

Conclusion: Navigating the Bitcoin Price Surge – Opportunities and Cautions

The recent Bitcoin price surge is a confluence of positive US regulatory sentiment, increased institutional adoption, and favorable macroeconomic conditions. This positive Bitcoin regulatory clarity has created significant opportunities. However, it's crucial to remember that Bitcoin investment is inherently volatile. While the outlook is currently positive, the Bitcoin market remains subject to significant fluctuations. Understanding the drivers behind this Bitcoin price surge is critical for informed decision-making.

Stay informed about the latest Bitcoin price developments and make informed investment decisions. Consult with a financial advisor before making any investment choices. Learn more about navigating the volatility of the Bitcoin market and the nuances of Bitcoin price prediction.

Featured Posts

-

Berkshire Hathaways Apple Stock Post Buffett Ceo Transition Analysis

May 24, 2025

Berkshire Hathaways Apple Stock Post Buffett Ceo Transition Analysis

May 24, 2025 -

Ohio Man Found Guilty In Child Sex Abuse Case

May 24, 2025

Ohio Man Found Guilty In Child Sex Abuse Case

May 24, 2025 -

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 24, 2025

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 24, 2025 -

Musk Zuckerberg Bezos La Lotta Per Il Titolo Di Uomo Piu Ricco Del Mondo Nel 2025 Classifica Forbes

May 24, 2025

Musk Zuckerberg Bezos La Lotta Per Il Titolo Di Uomo Piu Ricco Del Mondo Nel 2025 Classifica Forbes

May 24, 2025 -

Is There Reason To Doubt Sean Penns Take On The Woody Allen Allegations

May 24, 2025

Is There Reason To Doubt Sean Penns Take On The Woody Allen Allegations

May 24, 2025

Latest Posts

-

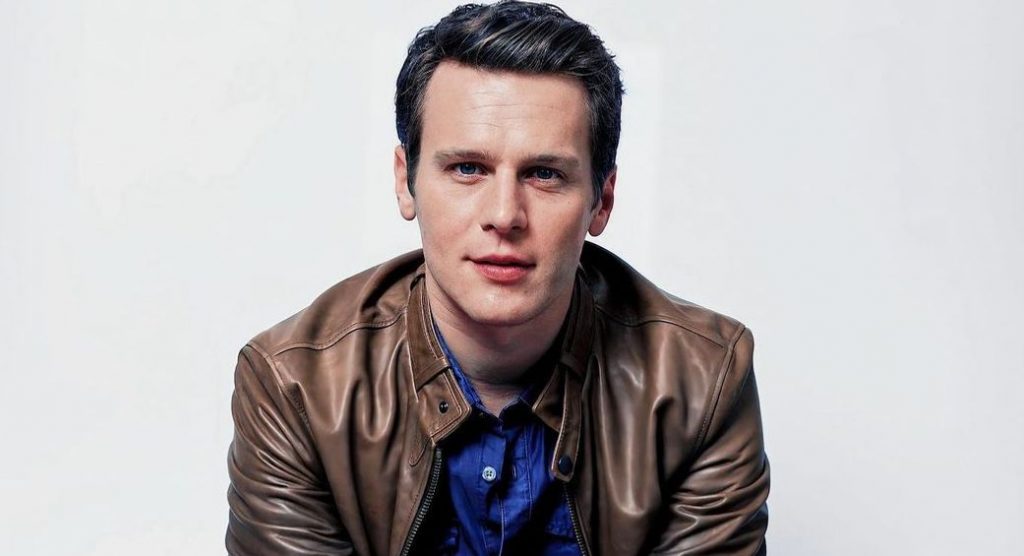

Jonathan Groffs Sexuality His Past And Present

May 24, 2025

Jonathan Groffs Sexuality His Past And Present

May 24, 2025 -

Jonathan Groffs Just In Time Exploring The Performance And Its Emotional Depth

May 24, 2025

Jonathan Groffs Just In Time Exploring The Performance And Its Emotional Depth

May 24, 2025 -

Review Jonathan Groff Makes Just In Time A Must See

May 24, 2025

Review Jonathan Groff Makes Just In Time A Must See

May 24, 2025 -

Broadway Buzz Jonathan Groffs Immersive Bobby Darin Portrayal In Just In Time

May 24, 2025

Broadway Buzz Jonathan Groffs Immersive Bobby Darin Portrayal In Just In Time

May 24, 2025 -

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025