Bitcoin Price Surge: Trade Tensions And Bullish Crypto Bets

Table of Contents

Geopolitical Uncertainty Fuels Bitcoin Demand

Rising geopolitical uncertainty is a key driver of the recent Bitcoin price surge. Investors, wary of traditional markets, are increasingly seeking alternative assets perceived as less susceptible to global instability.

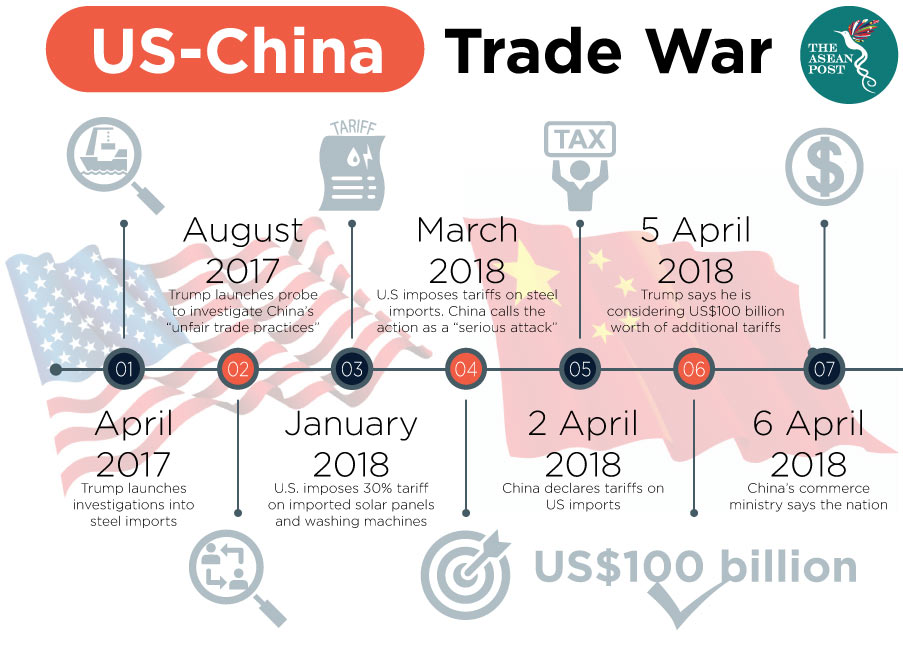

Trade Wars and Economic Instability

Escalating trade wars between major global powers create significant uncertainty in traditional markets, such as stocks and bonds. This uncertainty pushes investors to diversify their portfolios and seek alternative stores of value.

- Increased volatility in stock markets: The unpredictability of trade policies leads to increased volatility in established markets, making them less attractive for long-term investment.

- Safe-haven asset status of Bitcoin: Bitcoin, often perceived as a hedge against economic uncertainty, is increasingly seen as a safe-haven asset, similar to gold.

- Diversification strategies among investors: Sophisticated investors are incorporating Bitcoin into their portfolios as a way to diversify and mitigate risk associated with traditional assets.

Sanctions and Regulatory Uncertainty

Geopolitical sanctions and regulatory uncertainty in traditional financial systems further contribute to the appeal of Bitcoin. Its decentralized nature offers a level of freedom and security not always found in traditional banking systems.

- Bitcoin's resistance to censorship: Unlike fiat currencies, Bitcoin transactions are not subject to government censorship or control.

- Increased adoption in regions with unstable currencies: In countries with volatile or unreliable currencies, Bitcoin offers a more stable and reliable alternative.

- Potential for Bitcoin to bypass traditional banking systems: Bitcoin's decentralized structure allows for cross-border transactions without reliance on traditional banking infrastructure, making it attractive in regions with limited access to financial services.

Bullish Investor Sentiment and Institutional Adoption

The Bitcoin price surge is not solely driven by geopolitical factors; a significant surge in bullish investor sentiment, particularly from institutional sources, is playing a crucial role.

Growing Institutional Interest

The increased involvement of institutional investors—hedge funds, corporations, and asset management firms—is a major factor driving the current price appreciation. Their entry signifies a growing acceptance of Bitcoin as a legitimate asset class.

- Grayscale Investments and other institutional funds: Large-scale institutional investors like Grayscale Investments are significantly increasing their Bitcoin holdings, injecting considerable liquidity into the market.

- Growing acceptance of Bitcoin as a legitimate asset class: Increased institutional adoption signals a shift in perception, lending credibility and legitimacy to Bitcoin as an investment vehicle.

- Increased liquidity in Bitcoin markets: Institutional involvement brings substantial capital and liquidity, making the Bitcoin market more robust and less susceptible to dramatic price swings (though still volatile).

Retail Investor FOMO (Fear Of Missing Out)

Positive media coverage and the rising Bitcoin price itself fuels retail investor enthusiasm, creating a self-reinforcing cycle of price appreciation driven by FOMO.

- Social media influence on Bitcoin adoption: Social media platforms play a significant role in spreading awareness and excitement around Bitcoin, contributing to the overall hype.

- News articles and media coverage impacting investor sentiment: Positive news coverage further amplifies the bullish sentiment and attracts new investors.

- Psychological factors driving investment decisions: FOMO plays a powerful role, encouraging retail investors to jump on the bandwagon, further driving up demand and price.

Technical Factors Contributing to the Bitcoin Price Surge

Beyond macroeconomic and investor sentiment, certain technical factors also contribute to the Bitcoin price surge.

Halving Event Anticipation

The upcoming Bitcoin halving event, which reduces the rate of new Bitcoin creation, is a significant catalyst for the anticipated price increase. This event historically triggers scarcity and increased price appreciation.

- Reduced Bitcoin supply after the halving: The halving event reduces the rate at which new Bitcoins are mined, creating artificial scarcity.

- Historical price trends after previous halving events: Previous halving events have historically been followed by significant price increases in the months and years after.

- Market speculation and anticipation: The anticipation of the halving event itself fuels speculation and drives up demand in advance.

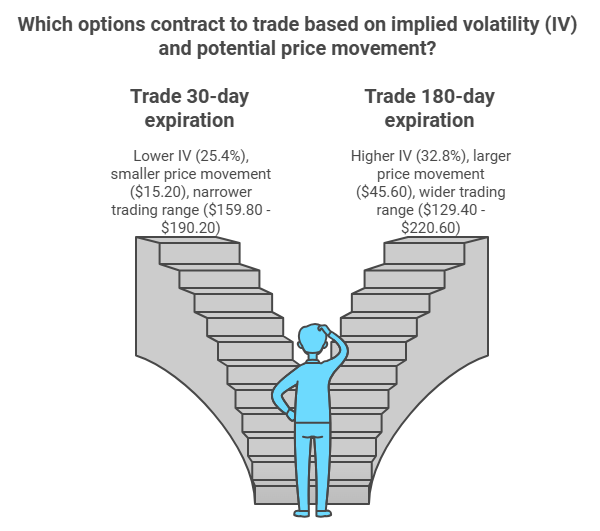

Technical Analysis and Chart Patterns

Technical analysis, while not a perfect predictor, shows indicators suggesting upward momentum. (Note: Detailed technical analysis is beyond the scope of this article. Consult with a financial professional for specific advice.)

- Mention key indicators like moving averages and RSI: These indicators, while not guarantees, can provide insights into potential price movements.

- Note that technical analysis is not foolproof: Technical indicators should be used in conjunction with other forms of analysis, not as sole predictors.

- Link to relevant charts (if available): Visual representations of price trends and indicators can enhance understanding.

Conclusion

The recent Bitcoin price surge is multifaceted, stemming from global trade tensions, increased institutional and retail investor interest, and the anticipated Bitcoin halving event. Navigating this volatile market requires careful consideration of these interconnected factors. While future price movements remain unpredictable, the current surge underscores Bitcoin's growing importance as a potential safe-haven asset and a store of value. To make informed decisions about your Bitcoin investments, continue to monitor the Bitcoin price surge and its impact on the broader financial landscape. Stay informed and make prudent choices.

Featured Posts

-

Brookfields Opportunistic Investment Strategy Amid Market Volatility

May 08, 2025

Brookfields Opportunistic Investment Strategy Amid Market Volatility

May 08, 2025 -

2025 Ptt Alimlari Kpss Li Ve Kpss Siz Is Imkanlari

May 08, 2025

2025 Ptt Alimlari Kpss Li Ve Kpss Siz Is Imkanlari

May 08, 2025 -

The Trade Wars Impact On Crypto One Cryptocurrency That Could Still Thrive

May 08, 2025

The Trade Wars Impact On Crypto One Cryptocurrency That Could Still Thrive

May 08, 2025 -

Ansany Asmglng Ka Sngyn Kys Mraksh Myn 4 Mlzman Grftar Kshty Hadthe Ky Thqyqat Jary

May 08, 2025

Ansany Asmglng Ka Sngyn Kys Mraksh Myn 4 Mlzman Grftar Kshty Hadthe Ky Thqyqat Jary

May 08, 2025 -

5 Military Movies A Powerful Mix Of Action And Emotion

May 08, 2025

5 Military Movies A Powerful Mix Of Action And Emotion

May 08, 2025

Latest Posts

-

Andor First Look A 31 Year Old Star Wars Tease Finally Revealed

May 08, 2025

Andor First Look A 31 Year Old Star Wars Tease Finally Revealed

May 08, 2025 -

Get Ready For Andor Season 2 A Quick Recap Of Season 1

May 08, 2025

Get Ready For Andor Season 2 A Quick Recap Of Season 1

May 08, 2025 -

Tony Gilroy Praises Andor A Look Back At His Star Wars Experience

May 08, 2025

Tony Gilroy Praises Andor A Look Back At His Star Wars Experience

May 08, 2025 -

Andor Season 2 Premiere What To Remember Before Watching

May 08, 2025

Andor Season 2 Premiere What To Remember Before Watching

May 08, 2025 -

Andor Season 2 A Recap Before The New Episodes

May 08, 2025

Andor Season 2 A Recap Before The New Episodes

May 08, 2025