Bitcoin's Critical Juncture: Analyzing Key Price Points For Investors

Table of Contents

Bitcoin's price has always been volatile, creating both immense opportunities and significant risks for investors. Understanding Bitcoin's critical price points – those levels that historically have triggered significant price movements – is crucial for navigating the market and making informed decisions. This article analyzes key Bitcoin price points, helping investors assess potential entry and exit strategies, and manage risk effectively. We'll explore how to identify these crucial levels and use them to improve your Bitcoin investment strategy.

Historical Bitcoin Price Points and Their Significance

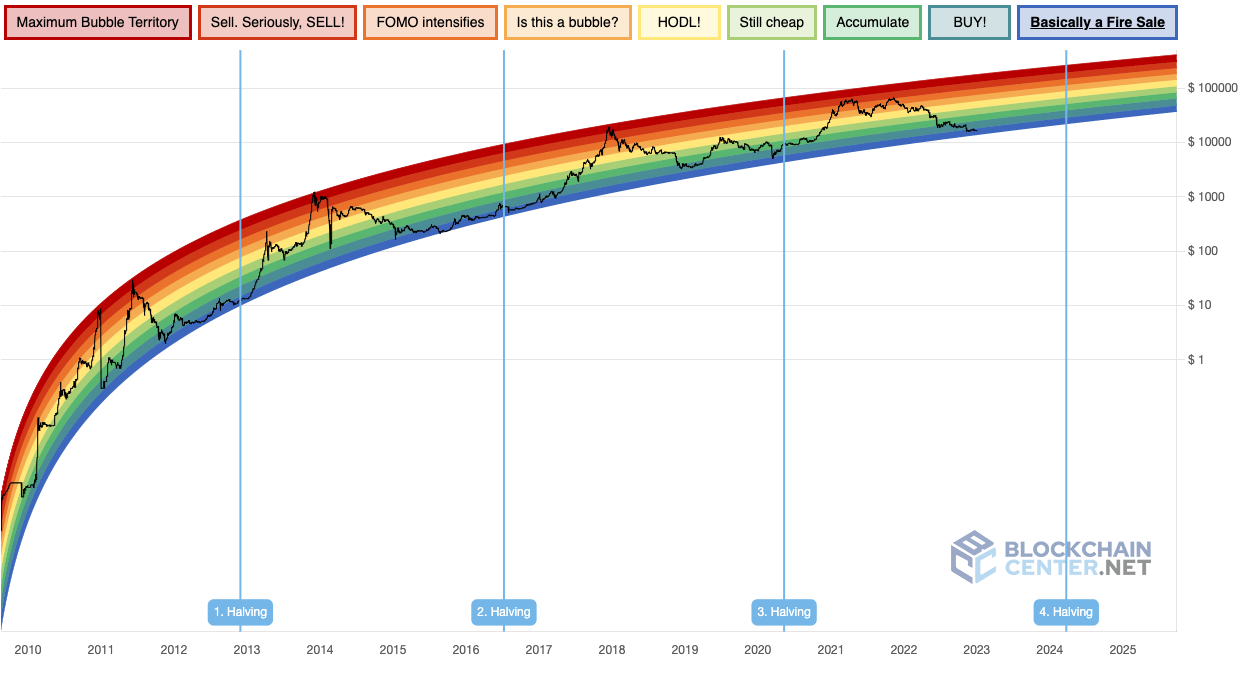

Analyzing past Bitcoin price movements is essential for predicting future trends, though it's not a foolproof method. By identifying key support and resistance levels, we can gain valuable insights into potential price reversals and breakouts. Understanding these historical Bitcoin price points allows investors to anticipate market reactions and adjust their strategies accordingly.

Key Support and Resistance Levels

Significant past support and resistance levels for Bitcoin include $20,000, $30,000, and $60,000. These levels have historically acted as barriers, either preventing further price increases (resistance) or decreases (support).

-

Illustrative Charts: (Imagine charts here showing past Bitcoin price action around $20k, $30k, and $60k, clearly marking support and resistance) These charts visually demonstrate how the price has reacted to these levels in the past.

-

Price Barriers: When Bitcoin approached $20,000 in the past, we saw periods of consolidation and price fluctuations before eventually breaking through or retracing. Similarly, $30,000 and $60,000 acted as significant hurdles, showcasing the psychological impact of these round numbers.

-

Market Sentiment: The psychological impact of these round numbers on investor sentiment is undeniable. Reaching a new all-time high, like breaking through $60,000, often triggers waves of optimism and FOMO (fear of missing out), potentially leading to further price increases. Conversely, a significant drop below a key support level can spark panic selling.

Analyzing Market Sentiment Around Key Price Points

News events, regulatory changes, and overall market conditions significantly impact Bitcoin's price at these key levels.

-

Past Events: The 2020 halving, Elon Musk's tweets, and various regulatory announcements have all influenced Bitcoin's price around these key price points. Understanding the context of these events is vital for interpreting past price action.

-

On-Chain Data & Social Sentiment: Analyzing on-chain metrics like transaction volume, mining difficulty, and the number of active addresses, coupled with social media sentiment analysis, can help gauge market confidence around critical price points. Increased on-chain activity alongside positive social sentiment could indicate a potential breakout above resistance.

Predicting Future Bitcoin Price Points

Predicting future Bitcoin price points with complete accuracy is impossible. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors. However, combining technical and fundamental analysis can improve your understanding of potential price movements.

Technical Analysis and its Role

Technical indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify potential support and resistance levels and predict price trends.

-

Combining Approaches: Technical analysis is most effective when combined with fundamental analysis. Technical indicators can signal potential price movements, but fundamental analysis provides the context and underlying reasons for those movements.

-

Cautious Approach: Never rely solely on technical indicators. They are tools to assist decision-making, not guarantees of future price movements. Always consider the broader market context and other factors.

Fundamental Analysis and Bitcoin's Long-Term Value

Fundamental analysis focuses on the intrinsic value of Bitcoin, considering factors like adoption rate, network growth, and the regulatory landscape.

-

Macroeconomic Factors: Global economic conditions, inflation rates, and the performance of traditional assets significantly impact Bitcoin's price. A flight to safety during economic uncertainty can drive up demand for Bitcoin.

-

Institutional Investors: The increasing involvement of institutional investors, like large corporations and hedge funds, significantly influences Bitcoin's price and stability. Their involvement often leads to more stable price action.

Risk Management Strategies Around Key Bitcoin Price Points

Effective risk management is crucial when navigating the volatile Bitcoin market and its price points. Employing strategies like Dollar-Cost Averaging (DCA) and utilizing stop-loss orders can significantly reduce your risk.

Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy helps mitigate the risk of investing a large sum at a market peak.

-

Advantages & Disadvantages: DCA reduces the impact of volatility and emotional decision-making. However, it may not yield the highest returns if the price consistently rises.

-

Strategic Use: DCA can be particularly useful around key support levels, where the potential for price increases is considered higher.

Stop-Loss Orders and Position Sizing

Stop-loss orders automatically sell your Bitcoin when the price reaches a predetermined level, limiting potential losses. Position sizing involves determining the appropriate amount to invest based on your risk tolerance.

-

Setting Stop-Loss Levels: Setting stop-loss orders slightly below key support levels can help protect your investment from significant losses.

-

Calculating Position Sizes: Never invest more than you can afford to lose. Calculate position sizes based on your risk tolerance and the potential price fluctuations around key price points.

Conclusion

Successfully navigating the cryptocurrency market requires understanding Bitcoin's critical price points. By carefully analyzing historical data, utilizing technical and fundamental analysis, and employing effective risk management strategies, investors can increase their chances of making profitable decisions. Remember, while identifying key Bitcoin price points offers valuable insights, no strategy guarantees success in the volatile cryptocurrency market. Conduct thorough research and consider consulting a financial advisor before making any investment decisions involving Bitcoin price points. Stay informed about market trends and continue to learn about managing your Bitcoin investments effectively.

Featured Posts

-

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025 -

The Long Walk A Simple Trailer A Scary Premise

May 08, 2025

The Long Walk A Simple Trailer A Scary Premise

May 08, 2025 -

Taiwan Dollars Rise Urgent Need For Economic Reform

May 08, 2025

Taiwan Dollars Rise Urgent Need For Economic Reform

May 08, 2025 -

Wall Streets 110 Prediction The Black Rock Etf Billionaires Are Buying

May 08, 2025

Wall Streets 110 Prediction The Black Rock Etf Billionaires Are Buying

May 08, 2025 -

Bitcoin Price Prediction Analyzing The Impact Of Trumps 100 Day Speech On Btc

May 08, 2025

Bitcoin Price Prediction Analyzing The Impact Of Trumps 100 Day Speech On Btc

May 08, 2025

Latest Posts

-

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025 -

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025 -

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025 -

Brezilya Bitcoin Yasal Maas Oedeme Yoentemi Olarak Kabul Edildi

May 08, 2025

Brezilya Bitcoin Yasal Maas Oedeme Yoentemi Olarak Kabul Edildi

May 08, 2025