Bitcoin's Future: Evaluating The Potential Impact Of A Trump Presidency On BTC Price

Table of Contents

Trump's Economic Policies and Bitcoin

Potential Impact of Deregulation

A Trump administration might favor deregulation across various sectors, potentially impacting Bitcoin's trajectory. This could lead to:

- Increased Institutional Investment: Reduced regulatory burdens could encourage larger institutional investors to enter the cryptocurrency market, boosting Bitcoin's price through increased demand.

- Potential for Increased Volatility: Less regulation could also lead to increased market volatility, as fewer safeguards are in place. This double-edged sword could benefit some traders while potentially harming others.

- Ease of Access to Crypto Markets: Simplified regulatory frameworks could make it easier for individuals to access and trade Bitcoin, potentially fueling adoption and price growth.

The potential for a more laissez-faire approach to financial markets under a Trump presidency contrasts sharply with the tighter regulatory environments seen under other administrations. This difference could significantly alter the landscape for cryptocurrency businesses and investors.

Fiscal Policy and Inflation

Trump's fiscal policies, often characterized by increased government spending, could contribute to inflation. This, in turn, could affect Bitcoin's value as a potential hedge against inflation.

- Increased Government Spending: Expansionary fiscal policies can lead to increased money supply, potentially driving inflation.

- Potential for Higher Inflation: Higher inflation erodes the purchasing power of fiat currencies, making alternative assets like Bitcoin more attractive.

- Bitcoin as a Safe Haven Asset: Historically, Bitcoin has shown a tendency to appreciate during periods of high inflation, acting as a store of value.

- Impact on USD Value: A weakening USD due to inflation could increase the demand for Bitcoin as a more stable alternative.

The correlation between inflation and Bitcoin's price is a subject of ongoing debate, but historical data suggests a potential relationship. Different inflationary scenarios would significantly impact Bitcoin’s price, requiring careful consideration.

Trump's Stance on Cryptocurrency Regulation

Past Statements and Actions

Analyzing Trump's previous public statements and actions regarding cryptocurrencies is crucial for predicting his future policy.

- Analysis of Previous Tweets: Examining his past social media posts provides insight into his initial opinions on crypto.

- Public Statements on Crypto: Gathering information from press conferences and interviews reveals his publicly stated views.

- Potential for Future Policy Shifts: While past statements offer clues, his future policy could differ based on evolving circumstances and advice from his administration.

A comprehensive review of his previous pronouncements on the subject will inform future expectations regarding potential regulatory changes.

Potential Regulatory Changes

A Trump administration could bring several regulatory changes affecting Bitcoin:

- Potential for Tax Changes Related to Crypto: Tax policies surrounding cryptocurrency could become stricter or more lenient, impacting investor behavior.

- Regulatory Clarity vs. Uncertainty: A Trump administration could either bring much-needed regulatory clarity to the crypto market or introduce further uncertainty, affecting investor confidence.

- Impact on Institutional Adoption: Clearer and less burdensome regulations could encourage greater institutional adoption of Bitcoin.

The potential for both positive and negative regulatory changes necessitates a cautious approach. Increased clarity regarding tax regulations or the development of a more comprehensive regulatory framework are both possibilities.

Geopolitical Factors and Bitcoin's Price

International Relations and Market Stability

Trump's foreign policy and international relations could significantly impact global economic stability and subsequently Bitcoin's price.

- Trade Wars: Trade disputes could create global economic uncertainty, potentially driving investors towards Bitcoin as a safe haven.

- Geopolitical Tensions: Increased geopolitical instability worldwide could lead to higher Bitcoin demand.

- Impact on Global Markets: Global market fluctuations due to political events can impact Bitcoin's price.

- Safe Haven Asset Status of Bitcoin: Bitcoin's perceived status as a safe-haven asset may be reinforced or challenged depending on global events.

Historical data demonstrates how global instability often correlates with Bitcoin price increases, highlighting Bitcoin's potential role as a hedge against uncertainty.

US-China Relations and Bitcoin

The US-China relationship under a Trump administration would significantly influence Bitcoin’s global trajectory.

- Trade Tensions: Increased trade tensions could destabilize global markets and impact Bitcoin.

- Technological Competition: The ongoing technological competition between the US and China could impact the development and adoption of cryptocurrencies.

- Impact on Chinese Crypto Adoption: Changes in US-China relations might affect China's crypto policies and adoption rates.

- Ripple Effect on Global Markets: Any significant shifts in the relationship will likely cause ripples throughout global financial markets, impacting Bitcoin.

The interplay between these two global powers will be crucial in determining the future adoption and price of Bitcoin.

Conclusion

The potential impacts of a Trump presidency on Bitcoin's price are multifaceted, stemming from economic policies, regulatory decisions, and geopolitical dynamics. A deregulatory approach might boost institutional investment and increase volatility, while fiscal policies could influence inflation and Bitcoin’s role as an inflation hedge. His stance on regulation could bring clarity or further uncertainty, impacting investor confidence. Geopolitical factors, particularly US-China relations, will also play a significant role. Therefore, the potential exists for both significant price increases and decreases, depending on the specific policies enacted and global events that unfold.

Call to Action: Stay informed about the evolving political landscape and its potential impact on Bitcoin. Continue researching the factors affecting Bitcoin's price and make informed decisions based on your own risk tolerance. Follow developments related to the Trump presidency and Bitcoin price predictions to make smart investment choices. Remember to conduct your own thorough research before investing in Bitcoin. Keywords: Bitcoin investment, Bitcoin future, BTC price analysis, Trump and Bitcoin.

Featured Posts

-

Ethereums Bullish Run Breaking Resistance And Eyeing 2 000

May 08, 2025

Ethereums Bullish Run Breaking Resistance And Eyeing 2 000

May 08, 2025 -

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025 -

Understanding The European Digital Identity Wallet A Comprehensive Guide

May 08, 2025

Understanding The European Digital Identity Wallet A Comprehensive Guide

May 08, 2025 -

Recent India Pakistan Conflict A Detailed Account Of The Strikes

May 08, 2025

Recent India Pakistan Conflict A Detailed Account Of The Strikes

May 08, 2025 -

Nevilles Prediction Psg Vs Arsenal A High Stakes Encounter

May 08, 2025

Nevilles Prediction Psg Vs Arsenal A High Stakes Encounter

May 08, 2025

Latest Posts

-

Proposed Changes To Uk Visa Policies Impact On Specific Nationalities

May 09, 2025

Proposed Changes To Uk Visa Policies Impact On Specific Nationalities

May 09, 2025 -

Potential Uk Visa Restrictions Which Countries Could Be Affected

May 09, 2025

Potential Uk Visa Restrictions Which Countries Could Be Affected

May 09, 2025 -

New Report Details Potential Uk Visa Application Restrictions

May 09, 2025

New Report Details Potential Uk Visa Application Restrictions

May 09, 2025 -

Updated Uk Visa Requirements Nigerians And Pakistanis Affected

May 09, 2025

Updated Uk Visa Requirements Nigerians And Pakistanis Affected

May 09, 2025 -

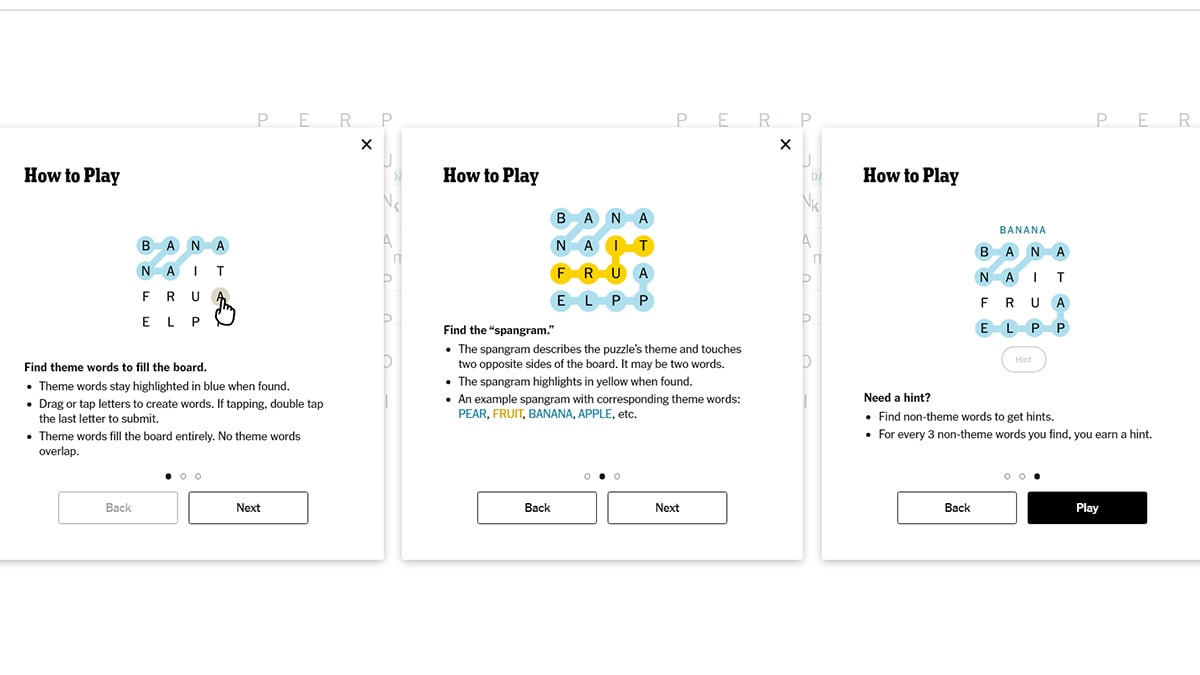

Unlock Nyt Strands Puzzle 377 March 15 Solutions Provided

May 09, 2025

Unlock Nyt Strands Puzzle 377 March 15 Solutions Provided

May 09, 2025