Ethereum's Bullish Run: Breaking Resistance And Eyeing $2,000

Table of Contents

Technical Analysis: Signs of a Breakout

Breaking Key Resistance Levels

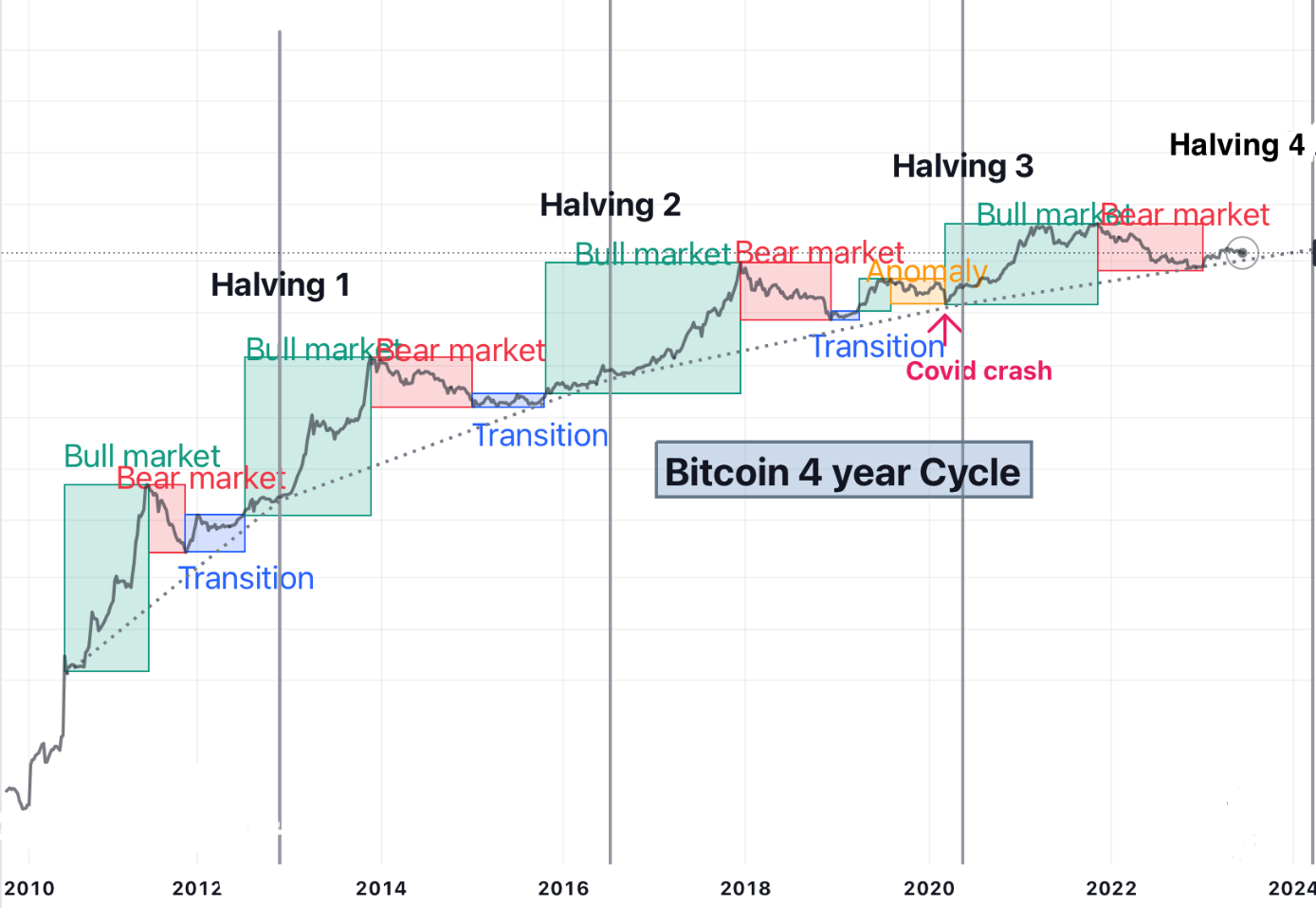

Recent price action shows Ethereum overcoming significant resistance levels. The price recently broke through the crucial psychological barrier of $1800, a level that had previously capped ETH's upward momentum for several weeks. This breakout is further supported by the formation of a classic bullish flag pattern on the daily chart, suggesting a continuation of the upward trend.

- Indicator Confirmation: The Relative Strength Index (RSI) is above 70, indicating overbought conditions, but the momentum hasn't faltered, signifying strong buying pressure. The Moving Average Convergence Divergence (MACD) shows a clear bullish crossover, further reinforcing the positive trend. Trading volume has also significantly increased during this breakout, confirming the legitimacy of the move.

- Chart Patterns: The chart clearly shows the price successfully breaking through a descending triangle pattern, a bullish signal often preceding significant price increases. (Insert relevant chart here)

- Increased Buying Pressure: This successful break of resistance levels suggests a substantial increase in buying pressure, with investors becoming increasingly confident in Ethereum's future prospects. The sustained price increase after breaking through the resistance indicates that this isn't just a fleeting price pump.

Increasing Trading Volume

The surge in Ethereum's price is accompanied by a significant increase in trading volume. This high volume is a crucial validation of the breakout, confirming that the price increase isn't merely driven by short-term speculation.

- Volume Comparison: Current trading volumes are significantly higher than those seen during previous periods of consolidation. This indicates a stronger conviction among investors.

- Institutional Involvement: Increased institutional investment in Ethereum is also likely contributing to the higher trading volumes. Large institutional buys typically involve substantial amounts of ETH, pushing prices higher.

- On-Chain Metrics: On-chain data, such as the increase in active addresses and transaction counts, further corroborates the growing interest and activity within the Ethereum network. This increased activity is a key driver of the Ethereum bullish run.

Market Sentiment and News

Positive Investor Sentiment

The overall sentiment surrounding Ethereum has shifted dramatically towards optimism. Positive news and developments are fueling investor confidence and driving the bullish momentum.

- Strategic Partnerships: Recent partnerships and integrations with major companies are boosting Ethereum's adoption and visibility, attracting new investors.

- Regulatory Clarity: Positive regulatory developments, including clearer guidelines on cryptocurrency usage, are reducing uncertainty and encouraging wider market participation.

- Social Sentiment: Social media sentiment analysis tools indicate a significant increase in positive sentiment towards Ethereum, reflecting the growing optimism among investors and enthusiasts.

Upcoming Ethereum Developments

Anticipated upgrades and network improvements are creating a positive outlook for Ethereum's future, contributing significantly to the current bullish run.

- Shanghai Upgrade Impact: The Shanghai upgrade, enabling withdrawals of staked ETH, is expected to unlock substantial liquidity and potentially drive increased price appreciation.

- Scaling Solutions: The implementation of scaling solutions like sharding will significantly improve Ethereum's transaction speed and efficiency, addressing a major bottleneck.

- Increased Demand: These upgrades will likely attract more developers and users, leading to increased demand for ETH and pushing prices even higher.

Potential Challenges and Risks

While the outlook is bullish, it's crucial to acknowledge potential challenges and risks.

Resistance Levels Above $2,000

Even with the current momentum, significant resistance levels lie above the $2,000 mark. Overcoming these could be challenging and may slow or even reverse the bullish trend.

- Historical Resistance: Historical price data indicates that the $2,000 to $2,500 range has historically acted as a strong resistance zone.

- Potential Reversal: Failure to break through these levels could lead to a temporary price correction or even a reversal of the current bullish trend.

Macroeconomic Factors

Macroeconomic conditions, such as inflation and interest rate hikes, could negatively impact the entire cryptocurrency market, including Ethereum.

- Investor Risk Appetite: Increased inflation and higher interest rates can reduce investor risk appetite, causing a market-wide sell-off that would affect Ethereum's price.

- Risk Management: Diversification and careful risk management strategies are essential to mitigate potential losses during periods of market volatility.

Conclusion

The current Ethereum bullish run shows promising signs, with the potential to push ETH towards $2,000 and beyond. The combination of technical breakthroughs, positive market sentiment, and upcoming network developments strongly suggests a sustained upward trend. However, challenges and risks remain, emphasizing the importance of thorough research and an understanding of the inherent volatility in the cryptocurrency market. Before investing in Ethereum, always conduct your own thorough due diligence. Stay informed about the ongoing Ethereum bullish run and its potential impact by continually monitoring the market and relevant news. Remember, a sound Ethereum investment strategy involves careful consideration of risk and market conditions.

Featured Posts

-

Xrps 400 Jump Predicting Future Price Movement

May 08, 2025

Xrps 400 Jump Predicting Future Price Movement

May 08, 2025 -

Saturday Night Live A Pivotal Point In Counting Crows History

May 08, 2025

Saturday Night Live A Pivotal Point In Counting Crows History

May 08, 2025 -

Is Artetas Arsenal Job At Risk Collymore Weighs In

May 08, 2025

Is Artetas Arsenal Job At Risk Collymore Weighs In

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025 -

Ps Zh Aston Villa Statistika Ta Rezultati Yevrokubkovikh Zustrichey

May 08, 2025

Ps Zh Aston Villa Statistika Ta Rezultati Yevrokubkovikh Zustrichey

May 08, 2025

Latest Posts

-

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025 -

Bitcoins Recent Rebound Signs Of Recovery Or Short Lived Surge

May 08, 2025

Bitcoins Recent Rebound Signs Of Recovery Or Short Lived Surge

May 08, 2025 -

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025 -

Marriyum Aurangzeb Addresses Lahore Zoo Ticket Price Increase

May 08, 2025

Marriyum Aurangzeb Addresses Lahore Zoo Ticket Price Increase

May 08, 2025 -

Bitcoin Rebound A New Bull Market Or Temporary Rally

May 08, 2025

Bitcoin Rebound A New Bull Market Or Temporary Rally

May 08, 2025