BMO Survey: Recession Concerns Halt Canadian Home Purchases

Table of Contents

Survey Highlights: Key Findings Impacting Canadian Home Purchases

The BMO survey, a reputable and widely followed indicator of market sentiment, utilizes a robust methodology involving a large sample size of potential homebuyers across various demographics and geographic locations in Canada. This ensures its findings offer a comprehensive overview of the current market conditions. The key takeaways reveal a significant shift in buyer behavior, driven primarily by economic uncertainty.

- Significant decrease in buyer interest due to economic uncertainty: The survey showed a marked drop in the number of Canadians actively searching for properties, with many expressing hesitation due to looming recessionary fears. This uncertainty is creating a considerable chill in the market.

- Rising interest rates as a major deterrent for potential homebuyers: The Bank of Canada's recent interest rate hikes have significantly impacted affordability, making mortgage payments considerably higher and discouraging many potential buyers from entering the market. This is particularly true for first-time homebuyers.

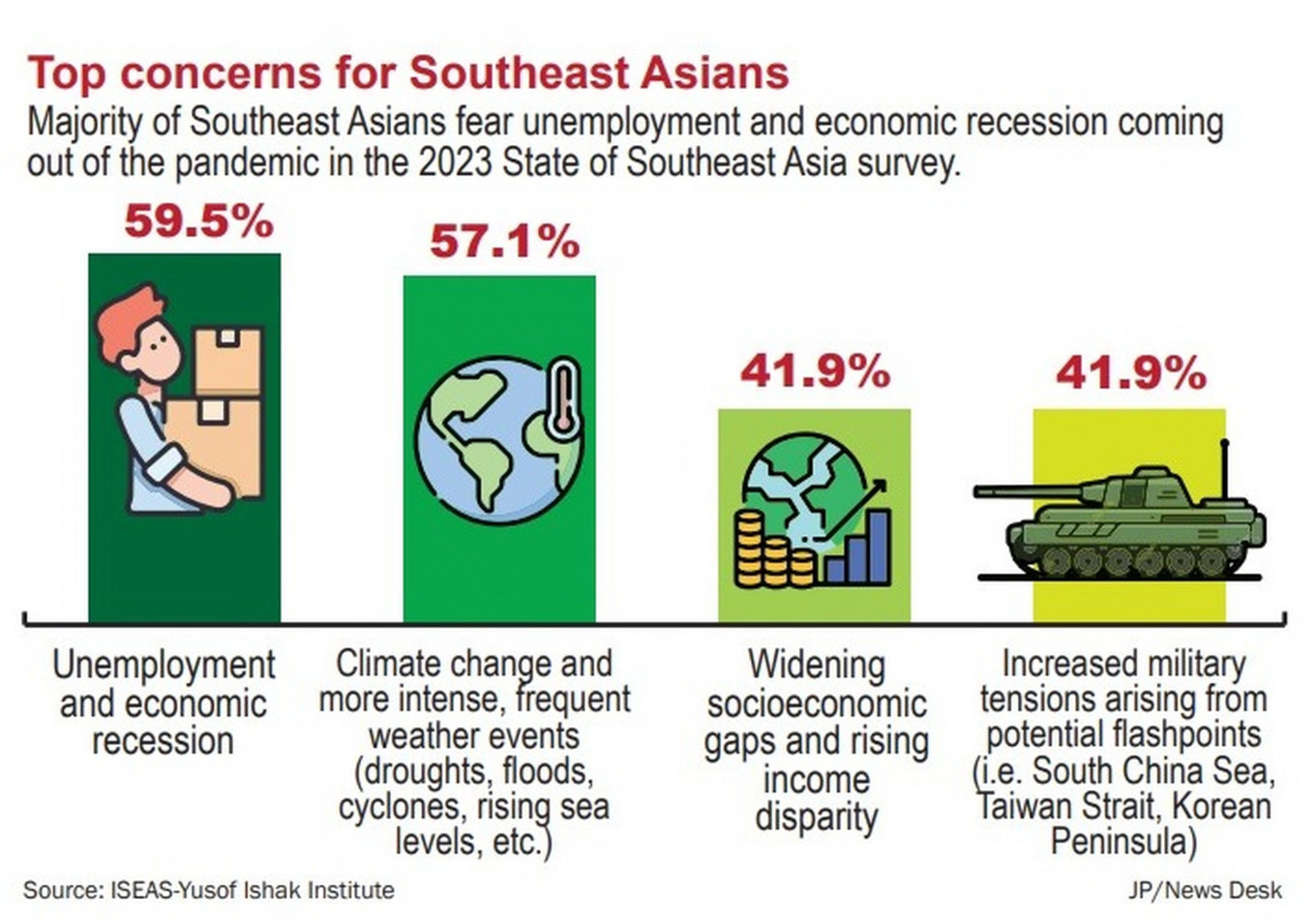

- Increased concerns about job security affecting purchasing power: The survey revealed a heightened level of anxiety surrounding job security, causing many Canadians to postpone major purchases like homes, preferring to prioritize financial stability. This cautious approach is impacting demand significantly.

- Shift in buyer sentiment towards a "wait-and-see" approach: Many potential buyers are adopting a more conservative strategy, choosing to wait and observe market developments before committing to a purchase. This hesitancy contributes to the slowdown in transactions.

- Geographical variations in market impact – highlight specific regions affected: While the slowdown is nationwide, certain regions like Vancouver and Toronto, historically known for their competitive markets, are experiencing a more pronounced impact due to already high property prices. Smaller cities are also feeling the effects, albeit to a lesser extent.

The Role of Recession Fears in the Slowdown of Canadian Home Purchases

Recessionary anxieties are profoundly affecting consumer behavior, impacting the Canadian home purchases market significantly. The psychological impact of potential job losses and economic instability is undeniable.

- Fear of job loss impacting affordability and willingness to commit to mortgages: The prospect of unemployment creates significant financial uncertainty, making many hesitant to take on the substantial financial commitment of a mortgage.

- Uncertainty about future income impacting borrowing capacity: Lenders are more cautious, requiring greater proof of income stability before approving mortgages. This stringent lending environment further reduces the pool of potential buyers.

- Hesitation to make large financial commitments during economic instability: In times of uncertainty, consumers are naturally inclined to delay large purchases, prioritizing savings and debt reduction over significant investments like property.

- Increased preference for saving and reducing debt over making significant purchases: Many Canadians are opting to bolster their financial reserves and pay down existing debt rather than taking on new financial obligations, directly impacting demand for housing.

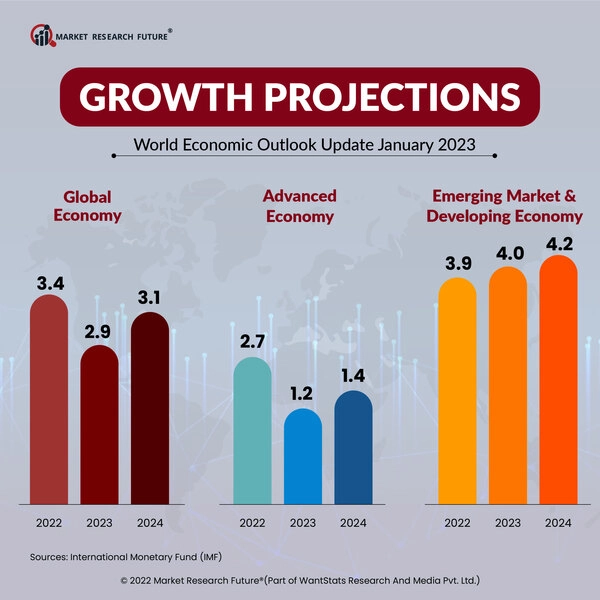

Rising Interest Rates Exacerbate the Situation

The Bank of Canada's efforts to combat inflation through interest rate hikes have directly contributed to the slowdown in Canadian home purchases. Higher borrowing costs are creating significant affordability challenges.

- Increased mortgage payments reducing purchasing power: Higher interest rates translate into substantially higher monthly mortgage payments, reducing the amount potential homebuyers can afford.

- Higher borrowing costs discouraging potential buyers: The increased cost of borrowing makes it more expensive to purchase a home, deterring many from entering the market.

- Impact on first-time homebuyers particularly vulnerable to higher rates: First-time homebuyers, often relying on maximum borrowing capacity, are disproportionately affected by rising interest rates, limiting their purchasing power and making homeownership less attainable.

Implications for the Canadian Real Estate Market

The current slowdown in Canadian home purchases has significant implications for the Canadian real estate market, both in the short and long term.

- Potential price corrections or stagnation in certain markets: Reduced demand could lead to price adjustments or market stagnation in some areas, especially those already experiencing high prices.

- Increased inventory levels as sellers struggle to find buyers: As demand decreases, properties may remain on the market for longer periods, leading to increased inventory and potential downward pressure on prices.

- Impact on related industries such as construction and mortgage lending: The slowdown will undoubtedly affect related sectors, potentially leading to reduced construction activity and impacting employment within these industries.

- Long-term implications for housing affordability and market stability: The current situation may have long-term repercussions for housing affordability and market stability, with potential consequences for economic growth and social welfare.

Conclusion

The BMO survey clearly indicates that recession concerns are significantly impacting Canadian home purchases, creating a noticeable slowdown in the market. Rising interest rates are compounding these challenges, leading to decreased buyer confidence and a shift towards a more cautious approach. Understanding the current climate surrounding Canadian home purchases is crucial for both buyers and sellers. Stay informed about the evolving market trends and consult with financial experts to navigate this period of uncertainty. Keep an eye out for further updates on the impact of recession fears on Canadian home purchases and related market analyses.

Featured Posts

-

Warszawa Premiera Ksiazki Ks Przemyslawa Sliwinskiego O Konklawe

May 07, 2025

Warszawa Premiera Ksiazki Ks Przemyslawa Sliwinskiego O Konklawe

May 07, 2025 -

Draymond Green And Steph Curry The Night Night Celebration And Post Game Commentary

May 07, 2025

Draymond Green And Steph Curry The Night Night Celebration And Post Game Commentary

May 07, 2025 -

Cobra Kai Maintaining Continuity With The Karate Kid Franchise

May 07, 2025

Cobra Kai Maintaining Continuity With The Karate Kid Franchise

May 07, 2025 -

Cleveland Cavaliers Sign G League Player For 10 Day Stint

May 07, 2025

Cleveland Cavaliers Sign G League Player For 10 Day Stint

May 07, 2025 -

Why Randles Season Should Give The Timberwolves Hope

May 07, 2025

Why Randles Season Should Give The Timberwolves Hope

May 07, 2025

Latest Posts

-

New Business Hot Spots Location Location Location A National Overview

May 08, 2025

New Business Hot Spots Location Location Location A National Overview

May 08, 2025 -

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025 -

Liberation Day Tariffs A Comprehensive Analysis Of Stock Market Volatility

May 08, 2025

Liberation Day Tariffs A Comprehensive Analysis Of Stock Market Volatility

May 08, 2025 -

Understanding The Dynamics Of New Business Hot Spots Across The Nation

May 08, 2025

Understanding The Dynamics Of New Business Hot Spots Across The Nation

May 08, 2025 -

The Unforeseen Consequences Of Liberation Day Tariffs On Stock Performance

May 08, 2025

The Unforeseen Consequences Of Liberation Day Tariffs On Stock Performance

May 08, 2025