‘Liberation Day’ Tariffs: A Comprehensive Analysis Of Stock Market Volatility

Table of Contents

Historical Context of Liberation Day and its Economic Significance

Liberation Day, a pivotal moment in [Country's Name] history, marked not only a significant political shift but also a considerable economic upheaval. [Briefly describe the historical event and its immediate economic consequences, e.g., political instability, regime change, etc.]. Pre-existing economic conditions, such as [mention relevant pre-existing conditions, e.g., high inflation, trade imbalances, etc.], amplified the impact of the newly implemented Liberation Day Tariffs. While precise historical stock market data for that period might be limited, available records suggest [mention any available data, e.g., a general market downturn, specific sector performance, etc.].

- Key economic indicators before, during, and after Liberation Day: [Provide specific examples of key indicators like GDP growth, inflation rates, unemployment figures, etc., and highlight significant changes around Liberation Day.]

- Significant political events leading up to the implementation of tariffs: [Discuss relevant political events that contributed to the implementation of tariffs, including any international pressure or domestic policy changes.]

- Impact of international relations on the market during this period: [Analyze how international relations, such as trade agreements or sanctions, influenced market behavior around Liberation Day.]

The Impact of Liberation Day Tariffs on Specific Sectors

The Liberation Day Tariffs had a profound and uneven impact on various sectors of the economy. Industries heavily reliant on imports, such as [mention specific sectors, e.g., manufacturing, agriculture, etc.], experienced immediate challenges. Conversely, sectors producing goods previously subject to import competition, like [mention specific sectors, e.g., domestic manufacturing, etc.], potentially benefited.

- Sectors most significantly impacted by the tariffs (positive and negative): [Provide a detailed analysis, including specific examples, of sectors positively and negatively affected by the tariffs, showing data where possible.]

- Examples of companies experiencing substantial stock price changes: [Provide case studies of specific companies, highlighting their performance before, during, and after the tariff implementation. Mention the specific stock tickers for better SEO.]

- Analysis of the supply chain disruptions caused by the tariffs: [Analyze how the tariffs disrupted supply chains, leading to increased costs and potential shortages for certain goods. Mention any resulting price increases or decreased availability.]

Volatility Metrics and Market Reactions to Liberation Day Tariffs

Understanding market volatility is crucial for assessing the impact of events like the implementation of Liberation Day Tariffs. Key metrics like the VIX index (a measure of market fear) and the standard deviation of stock returns provide valuable insights. Analysis of market data around the period of tariff implementation reveals [present data on market volatility – use charts and graphs if possible]. The announcement of the tariffs itself likely triggered immediate reactions, as investors adjusted their portfolios based on perceived risks and opportunities.

- Charts and graphs visualizing market volatility before, during, and after tariff implementation: [Include visually appealing charts and graphs showing volatility metrics, clearly labeled and referenced.]

- Correlation analysis between tariff announcements and stock market fluctuations: [Present any correlation analysis done, highlighting the statistical relationship between tariff announcements and stock market movements.]

- Discussion of investor sentiment and its influence on market behavior: [Discuss how investor sentiment, which can be gauged through surveys or news sentiment analysis, influenced market reactions to the tariffs.]

Long-Term Effects of Liberation Day Tariffs on Stock Market Behavior

The long-term consequences of the Liberation Day Tariffs extended beyond the immediate market reactions. Affected sectors experienced [describe long-term performance], while investor behavior and investment strategies adjusted accordingly. Regulatory changes following the tariff implementation further shaped the market landscape.

- Long-term performance of affected sectors after the tariff period: [Present data showing the long-term performance of affected sectors, comparing them to the overall market performance.]

- Changes in investment strategies adopted by investors in response to the tariffs: [Discuss changes in investment strategies, such as diversification, hedging, or sector rotation, adopted by investors as a response to the tariffs and their consequences.]

- Analysis of the long-term economic consequences of the tariffs: [Analyze the broader long-term economic impact of the Liberation Day Tariffs on the national economy, including any impact on GDP growth, employment, and trade balances.]

Conclusion: Understanding the Volatility Caused by Liberation Day Tariffs

This analysis demonstrates a clear link between the implementation of Liberation Day Tariffs and significant stock market volatility. Specific sectors experienced disproportionate impacts, both positive and negative, while the market overall exhibited heightened volatility. Understanding the long-term consequences of such events is vital for investors to make informed decisions and mitigate risks. Further research into "Liberation Day Tariffs" and their broader economic implications, coupled with a solid understanding of market volatility analysis, is crucial for developing robust investment strategies. Explore resources on [suggest further reading or resources, like academic papers or financial news sites], and incorporate this type of analysis into your investment approach to navigate market uncertainty effectively.

Featured Posts

-

Expert Prediction Bitcoin Could Soar By 1 500 In Five Years

May 08, 2025

Expert Prediction Bitcoin Could Soar By 1 500 In Five Years

May 08, 2025 -

Dispute Erupts Between Okc Thunder And National Media

May 08, 2025

Dispute Erupts Between Okc Thunder And National Media

May 08, 2025 -

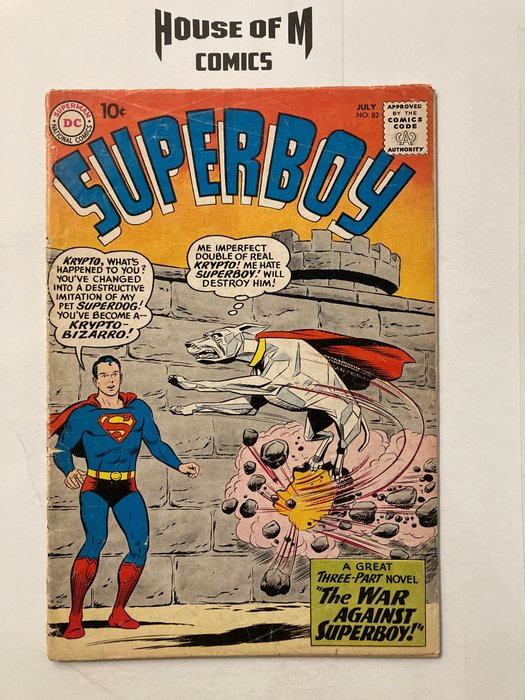

Minecraft Superman 5 Minute Thailand Theater Sneak Peek

May 08, 2025

Minecraft Superman 5 Minute Thailand Theater Sneak Peek

May 08, 2025 -

James Gunns Jimmy Olsen Photo A Hidden Superman Easter Egg

May 08, 2025

James Gunns Jimmy Olsen Photo A Hidden Superman Easter Egg

May 08, 2025 -

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian Thriller

May 08, 2025

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian Thriller

May 08, 2025

Latest Posts

-

Xrp To 5 In 2025 A Critical Examination Of The Forecast

May 08, 2025

Xrp To 5 In 2025 A Critical Examination Of The Forecast

May 08, 2025 -

Xrp Price Jumps Did Presidents Trump Article Boost Ripple

May 08, 2025

Xrp Price Jumps Did Presidents Trump Article Boost Ripple

May 08, 2025 -

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025 -

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 08, 2025

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 08, 2025 -

A Good Boy Indeed Kryptos Appearance In New Superman Footage

May 08, 2025

A Good Boy Indeed Kryptos Appearance In New Superman Footage

May 08, 2025