BofA Reassures Investors: Why Current Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Bullish Outlook and Rationale

BofA's positive outlook isn't based on blind optimism; it's rooted in a thorough analysis of several key economic indicators. Their assessment paints a picture of resilience and growth, supporting the current market valuations.

Strong Corporate Earnings and Profitability

BofA highlights robust corporate earnings and profitability across various sectors as a key justification for current valuations. Their reports point to strong performance in:

- Technology: Continued innovation and digital transformation drive significant earnings growth in this sector.

- Healthcare: Aging populations and advancements in medical technology fuel consistent demand and profitability.

- Financials: A recovering economy and rising interest rates are boosting the performance of financial institutions.

BofA's data suggests that these strong earnings are not merely temporary blips, but rather reflect underlying strength and sustainable growth within these sectors. This robust profitability, in their view, justifies the current, seemingly high, valuations.

Resilient Consumer Spending

Another pillar of BofA's bullish stance is the surprising resilience of consumer spending. Despite inflationary pressures, consumer spending remains relatively strong, fueled by:

- Strong Job Market: Low unemployment rates and wage growth provide consumers with the confidence and financial resources to continue spending.

- Pent-up Demand: Following the pandemic, there's still significant pent-up demand for goods and services.

- Savings from Pandemic: Many households accumulated savings during lockdowns, providing a cushion against inflation.

These factors, according to BofA's analysis, indicate a healthy consumer base that will continue to drive economic growth and support market valuations. Economic indicators like consumer confidence indices and retail sales figures support this assessment.

Inflation Cooling and Monetary Policy

BofA acknowledges inflation as a significant factor influencing market valuations. However, their analysis suggests that inflation is cooling down and that the Federal Reserve's monetary policy is effectively managing the situation.

- Inflation Predictions: BofA projects a gradual decline in inflation rates over the coming quarters.

- Interest Rate Forecasts: While further interest rate hikes are expected, BofA anticipates a potential pause or even a rate cut in the near future, depending on economic data.

- Federal Reserve Statements: BofA closely monitors statements and actions from the Federal Reserve to understand the trajectory of monetary policy and its likely impact on the market.

Addressing Common Investor Concerns

While BofA presents a positive outlook, they also acknowledge the concerns many investors hold. Let's address some of the most prevalent anxieties:

High Valuation Multiples

The concern about high Price-to-Earnings (P/E) ratios and other valuation metrics is understandable. BofA counters this concern by arguing that:

- Growth Prospects: Higher valuations are justified in sectors with significant growth potential and strong future earnings expectations.

- Technological Advancements: Innovation and technological disruption can warrant higher valuations, reflecting the potential for long-term value creation.

- Low Interest Rates (Historically): While interest rates are rising, historically low rates for an extended period contributed to higher valuations across the board. These prior periods offer a comparative backdrop.

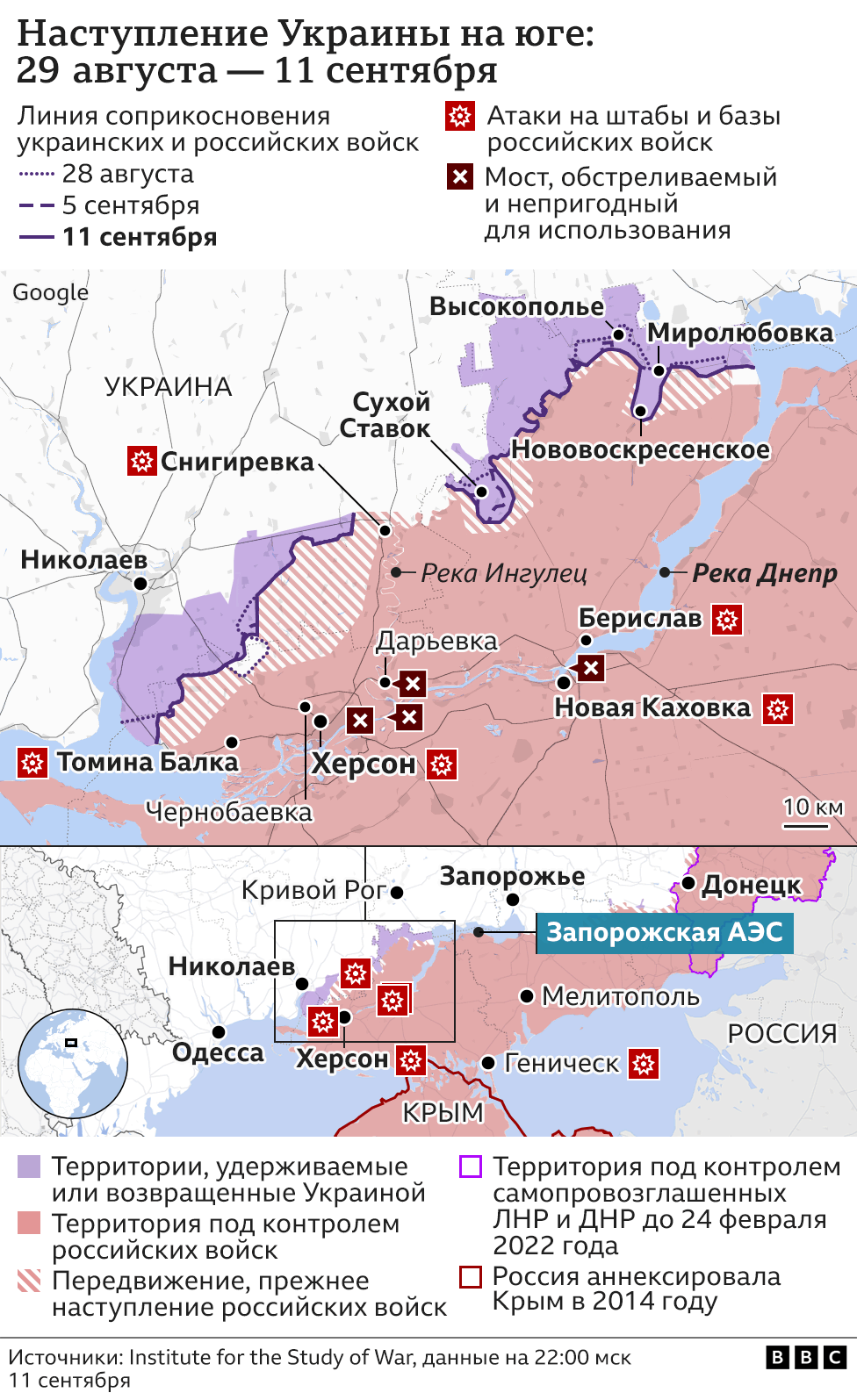

Geopolitical Risks and Market Uncertainty

Geopolitical risks, such as the war in Ukraine and ongoing trade tensions, undoubtedly introduce uncertainty. However, BofA incorporates these risks into their valuation models by:

- Scenario Planning: They develop multiple scenarios to assess the potential impact of various geopolitical events.

- Risk Mitigation Strategies: They identify potential mitigation strategies for investors to minimize exposure to geopolitical risks.

- Data-Driven Approach: Their analysis relies on data and rigorous modeling to quantify and assess these risks.

Potential for a Market Correction vs. a Crash

BofA distinguishes between a healthy market correction—a temporary pullback—and a catastrophic market crash. They believe a moderate correction is more likely than a major crash due to:

- Strong Fundamentals: The underlying fundamentals of the economy, including corporate earnings and consumer spending, remain relatively strong.

- Historically Low Defaults: Corporate debt defaults are relatively low, indicating a healthy corporate sector.

- Central Bank Support: Central banks worldwide are actively monitoring the situation and are prepared to intervene if necessary.

Conclusion: BofA's Reassurance: Navigating Stock Market Valuations with Confidence

BofA's analysis suggests that while current stock market valuations may appear high, they are not necessarily a harbinger of an imminent crash. Strong corporate earnings, resilient consumer spending, and a cooling inflation rate, coupled with the Federal Reserve's proactive monetary policy, contribute to a more optimistic outlook. While geopolitical risks exist, BofA's data-driven approach incorporates these factors to provide a comprehensive assessment. Don't let concerns over stock market valuations deter you. Understand BofA's perspective and make informed investment choices. The market presents opportunities, and with careful consideration of expert analysis like BofA's, investors can navigate the current landscape with greater confidence.

Featured Posts

-

Economic Slowdown Risk How Election Pledges Contribute To Deficits

Apr 25, 2025

Economic Slowdown Risk How Election Pledges Contribute To Deficits

Apr 25, 2025 -

The Tough Times Test How Political Parties Adapt To Crisis

Apr 25, 2025

The Tough Times Test How Political Parties Adapt To Crisis

Apr 25, 2025 -

Mir Na Dnepre Put K Stabilnosti I Sotrudnichestvu

Apr 25, 2025

Mir Na Dnepre Put K Stabilnosti I Sotrudnichestvu

Apr 25, 2025 -

Izmenenie Pozitsii Trampa Po Voyne V Ukraine

Apr 25, 2025

Izmenenie Pozitsii Trampa Po Voyne V Ukraine

Apr 25, 2025 -

A Friends Role In Linda Evangelistas Recovery From Mastectomy

Apr 25, 2025

A Friends Role In Linda Evangelistas Recovery From Mastectomy

Apr 25, 2025

Latest Posts

-

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025 -

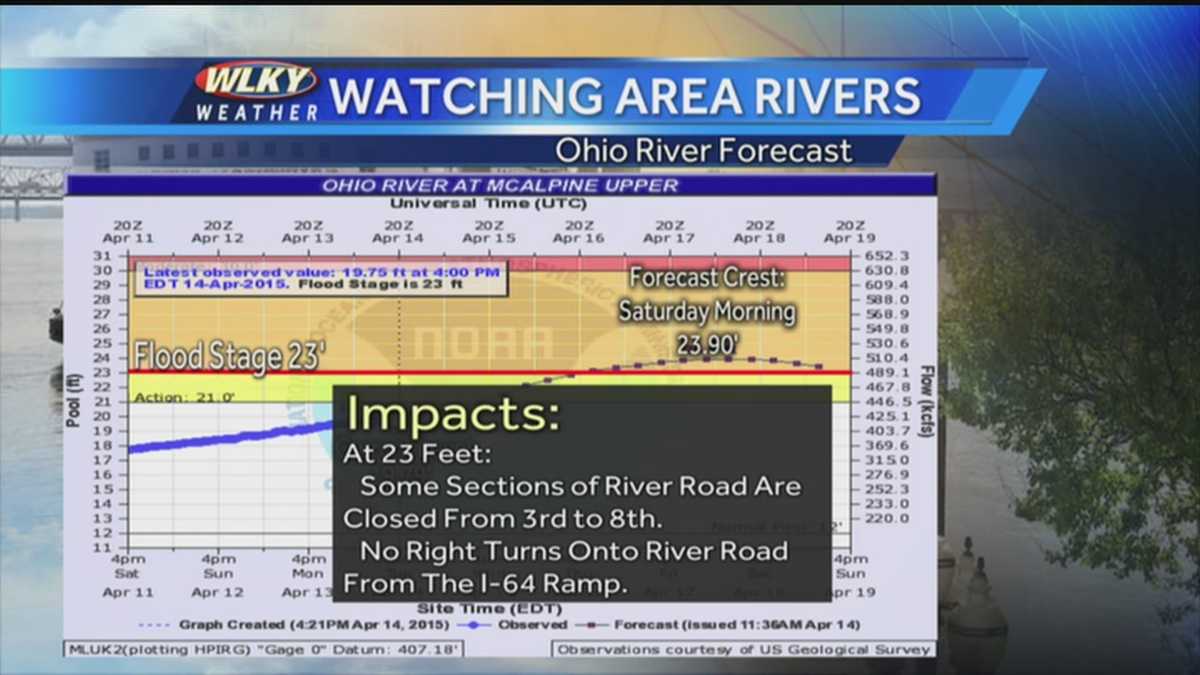

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025 -

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025 -

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025