BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Key Arguments for Current Market Stability

BofA's confidence in the current market stems from a confluence of factors, suggesting that the current valuations, while perhaps high compared to historical averages, are not indicative of an impending market crash. Their analysis focuses on several key areas:

Strong Corporate Earnings and Profitability

BofA's perspective emphasizes the strength of corporate earnings reports, pointing towards a robust underlying economy. Despite inflationary pressures and global uncertainty, many companies have demonstrated resilience and even increased profitability. This strong performance is not uniform across all sectors, but key areas are showing impressive strength.

- Increased profitability in specific sectors: The technology sector, particularly in areas like cloud computing and artificial intelligence, continues to see strong growth and high profit margins. Similarly, the energy sector has benefited from increased demand and higher prices.

- Positive revenue growth despite inflation: Many companies have successfully managed to pass on increased costs to consumers, maintaining revenue growth despite inflationary pressures. Effective cost-cutting measures and operational efficiency improvements have also played a role.

- Strong balance sheets of major corporations: The majority of large corporations maintain strong balance sheets, providing them with a buffer against potential economic downturns. This financial resilience allows them to weather storms and continue investing in growth initiatives.

Long-Term Growth Potential Remains

BofA takes a long-term view, recognizing that while short-term market fluctuations are inevitable, the underlying long-term growth potential of the economy remains strong. Several factors contribute to this optimistic outlook:

- Technological innovation driving new markets: Breakthroughs in artificial intelligence, renewable energy, and biotechnology are creating entirely new markets and investment opportunities. These innovations are expected to drive significant economic growth in the coming years.

- Demographic shifts creating investment opportunities: Changes in global demographics, such as an aging population in developed countries and a growing working-age population in emerging markets, present unique investment opportunities across various sectors.

- Government investment in infrastructure: Significant government investment in infrastructure projects, such as renewable energy initiatives and transportation upgrades, will stimulate economic activity and create jobs, further supporting long-term growth.

Interest Rate Impacts and BofA's Projections

The impact of rising interest rates is a major concern for investors. However, BofA's analysis suggests that the current interest rate hikes, while impacting valuations, are not necessarily a harbinger of a market collapse.

- BofA's interest rate forecast: BofA projects a relatively moderate pace of interest rate increases, suggesting that the Federal Reserve will likely prioritize a "soft landing" scenario.

- Impact of interest rates on specific sectors: While interest rate hikes can negatively affect some sectors, such as those reliant on debt financing, others may be less impacted or even benefit from higher rates.

- Strategies for mitigating interest rate risk: BofA recommends diversifying investment portfolios and adjusting asset allocation strategies to mitigate the risks associated with rising interest rates.

Addressing Investor Concerns Regarding High Valuations

Many investors remain apprehensive about the relatively high valuations in certain market segments. Addressing these concerns requires a closer look at the data and context:

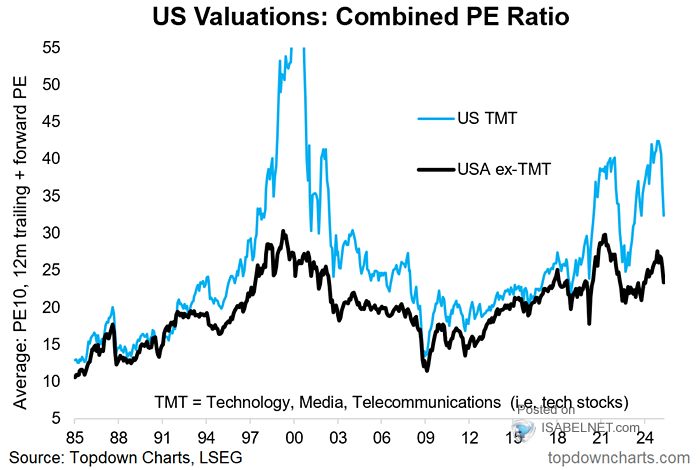

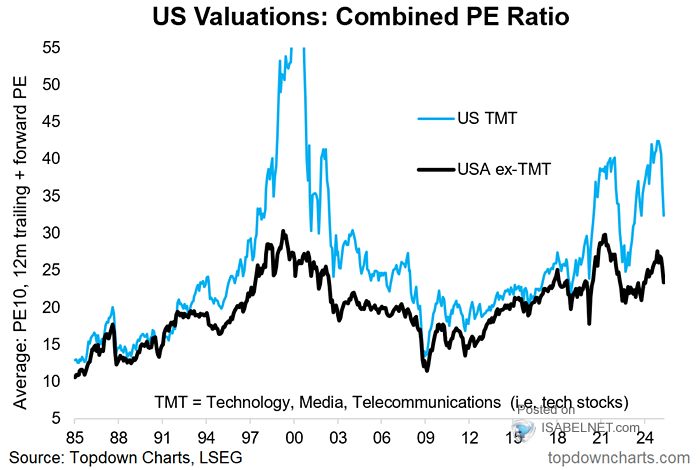

Comparing Current Valuations to Historical Data

While current valuations might appear high compared to historical averages, it is crucial to consider the broader context. A simple comparison of Price-to-Earnings (P/E) ratios, for example, needs to be analyzed in light of factors like inflation and interest rates.

- Comparison of P/E ratios: While P/E ratios may be elevated compared to historical averages, they are not unprecedented and need to be evaluated within the current economic environment.

- Market capitalization analysis: Analyzing market capitalization in relation to economic indicators provides a more comprehensive understanding of valuations.

- Historical precedent for periods of high valuation: History shows that periods of high valuations can persist for extended periods before corrections occur, and these periods have often been followed by continued growth.

The Role of Inflation and its Impact on Valuation

Inflation significantly impacts the interpretation of stock market valuations. Higher inflation erodes the purchasing power of future earnings, which affects valuation metrics.

- Inflation's impact on earnings: Companies face rising input costs during inflationary periods, impacting their profit margins.

- Strategies for investing during inflationary periods: Investors can mitigate the effects of inflation by investing in assets that tend to perform well during inflationary periods, such as real estate or commodities.

- BofA's inflation forecast: BofA’s analysis incorporates their projections for inflation, helping to contextualize the impact on valuations.

Conclusion

BofA's analysis suggests that current stock market valuations, while high in certain sectors, are not necessarily a cause for immediate concern. Strong corporate earnings, considerable long-term growth potential, and a manageable impact from interest rate hikes all contribute to their optimistic outlook. While uncertainties remain, BofA's assessment provides a reasoned perspective for investors to consider. Don't let market volatility scare you away from potentially lucrative investments. Understand BofA's reasoning and make informed decisions about your investment strategy based on the facts. Learn more about current stock market valuations and how to navigate this environment with confidence by researching further into BofA's reports and consulting with a financial advisor. Stay informed on the latest updates regarding BofA's assessment of stock market valuations.

Featured Posts

-

Essener Persoenlichkeiten Eine Radtour Durch Geschichte Und Gegenwart

May 24, 2025

Essener Persoenlichkeiten Eine Radtour Durch Geschichte Und Gegenwart

May 24, 2025 -

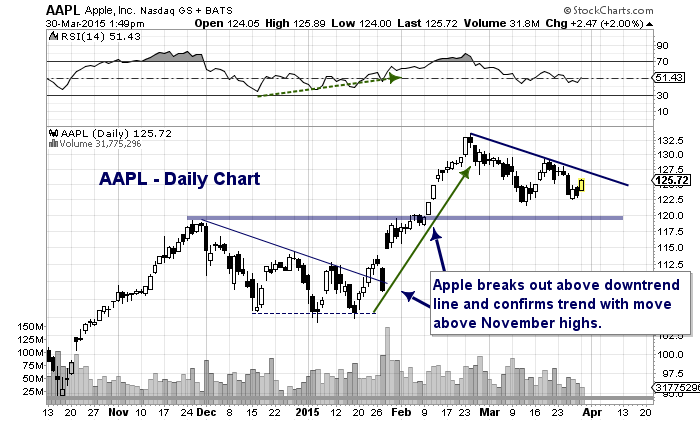

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025 -

High Cost Of Living Impacts Canadian Auto Theft Prevention

May 24, 2025

High Cost Of Living Impacts Canadian Auto Theft Prevention

May 24, 2025 -

Thames Water Examining The Disparity In Executive Compensation

May 24, 2025

Thames Water Examining The Disparity In Executive Compensation

May 24, 2025 -

Tennisistka Rybakina Kommentariy O Fizicheskoy Podgotovke

May 24, 2025

Tennisistka Rybakina Kommentariy O Fizicheskoy Podgotovke

May 24, 2025

Latest Posts

-

Are Florida Stores Open Memorial Day 2025 Publix Hours And More

May 24, 2025

Are Florida Stores Open Memorial Day 2025 Publix Hours And More

May 24, 2025 -

Unannounced Joe Jonas Concert Rocks The Fort Worth Stockyards

May 24, 2025

Unannounced Joe Jonas Concert Rocks The Fort Worth Stockyards

May 24, 2025 -

Is Publix Open Memorial Day 2025 Florida Store Holiday Hours

May 24, 2025

Is Publix Open Memorial Day 2025 Florida Store Holiday Hours

May 24, 2025 -

Columbus Child Sex Crimes Case Ends In Guilty Verdict

May 24, 2025

Columbus Child Sex Crimes Case Ends In Guilty Verdict

May 24, 2025 -

Sylvester Stallones Tulsa King Season 3 First Look At Dwight Manfredis Suits

May 24, 2025

Sylvester Stallones Tulsa King Season 3 First Look At Dwight Manfredis Suits

May 24, 2025