BofA's Analysis: Addressing Investor Concerns About High Stock Market Valuations

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's analysis provides a nuanced perspective on current stock market valuations, acknowledging the elevated levels while offering a more granular assessment than simply labeling the market as "overvalued." While their exact figures may fluctuate based on the specific report and timing, BofA generally considers valuations to be at the higher end of historical norms. They aren't necessarily forecasting an immediate crash, but emphasize the increased risk inherent in this environment.

-

Specific Valuation Metrics: BofA likely utilizes various valuation metrics, including the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), to assess market valuations. These metrics are compared to historical averages and industry benchmarks to gauge relative valuation.

-

Sector-Specific Valuations: BofA's analysis typically delves into sector-specific valuations, identifying sectors that appear particularly expensive (e.g., certain segments of the technology sector) and others that might present better value opportunities (e.g., undervalued cyclical sectors).

-

Discrepancies with Other Analyses: It's important to note that BofA's assessment might differ from other market analyses, reflecting varying methodologies and perspectives. Understanding these discrepancies can help investors form a more comprehensive view.

Understanding the Drivers of High Stock Market Valuations

Several factors have contributed to the perceived high stock market valuations. Understanding these drivers is crucial for investors to assess the sustainability of current prices.

-

Low Interest Rates: Historically low interest rates have made stocks a relatively more attractive investment compared to bonds, driving capital into the equity markets and pushing up prices.

-

Strong Corporate Earnings Growth: Strong corporate earnings, or the expectation of future strong growth, underpin higher valuations. Companies exceeding profit expectations naturally attract increased investment.

-

Increased Investor Confidence: Periods of increased investor confidence, often driven by positive economic indicators or government policy, lead to higher risk appetite and increased investment in the stock market.

-

Quantitative Easing and Monetary Policy: Central bank policies, such as quantitative easing (QE), have injected significant liquidity into the financial system, which can inflate asset prices, including stocks.

BofA's Recommendations for Investors

BofA's recommendations typically emphasize a cautious yet opportunistic approach in a high-valuation market. Their advice usually focuses on mitigating risk while still participating in potential market gains.

-

Portfolio Diversification: Diversification across different asset classes (stocks, bonds, real estate) and sectors is a key element of BofA's recommendations. This strategy reduces exposure to any single market segment.

-

Asset Class Recommendations: BofA may suggest a balanced portfolio allocation, potentially advising on shifting some allocation away from highly valued sectors towards those that appear more attractively priced or toward defensive asset classes like high-quality bonds.

-

Risk Management Strategies: BofA likely emphasizes the importance of risk management, including setting stop-loss orders to limit potential losses and employing strategies to hedge against market downturns.

-

Long-Term Investment Horizons: BofA frequently reinforces the importance of maintaining a long-term perspective, suggesting that short-term market fluctuations should not dictate investment decisions.

Mitigating Risk in a High-Valuation Market

Navigating a high-valuation market requires a proactive approach to risk management.

-

Due Diligence and Fundamental Analysis: Thorough due diligence, including fundamental analysis of individual companies, is critical. Focusing on undervalued or fundamentally strong companies can help mitigate risks.

-

Identifying Undervalued Stocks: Investors should actively seek undervalued stocks through careful research and analysis of financial statements, industry trends, and competitive landscapes.

-

Diversification to Reduce Volatility: A well-diversified portfolio across different sectors and asset classes is essential to reduce the impact of market volatility.

-

Defensive Investment Options: Considering defensive investment options, such as high-quality bonds or dividend-paying stocks, can provide a cushion during periods of market uncertainty.

Conclusion: Navigating the High-Valuation Market with BofA's Insights

BofA's analysis highlights the elevated nature of current stock market valuations, urging investors to adopt a cautious and strategic approach. Understanding the drivers of these valuations—low interest rates, strong corporate earnings, investor confidence, and monetary policy—is crucial. BofA's recommendations emphasize diversification, robust risk management strategies, and a long-term investment horizon. By carefully considering these insights, investors can better navigate the challenges and opportunities presented by this market environment. Stay informed about BofA's ongoing market analysis, develop a well-diversified portfolio considering BofA's recommendations, learn more about mitigating risks associated with high stock market valuations, and understand the factors impacting stock market valuation. Taking these steps will allow you to make informed investment decisions and build a resilient portfolio for the future.

Featured Posts

-

Valley High School Coach Receives Regional Coach Of The Year Award

May 30, 2025

Valley High School Coach Receives Regional Coach Of The Year Award

May 30, 2025 -

Replay Loeil De Philippe Caveriviere Du 24 Avril 2025 Face A Philippe Tabarot Video

May 30, 2025

Replay Loeil De Philippe Caveriviere Du 24 Avril 2025 Face A Philippe Tabarot Video

May 30, 2025 -

The Auto Industry Pushback Dealers Renew Fight Against Ev Sales Targets

May 30, 2025

The Auto Industry Pushback Dealers Renew Fight Against Ev Sales Targets

May 30, 2025 -

Elon Musks Attempt To Block Sam Altmans Middle East Ai Deal An Exclusive Look

May 30, 2025

Elon Musks Attempt To Block Sam Altmans Middle East Ai Deal An Exclusive Look

May 30, 2025 -

Guia Para El Reembolso De Boletos Del Axe Ceremonia 2025 Ticketmaster

May 30, 2025

Guia Para El Reembolso De Boletos Del Axe Ceremonia 2025 Ticketmaster

May 30, 2025

Latest Posts

-

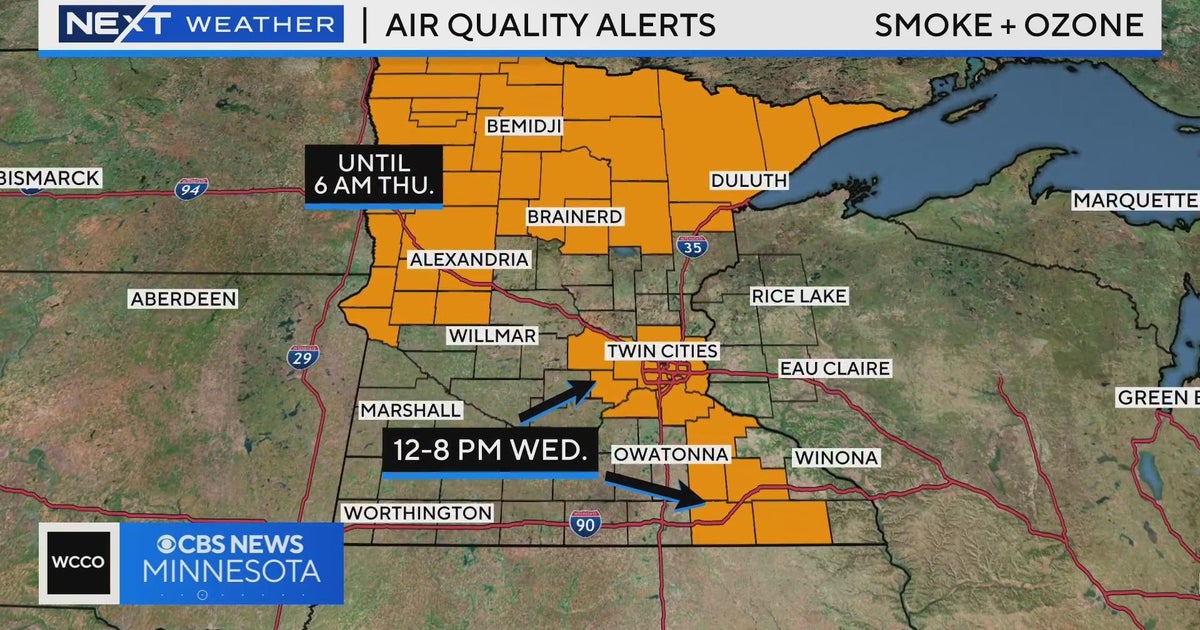

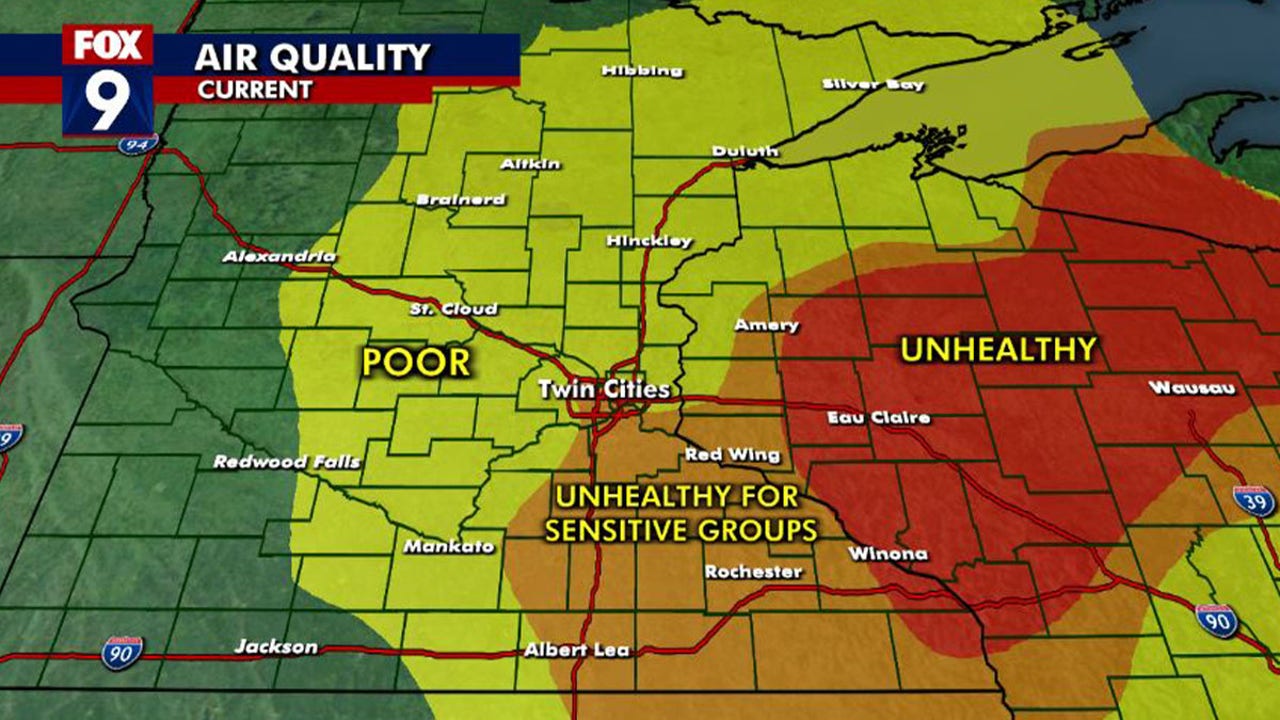

Wildfires In Canada Severe Air Quality Degradation In Minnesota

May 31, 2025

Wildfires In Canada Severe Air Quality Degradation In Minnesota

May 31, 2025 -

Canadian Wildfire Smoke Impacts Minnesotas Air Quality

May 31, 2025

Canadian Wildfire Smoke Impacts Minnesotas Air Quality

May 31, 2025 -

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025 -

The Texas Panhandle Wildfire A Year Of Recovery And Rebirth

May 31, 2025

The Texas Panhandle Wildfire A Year Of Recovery And Rebirth

May 31, 2025