BofA's Take: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Justification: Strong Underlying Economic Fundamentals

BofA's analysis points to robust underlying economic fundamentals as a key justification for the current market valuations. Their research emphasizes several positive indicators that support the seemingly high price tags on stocks. These strong economic fundamentals provide a foundation for continued growth and justify, at least partially, the current elevated valuations.

-

Strong Corporate Earnings Growth: Many companies are reporting consistently strong earnings growth, demonstrating robust profitability and financial health. This positive trend suggests that the market's valuation is, at least in part, supported by real performance.

-

Low Unemployment Rates: Low unemployment figures indicate a healthy labor market, fueling consumer spending and economic expansion. A strong workforce translates to increased productivity and greater consumer demand, supporting higher valuations.

-

Positive Consumer Spending: Consumer confidence and spending remain relatively high, signifying a healthy economy capable of sustaining current market levels. Strong consumer demand translates directly into corporate revenues, justifying higher stock prices.

-

Government Stimulus Measures: While the impact varies depending on the specific measures, government stimulus packages, where applicable, can provide a significant boost to economic activity, potentially justifying higher stock valuations.

-

Technological Advancements Driving Growth: Innovation in key sectors like technology, healthcare, and renewable energy fuels significant growth, further supporting higher valuations in those sectors and the market overall.

The Role of Interest Rates and Monetary Policy

BofA's perspective also considers the crucial role of interest rates and monetary policy in shaping stock valuations. The current low-interest-rate environment is a significant factor.

-

Low Interest Rate Environment: Extremely low interest rates make borrowing cheaper for companies and consumers, stimulating economic activity and driving up asset prices, including stocks. This low-cost borrowing environment supports higher price-to-earnings (P/E) ratios, a key valuation metric.

-

Central Bank Policies Supporting Market Liquidity: Central bank policies designed to increase market liquidity ensure ample capital is available for investment, supporting higher valuations. These policies aim to keep credit flowing and prevent a contraction in economic activity.

-

Potential Future Interest Rate Hikes and Their Expected Impact: While future interest rate hikes are anticipated, BofA's analysis likely incorporates projections of their gradual implementation and the expected impact on the market. A gradual increase is less likely to cause a significant market correction.

-

Low Rates Justify Higher Valuations: Simply put, when the cost of borrowing is low, investors are more willing to pay higher prices for assets with the expectation of future returns. This is a key component of BofA's justification for the current high valuations.

Long-Term Growth Prospects and Innovation

BofA's outlook emphasizes long-term growth prospects and the transformative power of innovation as key factors mitigating short-term valuation concerns. Their analysis focuses on the potential for sustained growth, driven by both established and emerging sectors.

-

Emerging Technologies and Their Potential for Market Expansion: Breakthroughs in areas like artificial intelligence, biotechnology, and sustainable energy hold immense potential to fuel significant market expansion in the coming years. These technological advancements offer opportunities for substantial long-term returns.

-

Global Economic Growth Projections: BofA's analysis likely incorporates projections of continued, albeit perhaps slower, global economic growth. This sustained, albeit moderate, growth supports the view that current valuations are not excessively inflated in the long term.

-

Long-Term Investment Strategies Mitigating Short-Term Valuation Concerns: BofA likely emphasizes the importance of long-term investment strategies to ride out short-term market volatility and benefit from long-term growth. Focusing on the long-term helps to mitigate the concerns about short-term valuation fluctuations.

-

Specific Sectors Poised for Significant Growth: The analysis probably highlights specific sectors projected for significant growth, such as technology, healthcare, and renewable energy, justifying higher valuations within those sectors.

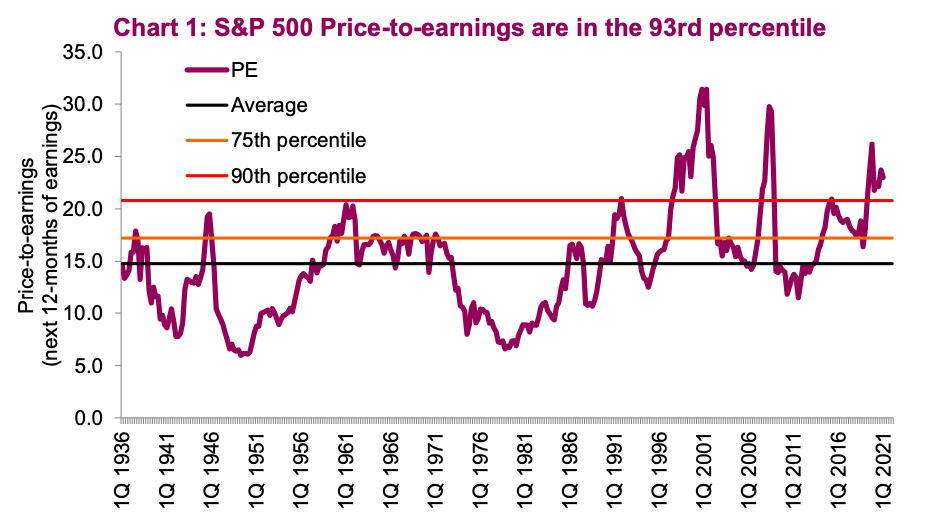

Addressing Valuation Metrics: A Deeper Dive

BofA's perspective likely involves a nuanced examination of valuation metrics, going beyond simple comparisons to historical averages.

-

Explanation of Relevant Valuation Metrics: The analysis would explain metrics like the price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and others, clarifying their significance and limitations.

-

Comparison with Historical Valuations: While acknowledging that valuations are high compared to historical averages, BofA's argument might focus on the unique economic context, such as the low-interest-rate environment, justifying the divergence from historical norms.

-

Factors Influencing Current Metrics (e.g., low interest rates, inflation): The analysis would emphasize the role of specific factors in influencing current valuation metrics, arguing that these factors warrant a different interpretation than a simple comparison to historical data.

-

BofA's Methodology and Rationale for Their Assessment: Transparency regarding their methodology and the rationale behind their conclusions is crucial for building trust and credibility. This would include details about their models and assumptions.

Managing Risk and Diversification

Even with BofA's reassuring perspective, managing risk remains paramount. The bank likely emphasizes the importance of prudent portfolio management, even in a seemingly strong market.

-

Importance of Diversification Across Asset Classes: Diversifying investments across different asset classes is crucial to mitigate risk and protect against potential market downturns. This is standard financial advice, particularly relevant in times of perceived high valuations.

-

Strategies for Mitigating Risk in a Potentially Volatile Market: The advice would include strategies to mitigate risk, such as hedging techniques or adjusting portfolio allocations based on risk tolerance.

-

Importance of Long-Term Investment Horizons: Maintaining a long-term investment horizon is crucial to weather short-term market fluctuations and benefit from long-term growth. This is especially important during times of perceived overvaluation.

-

Seeking Professional Financial Advice: BofA would likely emphasize the importance of seeking personalized financial advice from qualified professionals to tailor investment strategies to individual circumstances and risk tolerance.

Conclusion: Why High Valuations Shouldn't Deter Long-Term Investors (BofA's Perspective)

BofA's analysis suggests that while stock market valuations are high, several underlying economic factors and long-term growth prospects justify this assessment. Strong corporate earnings, low unemployment, positive consumer spending, and the impact of low interest rates are key elements supporting their perspective. Furthermore, long-term growth prospects fueled by technological innovation and global economic projections add to the rationale for a less-worried outlook. Don't let high stock market valuations deter your long-term investment strategy. Consider BofA's insights and take a proactive approach to managing your portfolio by diversifying and seeking professional financial advice. [Link to relevant BofA research here]

Featured Posts

-

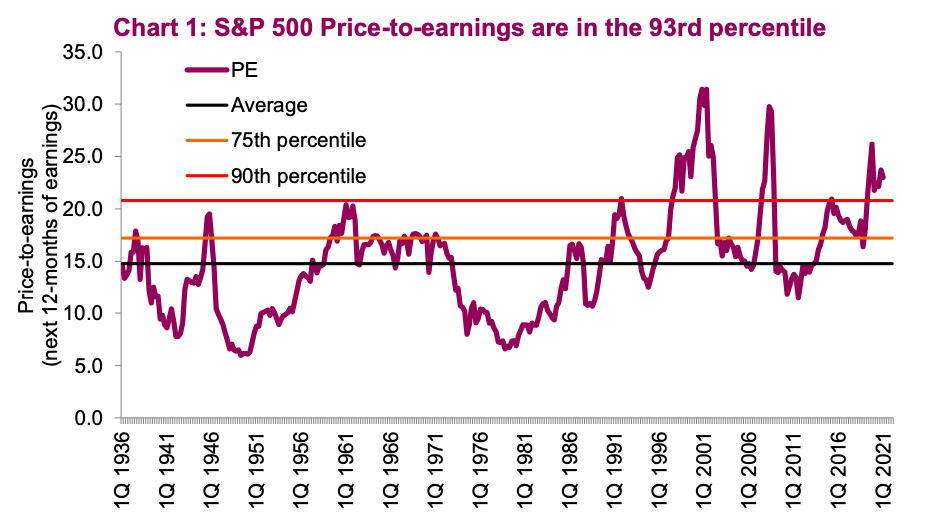

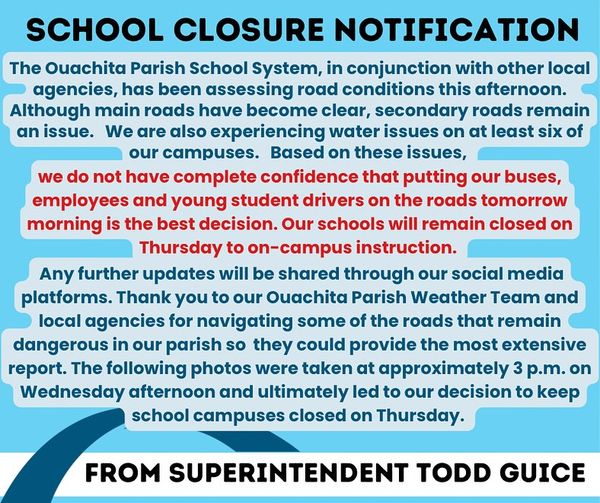

Oklahoma Schools Closed Wednesday Due To Icy Conditions

Apr 25, 2025

Oklahoma Schools Closed Wednesday Due To Icy Conditions

Apr 25, 2025 -

Would Perplexity Buy Chrome Analyzing A Potential Google Divestiture

Apr 25, 2025

Would Perplexity Buy Chrome Analyzing A Potential Google Divestiture

Apr 25, 2025 -

Jorge E Mateus E Felipe Amorim Sucesso No 1 Dia De Folia

Apr 25, 2025

Jorge E Mateus E Felipe Amorim Sucesso No 1 Dia De Folia

Apr 25, 2025 -

Revoluts 72 Revenue Increase A Deep Dive Into Fintechs Global Ambitions

Apr 25, 2025

Revoluts 72 Revenue Increase A Deep Dive Into Fintechs Global Ambitions

Apr 25, 2025 -

16 Million Fine For T Mobile Details Of Three Year Data Breach Settlement

Apr 25, 2025

16 Million Fine For T Mobile Details Of Three Year Data Breach Settlement

Apr 25, 2025

Latest Posts

-

Misterul Dosarelor X Revine La Galati

Apr 30, 2025

Misterul Dosarelor X Revine La Galati

Apr 30, 2025 -

Revelatii Uluitoare Dosarele X Si Galati O Investigatie Reluata

Apr 30, 2025

Revelatii Uluitoare Dosarele X Si Galati O Investigatie Reluata

Apr 30, 2025 -

Dosarele X Redeschise Ce Se Intampla La Galati Viata Libera Galati

Apr 30, 2025

Dosarele X Redeschise Ce Se Intampla La Galati Viata Libera Galati

Apr 30, 2025 -

Dosarele X Se Redeschid Investigatiile Viata Libera Galati

Apr 30, 2025

Dosarele X Se Redeschid Investigatiile Viata Libera Galati

Apr 30, 2025 -

Dosarele X O Redeschidere Posibila Viata Libera Galati

Apr 30, 2025

Dosarele X O Redeschidere Posibila Viata Libera Galati

Apr 30, 2025