BofA's View: Why Current Stock Market Valuations Are Not A Reason For Concern

Table of Contents

BofA's Rationale: Focusing on Long-Term Growth Potential

BofA's analysis emphasizes a shift in perspective: instead of fixating on short-term market fluctuations, investors should focus on the long-term growth potential of companies. This long-term stock market outlook is crucial for making sound investment decisions. Rather than reacting to daily price swings, BofA advocates for a more fundamental analysis based on sustainable growth and future earnings potential.

- Strong Corporate Earnings and Future Profit Expectations: BofA's research highlights strong corporate earnings reports and positive future profit expectations across various sectors. These projections, based on robust economic indicators and company-specific performance data, support the bank's optimistic view.

- Robust Growth Sectors: BofA's market analysis identifies several sectors poised for robust growth, including technology, healthcare, and renewable energy. These sectors, fueled by innovation and strong demand, are expected to drive significant future earnings growth.

- BofA's Sector-Specific Valuations: The bank has provided detailed assessments of specific market sectors and their valuations, emphasizing that many are still attractively priced considering their long-term growth prospects. This granular approach allows for a nuanced understanding of the market’s overall health.

Addressing Inflation and Interest Rate Concerns

Inflationary pressures and subsequent interest rate hikes are legitimate concerns impacting stock valuations. BofA acknowledges these challenges but offers a measured perspective on their long-term effects.

- Inflation's Impact on Corporate Profits: BofA's analysis suggests that while inflation does impact corporate profits, many companies have demonstrated pricing power, mitigating the negative effects. They project that the impact will be temporary and that businesses will adapt to the changed economic landscape.

- Federal Reserve's Monetary Policy: BofA's inflation outlook considers the Federal Reserve's monetary policy and its intended impact on inflation. They believe the Fed's actions, while potentially impacting short-term market performance, are necessary to maintain long-term economic stability and will ultimately be beneficial.

- Mitigating Inflation Risks: The bank suggests strategies for mitigating inflation risks within investment portfolios, including diversification across asset classes and focusing on companies with strong pricing power and resilient business models.

The Role of Innovation and Technological Advancements

Technological disruption and innovation are powerful drivers of long-term stock market growth. BofA highlights the role of technological advancements in shaping future valuations.

- Impact on Industries: BofA's tech sector analysis details how technological disruption is transforming various industries, creating new opportunities and driving efficiency gains. This, in turn, leads to enhanced profitability for companies that adapt and innovate.

- Innovation-Driven Growth: The bank emphasizes that innovation-driven growth is a key component of justifying current valuations in many sectors. Companies that are at the forefront of technological advancements are viewed as having significant long-term growth potential.

- Examples of Innovative Companies: BofA cites specific examples of innovative companies whose market performance reflects their disruptive technologies and strong growth trajectories. These examples support their argument for maintaining a positive outlook.

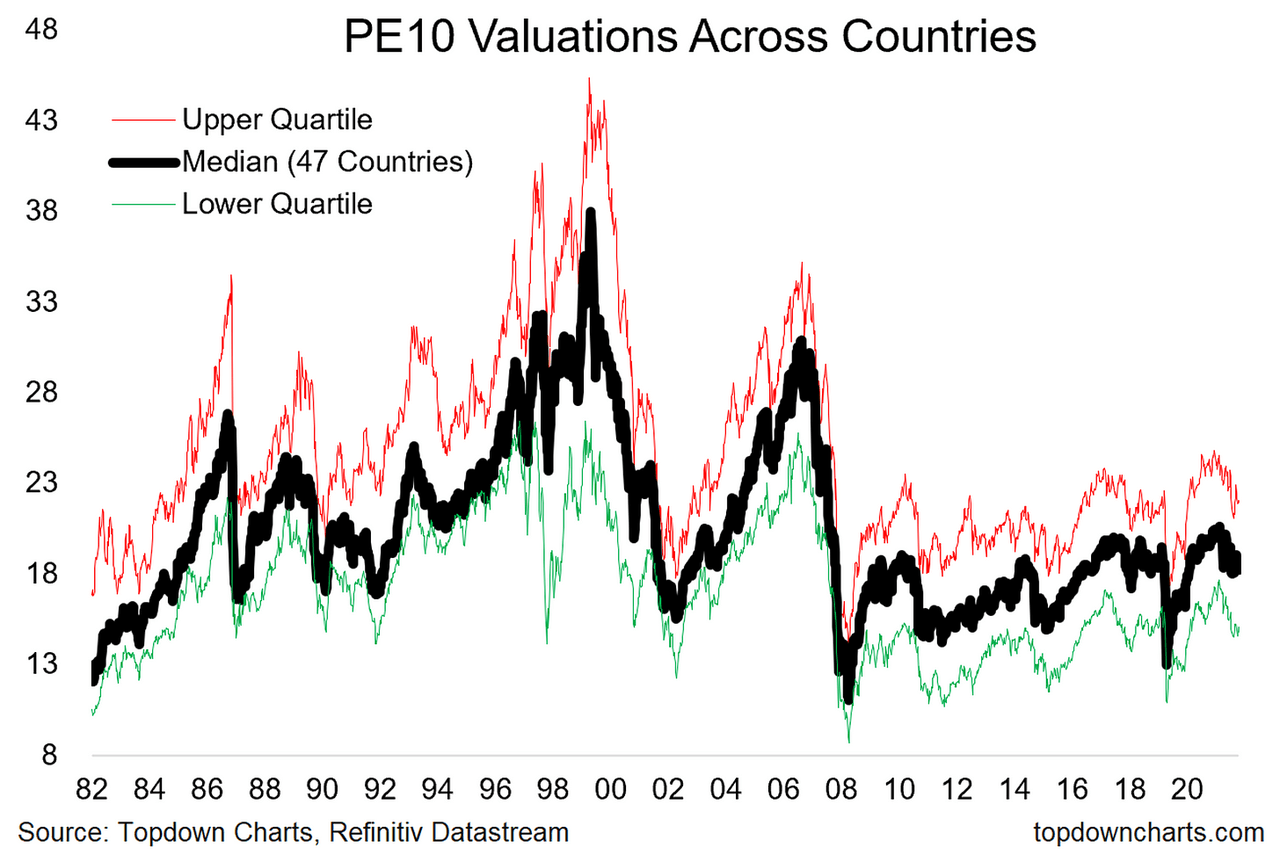

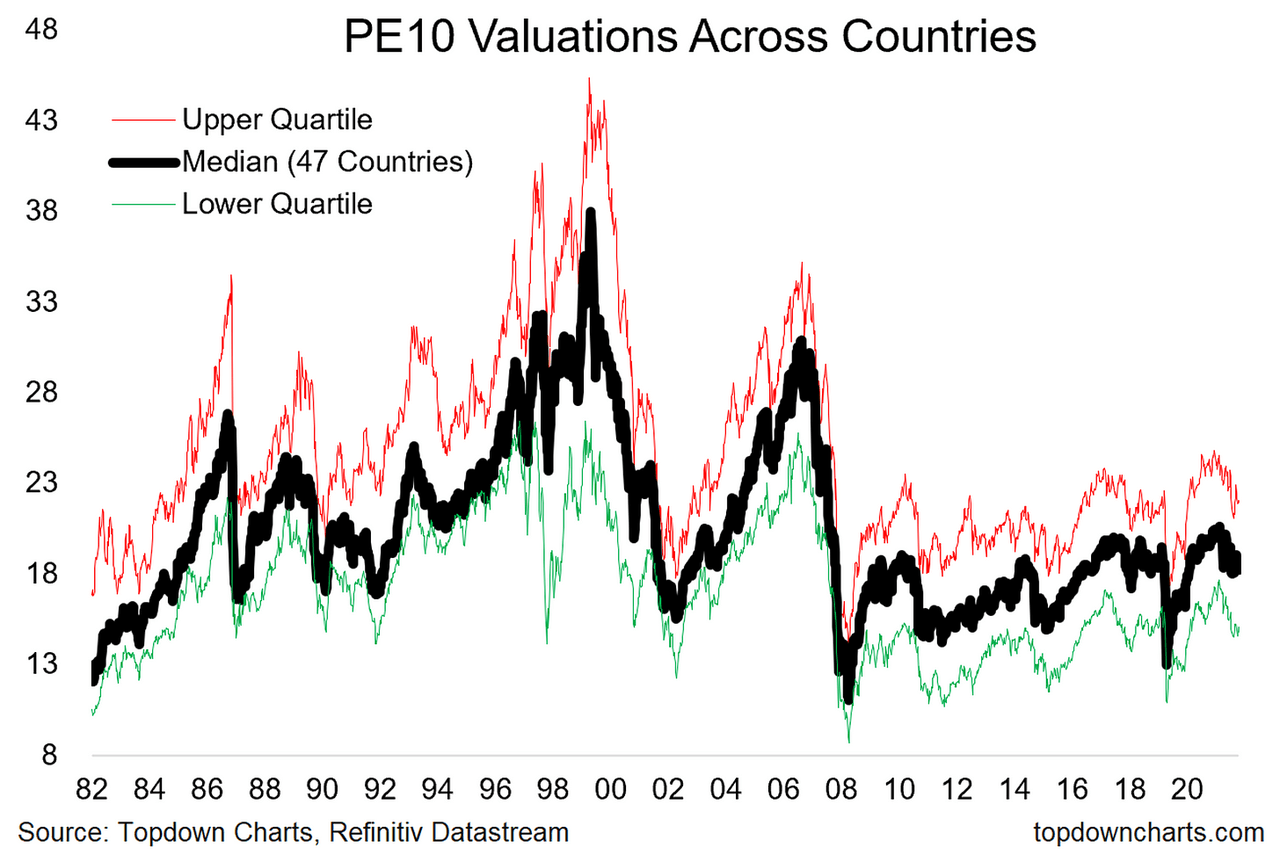

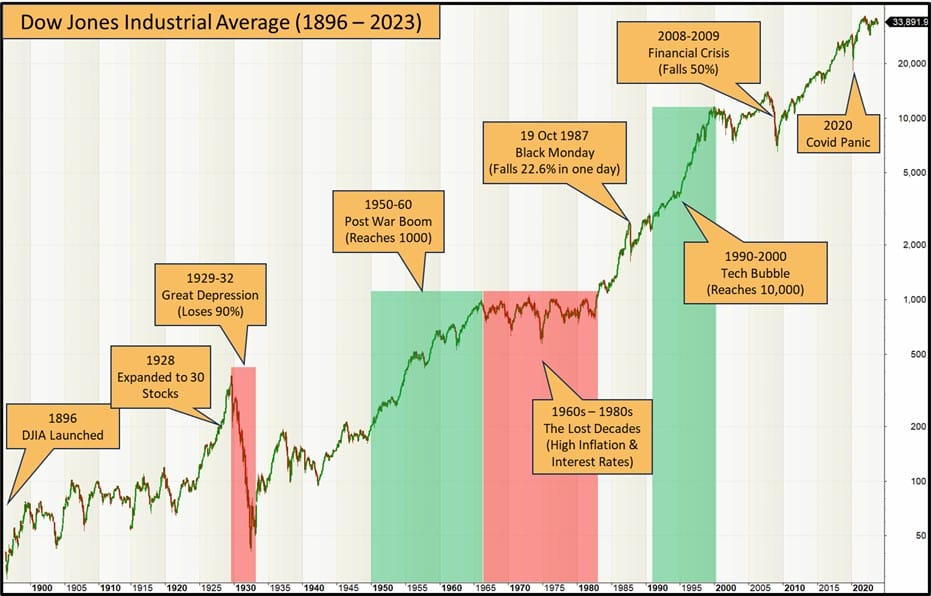

Comparing Current Valuations to Historical Data

BofA's historical data analysis provides crucial context for understanding current stock market valuations. By comparing current metrics to historical averages, the bank aims to provide a more balanced perspective.

- Price-to-Earnings (P/E) Ratios: The analysis compares current P/E ratios to historical averages, demonstrating that while valuations might seem high in certain sectors, they are not unprecedented when viewed within a longer historical context.

- Other Valuation Metrics: Beyond P/E ratios, BofA considers other relevant valuation metrics, placing current levels within a broader historical perspective. This holistic approach provides a more complete picture.

- Market Cycle Comparisons: The bank highlights similarities and discrepancies between the current market cycle and previous cycles, emphasizing that economic cycles are inherently dynamic and that current valuations are consistent with certain historical patterns.

BofA's Reassurance: Why You Shouldn't Be Alarmed by Current Stock Market Valuations

In conclusion, BofA's analysis suggests that current stock market valuations, while potentially high in certain sectors, are not inherently alarming when considering long-term growth potential. The bank emphasizes the importance of focusing on sustainable growth, managing inflation risks, acknowledging the role of innovation, and understanding historical market cycles. By focusing on these factors, investors can make more informed decisions and develop a robust long-term investment strategy. We encourage you to review BofA's market outlook and research their reports and publications for a deeper understanding of their comprehensive analysis and to better assess your portfolio in light of this information. Remember, a long-term perspective is key to navigating market fluctuations and achieving your investment goals.

Featured Posts

-

Nicki Chapmans 700 000 Country Home Investment A Property Success Story

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment A Property Success Story

May 24, 2025 -

Triumf Aleksandrovoy Nad Samsonovoy Na Starte Shtutgartskogo Turnira

May 24, 2025

Triumf Aleksandrovoy Nad Samsonovoy Na Starte Shtutgartskogo Turnira

May 24, 2025 -

Who Attended The Florida Film Festival Mia Farrow Christina Ricci And Other Notable Guests

May 24, 2025

Who Attended The Florida Film Festival Mia Farrow Christina Ricci And Other Notable Guests

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025 -

European Leaders Receive Exclusive Briefing Putins War Strategy Unchanged Says Trump

May 24, 2025

European Leaders Receive Exclusive Briefing Putins War Strategy Unchanged Says Trump

May 24, 2025

Latest Posts

-

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025 -

Kazakhstan Defeats Australia In Billie Jean King Cup Qualifying Tie

May 24, 2025

Kazakhstan Defeats Australia In Billie Jean King Cup Qualifying Tie

May 24, 2025 -

Hi Ho Kermit University Of Marylands 2025 Commencement Speaker Announced

May 24, 2025

Hi Ho Kermit University Of Marylands 2025 Commencement Speaker Announced

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025 -

Perviy Krug Shtutgartskogo Turnira Aleksandrova Silnee Samsonovoy

May 24, 2025

Perviy Krug Shtutgartskogo Turnira Aleksandrova Silnee Samsonovoy

May 24, 2025