Nicki Chapman's £700,000 Country Home Investment: A Property Success Story

Table of Contents

The Appeal of Country Homes as Investments

The UK's rural property market is booming, presenting lucrative opportunities for savvy investors. Country property investment offers a unique blend of lifestyle appeal and financial potential. Several factors drive this demand:

- Escaping City Life: Many people seek tranquility and space, trading urban hustle for rural charm. This increased demand directly impacts property values.

- Lifestyle Changes: The pandemic accelerated a shift towards remote work, making country living a more viable option. This fuelled a surge in interest in rural properties.

- Capital Appreciation: While urban property prices fluctuate, rural areas often see steady, long-term capital appreciation, making them an attractive option for long-term investors.

The potential for higher rental yields in desirable countryside locations compared to urban areas further strengthens the appeal of country property investment. Understanding the nuances of the rural property market, including local demand and infrastructure, is crucial for successful investment in this sector. This makes thorough market research – particularly of the surrounding area's amenities and transport links – a key factor in the success of a country property investment. Keywords such as "country property investment," "rural property market," and "capital appreciation" are frequently used by those working in this niche.

Nicki Chapman's Property Investment Strategy

While the specifics of Nicki Chapman's investment remain private, we can analyze likely factors behind her decision. Her choice of a country home likely reflects a strategic approach to real estate investment. Several possibilities merit consideration:

- Buy-to-Let Potential: The location and size of the property could suggest an intention to generate rental income. Rural areas often have a strong rental market, particularly for holiday lets.

- Renovation and Added Value: A strategic investment might involve purchasing a property needing renovation, adding value through improvements, and then selling at a profit. This is a commonly-used strategy for investors, allowing them to capitalize on the value of refurbishment.

- Long-Term Investment: A £700,000 investment in a country home suggests a long-term investment horizon. The strategy aims to benefit from the property's appreciation over time, rather than a quick sale.

Regardless of her precise approach, Nicki Chapman’s success highlights the importance of due diligence. This includes comprehensive market research, careful property evaluation, and a well-defined property investment strategy. Securing expert advice from estate agents, surveyors, and financial advisors is vital for navigating the complexities of the UK property market.

Lessons Learned from Nicki Chapman's Success

Nicki Chapman's successful property investment offers valuable lessons for aspiring investors:

- Thorough Market Research: Understanding local market trends, demand, and potential for growth is paramount. This requires careful analysis of comparable properties, rental yields, and future development plans in the area.

- Strategic Planning: A well-defined investment strategy is crucial, whether focusing on buy-to-let, renovation, or long-term capital appreciation. Understanding your risk tolerance is part of this.

- Expert Advice: Seeking guidance from professionals like estate agents, financial advisors, and solicitors protects your investment and ensures compliance with regulations.

- Patience and Long-Term Vision: Property investment is not a quick-profit scheme. Success requires patience and a long-term perspective.

By emulating these key aspects of successful property investment, aspiring investors can increase their chances of achieving similar returns. Patience is key in the property market, but rewards can be substantial for those who understand and plan effectively.

Conclusion: Investing in Your Future with Country Homes – Inspired by Nicki Chapman

Nicki Chapman's £700,000 investment in a country home exemplifies the potential for significant returns in the UK's thriving rural property market. Her success underscores the importance of thorough market research, strategic planning, and seeking professional guidance. By learning from her example and understanding the factors driving demand for country properties, you can increase your chances of successful property investment. Start your own property investment journey today, inspired by Nicki Chapman's £700,000 country home success story. Research the market and find your perfect investment opportunity!

Featured Posts

-

Post Night Out Annie Kilner Seen Without Wedding Ring

May 24, 2025

Post Night Out Annie Kilner Seen Without Wedding Ring

May 24, 2025 -

Aex Index Over 4 Drop Lowest Point In Over A Year

May 24, 2025

Aex Index Over 4 Drop Lowest Point In Over A Year

May 24, 2025 -

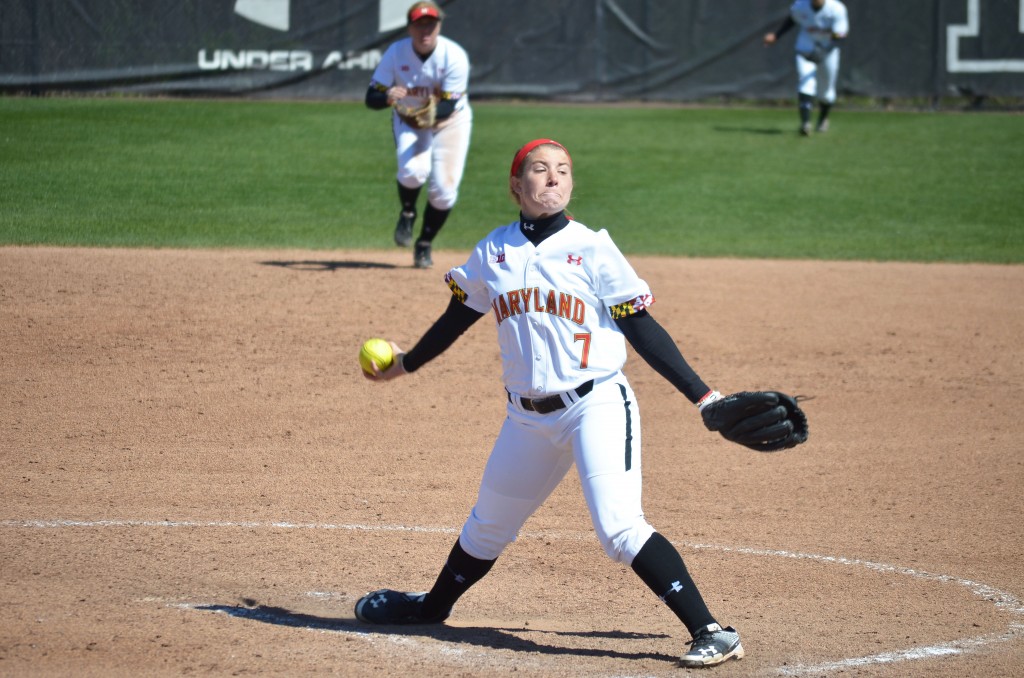

Maryland Softball Defeats Delaware 5 4 In Hard Fought Battle

May 24, 2025

Maryland Softball Defeats Delaware 5 4 In Hard Fought Battle

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

Major Delays On M56 Near Cheshire Deeside Due To Collision

May 24, 2025

Major Delays On M56 Near Cheshire Deeside Due To Collision

May 24, 2025

Latest Posts

-

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025 -

Importazioni Usa L Impatto Sui Prezzi Dell Abbigliamento

May 24, 2025

Importazioni Usa L Impatto Sui Prezzi Dell Abbigliamento

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

Demna Gvasalias Design Philosophy And Its Application At Gucci

May 24, 2025

Demna Gvasalias Design Philosophy And Its Application At Gucci

May 24, 2025 -

How Demna Gvasalia Is Redefining Gucci

May 24, 2025

How Demna Gvasalia Is Redefining Gucci

May 24, 2025