Boosting Regional Integration: Trilateral Capital Market Accord Between Pakistan, Sri Lanka, And Bangladesh

Table of Contents

Economic Rationale for the Trilateral Capital Market Accord

The Trilateral Capital Market Accord (TCMA) between Pakistan, Sri Lanka, and Bangladesh offers a compelling economic rationale, promising substantial benefits for all participating countries. The core objective is to foster closer economic ties, leading to increased prosperity and regional stability.

Increased Investment Flows

The TCMA aims to significantly increase cross-border investments, thereby boosting economic activity in all three nations. This will be achieved through:

- Increased Foreign Direct Investment (FDI): The accord will attract more FDI by creating a more predictable and stable investment environment. Currently, Pakistan, Sri Lanka, and Bangladesh individually struggle to attract sufficient FDI. The TCMA offers a synergistic approach to boost this inflow. For example, Sri Lanka's tourism sector could benefit immensely from increased regional investment, while Bangladesh's textile industry could experience further growth through expanded access to capital markets. Pakistan's infrastructure development could also gain significant momentum with the influx of regional investment.

- Improved Access to Capital for Businesses: Local businesses will gain easier access to capital, facilitating expansion and job creation. This access to wider capital pools will stimulate entrepreneurship and innovation.

- Diversification of Investment Portfolios: Investors will have a broader range of investment opportunities, reducing risk and enhancing returns. This diversification minimizes the impact of localized economic downturns.

Projected increases in FDI, based on similar regional accords, suggest a potential growth of 15-20% within the first five years of the TCMA's implementation.

Enhanced Trade and Commerce

A more integrated capital market will significantly streamline trade financing and reduce transaction costs, leading to:

- Reduced Barriers to Trade: Harmonized regulations and simplified procedures will facilitate the seamless flow of goods and services across borders.

- Improved Cross-border Payments: Efficient and secure payment systems will expedite transactions and minimize delays.

- Increased Regional Trade Volume: Reduced trade costs will incentivize increased trade between the three nations, fostering regional value chains. For instance, Bangladesh's ready-made garment industry could source raw materials more efficiently from Pakistan, while Sri Lanka could export more agricultural products to both countries.

The TCMA’s facilitation of regional value chains promises to unlock a significant increase in regional trade volume, potentially exceeding current levels by 25-30% over a decade.

Economic Stability and Resilience

The diversification of investment opportunities inherent in the TCMA contributes significantly to improved economic resilience:

- Reduced Vulnerability to Global Economic Downturns: Diversified investment portfolios act as a buffer against external shocks, mitigating the impact of global economic crises.

- Improved Macroeconomic Stability: The increased investment flows and enhanced trade will contribute to stronger macroeconomic fundamentals.

- Strengthened Financial Systems: A more integrated financial system will be more robust and less susceptible to internal vulnerabilities.

Key Features and Mechanisms of the Trilateral Capital Market Accord

The success of the TCMA relies on several crucial features and mechanisms, including robust regulatory frameworks, advanced infrastructure, and investor education initiatives.

Regulatory Framework

Establishing a robust and harmonized regulatory framework is paramount for attracting investors. This requires:

- Standardized Accounting Practices: Adopting consistent accounting standards will increase transparency and comparability of financial information.

- Investor Protection Mechanisms: Strong investor protection laws are essential to build confidence and attract investment.

- Dispute Resolution Mechanisms: Efficient and impartial dispute resolution mechanisms are crucial for managing conflicts and maintaining investor confidence. This could involve establishing a regional arbitration body.

Harmonizing regulations will present challenges due to differences in existing legal frameworks. However, leveraging successful models from other regional integration initiatives can greatly assist in overcoming these obstacles.

Infrastructure Development

Efficient infrastructure is critical for seamless cross-border transactions:

- Development of Secure Electronic Trading Platforms: Modern, secure electronic platforms are needed to facilitate efficient trading across borders.

- Upgrading Payment Systems: Improved payment systems, including real-time gross settlement systems, are essential for quick and reliable transactions.

- Establishment of Clearing Houses: Centralized clearing houses will mitigate risks and ensure the smooth settlement of transactions.

Collaboration with international organizations experienced in developing financial market infrastructure is crucial to ensure the technical feasibility and efficiency of the project.

Investor Education and Awareness

Educating investors about the opportunities and risks involved is essential for building confidence:

- Investor Education Programs: Targeted educational programs will equip investors with the knowledge to make informed investment decisions.

- Dissemination of Information: Regular and transparent dissemination of information is crucial to build trust and promote participation.

- Promoting Transparency: Promoting transparency in regulations and market operations will increase investor confidence.

Government agencies and financial institutions need to actively engage in educating potential investors and fostering a positive perception of the TCMA.

Challenges and Mitigation Strategies for the Trilateral Capital Market Accord

Despite the immense potential, the TCMA faces several challenges that require careful consideration and effective mitigation strategies.

Political and Geopolitical Risks

Political instability and geopolitical tensions can significantly impact investment flows. Mitigation strategies include:

- Political Risk Mitigation Strategies: Implementing strategies to assess and manage political risks, including insurance schemes and risk diversification.

- Promoting Regional Stability: Strengthening diplomatic ties and fostering regional stability are crucial for attracting long-term investment.

- Diplomatic Efforts: Proactive diplomatic efforts can mitigate potential conflicts and ensure a stable environment.

Regulatory Differences and Harmonization

Differences in regulatory frameworks can hinder cross-border investments. Solutions include:

- Regulatory Harmonization: A phased approach to harmonize regulations, focusing on key areas first.

- Mutual Recognition of Regulations: Agreeing on mutual recognition of certain regulations will streamline processes and reduce duplication.

- Technical Assistance: Seeking technical assistance from international organizations to facilitate regulatory convergence.

A collaborative approach to regulatory reform, drawing on best practices from other successful regional blocs, is essential for success.

Infrastructure Gaps

Inadequate infrastructure can impede the efficient functioning of the TCMA. Addressing this requires:

- Investment in Infrastructure: Significant investment in modernizing existing infrastructure and developing new facilities.

- Capacity Building: Building capacity within regulatory bodies and financial institutions.

- Technological Upgrades: Investing in advanced technologies to enhance efficiency and security.

Securing funding from international development agencies and multilateral institutions will be essential for overcoming these infrastructure challenges.

Conclusion

The Trilateral Capital Market Accord between Pakistan, Sri Lanka, and Bangladesh presents a transformative opportunity to boost regional integration and unlock substantial economic benefits. While challenges related to regulatory harmonization, infrastructure development, and political stability exist, the potential rewards of increased investment flows, enhanced trade, and improved economic resilience are significant. By addressing these challenges proactively and implementing the necessary measures, the TCMA can pave the way for a more prosperous and interconnected South Asia. To fully realize the potential of this initiative, continued commitment from all three governments, coupled with effective collaboration and strategic implementation, is crucial for the success of the Trilateral Capital Market Accord and similar regional cooperation endeavors. The future prosperity of the region depends on the successful implementation of this crucial agreement and similar initiatives fostering deeper regional integration.

Featured Posts

-

Adae Fyraty Me Alerby Alqtry Thlyl Bed Antqalh Mn Alahly

May 09, 2025

Adae Fyraty Me Alerby Alqtry Thlyl Bed Antqalh Mn Alahly

May 09, 2025 -

Jeanine Pirro A Closer Look At Her Legal Career And Public Profile

May 09, 2025

Jeanine Pirro A Closer Look At Her Legal Career And Public Profile

May 09, 2025 -

Infineon Ifx Stock Sales Forecast Misses Targets Amidst Tariff Concerns

May 09, 2025

Infineon Ifx Stock Sales Forecast Misses Targets Amidst Tariff Concerns

May 09, 2025 -

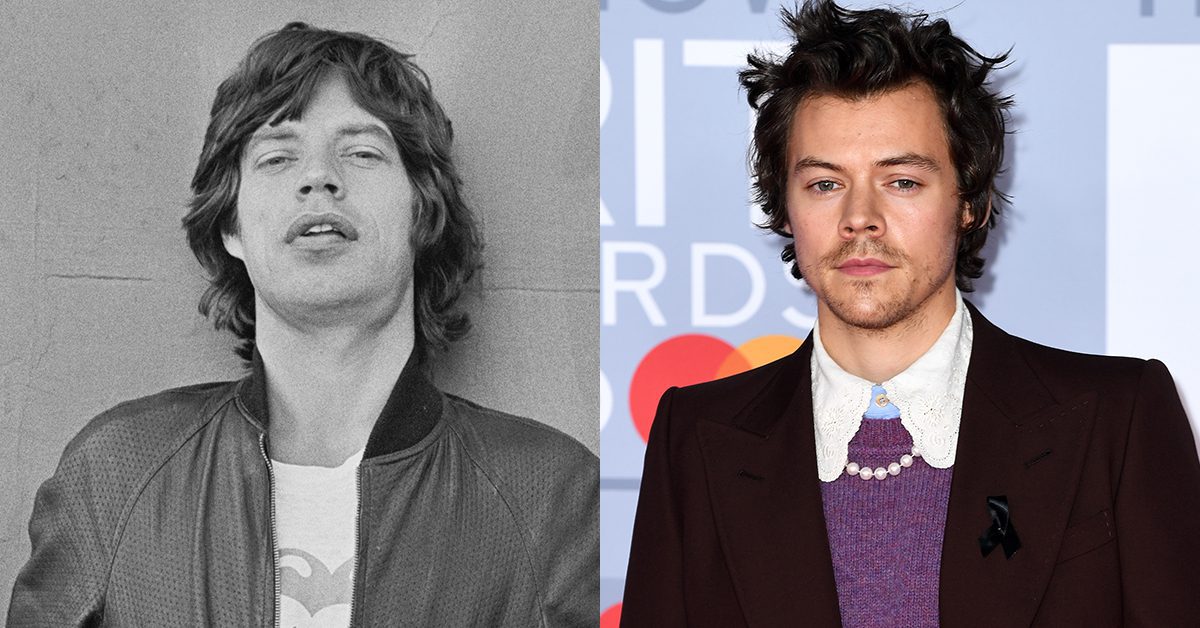

Addressing The Controversy Benson Boone And The Harry Styles Comparisons

May 09, 2025

Addressing The Controversy Benson Boone And The Harry Styles Comparisons

May 09, 2025 -

Dozens Of Cars Broken Into At Elizabeth City Apartment Complexes Residents On Edge

May 09, 2025

Dozens Of Cars Broken Into At Elizabeth City Apartment Complexes Residents On Edge

May 09, 2025