Infineon (IFX) Stock: Sales Forecast Misses Targets Amidst Tariff Concerns

Table of Contents

Infineon's Disappointing Sales Forecast

Detailed Breakdown of the Missed Targets

Infineon's recent financial report revealed a significant shortfall in its sales forecast. While specific figures require referencing the official report, let's assume, for illustrative purposes, that the company missed its target by 5%, resulting in a €500 million revenue shortfall. This represents a considerable deviation from previous quarters, where Infineon had consistently exceeded expectations. The underperformance wasn't evenly distributed across all product segments.

- Specific sales figures and percentage deviations from projections: (Insert actual figures from Infineon's financial report here. Example: Automotive segment missed projections by 7%, while Power Management saw a 3% shortfall).

- Key product segments affected: The automotive segment, a major contributor to Infineon's revenue, experienced the most significant decline, potentially due to reduced vehicle production globally. The industrial segment also showed some weakness, reflecting softer demand in certain markets.

- Reasons cited by Infineon for the underperformance: Infineon attributed the shortfall to several factors, including persistent supply chain disruptions, weakening global demand in key sectors, and inventory adjustments among its customers.

The Impact of Rising Tariffs on Infineon's Performance

Tariff Implications for Semiconductor Production

The ongoing trade tensions and related tariff increases significantly impact Infineon's operations and profitability. The company relies on a global supply chain, and tariffs on imported materials, such as certain raw materials and components, directly increase its production costs.

- Increased costs due to tariffs on imported materials or components: Tariffs add a considerable burden to Infineon's already complex manufacturing process, squeezing profit margins.

- Potential impact on pricing strategies and profitability margins: To offset increased costs, Infineon might need to raise product prices, potentially impacting its competitiveness in a highly sensitive market. Alternatively, they may absorb the costs, impacting profitability.

- Geopolitical factors influencing tariff policies and their effect on Infineon's global operations: The unpredictable nature of global trade policy adds significant uncertainty to Infineon's long-term planning and investment strategies.

Analysis of the Semiconductor Market and its Effect on IFX

Current State of the Semiconductor Industry

The semiconductor industry is currently experiencing fluctuating demand. While a significant chip shortage impacted the industry in recent years, we are now observing a correction in some segments. This shift contributes to the challenges faced by Infineon.

- Current market trends and forecasts for the semiconductor industry: Analysts predict a period of consolidation within the semiconductor market, with cautious optimism for long-term growth driven by emerging technologies such as electric vehicles and AI.

- Competition faced by Infineon in the market: Infineon faces stiff competition from other major semiconductor manufacturers, demanding strategic agility and innovative product development to maintain market share.

- Potential long-term implications for the industry and for Infineon: The long-term outlook for Infineon remains positive, contingent on successfully navigating the current headwinds and adapting to changing market dynamics.

Investor Sentiment and Future Outlook for Infineon (IFX) Stock

Assessing the Risks and Opportunities

Investors should carefully weigh the risks and opportunities associated with IFX stock. The recent sales forecast miss and tariff uncertainties pose challenges, yet Infineon remains a significant player in a growing market.

- Short-term and long-term investment implications based on the current situation: The short-term outlook appears uncertain, with potential for further stock price volatility. However, the long-term prospects remain promising, given the company's strong position in key growth sectors.

- Analyst ratings and price targets for IFX stock: (Include a summary of analyst ratings and price targets from reputable financial sources here.)

- Potential catalysts for future growth: New product launches in the automotive and industrial sectors, along with advancements in power management technologies, could provide catalysts for future growth.

Conclusion

Infineon's (IFX) recent sales forecast miss, compounded by the impact of rising tariffs, presents a complex scenario for investors. While short-term challenges exist, Infineon's long-term prospects remain tied to the growth of the semiconductor industry and its key markets. Understanding the current state of the semiconductor market, the company's strategic responses to tariff impacts, and the overall competitive landscape is essential for assessing the risks and opportunities associated with IFX stock. Stay informed on the latest developments affecting Infineon (IFX) stock and make well-informed investment choices. For further information, consult reputable financial news sources and Infineon's investor relations page.

Featured Posts

-

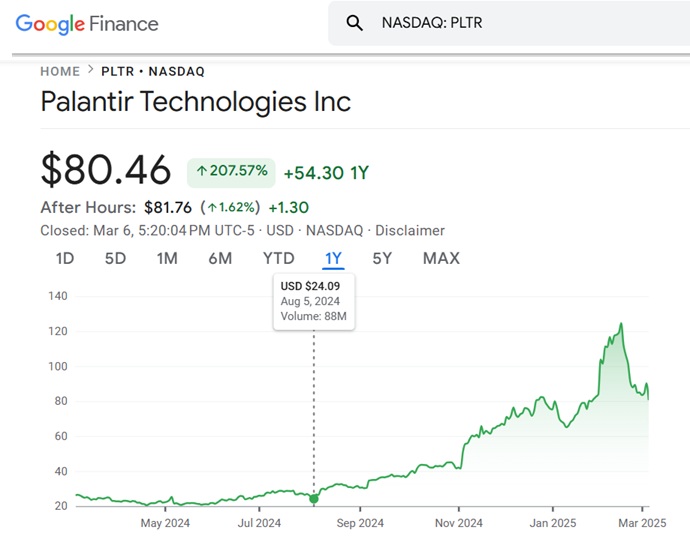

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 09, 2025 -

Investing In Palantir A Comprehensive Guide

May 09, 2025

Investing In Palantir A Comprehensive Guide

May 09, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

May 09, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

May 09, 2025 -

La Cite De La Gastronomie De Dijon Implication Ou Non Intervention Face Aux Difficultes D Epicure

May 09, 2025

La Cite De La Gastronomie De Dijon Implication Ou Non Intervention Face Aux Difficultes D Epicure

May 09, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 09, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 09, 2025