Breaking Resistance: Ethereum Price Poised For $2,000 Run?

Table of Contents

Technical Analysis Suggests Potential Breakout

Technical analysis of the Ethereum chart paints a potentially bullish picture. Several indicators suggest a possible upward trend towards the $2000 price target, hinting at a significant price breakout.

Chart Patterns and Indicators

Bullish chart patterns, combined with positive readings from key technical indicators, are fueling speculation of an upcoming price surge.

- Specific examples of bullish chart patterns observed: Recent price action suggests a potential head and shoulders reversal pattern, a classic bullish signal indicating a potential price reversal from a downtrend. Furthermore, the formation of a pennant pattern, characterized by consolidation within converging trendlines, often precedes a strong price move.

- Key support and resistance levels to watch: The $1,800 level represents a crucial support level, while the $2,000 mark serves as a significant resistance level. Breaking above $2,000 would signal a significant bullish confirmation. A retest of the $1,600 level could also indicate a potential support level for a continuation of the uptrend.

- Indicator readings and their interpretations: The Relative Strength Index (RSI) is showing signs of moving out of oversold territory, suggesting increasing bullish momentum. The Moving Average Convergence Divergence (MACD) is displaying a bullish crossover, further reinforcing the potential for an upward trend.

Fundamental Factors Fueling Ethereum's Growth

Beyond technical analysis, strong fundamental factors are bolstering Ethereum's growth and potentially driving its price higher.

Ethereum's Growing Ecosystem

The Ethereum ecosystem is experiencing explosive growth, creating significant demand for ETH.

- Growth in Total Value Locked (TVL) in DeFi protocols: The Total Value Locked (TVL) in decentralized finance (DeFi) protocols built on Ethereum continues to expand significantly, indicating increasing user adoption and confidence in the platform.

- Increasing NFT trading volume and market cap: The Non-Fungible Token (NFT) market, largely built on Ethereum, shows no signs of slowing down. Continued high trading volume and a growing market cap demonstrate the platform's significant role in the digital asset space.

- Examples of enterprise-level Ethereum adoption: Major corporations are increasingly exploring and integrating Ethereum blockchain technology into their operations, demonstrating the growing recognition of its potential for secure and transparent transactions.

Upcoming Ethereum Upgrades

The highly anticipated Ethereum 2.0 upgrade is poised to significantly enhance the network's capabilities, further attracting users and investors.

- Explanation of the benefits of ETH 2.0: ETH 2.0 will transition Ethereum to a proof-of-stake (PoS) consensus mechanism, resulting in improved scalability, reduced transaction fees, and increased energy efficiency.

- Expected timeline for major upgrades: While the full implementation of ETH 2.0 is ongoing, major milestones are regularly met, signaling steady progress towards a more efficient and scalable network.

- Potential impact on ETH price and demand: These upgrades are expected to positively impact Ethereum's price by increasing its appeal to both developers and users.

Market Sentiment and Investor Confidence

Positive market sentiment and growing investor confidence are essential drivers of Ethereum's potential price appreciation.

Institutional Investment

Institutional investors are increasingly recognizing Ethereum's value, leading to substantial investments.

- Examples of major institutions investing in ETH: Several prominent financial institutions have publicly disclosed their holdings in Ethereum, showcasing a growing institutional appetite for the cryptocurrency.

- Analysis of institutional investment trends: The trend indicates a growing belief in Ethereum's long-term potential and its role as a leading blockchain platform.

Retail Investor Demand

Retail investor enthusiasm and active participation are also influencing the Ethereum price.

- Data on retail ETH holdings and trading activity: Data suggests a steady increase in retail investor holdings and trading activity, indicating strong ongoing demand.

- Sentiment analysis from social media and online forums: Social media and online forums reveal positive sentiment surrounding Ethereum, with many retail investors expressing optimism about its future price.

Potential Risks and Challenges

Despite the bullish outlook, it's crucial to acknowledge potential risks and challenges.

Regulatory Uncertainty

Regulatory uncertainty surrounding cryptocurrencies globally poses a potential threat to the Ethereum market.

- Examples of recent regulatory actions or announcements: Governments worldwide are actively developing regulatory frameworks for cryptocurrencies, and the outcomes of these initiatives could significantly impact the Ethereum price.

- Potential scenarios and their effects on Ethereum’s price: Increased regulatory scrutiny could lead to price volatility, but a clear and supportive regulatory environment could enhance investor confidence.

Market Volatility

The cryptocurrency market is inherently volatile, and Ethereum's price is no exception.

- Historical examples of Ethereum price volatility: Ethereum's price history demonstrates periods of significant price swings, highlighting the inherent risks associated with investing in cryptocurrencies.

- Factors contributing to market volatility: Market sentiment, macroeconomic conditions, and regulatory developments all contribute to the volatility of the Ethereum price.

Will Ethereum Reach $2,000? A Look Ahead

The confluence of bullish technical indicators, a thriving ecosystem fueled by DeFi and NFT growth, upcoming upgrades like Ethereum 2.0, and increasing institutional and retail investor confidence suggests a strong potential for the Ethereum price to reach $2,000. However, it's crucial to remember the inherent risks associated with cryptocurrency investments, including regulatory uncertainty and market volatility. While no one can predict the future with certainty, a thorough understanding of these factors is essential for making informed decisions. Conduct your own thorough research before investing in Ethereum and other cryptocurrencies. The Ethereum price remains a dynamic market, demanding careful analysis of both the technical indicators and the fundamental factors that drive its value.

Featured Posts

-

Barcelona Vs Inter Milan Champions League Semifinal Result And Analysis

May 08, 2025

Barcelona Vs Inter Milan Champions League Semifinal Result And Analysis

May 08, 2025 -

The Impact Of Saturday Night Live On Counting Crows 98 Trajectory

May 08, 2025

The Impact Of Saturday Night Live On Counting Crows 98 Trajectory

May 08, 2025 -

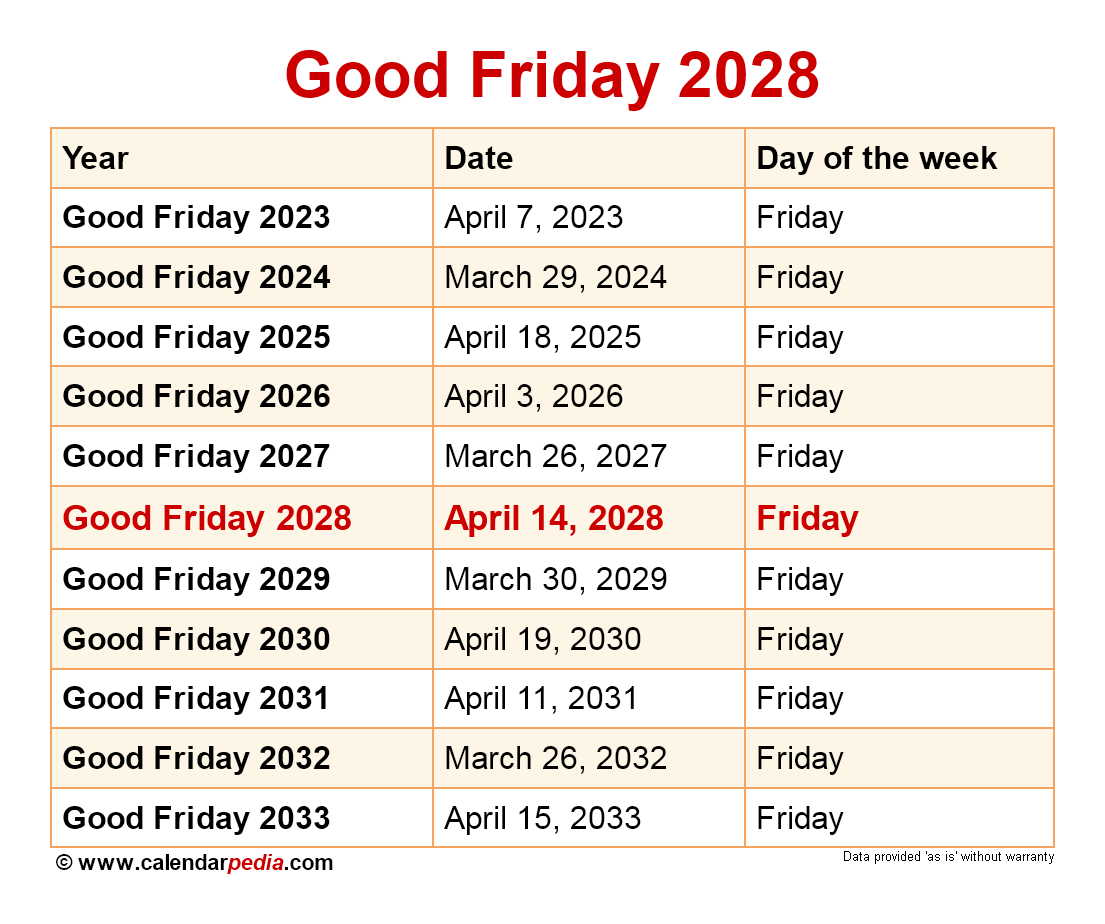

Daily Lotto Draw Results Friday April 18th 2025

May 08, 2025

Daily Lotto Draw Results Friday April 18th 2025

May 08, 2025 -

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Zielinskis Calf Injury Weeks On The Sidelines For Inter Milan

May 08, 2025

Zielinskis Calf Injury Weeks On The Sidelines For Inter Milan

May 08, 2025

Latest Posts

-

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025 -

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025 -

9 4000 2 360

May 08, 2025

9 4000 2 360

May 08, 2025