Broadcom's VMware Acquisition: AT&T Exposes A Staggering 1,050% Price Hike

Table of Contents

The Broadcom-VMware Deal: A Deep Dive

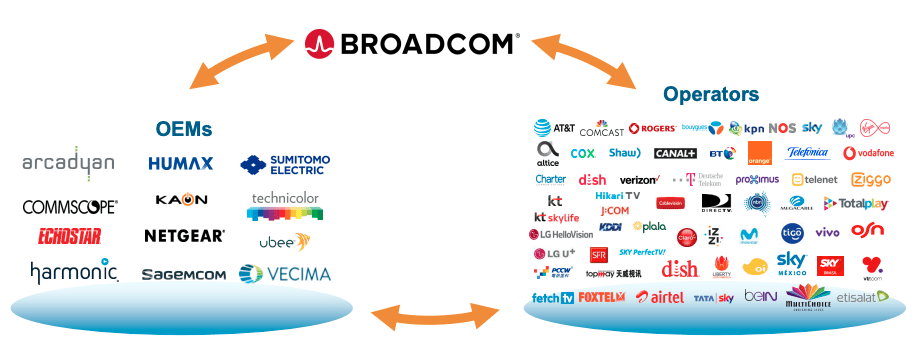

The $61 billion acquisition of VMware by Broadcom represents one of the largest technology mergers in history. Broadcom, a semiconductor giant, sought to expand its enterprise software portfolio with the addition of VMware's virtualization and cloud computing technologies. This move positions Broadcom as a major player in the enterprise software market, offering a comprehensive suite of solutions. Their rationale likely centers around increasing market share, leveraging VMware's existing customer base, and bundling services for increased profitability.

- Acquisition cost: $61 billion, funded through a combination of cash and debt.

- Timeline: The deal was announced in May 2022 and completed in late 2022.

- Key players: Hock Tan (Broadcom CEO), Raghu Raghuram (VMware CEO), and various investment banks and legal firms.

Broadcom's plans for VMware post-acquisition include integrating VMware's technology into its existing product line, potentially creating bundled offerings. This strategy could lead to further cost optimization for Broadcom but also presents potential challenges for existing VMware customers regarding pricing and service continuity. The long-term effects of this integration on the competitive landscape remain to be seen.

AT&T's 1050% Price Hike: A Case Study

AT&T's experience serves as a stark example of the potential fallout from Broadcom's VMware acquisition. Reports indicate that AT&T faced a 1050% increase in certain VMware licensing fees post-acquisition. This dramatic increase highlights the potential for significant cost escalation for businesses relying on VMware products. The reasons behind such a substantial price hike are likely multi-faceted, potentially involving renegotiated contracts, bundled service changes, and Broadcom leveraging its newly acquired market dominance.

- Services affected: The specific services impacted by the price hike haven't been fully disclosed publicly, but it's likely related to core VMware virtualization and cloud technologies.

- Pricing comparison: While precise pre- and post-acquisition pricing figures remain confidential in many instances, the 1050% increase reported by AT&T illustrates a massive disparity.

- AT&T's response: AT&T's public response to the price increase hasn't been fully detailed, but it's likely they are engaged in negotiations with Broadcom to mitigate costs.

This case study underscores the critical need for businesses to carefully review their contracts and consider potential price increases when dealing with recently merged entities.

Impact on the Broader Market: Antitrust Concerns and Competition

Broadcom's acquisition of VMware has raised significant antitrust concerns. The merger brings together two major players in the technology market, potentially leading to reduced competition and less innovation. Smaller companies that relied on a competitive VMware landscape now face a more powerful, potentially monopolistic Broadcom. This could stifle innovation and limit choices for businesses.

- Potential implications for competitors: Competitors in the virtualization and cloud computing markets may face increased pressure from a combined Broadcom-VMware entity.

- Effects on innovation: Reduced competition could lead to less innovation and slower development of new technologies within the industry.

- Potential legal challenges: Regulatory bodies worldwide are likely to scrutinize the deal for potential antitrust violations.

Navigating the Post-Acquisition Landscape: Strategies for Businesses

Businesses relying on VMware services need proactive strategies to manage the potential impact of Broadcom's acquisition. Careful contract review, budget planning, and exploring alternative solutions are crucial.

- Tips for negotiating with VMware: Businesses should leverage their bargaining power, particularly for large contracts, to negotiate favorable pricing terms.

- Strategies for mitigating price increases: This includes exploring alternative virtualization solutions, optimizing resource utilization, and considering open-source alternatives.

- Recommendations for long-term cost optimization: Implement robust cost management practices, including regular budget reviews and proactive vendor management.

Conclusion: Understanding the Implications of Broadcom's VMware Acquisition

Broadcom's VMware acquisition has significant implications for the technology industry. AT&T's experience with a 1050% price hike serves as a stark warning. The potential for reduced competition, increased market dominance by Broadcom, and substantial price increases for businesses are serious concerns. The ongoing impact of Broadcom's VMware acquisition on the broader market remains to be seen, including the outcome of potential antitrust investigations. To stay informed about the ongoing developments surrounding Broadcom's VMware acquisition and its impact on your business, further research into the topic using keywords like "Broadcom's VMware acquisition," "VMware pricing post-acquisition," and "Broadcom antitrust concerns" is highly recommended. Proactive cost management and strategic planning are essential to navigate this changing landscape.

Featured Posts

-

Did Christina Aguilera Go Too Far Public Outcry Over Altered Photoshoot Images

May 02, 2025

Did Christina Aguilera Go Too Far Public Outcry Over Altered Photoshoot Images

May 02, 2025 -

The Fortnite Backward Music Update A Critical Analysis

May 02, 2025

The Fortnite Backward Music Update A Critical Analysis

May 02, 2025 -

Ywm Eyd Bharty Fwj Ky Karrwayy Myn Kshmyry Nwjwan Shhyd

May 02, 2025

Ywm Eyd Bharty Fwj Ky Karrwayy Myn Kshmyry Nwjwan Shhyd

May 02, 2025 -

Breaking The Silence Dr Shradha Malik On The Importance Of Mental Health Awareness

May 02, 2025

Breaking The Silence Dr Shradha Malik On The Importance Of Mental Health Awareness

May 02, 2025 -

The Ripple Xrp Phenomenon Understanding Its Potential And Risks

May 02, 2025

The Ripple Xrp Phenomenon Understanding Its Potential And Risks

May 02, 2025

Latest Posts

-

Canelo Alvarez On Benavidez What Irritated The Champion

May 05, 2025

Canelo Alvarez On Benavidez What Irritated The Champion

May 05, 2025 -

The Bradley Cooper Story As Told By Gigi Hadid

May 05, 2025

The Bradley Cooper Story As Told By Gigi Hadid

May 05, 2025 -

Canelo Alvarez Prioritizes Plant Fight Ignores Crawford Speculation

May 05, 2025

Canelo Alvarez Prioritizes Plant Fight Ignores Crawford Speculation

May 05, 2025 -

Unheard Details Gigi Hadids Perspective On Bradley Cooper

May 05, 2025

Unheard Details Gigi Hadids Perspective On Bradley Cooper

May 05, 2025 -

Canelo Alvarez Vs Plant Crawford Talk Postponed

May 05, 2025

Canelo Alvarez Vs Plant Crawford Talk Postponed

May 05, 2025