The Ripple (XRP) Phenomenon: Understanding Its Potential And Risks

Table of Contents

Ripple Technology and Functionality

Ripple's core technology revolves around the XRP Ledger, a distributed ledger technology (DLT) designed for speed, scalability, and low transaction fees. Unlike Bitcoin and Ethereum which rely on Proof-of-Work consensus mechanisms, the XRP Ledger employs a unique consensus mechanism, making it significantly faster and more energy-efficient.

- Fast transaction speeds: XRP transactions are processed in a matter of seconds, a stark contrast to the minutes or even hours required by Bitcoin and Ethereum. This speed is crucial for facilitating real-time payments.

- Low energy consumption: The XRP Ledger's energy efficiency is a significant advantage, addressing environmental concerns associated with Proof-of-Work cryptocurrencies.

- Focus on cross-border payments: RippleNet, Ripple's network for institutional clients, leverages XRP to facilitate seamless and cost-effective cross-border payments. This is a key differentiator for XRP, targeting a large and underserved market.

- XRP's role in RippleNet: XRP acts as a bridge currency, enabling instant conversions between different fiat currencies and cryptocurrencies. This significantly reduces transaction times and costs compared to traditional banking systems.

These features make the XRP Ledger a compelling alternative for financial institutions seeking faster, cheaper, and more efficient payment solutions. The combination of transaction speed, scalability, low fees, and energy efficiency positions XRP as a potential game-changer in the global payments landscape.

Adoption and Market Position of XRP

While XRP’s adoption among financial institutions is a key aspect of its narrative, the landscape is complex. While RippleNet boasts several partnerships, the level of actual XRP usage within these partnerships can vary. The XRP market cap fluctuates significantly and its position relative to other cryptocurrencies like Bitcoin and Ethereum is constantly changing.

- Major financial institutions using RippleNet: While Ripple touts partnerships, the extent of XRP usage within these partnerships varies greatly and remains a subject of debate. Specific examples often involve RippleNet's infrastructure rather than direct XRP use.

- Comparison of XRP's market cap: XRP's market capitalization is considerably smaller than Bitcoin and Ethereum, making it a more volatile and riskier investment. It often faces competition for market share from newer and alternative cryptocurrencies.

- Analysis of XRP's price volatility: XRP's price history demonstrates significant volatility. Its price has been heavily influenced by market sentiment, regulatory news, and the ongoing legal battles faced by Ripple Labs.

- Partnerships and collaborations: Partnerships with various financial institutions continue to impact XRP's adoption, but the full impact is often debated due to the complexities of each individual relationship.

Analyzing XRP’s market cap, institutional adoption, and price volatility is essential for understanding its current market position and potential future growth. Predicting the future XRP price remains challenging, demanding careful analysis of both technical and fundamental factors.

Regulatory Landscape and Legal Challenges

The regulatory landscape surrounding XRP is a significant factor influencing its price and future prospects. The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a considerable shadow of uncertainty.

- Summary of the SEC lawsuit: The SEC alleges that XRP is an unregistered security, impacting its trading and potentially its future adoption. The outcome of this case will significantly affect XRP's regulatory status.

- Potential outcomes of the lawsuit: A favorable ruling for Ripple could boost XRP's price and adoption. Conversely, an unfavorable ruling could significantly diminish its value and severely restrict its use.

- Regulatory uncertainty in the cryptocurrency space: The cryptocurrency market is characterized by evolving regulatory frameworks worldwide, making it challenging to predict the future of XRP.

- Comparison of XRP regulations in different jurisdictions: Regulatory approaches to XRP vary across countries, highlighting the complexities and challenges in navigating international financial regulations.

Understanding the intricacies of the SEC lawsuit, XRP regulation, and regulatory uncertainty is paramount for any investor considering exposure to XRP.

Investment Considerations and Risks Associated with XRP

Investing in XRP offers the potential for substantial returns but also carries significant risks. High volatility, regulatory uncertainty, and technological risks all need careful consideration.

- Risk assessment: High volatility is a major risk, alongside regulatory risk (the outcome of the SEC lawsuit), technological risk (changes in blockchain technology), and market risk (overall market sentiment towards cryptocurrencies).

- Potential rewards: The potential for high growth, especially if the SEC lawsuit is resolved favorably, makes XRP an appealing asset for some investors. It may also offer diversification benefits within a broader cryptocurrency portfolio.

- Investment strategies: Diversification and risk management techniques are crucial. Investors should never invest more than they can afford to lose.

- Importance of thorough research: Before investing in XRP, conducting comprehensive research is paramount. Understanding its technology, market position, and regulatory challenges is vital for making informed decisions.

Analyzing XRP investment opportunities requires careful consideration of risk assessment and the development of a suitable investment strategy. Remember that the cryptocurrency market is inherently volatile, making risk management a critical element of any investment plan.

Conclusion

Ripple (XRP) presents a complex investment opportunity with significant potential rewards and equally considerable risks. Its innovative technology and focus on institutional adoption are noteworthy, but the ongoing regulatory challenges and inherent volatility demand careful consideration. Understanding the technology, market position, regulatory landscape, and inherent risks is crucial for anyone contemplating investing in XRP.

Call to Action: Before making any investment decisions related to Ripple (XRP), conduct thorough research and consult with a financial advisor. Learn more about the intricacies of the Ripple (XRP) phenomenon and make informed decisions about your investment strategy. Remember that this is not financial advice, and all investment decisions should be made after careful consideration of your individual financial situation and risk tolerance.

Featured Posts

-

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

May 02, 2025

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

May 02, 2025 -

Xrp Price Jump Impact Of Trumps Ripple Article On Cryptocurrency

May 02, 2025

Xrp Price Jump Impact Of Trumps Ripple Article On Cryptocurrency

May 02, 2025 -

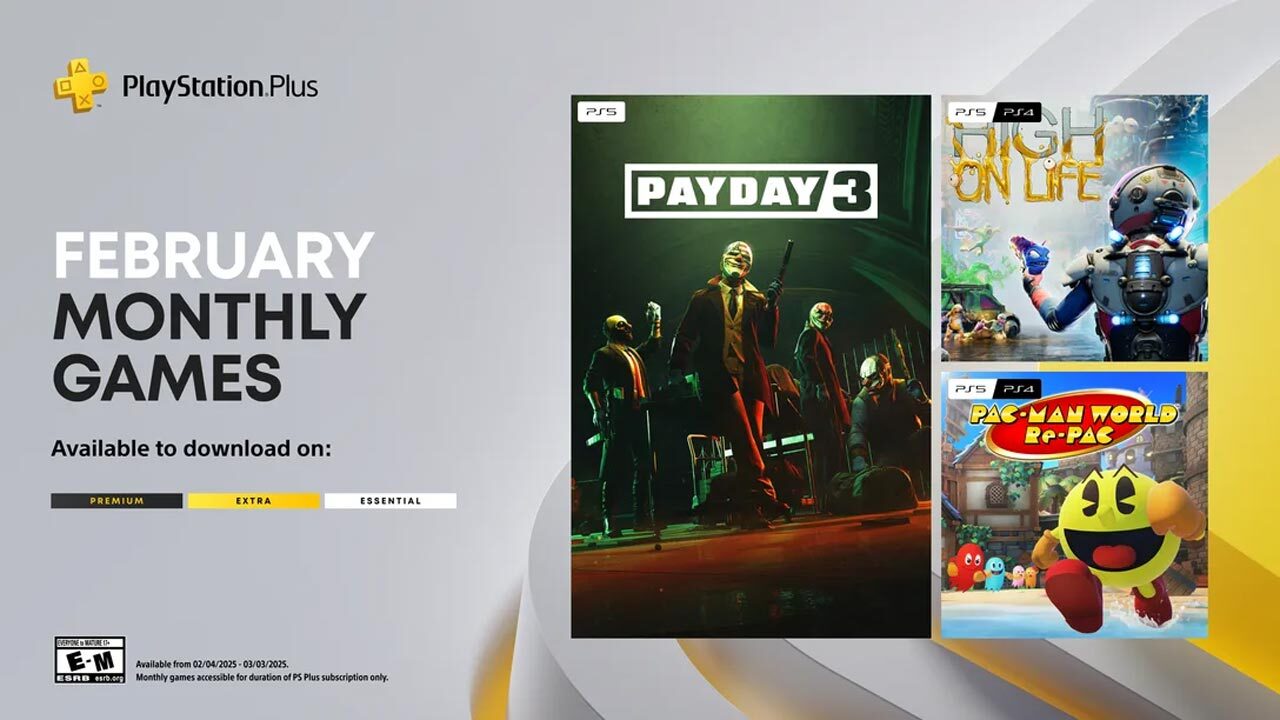

One Of 2024s Best Underrated Games Your Ps Plus February Treat

May 02, 2025

One Of 2024s Best Underrated Games Your Ps Plus February Treat

May 02, 2025 -

Michael Sheens Million Pound Giveaway Christopher Stevens Scathing Review

May 02, 2025

Michael Sheens Million Pound Giveaway Christopher Stevens Scathing Review

May 02, 2025 -

Automating Workboats The Tbs Safety And Nebofleet Collaboration

May 02, 2025

Automating Workboats The Tbs Safety And Nebofleet Collaboration

May 02, 2025

Latest Posts

-

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025 -

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025 -

Lee Anderson Welcomes Councillor Defection To Reform Party

May 03, 2025

Lee Anderson Welcomes Councillor Defection To Reform Party

May 03, 2025