Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Hike Concerns

Table of Contents

AT&T's Vocal Concerns Regarding VMware Pricing Post-Acquisition

AT&T, like many large enterprises, relies heavily on VMware's virtualization technologies. This significant dependency makes them particularly vulnerable to potential price increases following the Broadcom acquisition.

Increased Dependency on VMware Products:

- Existing Contracts: AT&T's existing contracts with VMware are now subject to renegotiation under Broadcom's ownership, potentially leading to significantly higher costs. The terms of these contracts will be crucial in determining the immediate impact.

- Limited Alternatives: The lack of readily available and equally effective alternatives to VMware's virtualization solutions significantly weakens AT&T's bargaining power. Switching providers would be a costly and complex undertaking.

- Projected Cost Increases: Analyzing AT&T's current VMware spending and extrapolating based on Broadcom's historical pricing practices in similar acquisitions allows for a projection of potential future cost increases. Conservative estimates suggest a substantial rise in annual expenditure.

Impact on Network Infrastructure Costs:

VMware's virtualization solutions are deeply integrated into AT&T's network infrastructure. Any price hikes would directly translate to considerable increases in operational expenses, impacting profitability and potentially affecting service offerings.

- Network Integration: VMware's products are used across various aspects of AT&T's network, from server virtualization to network function virtualization (NFV). This widespread usage amplifies the impact of price increases.

- Cost Increase Estimates: Based on Broadcom's past acquisitions and their subsequent pricing strategies, we can estimate potential cost increases for AT&T's network infrastructure. These increases could run into hundreds of millions of dollars annually.

- Alternative Solutions: While alternatives to VMware exist, migrating to them would be a massive undertaking, requiring significant investment and potential service disruptions. The cost-benefit analysis of such a transition needs careful consideration.

Broadcom's Acquisition Strategy and Potential for Price Increases

Broadcom has a history of acquiring companies and subsequently adjusting pricing strategies. Examining this history provides valuable insight into the potential price increases for VMware products.

Broadcom's History of Acquisitions and Subsequent Pricing:

Broadcom's past acquisitions demonstrate a pattern of increased pricing following the integration of acquired companies. This trend supports AT&T's concerns about future VMware pricing.

- Case Studies: A detailed analysis of past Broadcom acquisitions reveals a consistent pattern of price hikes for acquired products and services after the completion of the mergers. These examples offer a clear indication of Broadcom's post-acquisition pricing approach.

- Financial Analysis: Examining Broadcom's financial statements, particularly profit margins, reveals a focus on maximizing profitability. This financial drive further reinforces the likelihood of price increases post-acquisition.

- Expert Opinions: Industry analysts and experts predict increased pricing for VMware products under Broadcom's ownership, citing the company's historical practices and its focus on shareholder value.

Antitrust Concerns and Regulatory Scrutiny:

The Broadcom-VMware acquisition faces intense regulatory scrutiny globally. The outcome of these investigations could significantly influence future pricing strategies.

- Antitrust Investigations: Various regulatory bodies are investigating the potential anti-competitive effects of the merger. The results of these investigations could impose restrictions on Broadcom's pricing power.

- Regulatory Intervention: Depending on the findings of the investigations, regulatory bodies may impose conditions on the acquisition, potentially limiting price increases or mandating fair pricing practices.

- Legal Precedents: Legal precedents from similar mergers and acquisitions will inform the regulatory decisions and will likely influence the final outcome, impacting pricing policies.

The Broader Impact on Enterprise Software Costs and Cloud Computing

The Broadcom-VMware acquisition's impact extends far beyond AT&T, potentially influencing the entire enterprise software market and the broader cloud computing landscape.

Ripple Effect Across the Enterprise Software Market:

The acquisition raises concerns about monopolistic practices and the potential for a domino effect, leading to increased software costs across the board.

- Competitive Landscape: The merger reduces competition in the virtualization market, potentially leading to less innovation and higher prices for alternative solutions.

- Impact on Smaller Businesses: Smaller businesses and startups that rely heavily on VMware technologies are particularly vulnerable to price increases, potentially hindering their growth and competitiveness.

- Enterprise Software Spending: The acquisition will likely cause a significant increase in overall enterprise software spending, affecting IT budgets and potentially impacting investment in other areas.

Long-Term Implications for Cloud Computing Prices:

VMware plays a vital role in hybrid and multi-cloud environments. Broadcom's control over VMware could significantly impact cloud computing prices and competitiveness.

- Hybrid and Multi-Cloud: VMware's technologies are extensively used in hybrid and multi-cloud strategies. Price increases could significantly affect the cost of these increasingly popular deployment models.

- Cloud Service Prices: The acquisition could lead to increased prices for cloud services that rely on VMware technologies, potentially slowing down cloud adoption rates among smaller organizations.

- Market Dynamics: The acquisition could reshape the competitive dynamics of the cloud computing market, potentially leading to reduced innovation and less choice for consumers.

Conclusion

Broadcom's acquisition of VMware presents significant challenges, especially regarding pricing. AT&T's concerns are representative of a broader industry anxiety regarding potential price hikes for virtualization and cloud computing services. The acquisition's impact extends beyond AT&T, potentially influencing enterprise software costs and the broader cloud computing market. Regulatory scrutiny is crucial to mitigate potential monopolistic practices and protect consumers from excessive price increases.

Call to Action: Stay informed about the ongoing developments surrounding the Broadcom VMware acquisition and its implications for your organization. Understanding the potential for increased Broadcom VMware costs is crucial for effective budgeting and strategic planning. Continue monitoring news and expert analysis to adapt to the evolving landscape of enterprise software pricing.

Featured Posts

-

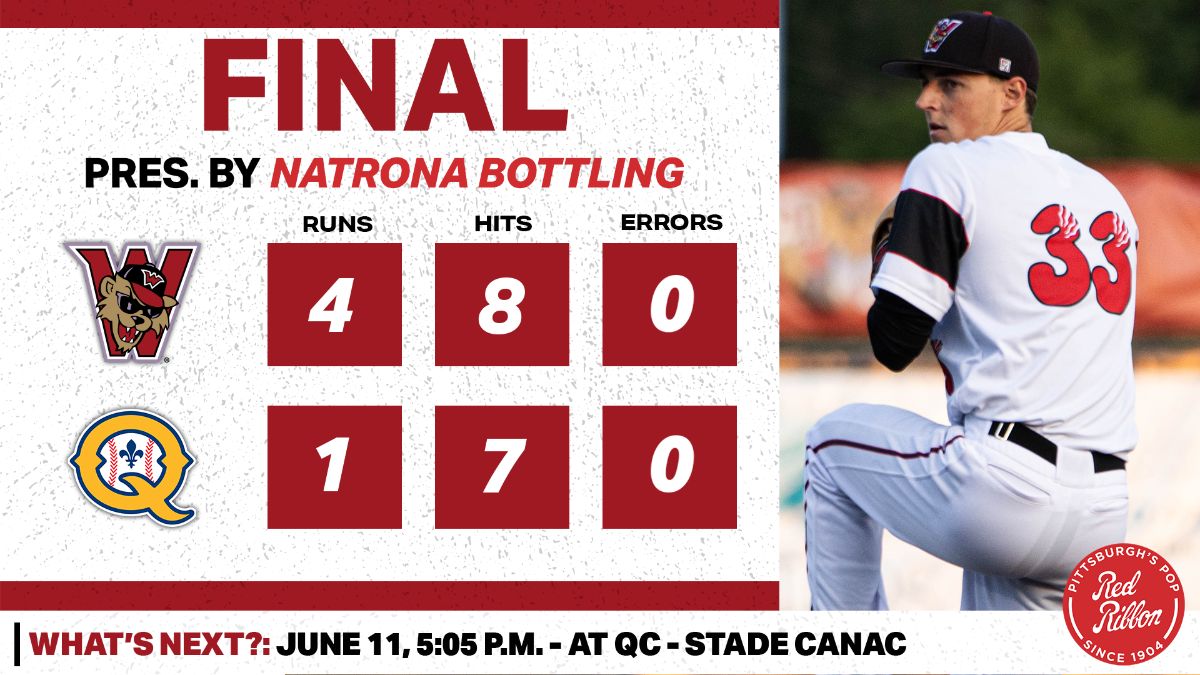

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025 -

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

Apr 28, 2025

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

Apr 28, 2025 -

Is A Bank Of Canada Rate Cut Imminent Analysis Of Grim Retail Sales Data

Apr 28, 2025

Is A Bank Of Canada Rate Cut Imminent Analysis Of Grim Retail Sales Data

Apr 28, 2025 -

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

Apr 28, 2025

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

Apr 28, 2025 -

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025

Latest Posts

-

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025 -

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025 -

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025 -

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025 -

Rodons Strong Performance Yankees Offense Secure Win Against Astros

Apr 28, 2025

Rodons Strong Performance Yankees Offense Secure Win Against Astros

Apr 28, 2025