Brookfield's US Manufacturing Investment On Hold: Tariff Impact

Table of Contents

The Role of Tariffs in Brookfield's Decision

Tariffs have directly influenced Brookfield's strategic investment decisions. The imposition of tariffs has led to a substantial increase in the cost of imported materials and components crucial for US manufacturing operations. This increased cost of goods sold directly impacts profitability, making US manufacturing less attractive compared to other investment opportunities. Furthermore, the inherent uncertainty surrounding global trade, fueled by fluctuating tariff policies, creates significant challenges in accurately forecasting future costs and returns. This uncertainty makes long-term investment planning extremely difficult and risky for Brookfield.

- Increased input costs for manufacturing: Tariffs inflate the price of imported raw materials, machinery, and parts, significantly impacting production costs.

- Reduced profitability projections for US manufacturing plants: Higher input costs directly reduce profit margins, making US-based manufacturing less financially viable.

- Difficulty in accurately forecasting future costs and returns: The unpredictable nature of tariff policies makes it nearly impossible to develop reliable financial models for manufacturing investments.

- Hesitation due to potential future tariff increases or changes: The fear of further tariff hikes or policy shifts creates an environment of hesitancy and discourages long-term commitment.

Alternative Investment Strategies for Brookfield

Faced with the challenges posed by tariffs on US manufacturing investment, Brookfield is likely exploring alternative investment avenues. This could involve shifting focus towards sectors less vulnerable to tariff fluctuations. Additionally, geographical diversification is a likely strategy, with Brookfield potentially increasing investments in international markets where tariffs pose less of a barrier. Domestic markets with reduced import reliance might also become more attractive.

- Increased investment in sectors less affected by tariffs: This might involve sectors like technology, services, or domestic-focused industries.

- Expansion of investment opportunities in international markets: This could entail investment in manufacturing facilities in countries with more stable trade policies.

- Potential focus on domestic markets with reduced import reliance: Investments in industries that rely predominantly on domestically sourced materials would mitigate tariff risks.

- Exploration of merger and acquisition opportunities in stable markets: Acquiring established companies in stable markets could provide a safer and more predictable return on investment.

The Wider Impact on US Manufacturing

Brookfield's decision to halt US manufacturing investment has broader implications for the US economy. Reduced investment translates directly into decreased job creation within the manufacturing sector. This slowdown in investment will negatively impact economic growth, as manufacturing contributes significantly to overall GDP. Furthermore, the ripple effect on related industries and supply chains is considerable, potentially leading to disruptions and reduced overall output.

- Reduced job creation in the manufacturing sector: Fewer investments mean fewer new jobs and potentially job losses in existing facilities.

- Negative impact on economic growth due to decreased production: Reduced manufacturing output directly impacts GDP growth and overall economic prosperity.

- Disruptions in supply chains due to reduced manufacturing capacity: Decreased production capacity can lead to shortages and delays throughout the supply chain.

- Potential loss of competitiveness for US manufacturers globally: Higher production costs due to tariffs make US manufacturers less competitive in the global market.

Potential Future Scenarios and Brookfield's Response

The future trajectory of Brookfield's US manufacturing investment hinges significantly on future tariff policies. Several scenarios are possible:

- Scenario 1: Tariff reduction – resumption of investment: A significant reduction in tariffs could incentivize Brookfield to resume its investments in US manufacturing.

- Scenario 2: Tariff escalation – continued investment hesitation: Further tariff increases would likely solidify Brookfield's hesitation and prolong the investment freeze.

- Scenario 3: Tariff stability – cautious investment approach: Even with tariff stability, Brookfield might adopt a cautious approach, carefully evaluating risks before committing substantial capital.

- Brookfield's potential for strategic partnerships to mitigate risk: Brookfield might seek partnerships to share risks and costs, potentially unlocking investment opportunities even in a challenging tariff environment.

Conclusion: Brookfield's US Manufacturing Investment on Hold: A Cautious Wait-and-See Approach

Brookfield's decision to temporarily halt its US manufacturing investments underscores the significant impact of tariffs on investment decisions. The increased costs, uncertainty, and reduced profitability stemming from tariffs have made US manufacturing a less attractive investment prospect. This decision carries broader economic consequences, potentially impacting job creation, economic growth, and the competitiveness of the US manufacturing sector. To stay informed on the evolving situation, it's crucial to follow future updates on Brookfield's response to tariff changes and potential shifts in their investment approach. Learn more about the complex interplay of tariffs and US manufacturing investment by exploring related resources [link to relevant articles/reports].

Featured Posts

-

Understanding The Recent Conflict Within Reform Uk

May 03, 2025

Understanding The Recent Conflict Within Reform Uk

May 03, 2025 -

The Airbus Tariff Dispute Implications For Us Airlines

May 03, 2025

The Airbus Tariff Dispute Implications For Us Airlines

May 03, 2025 -

Energy Policy Reform Guido Fawkes On The New Direction Of Travel

May 03, 2025

Energy Policy Reform Guido Fawkes On The New Direction Of Travel

May 03, 2025 -

Nostalgia Trip Sony Brings Back Retro Ps Console Themes For Ps 5

May 03, 2025

Nostalgia Trip Sony Brings Back Retro Ps Console Themes For Ps 5

May 03, 2025 -

1 T

May 03, 2025

1 T

May 03, 2025

Latest Posts

-

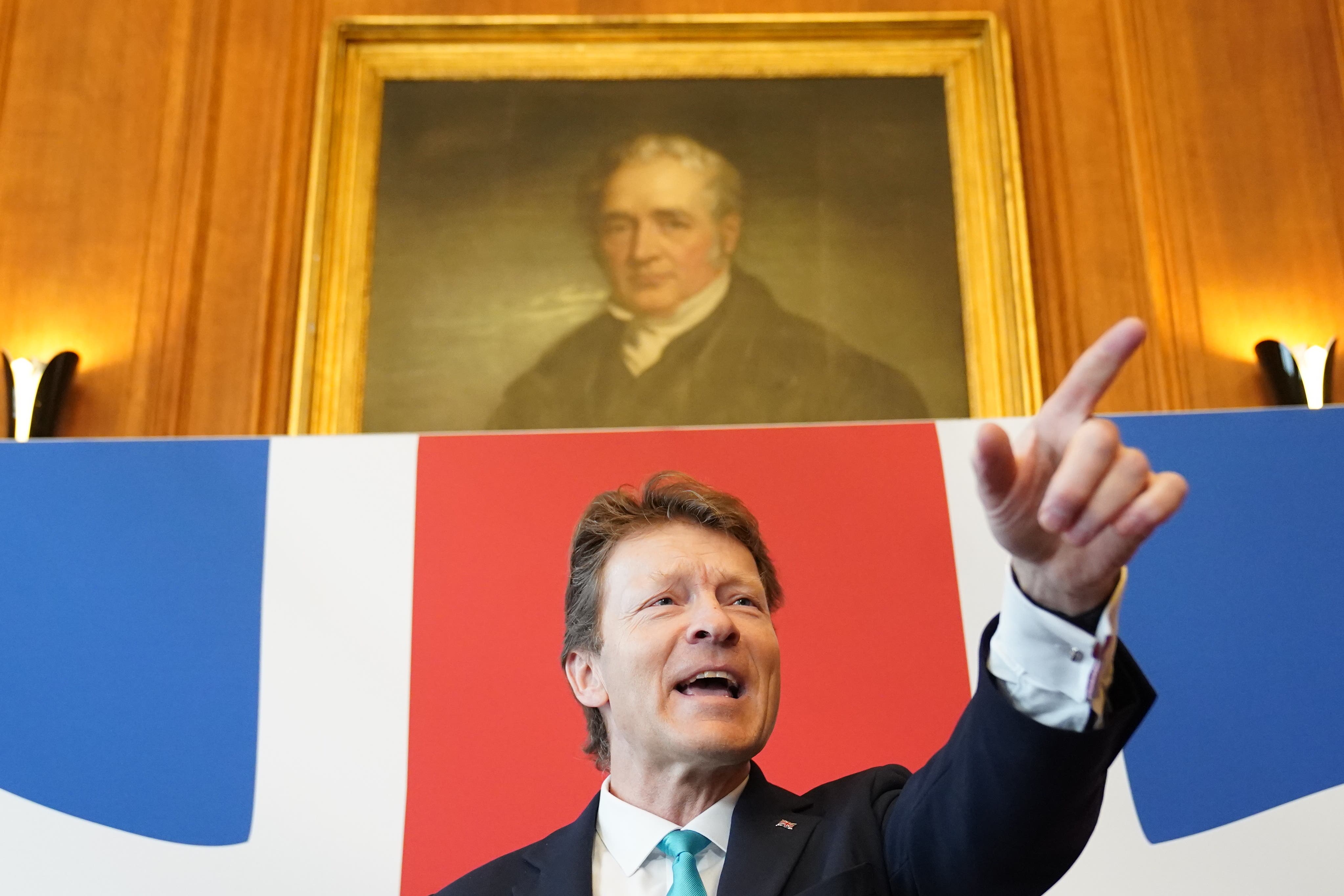

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025 -

Souness Identifies The Missing Piece In Arsenals Title Challenge

May 03, 2025

Souness Identifies The Missing Piece In Arsenals Title Challenge

May 03, 2025 -

Arsenals Title Near Miss Souness Points To Crucial Role

May 03, 2025

Arsenals Title Near Miss Souness Points To Crucial Role

May 03, 2025 -

Concerns Over Mp Treatment Lead To Reform Uk Staff Walkout

May 03, 2025

Concerns Over Mp Treatment Lead To Reform Uk Staff Walkout

May 03, 2025 -

Charity Swim Graeme Souness Takes On The Channel For Isla

May 03, 2025

Charity Swim Graeme Souness Takes On The Channel For Isla

May 03, 2025