The Airbus Tariff Dispute: Implications For US Airlines

Table of Contents

The ongoing Airbus tariff dispute between the US and the EU has cast a long shadow over the American airline industry, significantly impacting operational efficiency and profitability. This complex trade war, characterized by retaliatory tariffs on aircraft and aircraft parts, presents a multifaceted challenge for US airlines, demanding strategic adaptation and proactive mitigation strategies. This article will dissect the intricacies of the Airbus tariff dispute and its specific ramifications for US carriers.

<h2>Increased Aircraft Costs for US Airlines</h2>

The tariffs levied on Airbus aircraft represent a substantial increase in acquisition costs, making them a less attractive option compared to their Boeing counterparts. This has profound implications for US airlines' purchasing decisions and overall financial health.

<h3>Impact on Purchasing Decisions</h3>

The higher upfront cost of new Airbus planes directly impacts airline budgets. This translates to:

- Higher upfront costs for new Airbus planes: Airlines face significantly inflated prices, eating into capital expenditure budgets.

- Reduced profitability on new aircraft purchases: The increased cost reduces the return on investment for new aircraft acquisitions.

- Potential shift towards Boeing aircraft, even if less suitable: The economic pressure may force airlines to opt for Boeing aircraft, regardless of their specific operational needs.

- Long-term implications for fleet modernization strategies: Airlines may delay or alter their fleet modernization plans due to the increased costs associated with Airbus aircraft. This could affect long-term competitiveness and efficiency.

<h3>Financial Strain and Reduced Profitability</h3>

The added expense associated with the Airbus tariffs extends beyond the initial purchase. The financial strain on US airlines includes:

- Increased operating expenses impacting margins: The higher cost of aircraft directly impacts operating margins, squeezing profitability.

- Potential for higher airfares to offset increased costs: Airlines may pass on some of the increased costs to consumers through higher airfares, potentially impacting demand.

- Reduced opportunities for expansion and fleet renewal: The financial burden limits airlines' ability to invest in expansion projects and fleet renewal programs.

- Pressure on airline stock prices and investor confidence: The negative financial impact can lead to reduced investor confidence and pressure on airline stock prices.

<h2>Supply Chain Disruptions and Delays</h2>

The Airbus tariff dispute extends beyond the aircraft themselves; it also disrupts the complex supply chains for parts and maintenance services.

<h3>Parts and Maintenance Challenges</h3>

Tariffs imposed on Airbus parts and maintenance services lead to several challenges:

- Increased costs for spare parts and maintenance: The cost of maintaining Airbus fleets rises significantly, impacting operational budgets.

- Potential delays in repairs and maintenance schedules: Delays in procuring parts can lead to prolonged maintenance schedules and increased aircraft downtime.

- Increased downtime for affected aircraft: Longer maintenance periods translate to reduced operational capacity and lost revenue.

- Challenges in maintaining operational efficiency: The added complexity and uncertainty in the supply chain hamper airlines' ability to maintain efficient operations.

<h3>Impact on Airline Scheduling and Operations</h3>

Supply chain disruptions have a direct impact on the day-to-day operations of US airlines:

- Increased operational complexity: Managing the complexities of a disrupted supply chain adds significant overhead.

- Potential for schedule disruptions and delays: Parts shortages can lead to flight cancellations and delays, impacting customer satisfaction.

- Negative impact on customer satisfaction: Disruptions and delays negatively impact the passenger experience and damage airline reputation.

- Reputational damage for affected airlines: Frequent disruptions can damage an airline’s reputation and customer loyalty.

<h2>Strategic Implications and Competitive Landscape</h2>

The Airbus tariff dispute significantly alters the competitive landscape of the US airline industry and has broader strategic implications.

<h3>Shifting Market Dynamics</h3>

The tariffs create a more favorable environment for Boeing, influencing aircraft purchasing decisions:

- Increased market share for Boeing: Boeing benefits from the increased cost of Airbus aircraft, potentially gaining a larger market share.

- Potential consolidation within the US airline industry: The economic pressure could lead to mergers and acquisitions within the industry.

- Changes in airline alliances and partnerships: Airlines may adjust their alliances and partnerships to navigate the changed market dynamics.

- Long-term implications for the global aviation market: The dispute has the potential to reshape the global aviation market for years to come.

<h3>Lobbying Efforts and Political Pressure</h3>

US airlines are likely to engage in lobbying efforts to influence the resolution of the dispute:

- Pressure on the US government to negotiate a favorable outcome: Airlines will lobby for a resolution that minimizes the negative impact on their operations.

- Potential for legal challenges against the tariffs: Airlines may pursue legal action to challenge the validity or impact of the tariffs.

- Collaboration among airlines to present a unified front: Airlines may collaborate to present a stronger and more unified voice in negotiations.

- Influence on future trade agreements and negotiations: The outcome of this dispute will likely influence future trade negotiations and agreements.

<h2>Conclusion</h2>

The Airbus tariff dispute presents a significant challenge for US airlines, leading to increased costs, supply chain disruptions, and shifts in the competitive landscape. Understanding the ramifications of this dispute is crucial for airlines to adapt their strategies and mitigate potential negative impacts. Staying informed about developments in the Airbus tariff dispute and its ongoing implications is vital for the US airline industry’s long-term success. Further research into the specific effects on individual airlines and the potential for future trade agreements is recommended to fully grasp the scope of this complex issue. The long-term effects of this trade conflict warrant continued monitoring and strategic planning by all stakeholders.

Featured Posts

-

Anchor Brewing Companys Closure 127 Years Of History Conclude

May 03, 2025

Anchor Brewing Companys Closure 127 Years Of History Conclude

May 03, 2025 -

Join Sonys New Play Station Beta Program Everything You Need To Know

May 03, 2025

Join Sonys New Play Station Beta Program Everything You Need To Know

May 03, 2025 -

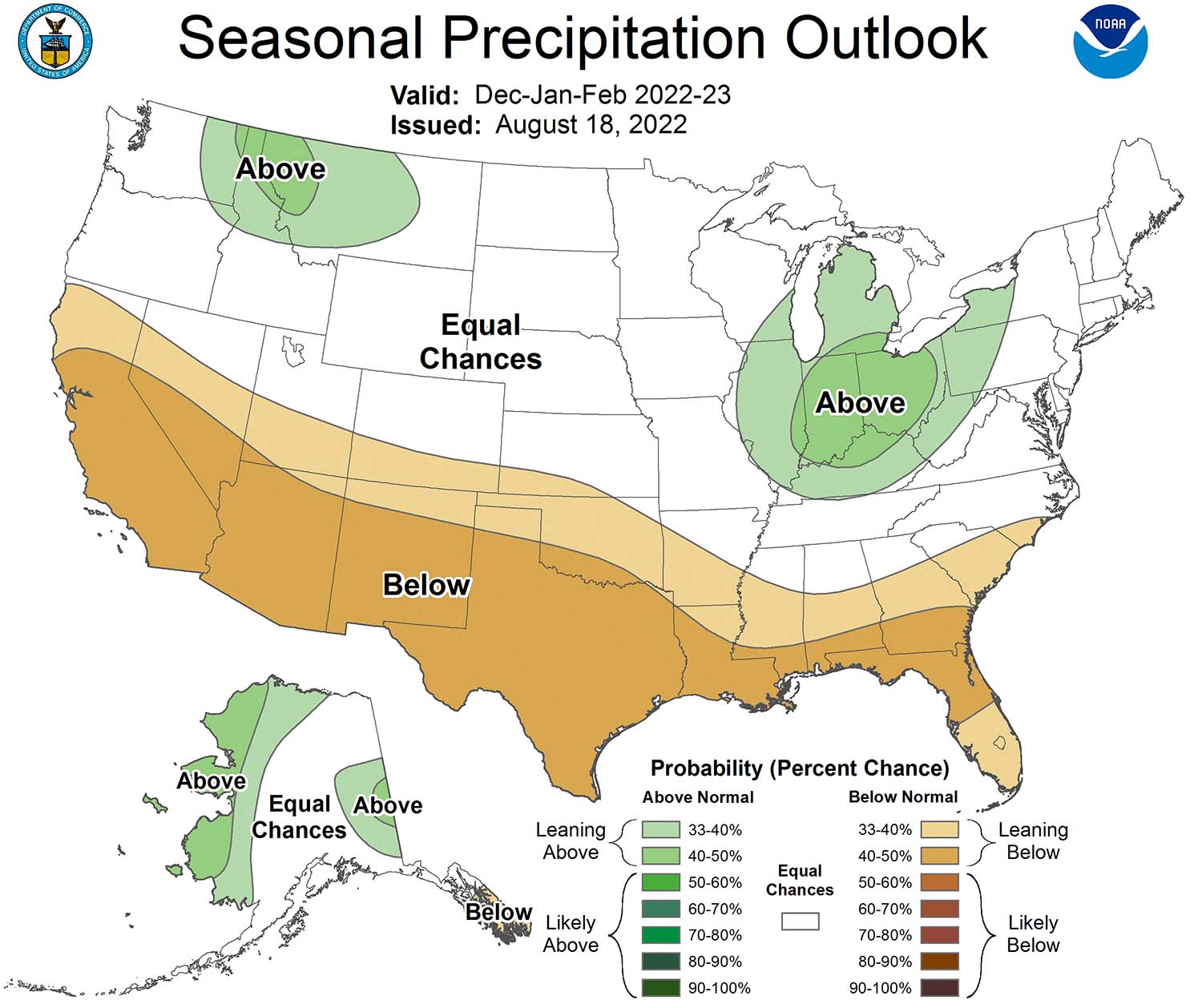

Tulsa Winter Weather 2024 A Statistical Overview

May 03, 2025

Tulsa Winter Weather 2024 A Statistical Overview

May 03, 2025 -

Political Row Erupts Farage Faces Off Against Teaching Union Over Far Right Accusations

May 03, 2025

Political Row Erupts Farage Faces Off Against Teaching Union Over Far Right Accusations

May 03, 2025 -

Analysis Recent Fortnite Game Mode Shutdowns

May 03, 2025

Analysis Recent Fortnite Game Mode Shutdowns

May 03, 2025

Latest Posts

-

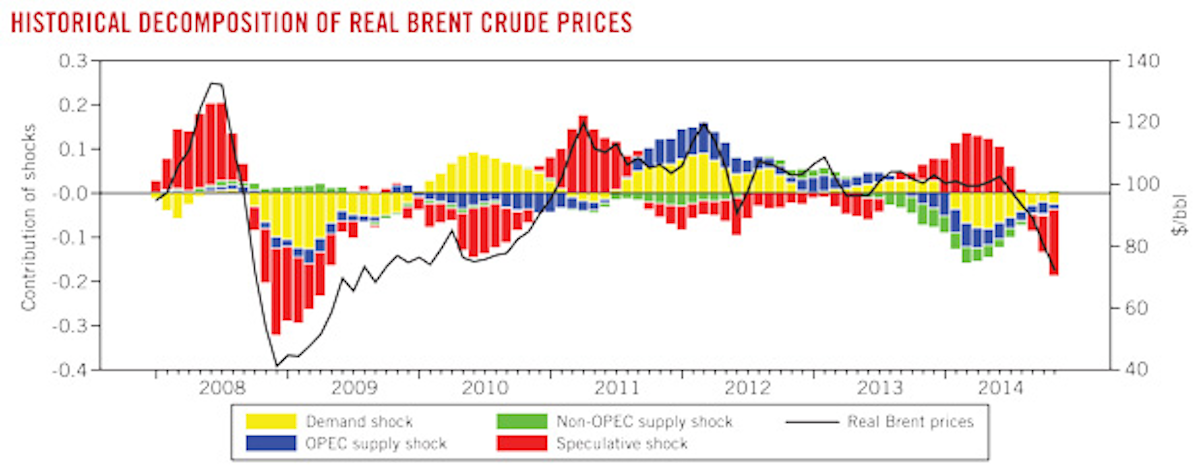

The Ripple Effect Oil Supply Shocks And The Airline Industrys Future

May 04, 2025

The Ripple Effect Oil Supply Shocks And The Airline Industrys Future

May 04, 2025 -

Oil Prices And Airline Profits A Direct Correlation In Times Of Crisis

May 04, 2025

Oil Prices And Airline Profits A Direct Correlation In Times Of Crisis

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

45 Vuelta Ciclista A La Region De Murcia El Suizo Christen Se Lleva El Triunfo

May 04, 2025

45 Vuelta Ciclista A La Region De Murcia El Suizo Christen Se Lleva El Triunfo

May 04, 2025 -

Airlines Face Headwinds Navigating The Impact Of Oil Supply Disruptions

May 04, 2025

Airlines Face Headwinds Navigating The Impact Of Oil Supply Disruptions

May 04, 2025