Buffett's Succession: The Future Of Berkshire Hathaway's Apple Investment

Table of Contents

The Magnitude of Berkshire Hathaway's Apple Stake

Berkshire Hathaway's Apple holdings are colossal, representing a significant portion of its overall investment portfolio. This massive investment has significantly contributed to Berkshire's impressive returns over the years, making the future of this stake a key concern for investors. The sheer size of the investment underscores its importance in shaping Berkshire Hathaway's financial future.

- Percentage of Berkshire's portfolio held in Apple: As of [insert most recent data], Apple represents approximately [insert percentage]% of Berkshire Hathaway's total equity portfolio, making it the largest single holding by a considerable margin.

- Apple's market capitalization compared to Berkshire's: Apple's massive market capitalization dwarfs many companies, including Berkshire Hathaway itself. This highlights the significant influence Apple's performance has on Berkshire's overall financial health.

- Historical performance of Apple stock within Berkshire's portfolio: Apple's stock performance has consistently contributed significantly to Berkshire's overall returns. Analyzing the historical performance of Apple within the Berkshire portfolio is crucial for understanding the potential impact of future changes.

Potential Successors and Their Investment Philosophies

The succession plan for Warren Buffett involves two key figures: Greg Abel and Ajit Jain. Their individual investment philosophies, while aligned with Berkshire's value investing principles, could lead to different approaches to managing the Apple investment. Understanding their styles is critical in assessing the future of this significant stake.

- Greg Abel's background and potential approach to tech investments: Greg Abel's background in Berkshire's non-insurance operations suggests a more hands-on approach to investments, potentially encompassing a deeper understanding of the technology sector.

- Ajit Jain's insurance expertise and its relevance to the Apple stake: Ajit Jain's expertise in insurance and risk management could influence the risk tolerance applied to the Apple investment. A more cautious approach might lead to adjustments in Berkshire's Apple holdings.

- Comparison of risk tolerance between Buffett and potential successors: While both Abel and Jain are likely to maintain a conservative approach, subtle differences in risk tolerance compared to Buffett could lead to shifts in investment strategy. This might result in either increasing or decreasing the Apple investment.

Future Market Conditions and Their Impact on Apple

The future performance of Apple, and consequently Berkshire Hathaway's investment, hinges on various market factors. Economic conditions, technological disruptions, and regulatory changes will all play a role in shaping Apple's trajectory.

- Potential impact of economic recession on Apple sales: A global recession could severely impact consumer spending, potentially lowering demand for Apple products and affecting their financial performance.

- Competition from other tech giants (e.g., Samsung, Google): Intense competition from other tech companies continuously challenges Apple's market dominance. The success of competitors' innovative products can directly impact Apple's sales and market share.

- Long-term trends in the smartphone and technology markets: The long-term trajectory of the smartphone market and the technology sector in general will significantly influence Apple's long-term prospects. Understanding these trends is crucial for predicting the performance of Berkshire's Apple investment.

Alternative Investment Strategies for Berkshire Hathaway Post-Buffett

After Buffett's departure, Berkshire Hathaway might explore alternative investment strategies. This could involve diversifying its portfolio or adjusting its current holdings in Apple.

- Investing in other tech companies: Berkshire might diversify its tech investments by acquiring stakes in other innovative technology companies, potentially reducing its reliance on a single holding.

- Expanding into renewable energy or other sectors: Berkshire could also explore growth opportunities in other sectors such as renewable energy or healthcare, reflecting a broader diversification strategy.

- Maintaining a conservative, value-investing approach: Despite potential changes, Berkshire Hathaway is likely to maintain its focus on value investing, ensuring a long-term, stable approach to investment management.

Conclusion

The future of Berkshire Hathaway's Apple investment under new leadership is complex and depends on various factors. The potential successors' investment philosophies, coupled with future market conditions, will significantly impact the size and nature of this substantial holding. The sheer magnitude of Berkshire's Apple stake underscores its importance in shaping the company’s future financial performance.

Understanding the complexities of Buffett's succession is crucial for anyone invested in Berkshire Hathaway or interested in the future of Apple. Stay informed about the evolving situation and continue researching the potential implications for this massive investment. Further research into the individual investment strategies of potential successors will provide a more complete picture of the future of Berkshire Hathaway's Apple investment.

Featured Posts

-

Leeds Transfer Pursuit Focus On Kyle Walker Peters

May 24, 2025

Leeds Transfer Pursuit Focus On Kyle Walker Peters

May 24, 2025 -

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025 -

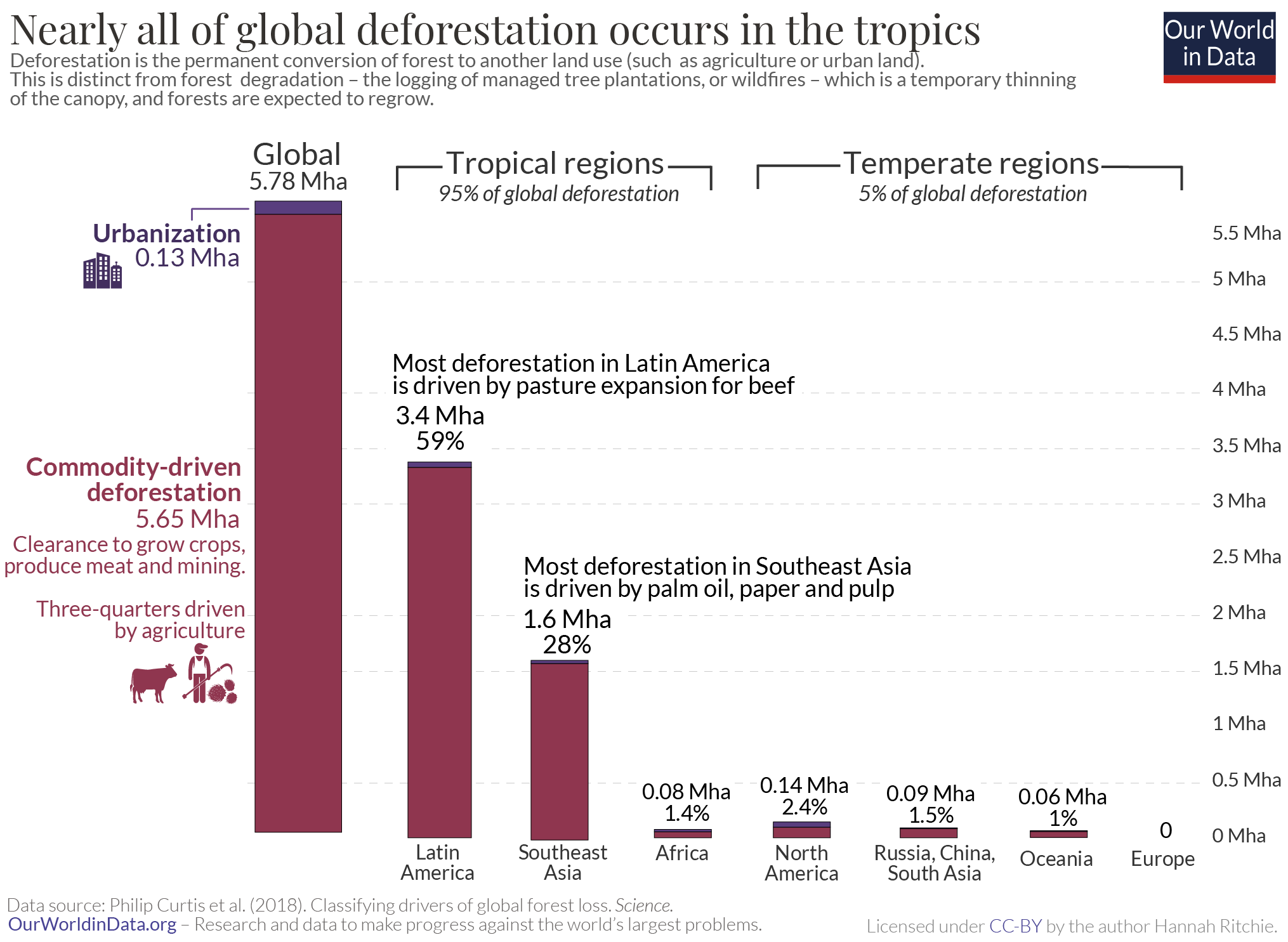

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

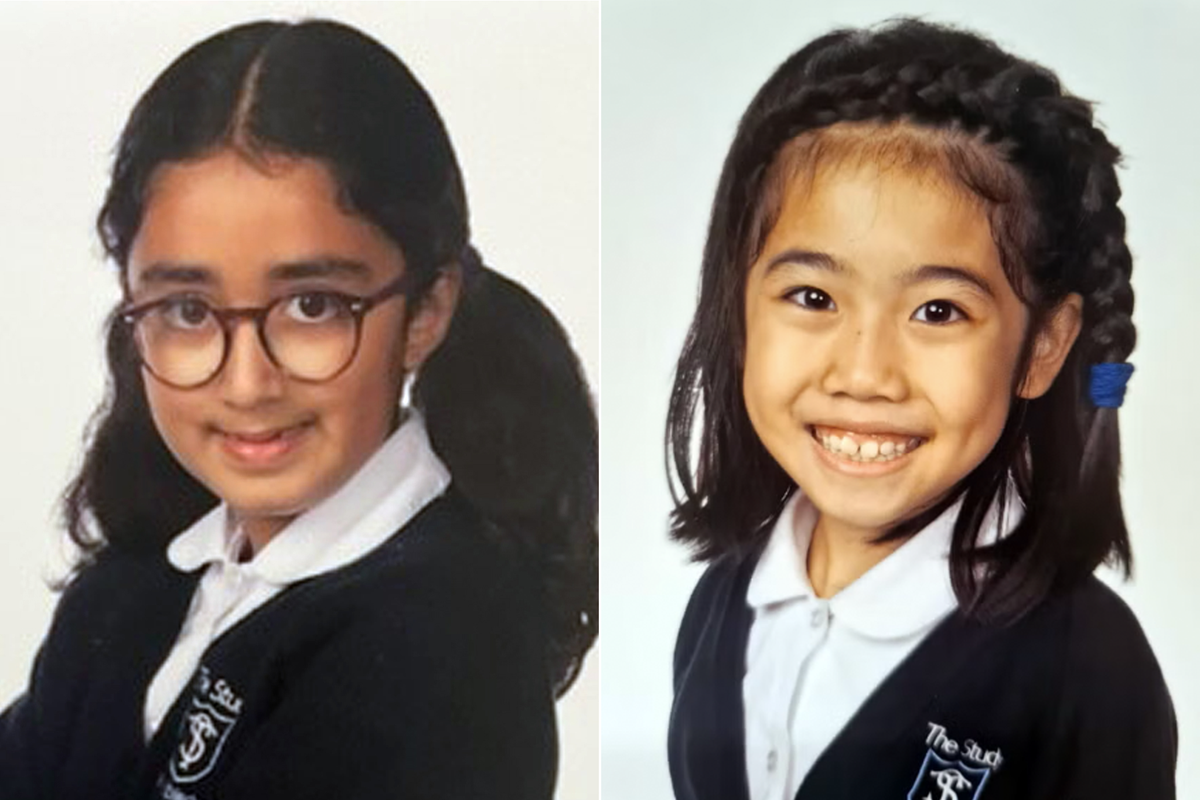

Fatal Shop Stabbing Police Rearrest Teen Previously Granted Bail

May 24, 2025

Fatal Shop Stabbing Police Rearrest Teen Previously Granted Bail

May 24, 2025 -

Seytan Tueyue Gibi En Cekici Burclar Belirlendi

May 24, 2025

Seytan Tueyue Gibi En Cekici Burclar Belirlendi

May 24, 2025

Latest Posts

-

Horoscopo 4 Al 10 De Marzo De 2025 Pronosticos Para Todos Los Signos Zodiacales

May 24, 2025

Horoscopo 4 Al 10 De Marzo De 2025 Pronosticos Para Todos Los Signos Zodiacales

May 24, 2025 -

Financial Strain Leads To Increased Auto Theft In Canada A Growing Concern

May 24, 2025

Financial Strain Leads To Increased Auto Theft In Canada A Growing Concern

May 24, 2025 -

Descubre Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025

Descubre Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025 -

Tutumlulukta Oende Gelen 3 Burc

May 24, 2025

Tutumlulukta Oende Gelen 3 Burc

May 24, 2025 -

Predicciones Astrologicas Horoscopo Del 4 Al 10 De Marzo De 2025

May 24, 2025

Predicciones Astrologicas Horoscopo Del 4 Al 10 De Marzo De 2025

May 24, 2025