CAC 40: End-of-Week Decline, Yet Stable Performance For The Week (March 7, 2025)

Table of Contents

Friday's Dip in the CAC 40: Understanding the Decline

Key Factors Contributing to the Friday Drop

Friday's decline in the CAC 40 can be attributed to a confluence of factors. Several key events contributed to the negative sentiment.

- Disappointing Earnings Report: A major player in the technology sector, "TechGiant Corp," released disappointing Q1 earnings, triggering a sell-off that impacted the broader market. This underscored the vulnerability of the index to individual company performance.

- Geopolitical Uncertainty: Rising tensions in Eastern Europe added to investor anxiety, prompting a flight to safety and impacting riskier assets like equities listed on the CAC 40.

- Technical Indicators: The CAC 40 had been approaching a significant resistance level around 7,300 points for several days. This technical indicator, combined with the negative news flow, triggered profit-taking among some investors, leading to the Friday decline. The support level at 7,200 was briefly tested but held.

- Sector-Specific Impacts: The energy sector was particularly hard hit, with several major oil and gas companies experiencing sharper declines than the overall index. This highlighted the sensitivity of certain sectors to fluctuating global energy prices.

[Insert chart/graph visualizing Friday's decline here]

Strong Weekly Performance of the CAC 40: A Resilient Market?

Analysis of Weekly Gains Despite Friday's Loss

Despite Friday's drop, the CAC 40 still managed a respectable weekly performance, closing up 0.8% for the week. This demonstrates a degree of market resilience.

- Resilient Sectors: The luxury goods and pharmaceutical sectors showed particular strength throughout the week, largely unaffected by Friday's downturn. This suggests a degree of diversification within the index and ongoing investor confidence in these specific sectors.

- Positive Economic Indicators: The release of positive French employment data earlier in the week boosted investor confidence, offsetting some of the negative sentiment from the geopolitical concerns.

- Government Stimulus Measures: The ongoing government stimulus program aimed at supporting key industries contributed to a more optimistic outlook, mitigating the impact of the Friday decline.

- Investor Sentiment: While some short-term anxieties were present, the overall investor sentiment regarding the long-term growth prospects of the French economy remained largely positive, helping to maintain the CAC 40's overall strength.

Looking Ahead: What to Expect for the CAC 40

Short-Term Outlook

The short-term outlook for the CAC 40 remains somewhat uncertain. While the overall positive weekly performance suggests resilience, the Friday dip indicates lingering volatility. We anticipate a sideways trend in the coming week, with the index potentially consolidating around the 7,250 – 7,350 point range. Key factors influencing the short-term trajectory include further developments in the geopolitical situation and the release of key economic indicators.

Long-Term Outlook

The long-term prospects for the CAC 40 remain positive, underpinned by a strong domestic economy and several growth sectors. While short-term fluctuations are expected, the ongoing investments in renewable energy, technology, and luxury goods suggest a robust long-term outlook for the index. Further economic reforms and strategic government initiatives should continue to support sustainable growth.

Conclusion: CAC 40: Navigating Volatility and Maintaining a Long-Term Perspective

The CAC 40's performance this week ending March 7, 2025, presented a clear contrast: a Friday dip versus a strong overall weekly performance. This highlights the importance of understanding both short-term market fluctuations and long-term market trends when considering investments in the CAC 40. Investors should remain informed about key economic indicators, geopolitical developments, and company-specific news to navigate market volatility effectively. To stay updated on the latest CAC 40 movements and market analysis, subscribe to our newsletter for regular insights and informed investment decisions. Keep a close eye on the CAC 40 index for continued opportunities.

Featured Posts

-

Solve New York Times Connections 646 Hints And Answers For March 18 2025

May 24, 2025

Solve New York Times Connections 646 Hints And Answers For March 18 2025

May 24, 2025 -

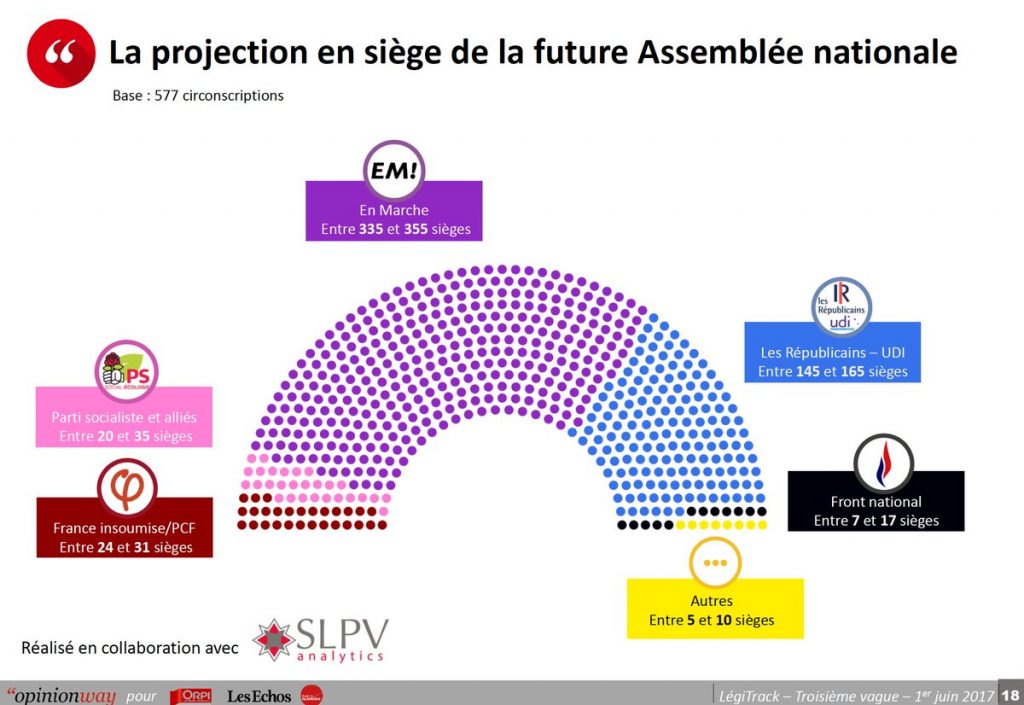

French Elections 2027 Bardellas Path To Power

May 24, 2025

French Elections 2027 Bardellas Path To Power

May 24, 2025 -

A Successful Escape To The Country Tips And Considerations

May 24, 2025

A Successful Escape To The Country Tips And Considerations

May 24, 2025 -

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025 -

90 Let Sergeyu Yurskomu Pamyati Velikogo Aktera Intellektuala I Ostroslova

May 24, 2025

90 Let Sergeyu Yurskomu Pamyati Velikogo Aktera Intellektuala I Ostroslova

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025