Canadian Dollar Performance: Mixed Signals Amidst Global Market Volatility

Table of Contents

Impact of Commodity Prices on CAD Performance

The Canadian economy is heavily reliant on commodity exports, particularly oil and natural gas. Fluctuations in global commodity prices directly impact the CAD exchange rate. Therefore, understanding the relationship between commodity prices and CAD performance is paramount for anyone interested in Canadian currency markets. The price of oil, for example, often acts as a leading indicator for the CAD's strength.

-

Increased oil prices generally strengthen the CAD. When global demand for oil rises, so does the Canadian dollar, as increased export revenue flows into the country. This boosts the Canadian economy and subsequently strengthens the CAD.

-

Decreased demand for commodities weakens the CAD. Conversely, a decline in global commodity demand, perhaps due to a global recession or a shift in energy consumption patterns, directly impacts Canadian exports and weakens the CAD. This leads to lower export revenue and a decrease in the demand for the Canadian dollar.

-

Geopolitical events significantly affect commodity markets and, consequently, the CAD. Global conflicts or political instability in major oil-producing regions can disrupt supply chains and dramatically impact oil prices, creating significant volatility in the CAD exchange rate.

-

Diversification of the Canadian economy is lessening, but not eliminating, reliance on commodity prices. While Canada is increasingly diversifying its economy, its dependence on resource extraction remains substantial. This means that fluctuations in commodity markets will continue to influence the CAD's performance in the foreseeable future. The Canadian government is working to improve economic diversification but the legacy of commodity dependence will continue to affect CAD performance.

Influence of Interest Rate Differentials

The Bank of Canada's monetary policy decisions regarding interest rates play a crucial role in the CAD's value. Higher interest rates attract foreign investment, strengthening the currency. This is due to the higher returns available to investors compared to countries with lower interest rates.

-

Interest rate hikes by the Bank of Canada typically boost the CAD. When the Bank of Canada increases interest rates, it makes the Canadian dollar more attractive to foreign investors seeking higher yields, thus increasing demand and strengthening the currency.

-

Interest rate cuts weaken the CAD relative to other currencies. Conversely, if the Bank of Canada lowers interest rates, it makes the CAD less attractive, leading to decreased demand and a weaker currency relative to other currencies offering higher returns.

-

Comparison of Canadian interest rates with those of major trading partners is vital for CAD forecasting. Analyzing the difference between Canadian interest rates and those of major trading partners, particularly the US, is a key factor in predicting CAD movement. A higher differential often leads to a stronger CAD.

-

Market expectations regarding future interest rate changes significantly impact the CAD. Market speculation about potential future interest rate adjustments by the Bank of Canada can also influence the CAD's value, even before any official announcements are made. This makes anticipating future moves in the CAD dependent on understanding market expectations and sentiment.

The Role of the US Dollar

The US dollar is the dominant global currency, and its strength or weakness significantly impacts the CAD. A strong USD typically weakens the CAD because of the close economic ties between Canada and the United States.

-

USD strength often inversely correlates with CAD strength. When the US dollar strengthens against other major currencies, it typically weakens the CAD, as investors tend to shift towards the stronger US dollar.

-

US economic data releases heavily influence the USD/CAD exchange rate. Key economic indicators released in the US, such as employment figures, inflation data, and GDP growth, can significantly impact the USD/CAD exchange rate. Positive US economic news often strengthens the USD and weakens the CAD.

-

Geopolitical factors impacting the US economy ripple through to the CAD. Global events that affect the US economy, such as trade wars or geopolitical tensions, have a knock-on effect on the CAD as the Canadian economy is closely intertwined with that of the US.

-

Tracking the USD/CAD exchange rate is essential for those involved in cross-border transactions. Businesses and individuals engaging in transactions between Canada and the US must carefully monitor the USD/CAD exchange rate to manage currency risk and optimize their financial outcomes.

Global Economic Uncertainty and its Effect on the CAD

Global economic uncertainty, including inflation, recession fears, and geopolitical instability, creates volatility in the foreign exchange market and impacts the CAD. In times of uncertainty, investors often seek safer havens, driving demand for stable currencies and potentially weakening the CAD.

-

Global inflation affects commodity prices and investor sentiment, influencing the CAD. High global inflation can impact commodity prices, which in turn affects the Canadian economy and the CAD's value. It can also lead to investor uncertainty, potentially weakening the CAD.

-

Recession fears in major economies tend to weaken the CAD. Concerns about a global recession often lead to risk aversion in the markets, resulting in a flight to safety and a weakening of currencies like the CAD, which is considered a relatively riskier asset compared to major currencies like the USD or EUR.

-

Geopolitical risks, such as conflicts or trade wars, introduce significant uncertainty, leading to CAD fluctuations. Political instability or unexpected global events can lead to volatility in the foreign exchange market, negatively impacting the CAD.

-

Risk aversion in global markets generally leads to a stronger USD and a weaker CAD. During periods of high global uncertainty, investors often seek the safety of the US dollar, leading to a stronger USD and a weaker CAD.

Conclusion

The Canadian dollar's performance reflects a complex interplay of commodity prices, interest rate differentials, the strength of the US dollar, and overall global economic conditions. Understanding these factors is crucial for navigating the volatility of the foreign exchange market. Staying informed about the latest economic news, Bank of Canada announcements, and global market trends is essential for making informed decisions regarding the Canadian dollar performance. Continuously monitor the Canadian dollar performance to optimize your strategies and mitigate potential risks associated with currency fluctuations.

Featured Posts

-

Trumps Shift In Tone Triggers Gold Price Rally

Apr 25, 2025

Trumps Shift In Tone Triggers Gold Price Rally

Apr 25, 2025 -

Trumps Focus On Foreign Funding Examining Its Impact On Harvard And Other Universities

Apr 25, 2025

Trumps Focus On Foreign Funding Examining Its Impact On Harvard And Other Universities

Apr 25, 2025 -

Analyzing The Impact Of Trumps Statements On The Krw Usd Currency Pair

Apr 25, 2025

Analyzing The Impact Of Trumps Statements On The Krw Usd Currency Pair

Apr 25, 2025 -

Trump The Unmentioned Elephant In Canadas Election

Apr 25, 2025

Trump The Unmentioned Elephant In Canadas Election

Apr 25, 2025 -

Backlash Mounts Against Newsom After Toxic Democrats Statement

Apr 25, 2025

Backlash Mounts Against Newsom After Toxic Democrats Statement

Apr 25, 2025

Latest Posts

-

Louisvilles Shelter In Place Order A Time For Remembrance And Safety

Apr 30, 2025

Louisvilles Shelter In Place Order A Time For Remembrance And Safety

Apr 30, 2025 -

Shelter In Place Louisville Community Reflects On Past Tragedy During Emergency

Apr 30, 2025

Shelter In Place Louisville Community Reflects On Past Tragedy During Emergency

Apr 30, 2025 -

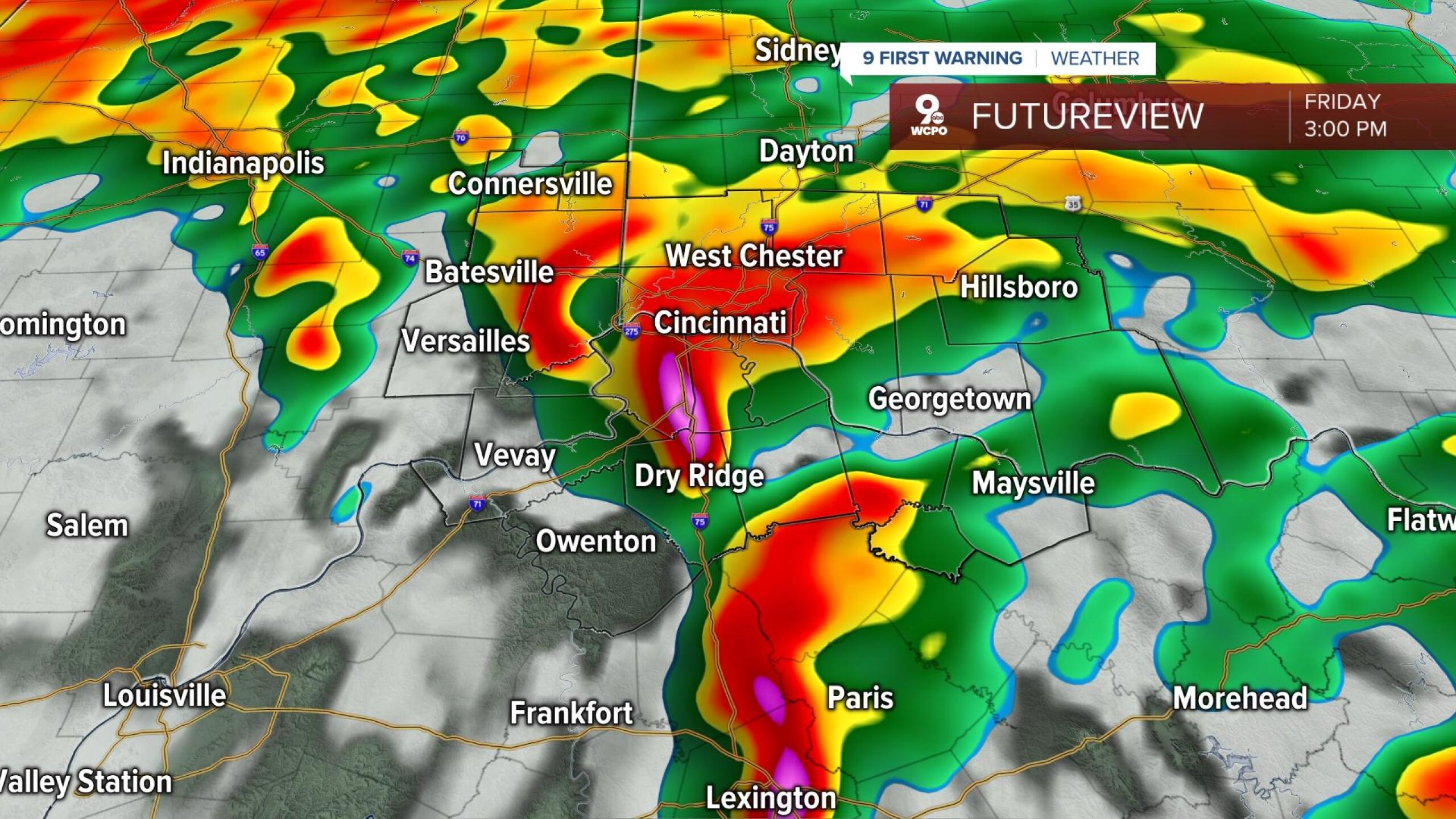

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025 -

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025 -

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025