Canadian Tire Acquisition Of Hudson's Bay: Potential Benefits And Risks

Table of Contents

Potential Benefits for Canadian Tire

A Canadian Tire acquisition of Hudson's Bay presents several compelling advantages, potentially reshaping the Canadian retail landscape.

Expanded Retail Footprint and Market Reach

Acquiring Hudson's Bay would dramatically expand Canadian Tire's retail footprint and market reach. This retail expansion would provide access to new demographics and geographic locations, particularly within major urban centers where Hudson's Bay maintains a strong presence.

- Increased store presence in major cities: Gaining access to Hudson's Bay's prime real estate locations in major metropolitan areas would significantly increase Canadian Tire's visibility and accessibility to a broader customer base.

- Access to a more affluent customer base: Hudson's Bay caters to a more affluent clientele than Canadian Tire's traditional customer base, offering an opportunity for market share expansion into a higher spending demographic.

- Potential for synergies in supply chain and logistics: Combining the two companies' supply chains could lead to significant cost savings and operational efficiencies through economies of scale. Geographic diversification would also improve resilience to regional economic fluctuations.

These factors contribute to improved market share and geographic diversification, key elements in a successful retail strategy.

Diversification of Product Offerings

Hudson's Bay's strong presence in apparel and high-end home goods offers Canadian Tire the opportunity for significant product diversification. This brand expansion would broaden its product portfolio and attract a wider customer base.

- Reduction of reliance on core categories: Diversifying beyond its core automotive, sporting goods, and home improvement offerings reduces Canadian Tire's reliance on any single product category, mitigating risk.

- Increased customer loyalty through wider selection: Offering a more comprehensive range of products under one roof could increase customer loyalty and encourage higher spending per visit.

- Opportunities for cross-promotion: Synergies between the brands could lead to effective cross-promotion, driving traffic to both Canadian Tire and Hudson's Bay stores and online platforms.

This product diversification strategy could lead to significant customer acquisition and enhance overall brand strength.

Enhanced Brand Image and Prestige

The acquisition of a luxury brand like Hudson's Bay could significantly elevate Canadian Tire's overall brand image and perception. This brand elevation would attract a more sophisticated customer segment.

- Improved brand perception: Associating with a prestigious brand like Hudson's Bay could position Canadian Tire as a more upscale and versatile retailer.

- Potential for upmarket private label brands: The acquisition could facilitate the development of premium private label brands, further enhancing Canadian Tire's brand portfolio and market positioning.

- Access to Hudson's Bay's established luxury customer base: Canadian Tire would gain immediate access to a new segment of high-spending consumers, boosting revenue and market share.

Potential Risks for Canadian Tire

While the potential benefits are substantial, a Canadian Tire acquisition of Hudson's Bay also presents significant risks.

Integration Challenges and Costs

Merging two large and complex retail organizations would present substantial integration challenges and costs.

- System integration challenges: Integrating different IT systems, inventory management processes, and supply chains could be costly and time-consuming. Thorough due diligence is crucial.

- Potential employee redundancies: Overlapping roles and functions might lead to employee redundancies, creating significant human resource challenges.

- Significant upfront investment: The acquisition would necessitate a substantial upfront investment, potentially impacting Canadian Tire's financial leverage and short-term profitability.

- Potential disruption to existing operations: The integration process could disrupt ongoing operations at both companies, impacting customer service and potentially harming brand reputation.

Brand Dilution and Customer Confusion

Merging distinct brand identities carries the risk of brand dilution and customer confusion.

- Risk of losing core Canadian Tire customers: Some existing Canadian Tire customers might be alienated by the association with a more upscale brand like Hudson's Bay.

- Potential for brand cannibalization: The product overlap between the two brands could lead to internal competition and cannibalization of sales.

- Challenges in maintaining separate brand identities: Maintaining the distinct identities of both brands while leveraging synergies will require careful brand management and market segmentation strategies.

Financial Risks and Debt Burden

The financial implications of such a large acquisition should be carefully evaluated.

- Increased debt levels: Financing the acquisition could significantly increase Canadian Tire's debt levels, impacting its credit rating and financial flexibility.

- Potential impact on credit ratings: A substantial increase in debt could lead to a downgrade in Canadian Tire's credit rating, increasing borrowing costs.

- Pressure on profitability in the short-term: The integration process and associated costs could pressure profitability in the short-term, even if long-term benefits are expected. Careful assessment of return on investment is critical.

Conclusion: Weighing the Pros and Cons of a Canadian Tire-Hudson's Bay Acquisition

A Canadian Tire acquisition of Hudson's Bay presents both exciting opportunities and considerable challenges. The potential benefits, including expanded market reach, product diversification, and brand enhancement, are significant. However, the risks of integration difficulties, brand dilution, and increased financial leverage should not be underestimated. The success of such a merger would depend heavily on careful planning, effective execution, and a well-defined integration strategy. The strategic importance of this potential acquisition for Canadian Tire, and indeed the Canadian retail landscape, cannot be overstated.

What are your thoughts on a potential Canadian Tire-Hudson's Bay acquisition? Share your opinions and insights in the comments section below. Follow us for further updates on Canadian Tire acquisitions and retail market analysis!

Featured Posts

-

Fenerbahce Nin Yildizi Ajax Ta Mourinho Nun Rolue Ve Transferin Detaylari

May 20, 2025

Fenerbahce Nin Yildizi Ajax Ta Mourinho Nun Rolue Ve Transferin Detaylari

May 20, 2025 -

Diplomatie Bilaterale Le President Mahama Renforce Les Liens Entre Le Ghana Et La Cote D Ivoire A Abidjan

May 20, 2025

Diplomatie Bilaterale Le President Mahama Renforce Les Liens Entre Le Ghana Et La Cote D Ivoire A Abidjan

May 20, 2025 -

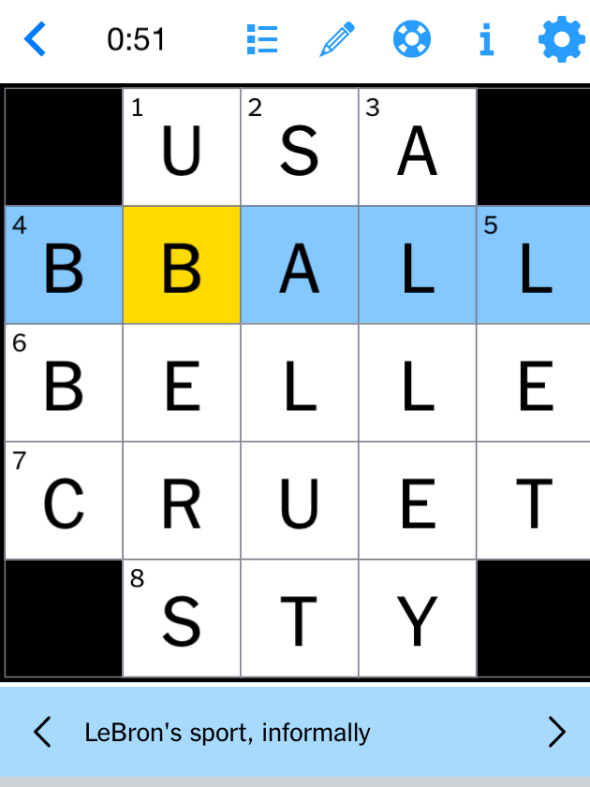

Solve The Nyt Mini Daily Puzzle May 13 2025 Solutions And Help

May 20, 2025

Solve The Nyt Mini Daily Puzzle May 13 2025 Solutions And Help

May 20, 2025 -

Good Morning America Backstage Turmoil Sparks Job Cut Fears Among Stars

May 20, 2025

Good Morning America Backstage Turmoil Sparks Job Cut Fears Among Stars

May 20, 2025 -

Dubai Holding Reit Ipo Size Boosted To 584 Million

May 20, 2025

Dubai Holding Reit Ipo Size Boosted To 584 Million

May 20, 2025

Latest Posts

-

Is Henriksen The Next Klopp Or Tuchel At Mainz

May 20, 2025

Is Henriksen The Next Klopp Or Tuchel At Mainz

May 20, 2025 -

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano Paljastettu

May 20, 2025

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano Paljastettu

May 20, 2025 -

Mainz 05s Henriksen The Next Big Manager A Klopp Tuchel Legacy

May 20, 2025

Mainz 05s Henriksen The Next Big Manager A Klopp Tuchel Legacy

May 20, 2025 -

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Johdolla

May 20, 2025

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Johdolla

May 20, 2025 -

Can Mainzs Henriksen Replicate The Success Of Klopp And Tuchel

May 20, 2025

Can Mainzs Henriksen Replicate The Success Of Klopp And Tuchel

May 20, 2025