Cancer Drug Setback Sends Akeso Shares Plummeting

Table of Contents

The Failed Clinical Trial and its Implications

The setback centers around Akeso's lead candidate, [Drug Name], a targeted therapy designed to treat [Cancer Type]. The drug's failure to progress in its Phase III clinical trial represents a significant blow to the company. Phase III trials are crucial because they involve large-scale testing to confirm efficacy and safety before regulatory approval. This stage is the final hurdle before a drug can be marketed to the public, making this failure particularly devastating.

Key findings from the trial that led to the setback include:

- Unexpected adverse events reported at a higher-than-acceptable rate during the trial.

- Failure to meet pre-defined efficacy endpoints, indicating the drug did not demonstrate a statistically significant improvement in patient outcomes compared to the control group.

- Statistical insignificance of the results, rendering the data insufficient to support the drug's effectiveness.

This failure raises serious concerns about the drug's viability and the future direction of Akeso's research and development efforts in this specific area of oncology. The implications for patients awaiting a potential new treatment are equally significant.

Market Reaction and Investor Sentiment

The news of the failed clinical trial triggered an immediate and dramatic market reaction. Akeso's share price plummeted by [Percentage]% within hours of the announcement, resulting in a [Dollar Amount] loss in market capitalization. This significant drop reflects widespread investor concern and a loss of confidence in Akeso's future prospects.

Investor actions following the announcement included:

- Mass sell-offs observed immediately after the announcement, driving down the share price rapidly.

- Credit rating agencies issuing negative outlooks, further dampening investor confidence and potentially impacting Akeso's ability to secure future funding.

- Withdrawal of investments from some venture capitalists, highlighting the risk aversion among investors in the wake of the setback.

The overall market sentiment surrounding Akeso has shifted dramatically from optimism to caution, underscoring the high-stakes nature of clinical trials in the pharmaceutical industry and the volatility of the stock market in response to such news.

Akeso's Response and Future Plans

In response to the setback, Akeso released an official statement [briefly summarize the statement]. The company is currently evaluating its options, which may include:

- Further research to explore potential modifications to the drug's formulation or administration.

- A reassessment of the clinical trial design to identify areas for improvement in future studies.

- A complete shift in focus towards other drugs in their pipeline, potentially prioritizing those showing greater promise.

Akeso also emphasized the continuation of its other clinical trials, suggesting a commitment to its broader drug development strategy. However, the financial impact of the setback remains uncertain and will require careful management to ensure the company's long-term stability.

Comparative Analysis with Competitors

While this setback is significant for Akeso, it's important to consider the broader context of the biopharmaceutical industry. Setbacks in clinical trials are not uncommon, and many competitor companies have faced similar challenges. [Optional: Briefly compare Akeso's situation with similar incidents in competing companies, highlighting the differences and similarities]. This comparative analysis helps contextualize Akeso's situation within the competitive landscape, and assesses the potential long-term impact on market share and future research directions.

Analyzing the Akeso Shares Plummet Following Cancer Drug Setback

In summary, the failed Phase III clinical trial of [Drug Name] has resulted in a significant "Cancer Drug Setback Sending Akeso Shares Plummeting," triggering a sharp decline in Akeso's stock price and raising serious concerns among investors. The company's response and future plans will be crucial in determining its ability to recover from this setback. The impact extends beyond Akeso, influencing investor confidence in the broader biopharmaceutical industry and highlighting the inherent risks involved in drug development.

To stay informed on further developments regarding this situation, it is essential to follow Akeso's official statements and analyst reports to track the evolution of the cancer drug setback and its impact on Akeso shares. Making informed investment decisions requires a thorough understanding of the complexities of clinical trials and the market’s reactions to such events. Stay informed and stay invested wisely.

Featured Posts

-

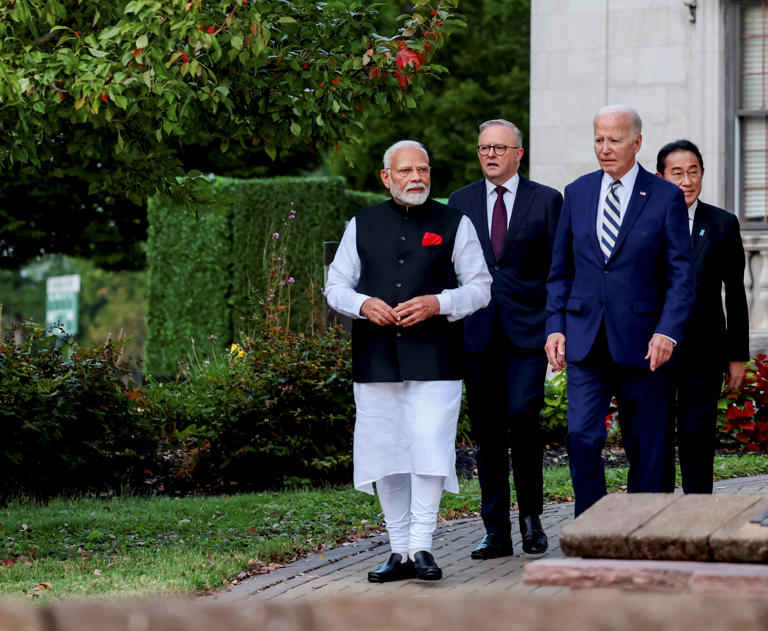

Global Competition Heats Up The Race To Attract Us Researchers

Apr 29, 2025

Global Competition Heats Up The Race To Attract Us Researchers

Apr 29, 2025 -

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 29, 2025

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 29, 2025 -

Investor Guide Navigating High Stock Market Valuations With Bof As Analysis

Apr 29, 2025

Investor Guide Navigating High Stock Market Valuations With Bof As Analysis

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Open Ais Chat Gpt The Ftc Investigation And Its Potential Impact

Apr 29, 2025

Open Ais Chat Gpt The Ftc Investigation And Its Potential Impact

Apr 29, 2025

Latest Posts

-

Recent Russian Military Activities A Cause For European Concern

Apr 29, 2025

Recent Russian Military Activities A Cause For European Concern

Apr 29, 2025 -

Understanding Russias Military Strategy And Its Impact On Europe

Apr 29, 2025

Understanding Russias Military Strategy And Its Impact On Europe

Apr 29, 2025 -

The Rise Of Huawei A New Contender In The Ai Chip Market

Apr 29, 2025

The Rise Of Huawei A New Contender In The Ai Chip Market

Apr 29, 2025 -

Russias Military Posturing The Implications For European Security

Apr 29, 2025

Russias Military Posturing The Implications For European Security

Apr 29, 2025 -

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025