CATL's $1 Billion Indonesia Expansion: A Loan For Growth?

Table of Contents

CATL's Strategic Rationale for Indonesian Expansion

CATL's decision to invest heavily in Indonesia is a strategic move driven by several key factors. This expansion isn't just about building a factory; it's about securing a crucial piece of the future of electric vehicle manufacturing.

Access to Raw Materials

Indonesia boasts abundant nickel reserves, a critical component in the production of EV batteries, particularly nickel-based cathode materials like NMC (Nickel Manganese Cobalt). This strategic location offers CATL several significant advantages:

- Reduced reliance on imports and securing a stable supply chain for nickel: Direct access to nickel minimizes reliance on volatile global markets and ensures a consistent supply of raw materials. This reduces production delays and price uncertainty.

- Potential for vertical integration, controlling the supply chain from mining to battery cell manufacturing: By controlling the entire supply chain, CATL can optimize costs, improve efficiency, and enhance its competitive advantage in the global EV battery market. This vertical integration strategy is a key differentiator.

- Lower transportation costs and reduced environmental impact associated with material sourcing: Locating production closer to the source of raw materials significantly reduces transportation costs and the carbon footprint associated with material sourcing and logistics.

Growing Southeast Asian EV Market

Indonesia's EV market is experiencing explosive growth, fueled by government incentives and a growing awareness of environmental concerns. This presents a massive opportunity for CATL:

- Positioning for first-mover advantage in a rapidly expanding market: Establishing a strong presence early on allows CATL to capture significant market share before competitors can fully establish themselves.

- Proximity to key regional markets, facilitating efficient distribution and sales: Indonesia's central location in Southeast Asia makes it an ideal hub for distributing EV batteries to other countries in the region, reducing shipping times and costs.

- Capturing market share from competitors in the Southeast Asian region: This expansion puts CATL in a prime position to compete with and potentially outmaneuver rivals seeking to establish themselves in this rapidly growing market.

Government Incentives and Support

The Indonesian government is actively courting foreign investment in the EV sector, offering substantial incentives and support:

- Tax breaks and subsidies for EV battery manufacturing facilities: These financial incentives significantly reduce the cost of setting up and operating the Indonesian plant.

- Access to government-backed loans and financing schemes: The government's support may include access to favorable loan terms and other financing options, easing the financial burden of the large-scale investment.

- Simplified regulatory processes for foreign investors: Streamlined regulations accelerate the project's timeline and reduce bureaucratic hurdles, contributing to a more efficient and faster rollout of the facility.

Financing the Indonesian Expansion: Debt vs. Equity

CATL's $1 billion investment likely involves a complex mix of funding sources. Understanding the financing structure is key to understanding the long-term implications of this expansion.

Potential Sources of Financing

The scale of this project suggests a diverse funding strategy:

- Exploration of various loan structures, including green bonds or syndicated loans: Green bonds align with environmental sustainability goals, potentially attracting investors focused on ESG (Environmental, Social, and Governance) factors. Syndicated loans distribute the risk among multiple lenders.

- Potential partnerships with Indonesian banks and financial institutions: Collaborating with local banks can provide valuable local expertise and access to government-backed programs.

- Role of government subsidies and incentives in reducing the overall financial burden: Government support is likely a significant factor in making this investment financially viable.

Assessing the Risk Profile

Investing in a developing economy presents inherent risks:

- Analysis of currency fluctuations and their impact on project costs: Fluctuations in the Indonesian Rupiah against the Chinese Yuan and other currencies can significantly impact project costs and profitability.

- Evaluation of geopolitical risks and their potential influence on investment stability: Political stability and potential geopolitical shifts within Indonesia and the broader Southeast Asian region need careful assessment.

- Assessment of potential operational challenges associated with setting up a large-scale manufacturing facility in a new market: Challenges include navigating local regulations, securing skilled labor, and managing logistical complexities in a new environment.

Long-Term Implications for CATL and Indonesia

The consequences of this expansion are far-reaching for both CATL and Indonesia.

Impact on CATL's Global Strategy

This Indonesian expansion significantly enhances CATL's global position:

- Enhanced market diversification and reduced reliance on any single market: Expanding into Southeast Asia mitigates risks associated with relying heavily on any single geographic region.

- Increased manufacturing capacity to meet growing global demand: The new facility significantly expands CATL's production capacity, enabling it to meet the rapidly growing global demand for EV batteries.

- Potential for technological advancements and innovation driven by the new facility: Operating in a new environment may stimulate innovation and lead to improved manufacturing processes and product development.

Benefits for the Indonesian Economy

The economic benefits for Indonesia are substantial:

- Creation of high-skilled jobs in the manufacturing and related industries: The project creates numerous jobs, boosting employment and stimulating economic activity.

- Foreign exchange earnings from exports of batteries and battery materials: The facility will contribute to Indonesia's foreign exchange reserves through exports.

- Advancement of Indonesia's renewable energy goals and reduction in carbon emissions: The investment contributes to Indonesia's efforts to transition to cleaner energy sources and reduce its carbon footprint.

Conclusion

CATL's $1 billion investment in Indonesia is a bold strategic move, likely a blend of internal funds and external financing, aiming to exploit the growing Southeast Asian EV market and secure vital raw materials. While financial and operational risks exist, the potential rewards for both CATL and Indonesia are considerable. Success hinges on managing risks effectively, seamless supply chain integration, and sustained government support. To stay abreast of developments in this pivotal investment, follow news and analysis related to CATL's Indonesian expansion and the broader electric vehicle battery market. Understanding the financing behind this substantial investment is vital for predicting future trends in EV battery production and the broader renewable energy landscape.

Featured Posts

-

Ovechkin I Zal Slavy Iihf Kommentariy Krikunova

May 07, 2025

Ovechkin I Zal Slavy Iihf Kommentariy Krikunova

May 07, 2025 -

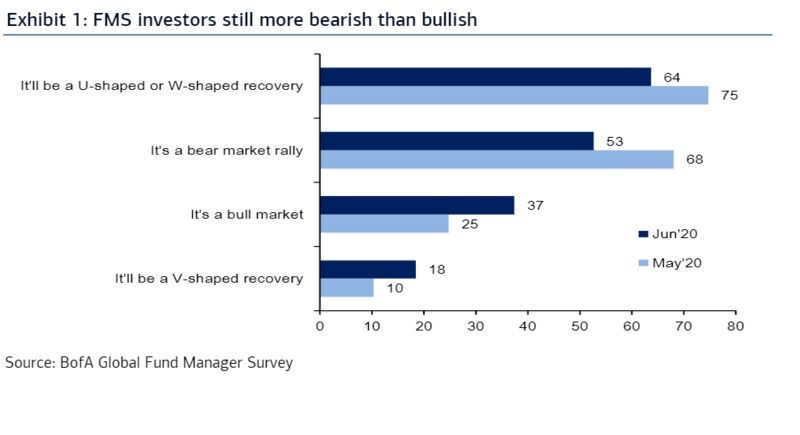

Stock Market Valuation Anxiety Bof A Offers A Calming Perspective

May 07, 2025

Stock Market Valuation Anxiety Bof A Offers A Calming Perspective

May 07, 2025 -

Anthony Edwards And Lakers Center In On Court Altercation

May 07, 2025

Anthony Edwards And Lakers Center In On Court Altercation

May 07, 2025 -

Daily Lotto Results For Thursday 17th April 2025

May 07, 2025

Daily Lotto Results For Thursday 17th April 2025

May 07, 2025 -

Charity Gig Lewis Capaldis Unexpected Live Performance Return

May 07, 2025

Charity Gig Lewis Capaldis Unexpected Live Performance Return

May 07, 2025

Latest Posts

-

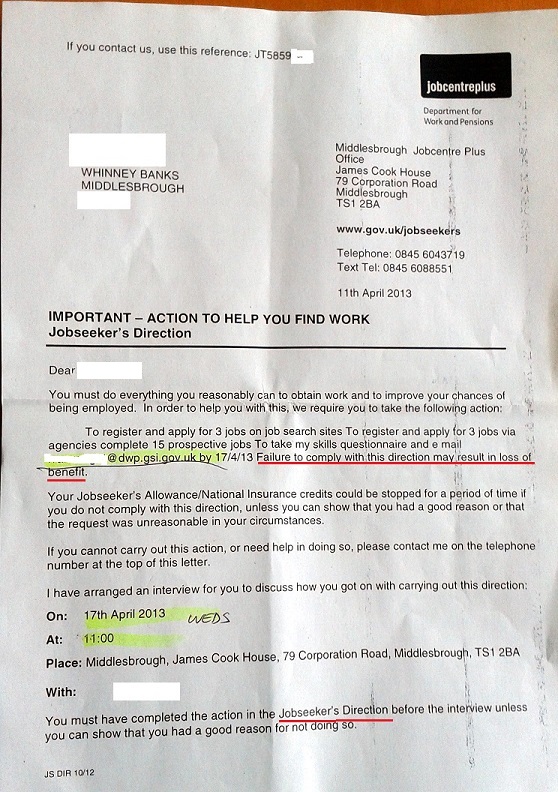

Four Word Warning From Dwp Potential Benefit Cuts In The Uk

May 08, 2025

Four Word Warning From Dwp Potential Benefit Cuts In The Uk

May 08, 2025 -

Uk Households Receive Dwp Letters Benefits Under Threat

May 08, 2025

Uk Households Receive Dwp Letters Benefits Under Threat

May 08, 2025 -

Dwp Issues Warning Benefit Cuts Imminent For Uk Households

May 08, 2025

Dwp Issues Warning Benefit Cuts Imminent For Uk Households

May 08, 2025 -

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025 -

Impact Of Dwps Universal Credit Overhaul What Claimants Need To Know

May 08, 2025

Impact Of Dwps Universal Credit Overhaul What Claimants Need To Know

May 08, 2025