Cenovus Prioritizes Internal Growth, Dimming Prospects Of MEG Bid

Table of Contents

Cenovus's Internal Growth Strategy

Cenovus's revised strategy emphasizes maximizing returns from existing assets and strengthening its financial position before undertaking large-scale acquisitions like a potential MEG Energy takeover. This internal focus is multifaceted:

Focus on Operational Efficiency and Cost Reduction

Cenovus is actively streamlining its operations to enhance profitability and reduce expenditure. This involves:

- Streamlining operations: Implementing lean management principles to eliminate redundancies and improve workflow.

- Technology implementation: Utilizing advanced technologies like artificial intelligence and machine learning for enhanced oil recovery (EOR) techniques, boosting production from existing wells.

- Optimizing existing assets: Focusing on maximizing production from current infrastructure through improved maintenance and operational procedures.

- Reducing capital expenditure (CAPEX): Prioritizing projects with high returns and deferring less profitable expansion plans.

Cenovus's commitment to extracting maximum value from its existing infrastructure before embarking on costly acquisitions signifies a prudent approach to resource allocation. Successful implementations of new technologies, such as advanced analytics for reservoir management, are already demonstrating tangible results.

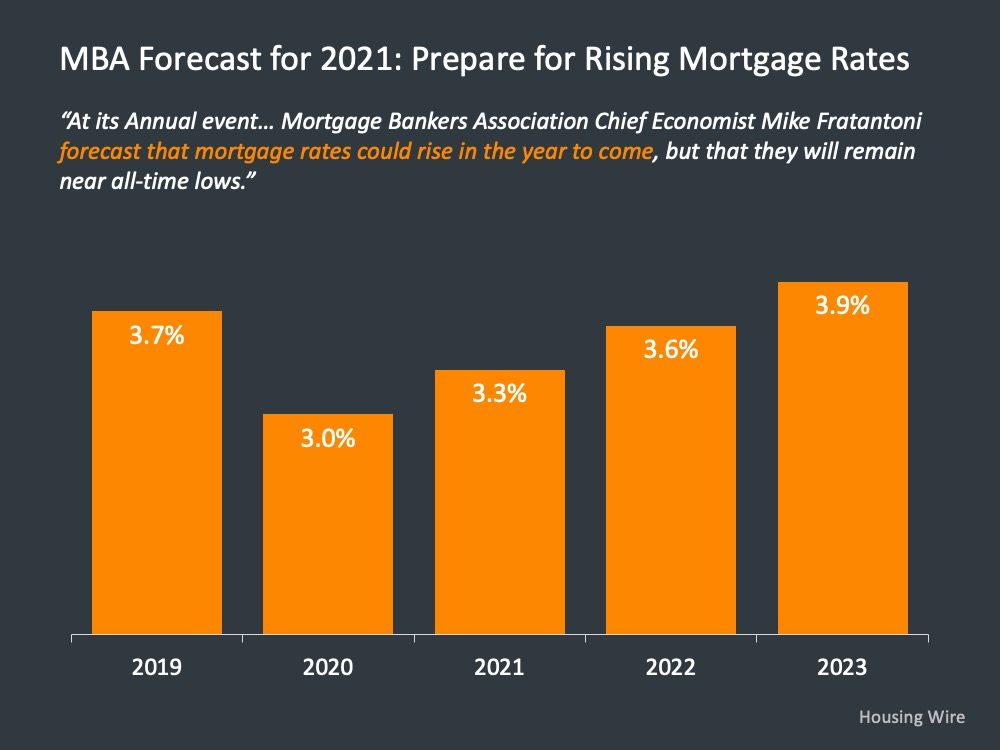

Debt Reduction and Financial Strength

A cornerstone of Cenovus's internal growth strategy is strengthening its financial position. This involves:

- Aggressive debt repayment: Prioritizing debt reduction to improve the company's credit rating and reduce financial risk.

- Improved credit rating: A higher credit rating translates to lower borrowing costs, freeing up capital for reinvestment in core operations.

- Increased free cash flow: Improved operational efficiency and cost reductions are driving higher free cash flow, providing additional resources for internal investments.

- Strengthening the balance sheet: Building a robust balance sheet reduces the company's dependence on external financing and enhances its financial flexibility.

A strong financial position provides the stability and resources necessary to support organic growth initiatives without the financial strain of a significant acquisition like the potential Cenovus MEG acquisition.

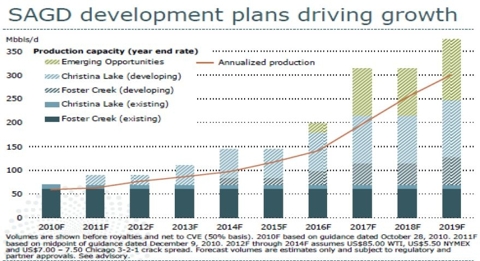

Exploration and Development in Existing Assets

Cenovus is concentrating on exploration and development within its existing asset portfolio:

- Increased exploration and production in established regions: Focusing on areas with proven reserves and established infrastructure minimizes risk and accelerates project timelines.

- Leveraging existing infrastructure: Utilizing existing pipelines, processing facilities, and other infrastructure minimizes capital expenditure and speeds up project development.

- Focusing on high-return opportunities: Prioritizing projects with the highest potential for return on investment (ROI) optimizes resource allocation.

By concentrating on existing assets, Cenovus minimizes the risks associated with new ventures and creates a more predictable and sustainable growth trajectory compared to the uncertainties inherent in a large acquisition such as a Cenovus MEG merger.

Diminished Prospects of a MEG Energy Acquisition

The shift towards internal growth effectively diminishes the likelihood of a Cenovus MEG acquisition. Several factors contribute to this change:

Strategic Shift Away from Large-Scale Acquisitions

Cenovus's leadership has publicly communicated its preference for organic growth over large acquisitions. This strategic shift includes:

- Statements from Cenovus executives: Public pronouncements by Cenovus leadership clearly indicate a focus on internal growth as the primary driver of future expansion.

- Revised acquisition criteria: The company has reportedly revised its acquisition criteria, explicitly excluding deals of the scale of a potential MEG Energy acquisition.

- Focusing resources on internal projects: Cenovus is actively allocating its resources and capital towards its internal growth initiatives, diverting funds away from potential external acquisitions.

These actions demonstrate a clear and decisive strategic pivot away from large-scale mergers and acquisitions. The financial implications of foregoing a MEG acquisition, while significant, are outweighed by the perceived benefits of a more controlled, internally-driven growth path.

Valuation Concerns and Potential Synergies

Concerns regarding MEG Energy's current valuation and the potential synergies between the two companies also play a role:

- MEG's current valuation: Cenovus may deem MEG's current market valuation as too high, making an acquisition financially unjustifiable.

- Challenges in integrating MEG's assets: Integrating MEG's assets into Cenovus's existing operations could prove challenging and costly, potentially offsetting any potential synergies.

- Lack of significant synergistic benefits: Cenovus may have concluded that the potential synergies resulting from an acquisition would not justify the cost and complexity of the integration process.

These considerations, along with the preference for internal growth, explain why a Cenovus MEG acquisition appears less feasible at this time. Potential conflicts in operational strategies and corporate cultures could also contribute to this decision.

Impact on MEG Energy and the Market

Cenovus's decision has significant ramifications for MEG Energy and the broader Canadian oil and gas market:

- Potential impact on MEG's stock price: The reduced likelihood of a takeover by Cenovus could negatively impact MEG's stock price in the short term.

- Increased uncertainty for MEG investors: The uncertainty surrounding MEG's future prospects could cause some investors to seek alternative investment opportunities.

- Opportunities for other potential buyers: The absence of Cenovus as a potential acquirer opens the door for other companies to express interest in MEG.

- Implications for the broader Canadian oil and gas market: The decision reflects a wider trend in the industry towards a more cautious and financially conservative approach to expansion.

Conclusion

Cenovus's decision to prioritize internal growth over a potential Cenovus MEG acquisition reflects a significant strategic shift in the Canadian energy sector. This focus on operational efficiency, debt reduction, and organic expansion suggests a more conservative and financially responsible approach to growth. While eliminating a Cenovus MEG merger for now, this opens interesting avenues for both companies and the broader energy market. Investors and analysts will closely monitor Cenovus's execution of its internal growth strategy and its impact on performance and valuation. Future developments regarding the Cenovus MEG acquisition (or lack thereof) will undoubtedly continue to shape the Canadian energy landscape. Stay informed about future developments in the Cenovus and MEG energy sectors.

Featured Posts

-

Gwen Stefanis Black Dress A Sheer Moment At The Opry Celebration

May 27, 2025

Gwen Stefanis Black Dress A Sheer Moment At The Opry Celebration

May 27, 2025 -

How Gucci Uses Bamboo Sustainability And Design Innovation In Fashion

May 27, 2025

How Gucci Uses Bamboo Sustainability And Design Innovation In Fashion

May 27, 2025 -

Analiz Isw Chomu Putin Unikaye Kompromisiv Z Ukrayinoyu

May 27, 2025

Analiz Isw Chomu Putin Unikaye Kompromisiv Z Ukrayinoyu

May 27, 2025 -

Daniel Craig And The Future Of The Knives Out Film Series

May 27, 2025

Daniel Craig And The Future Of The Knives Out Film Series

May 27, 2025 -

Asmongolds Take Kai Cenat Feud And Ninjas Reaction

May 27, 2025

Asmongolds Take Kai Cenat Feud And Ninjas Reaction

May 27, 2025

Latest Posts

-

Avis Galaxy S25 128 Go A 814 22 E Bon Plan A Saisir

May 28, 2025

Avis Galaxy S25 128 Go A 814 22 E Bon Plan A Saisir

May 28, 2025 -

Promo Galaxy S25 128 Go 5 Etoiles Seulement 814 22 E

May 28, 2025

Promo Galaxy S25 128 Go 5 Etoiles Seulement 814 22 E

May 28, 2025 -

Bon Plan Samsung Galaxy S25 128 Go 5 Etoiles A 814 22 E

May 28, 2025

Bon Plan Samsung Galaxy S25 128 Go 5 Etoiles A 814 22 E

May 28, 2025 -

Secure A Personal Loan Today Low Interest Rates Available

May 28, 2025

Secure A Personal Loan Today Low Interest Rates Available

May 28, 2025 -

Les Smartphones Les Plus Endurants De L Annee Classement Top 5

May 28, 2025

Les Smartphones Les Plus Endurants De L Annee Classement Top 5

May 28, 2025