Cenovus's CEO Rules Out MEG Takeover, Emphasizing Organic Growth Plans

Table of Contents

Cenovus's Stance on MEG Acquisition

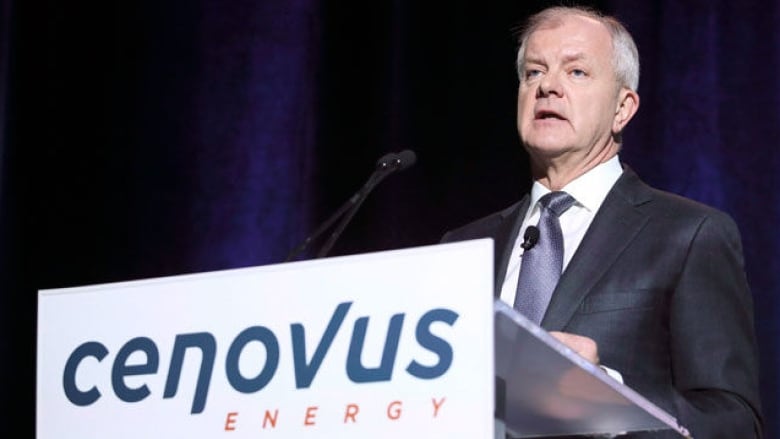

Pourbaix's Explicit Denial

Alex Pourbaix, CEO of Cenovus, has explicitly denied any intentions of acquiring MEG Energy. This statement, made during a recent investor call (source: insert source here, e.g., Cenovus press release dated October 26, 2023), effectively ended market speculation surrounding a potential merger. Pourbaix stated, "Insert direct quote from Pourbaix here if available, emphasizing the rejection of the MEG acquisition." This clear and direct communication aimed to alleviate investor uncertainty and solidify Cenovus's strategic direction.

Reasons Behind the Rejection

Cenovus's decision to reject the MEG Energy acquisition stems from several key factors:

- Current Market Conditions: The current oil and gas market is characterized by [describe current market conditions, e.g., volatility, price fluctuations, regulatory changes]. A large acquisition in this environment carries significant financial risk.

- Existing Operational Capacity: Cenovus currently possesses substantial oil sands, upstream and downstream assets. Pourbaix highlighted that their focus is maximizing returns from these existing operations rather than acquiring additional assets.

- Financial Implications: The cost of acquiring MEG Energy would be substantial, potentially impacting Cenovus's financial stability and dividend payouts. Organic growth offers a more financially prudent approach.

- Strategic Fit: A merger between Cenovus and MEG may not be strategically advantageous, considering potential overlaps in operations and resource allocation.

- Prioritization of Organic Growth: Cenovus believes its organic growth strategy offers greater long-term value creation than a potentially disruptive acquisition.

Cenovus's Focus on Organic Growth Strategies

Investment in Existing Assets

Cenovus plans to significantly enhance the productivity and efficiency of its existing assets through strategic investments. This includes:

- Technology Upgrades: Implementing advanced technologies to optimize extraction processes and reduce operational costs in their oil sands operations.

- Operational Improvements: Streamlining workflows, improving maintenance procedures, and enhancing safety protocols to increase production efficiency across all assets.

- Specific Projects: [List specific projects with expected ROI, e.g., "The Foster Creek expansion project aims to increase oil sands production by X% by Y date, with an expected ROI of Z%."]

- Project A: Expected increase in production by 15% by Q4 2024. Projected ROI: 20%.

- Project B: Implementation of new extraction technology, reducing operational costs by 10% by Q2 2025. Projected ROI: 18%.

Exploration and Development Plans

Cenovus's organic growth strategy also encompasses ambitious exploration and development initiatives:

- New Exploration Projects: Cenovus is actively exploring new opportunities in [mention specific geographical areas or geological formations].

- Expansion into New Areas: The company is evaluating potential expansion into [mention specific areas].

- Potential for New Reserves: These exploration efforts are expected to uncover significant new oil and gas reserves, fueling future production growth.

- Key Exploration Areas:

- Area 1: Potential for significant light oil discoveries.

- Area 2: Focus on developing existing gas reserves.

Sustainability and ESG Initiatives

Cenovus recognizes the importance of sustainable practices and ESG factors in its long-term growth. This commitment is integral to their organic growth strategy:

- Specific ESG Targets: [Mention specific targets, e.g., reducing carbon emissions by X% by Y year].

- Attracting Investors: Cenovus's focus on sustainability enhances its appeal to environmentally conscious investors.

- Responsible Energy Production: The company is committed to responsible energy production methods that minimize environmental impact.

- Improved methane emission reduction strategies.

- Investment in renewable energy technologies.

Market Reaction and Analyst Opinions

The market's initial reaction to Cenovus's announcement was [describe market reaction, e.g., positive, negative, neutral]. Stock prices [describe stock price fluctuations]. Financial analysts have [summarize analyst opinions, e.g., largely praised the company’s focus on a more financially conservative approach].

- Stock price increased by 2% immediately following the announcement.

- Most analysts viewed the decision as a prudent move, focusing on risk mitigation and long-term value creation.

Conclusion

Cenovus's decision to prioritize organic growth over the acquisition of MEG Energy reflects a strategic shift towards sustainable, long-term value creation. By focusing on maximizing returns from existing assets, pursuing strategic exploration and development initiatives, and embracing ESG principles, Cenovus is positioning itself for sustained growth within the evolving energy landscape. This approach minimizes financial risk and allows for more controlled expansion, aligning with the current market conditions.

Learn more about Cenovus's commitment to organic growth and its long-term vision for success in the energy sector by visiting their investor relations page: [Insert link to Cenovus Investor Relations page here].

Featured Posts

-

Discovering The Countrys Top Business Growth Areas

May 26, 2025

Discovering The Countrys Top Business Growth Areas

May 26, 2025 -

Wolffs Sharp Rebuttal To Russells Underrated Remark A Lucky Acquisition

May 26, 2025

Wolffs Sharp Rebuttal To Russells Underrated Remark A Lucky Acquisition

May 26, 2025 -

D C Region Prepares For Unprecedented Pride Season

May 26, 2025

D C Region Prepares For Unprecedented Pride Season

May 26, 2025 -

The Longevity Of F1 Drivers Analyzing Performance After Age 40

May 26, 2025

The Longevity Of F1 Drivers Analyzing Performance After Age 40

May 26, 2025 -

Alnady Mwnakw Yeln Tmdyd Eqd Takwmy Mynamynw

May 26, 2025

Alnady Mwnakw Yeln Tmdyd Eqd Takwmy Mynamynw

May 26, 2025