CFP Board CEO Announces Retirement For Early 2026

Table of Contents

Impact of the CEO's Retirement on the CFP Board

The retirement of [CEO's Name] marks a critical transition period for the CFP Board. A successful leadership handover is paramount to maintaining the organization's stability and its continued influence on the financial planning profession. The upcoming transition presents several potential challenges:

-

Potential Disruption to Ongoing Initiatives: Several key projects and initiatives are likely underway at the CFP Board. A change in leadership could potentially disrupt these efforts, causing delays or requiring a reassessment of priorities. The successful implementation of these initiatives is critical for maintaining the value and relevance of the CFP certification.

-

Impact on CFP Certification Processes and Standards: The integrity of the CFP certification process is paramount. Any transition period needs to ensure the maintenance of rigorous standards and consistent examination procedures. Any perceived weakening of these standards could erode public trust in the CFP designation.

-

Need for a Smooth Transition to Maintain Industry Confidence: Maintaining the confidence of both financial advisors holding the CFP® certification and the public who rely on these professionals is crucial. A smooth, well-managed transition will be vital in reassuring all stakeholders that the CFP Board remains a strong and reliable organization.

-

Speculation on Potential Candidates for the Next CEO: The search for a suitable successor is already generating considerable speculation within the industry. The next CEO will need to possess a strong understanding of the financial planning profession, exceptional leadership skills, and a proven track record of success.

The Legacy of [CEO's Name] at the CFP Board

[CEO's Name]'s tenure as CEO of the CFP Board has been marked by [mention specific achievements, e.g., significant expansion of the CFP® program, increased consumer protection initiatives, successful advocacy efforts]. Their contributions have undeniably shaped the landscape of financial planning.

-

Specific Initiatives Launched: [List specific initiatives launched during their tenure, e.g., new educational programs, enhanced ethical standards, technological advancements in CFP® processes].

-

Positive Impact on the CFP Certification Program: [Describe the positive impacts, e.g., increased recognition of the CFP® credential, enhanced rigor of the certification process, improved accessibility for candidates].

-

Improvements in Consumer Protection or Advisor Standards: [Highlight achievements in consumer protection and advisor standards, e.g., new ethical guidelines, stricter enforcement procedures, improved consumer complaint mechanisms].

-

Notable Industry Awards or Recognition: [Mention any industry awards or recognition received by the CEO or the CFP Board during their leadership].

Future of the CFP Certification and Financial Planning

The CFP Board's future trajectory after [CEO's Name]'s retirement hinges on several key factors. The organization's ability to navigate the transition effectively, maintain its commitment to high professional standards, and adapt to evolving industry trends will ultimately determine its continued success.

-

Continued Relevance of the CFP Designation: The CFP® designation will continue to be a benchmark for financial planning professionals. The CFP Board must continue to adapt to the changing financial landscape to ensure its continued relevance.

-

Future Changes to CFP Requirements or Exam: The CFP Board may introduce adjustments to the CFP certification requirements or the examination process to meet evolving industry needs and maintain the credibility of the certification.

-

Impact on Financial Advisor Career Paths: The CFP® designation remains a crucial element for financial advisors seeking career advancement and enhanced professional credibility. The CFP Board's direction will significantly influence future career paths within the profession.

-

Emerging Trends in Financial Planning: The financial planning profession is constantly evolving, with emerging trends such as fintech integration, increased focus on sustainability, and the growing demand for specialized financial planning services. The CFP Board must adapt to these changes.

The Search for the Next CFP Board CEO

The selection process for the next CEO will likely involve a comprehensive search, considering candidates with extensive experience in financial services, proven leadership skills, and a deep understanding of the CFP Board's mission and values.

-

Timeline for the Search and Appointment: The CFP Board will likely establish a clear timeline for the search and appointment process, ensuring a smooth transition of leadership.

-

Likely Candidates or Qualities of the Ideal Candidate: The ideal candidate will likely possess extensive experience in the financial services industry, a strong understanding of regulatory compliance, exceptional leadership skills, and a commitment to upholding the highest ethical standards.

-

Importance of Industry Experience and Leadership Skills: The next CEO must possess a blend of industry expertise and leadership capabilities to effectively guide the CFP Board through future challenges and opportunities.

Conclusion: Looking Ahead After the CFP Board CEO Retirement Announcement

The retirement of [CEO's Name] marks a significant moment for the CFP Board and the financial planning profession. The upcoming transition presents both challenges and opportunities. Maintaining the integrity of the CFP certification, adapting to evolving industry trends, and ensuring a smooth leadership handover are all critical for the future success of the CFP Board. Stay updated on the CFP Board CEO search, learn more about the future of CFP certification, and follow the developments at the CFP Board to remain informed about this important transition.

Featured Posts

-

Boostez Vos Thes Dansants Grace Au Numerique Conseils Et Outils

May 02, 2025

Boostez Vos Thes Dansants Grace Au Numerique Conseils Et Outils

May 02, 2025 -

Directorial Change Understanding Chris Columbuss Departure From The Harry Potter Franchise Part 3

May 02, 2025

Directorial Change Understanding Chris Columbuss Departure From The Harry Potter Franchise Part 3

May 02, 2025 -

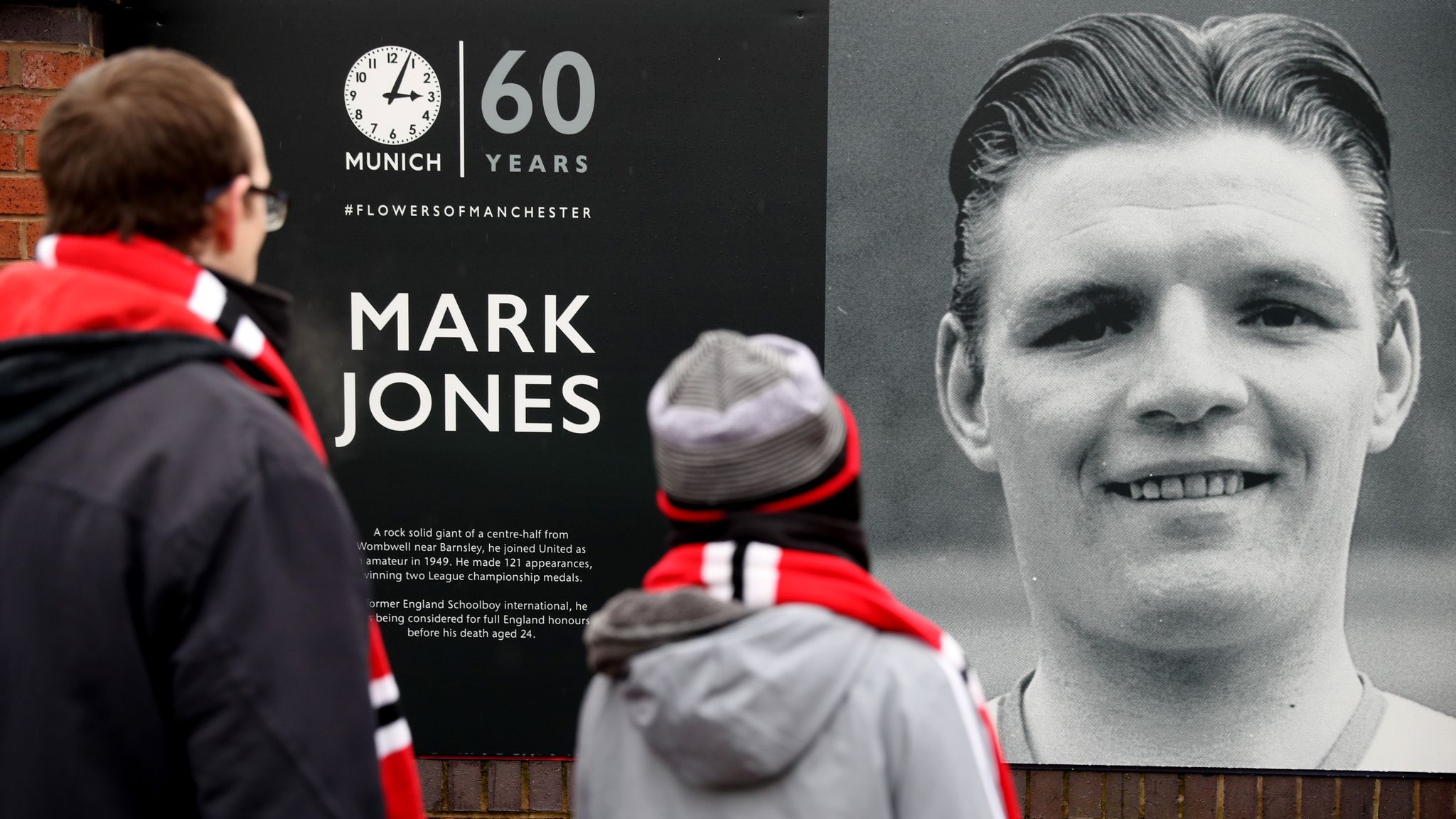

Manchester United Community Mourns With Poppys Family

May 02, 2025

Manchester United Community Mourns With Poppys Family

May 02, 2025 -

Gaming Revenue In Macau Better Than Predicted Before Golden Week

May 02, 2025

Gaming Revenue In Macau Better Than Predicted Before Golden Week

May 02, 2025 -

Unlocking Shared Experiences With Project Muse Collaboration And Community

May 02, 2025

Unlocking Shared Experiences With Project Muse Collaboration And Community

May 02, 2025

Latest Posts

-

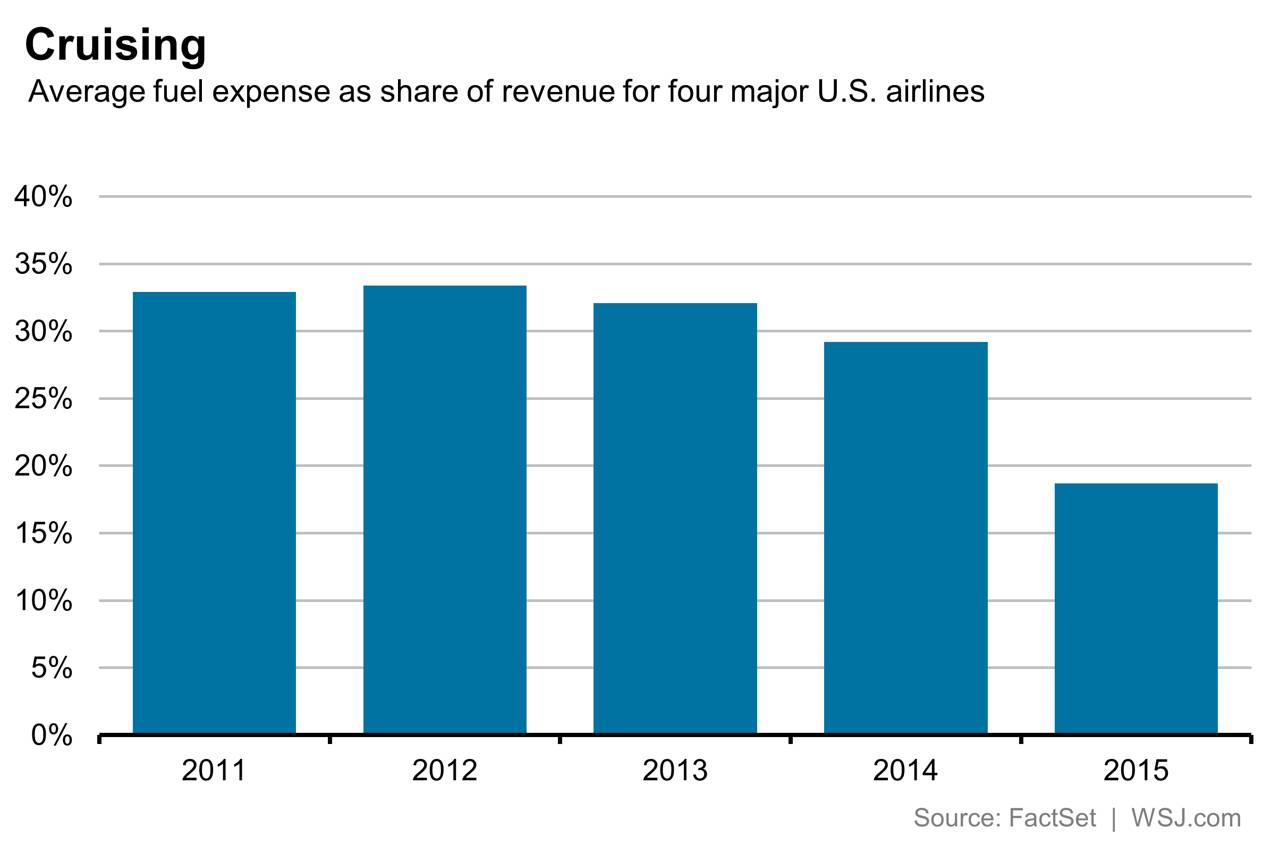

The Impact Of Oil Supply Disruptions On Air Travel And Airlines

May 03, 2025

The Impact Of Oil Supply Disruptions On Air Travel And Airlines

May 03, 2025 -

Oil Price Volatility A Major Threat To Airline Profitability

May 03, 2025

Oil Price Volatility A Major Threat To Airline Profitability

May 03, 2025 -

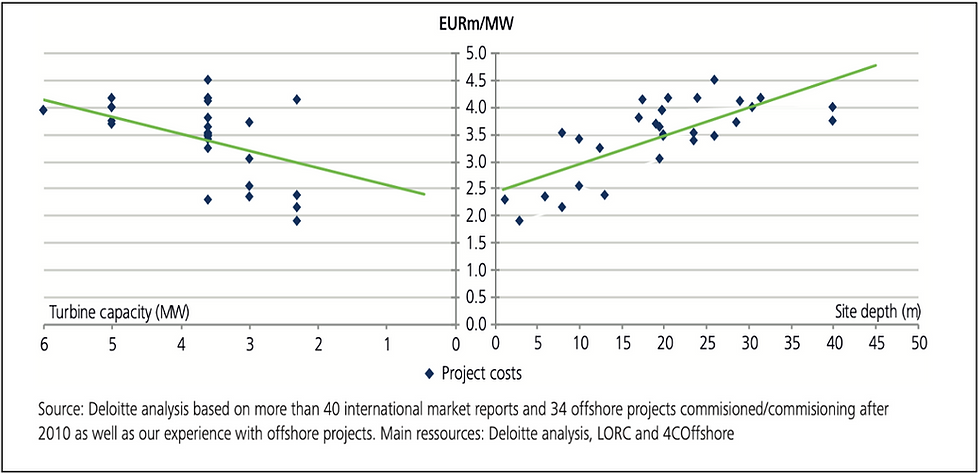

Cost Concerns Hamper Growth Of Offshore Wind Energy Projects

May 03, 2025

Cost Concerns Hamper Growth Of Offshore Wind Energy Projects

May 03, 2025 -

Fuel Crisis Navigating The Impact Of Oil Supply Shocks On Airlines

May 03, 2025

Fuel Crisis Navigating The Impact Of Oil Supply Shocks On Airlines

May 03, 2025 -

Offshore Winds High Price Tag A Barrier To Future Development

May 03, 2025

Offshore Winds High Price Tag A Barrier To Future Development

May 03, 2025