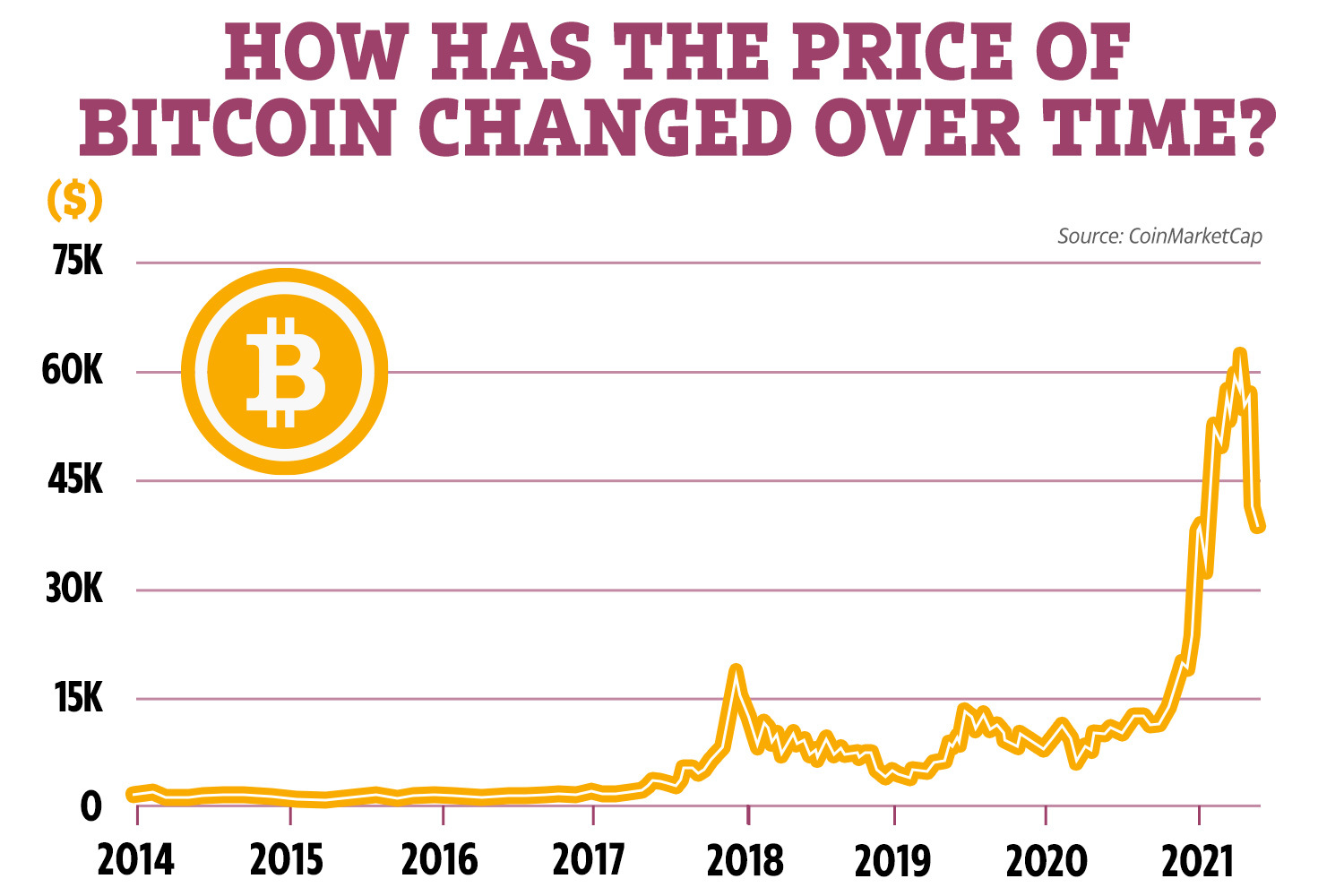

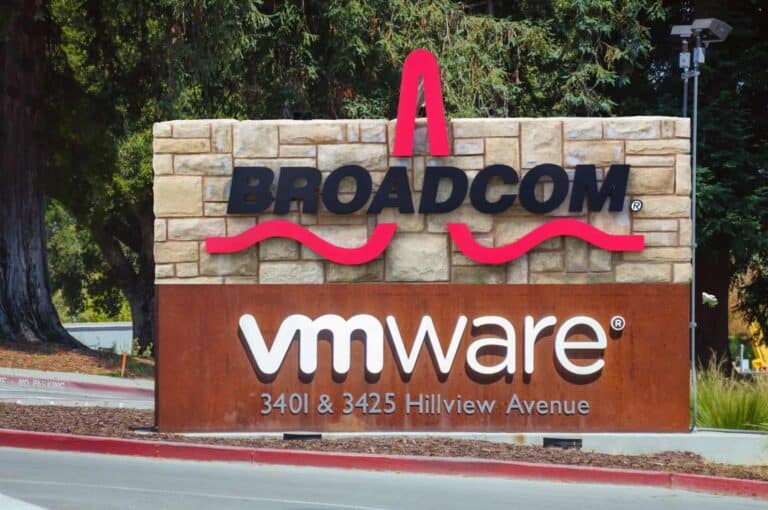

Chart Of The Week: Bitcoin's Potential 10x Price Surge

Table of Contents

On-Chain Data Suggesting Accumulation and Reduced Selling Pressure

On-chain data provides invaluable insights into Bitcoin's underlying dynamics. Several key metrics point towards a significant reduction in selling pressure and increased accumulation, bolstering the case for a potential 10x price surge.

Increased Bitcoin Supply Held on Exchanges

The percentage of Bitcoin held on exchanges has been steadily decreasing. This signifies that fewer coins are readily available for sale, potentially leading to price appreciation as demand outstrips supply.

- Correlation with Past Bull Runs: Historically, a decline in exchange-held Bitcoin has preceded significant bull runs. Analyzing past market cycles reveals a strong correlation between decreased exchange supply and subsequent price increases.

- Data and Charts: [Insert relevant chart here showing the decreasing percentage of Bitcoin held on exchanges over time, sourced from Glassnode or CoinMetrics]. This visual representation clearly demonstrates the ongoing trend of accumulation.

- On-Chain Analysis Tools: Platforms like Glassnode and CoinMetrics provide comprehensive on-chain data, allowing analysts to track this crucial metric and gain a deeper understanding of market dynamics. Their sophisticated tools are instrumental in identifying such significant trends.

Growing Number of Long-Term Holders

The number of long-term Bitcoin holders (those holding for over a year) is steadily increasing. This signifies growing confidence in Bitcoin's long-term value proposition and a decreased likelihood of short-term selling pressure.

- Reduced Likelihood of Short-Term Price Drops: Long-term holders are less likely to panic sell during market corrections, providing a stable base of support for the price.

- Statistics on Long-Term Holder Growth: [Insert statistics here showing the percentage growth of long-term Bitcoin holders, sourced from reputable on-chain analysis platforms]. This data quantitatively supports the narrative of increased conviction amongst Bitcoin investors.

- Market Sentiment and Investor Confidence: The increasing number of long-term holders reflects a positive shift in market sentiment and a growing belief in Bitcoin's long-term potential as a store of value and a hedge against inflation.

Macroeconomic Factors Contributing to Bitcoin's Potential Growth

Macroeconomic headwinds are also contributing to Bitcoin's appeal as a safe haven asset and a potential driver of future price appreciation.

Inflation and the Search for Alternative Assets

Persistent inflation and concerns about fiat currency devaluation are pushing investors towards alternative assets like Bitcoin.

- Bitcoin as "Digital Gold": Bitcoin is increasingly viewed as "digital gold," a scarce, decentralized asset that offers protection against inflation. Its limited supply of 21 million coins acts as a natural hedge against inflationary pressures.

- Institutional Investor Adoption: Large institutional investors are increasingly adding Bitcoin to their portfolios, further driving demand and legitimizing its role as an asset class. Examples include [mention specific examples of institutional investors].

- Government Policies and Bitcoin Adoption: Government policies, both supportive and restrictive, can influence Bitcoin adoption. Increased regulatory clarity in certain jurisdictions could lead to increased institutional investment and mainstream adoption.

Growing Institutional Adoption and Regulatory Clarity

The growing acceptance of Bitcoin by institutional investors, coupled with increasing regulatory clarity in various jurisdictions, is fueling its price potential.

- Corporate Bitcoin Holdings: Several major corporations have added Bitcoin to their balance sheets, signaling a growing acceptance of Bitcoin as a viable asset. [Provide specific examples here].

- Regulatory Clarity Boosts Confidence: Clearer regulatory frameworks provide greater certainty for investors, encouraging more institutional participation and driving further price appreciation.

- Upcoming Regulatory Developments: Any upcoming regulatory developments, whether positive or negative, can significantly impact Bitcoin's price. Monitoring these developments is crucial for understanding future price movements.

Technical Analysis Supporting a Potential Bitcoin Price Surge

Technical analysis provides further support for the potential of a Bitcoin price surge. Several indicators point towards a bullish outlook.

Chart Patterns and Key Resistance Levels

Analysis of Bitcoin's price charts reveals several key patterns and resistance levels that suggest the potential for a significant price breakout.

- Chart Patterns and Visual Aids: [Include relevant charts here, identifying patterns like head and shoulders, cup and handle, or other relevant chart patterns. Clearly label support and resistance levels.]

- Technical Indicators (RSI, MACD): Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide additional insights into momentum and potential price reversals. [Include data points and explanation of these indicators].

- Potential Price Targets: Based on technical analysis, potential price targets for Bitcoin could be [state potential price targets based on analysis]. These targets are, of course, speculative.

Volume and Momentum Indicators

Volume and momentum indicators further strengthen the case for a potential price surge.

- Volume and Chart Patterns: High volume accompanying price breakouts confirms the strength of the move and increases the likelihood of a sustained uptrend.

- Numerical Data: [Include relevant numerical data to support the analysis of volume and momentum indicators.]

- Volume and Price Action: Considering volume in conjunction with price action provides a more comprehensive understanding of market sentiment and potential future price movements.

Conclusion

The confluence of on-chain data, macroeconomic factors, and compelling technical analysis suggests a strong possibility of a significant Bitcoin price surge. While a 10x increase is ambitious, the underlying factors point towards a bullish outlook for Bitcoin in the coming months and years. This analysis should not be considered financial advice. It's crucial to conduct your own thorough research before investing in Bitcoin or any other cryptocurrency. Stay informed about the latest developments in the Bitcoin market and continue to monitor the Chart of the Week for further insights into Bitcoin's potential 10x price surge and other crypto market trends. Remember to always invest responsibly and only with capital you can afford to lose.

Featured Posts

-

Open Ai Facing Ftc Investigation Understanding The Concerns And Potential Outcomes

May 08, 2025

Open Ai Facing Ftc Investigation Understanding The Concerns And Potential Outcomes

May 08, 2025 -

Inter Milans Sommer Out Thumb Injury Jeopardizes Key Fixtures

May 08, 2025

Inter Milans Sommer Out Thumb Injury Jeopardizes Key Fixtures

May 08, 2025 -

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Hike

May 08, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Hike

May 08, 2025 -

Arsenal Ps Zh Vse Matchi V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Vse Matchi V Evrokubkakh

May 08, 2025 -

Brezilya Da Bitcoin Ile Maas Oedemek Avantajlar Ve Dezavantajlar

May 08, 2025

Brezilya Da Bitcoin Ile Maas Oedemek Avantajlar Ve Dezavantajlar

May 08, 2025

Latest Posts

-

Tuerkiye De Kripto Para Piyasasi Ve Bakan Simsek In Goeruesleri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Ve Bakan Simsek In Goeruesleri

May 08, 2025 -

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025 -

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025 -

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025