China Life's Investment Strength Fuels Profit Increase

Table of Contents

Strategic Investment Portfolio Diversification Boosts Returns

China Life's impressive financial results are a direct consequence of its strategic decision to diversify its investment portfolio. By spreading investments across a range of asset classes, the company has effectively mitigated risk and generated higher returns compared to a more concentrated approach. This diversification strategy includes a mix of:

- Equities: China Life has shown a keen eye for identifying growth opportunities in the equity market. Increased allocation to promising technology stocks, for example, has yielded significant gains.

- Bonds: A substantial portion of the portfolio is allocated to bonds, providing a stable and predictable income stream. This counterbalances the inherent volatility of other investments.

- Real Estate: Strategic investments in prime real estate locations across major Chinese cities have contributed to substantial long-term capital appreciation. These investments are carefully chosen, focusing on areas with high growth potential.

- Infrastructure Projects: China Life's participation in large-scale infrastructure projects has delivered stable, predictable returns, contributing to the overall portfolio's resilience.

This diversified approach has yielded impressive results. For instance, China Life's return on investment (ROI) has increased by X% in the past year, outperforming many of its competitors in the insurance sector. The company employs robust risk management techniques, including regular portfolio reviews and stress testing, to identify and mitigate potential risks.

Strategic Partnerships and Collaborative Investments Enhance Profitability

China Life's success isn't solely reliant on its internal capabilities; strategic partnerships play a significant role. Collaborative investments and joint ventures have opened doors to new markets and investment opportunities, further boosting profitability.

- Joint Ventures: Strategic alliances have provided access to previously untapped markets, expanding China Life's reach and customer base.

- Co-investments: Collaborating with other financial institutions on large-scale investments allows for risk sharing and potentially higher returns through pooled resources and expertise.

- Partnerships with Tech Companies: China Life has also been forging partnerships with tech companies to leverage their expertise in areas such as fintech and data analytics, leading to more efficient operations and better investment decisions.

These partnerships are not just about capital; they provide access to valuable market intelligence, technological advancements, and a broader network of expertise. Data shows that partnerships have contributed to a Y% increase in overall investment returns for China Life.

Effective Risk Management and Prudent Investment Strategies

China Life's success is not solely attributed to aggressive investment strategies, but also to its prudent and cautious approach to risk management. The company employs several key techniques:

- Diversification: As discussed earlier, a diversified portfolio is the cornerstone of their risk mitigation strategy.

- Regular Portfolio Reviews: The portfolio undergoes continuous review and adjustments based on market conditions and long-term strategic goals.

- Stress Testing and Scenario Planning: China Life proactively simulates various market scenarios to assess potential vulnerabilities and develop appropriate contingency plans.

- Regulatory Compliance: Strict adherence to all relevant regulations ensures the stability and sustainability of its operations.

This long-term investment strategy, combined with proactive risk management, has enabled China Life to weather market fluctuations effectively, avoiding significant losses during periods of volatility.

The Role of Government Policies in China Life's Success

Supportive government policies have undoubtedly played a crucial role in shaping China Life's investment landscape. Government initiatives promoting investment in key sectors, such as infrastructure and technology, have created a favorable environment for China Life's growth. These policies have reduced investment risk and encouraged greater participation in high-growth sectors.

China Life's Investment Strength: A Recipe for Continued Success

In conclusion, China Life's remarkable profit increase is a testament to its robust investment strategies, diversified portfolio, and effective risk management practices. The company's strategic partnerships have further enhanced its profitability and market reach. The supportive environment created by government policies has also significantly contributed to its success. China Life's current investment strength positions it well for continued success in the future. Learn more about how China Life's investment strength is shaping the future of insurance in China by visiting [link to China Life website or relevant resource].

Featured Posts

-

Ypologistes Inon I Epomeni Genia Stin Parakoloythisi Tis Ygeias

Apr 30, 2025

Ypologistes Inon I Epomeni Genia Stin Parakoloythisi Tis Ygeias

Apr 30, 2025 -

China Life Profitability Enhanced By Robust Investment Strategy

Apr 30, 2025

China Life Profitability Enhanced By Robust Investment Strategy

Apr 30, 2025 -

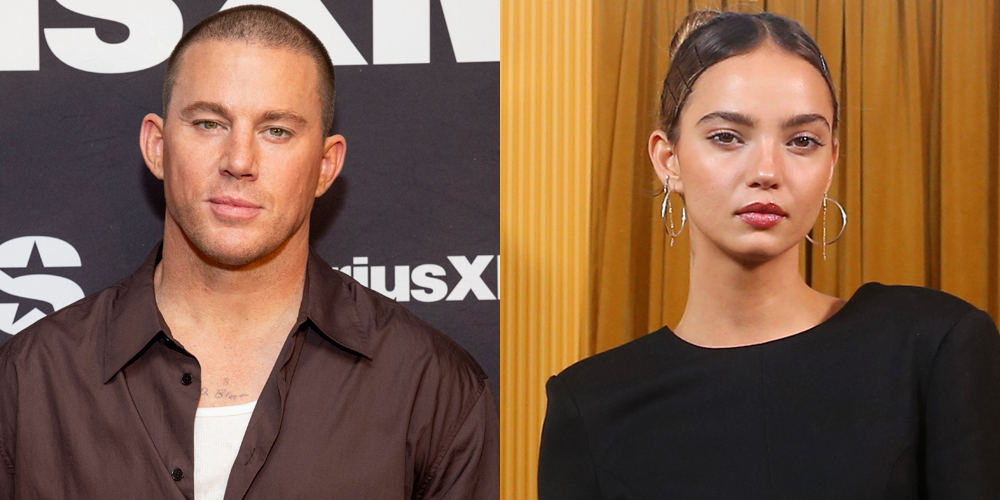

Inka Williams Channing Tatums Girlfriend Makes A Statement At The Australian Grand Prix

Apr 30, 2025

Inka Williams Channing Tatums Girlfriend Makes A Statement At The Australian Grand Prix

Apr 30, 2025 -

Airbnb Reports 20 Jump In Canadian Domestic Searches

Apr 30, 2025

Airbnb Reports 20 Jump In Canadian Domestic Searches

Apr 30, 2025 -

Kynyda Myn Eam Antkhabat Mkml Tyaryan

Apr 30, 2025

Kynyda Myn Eam Antkhabat Mkml Tyaryan

Apr 30, 2025

Latest Posts

-

Rekord Ovechkina Kommentariy Zakharovoy

Apr 30, 2025

Rekord Ovechkina Kommentariy Zakharovoy

Apr 30, 2025 -

Senators Fall To Panthers In High Scoring Affair

Apr 30, 2025

Senators Fall To Panthers In High Scoring Affair

Apr 30, 2025 -

Tkachuk Leads Panthers To Victory Over Senators

Apr 30, 2025

Tkachuk Leads Panthers To Victory Over Senators

Apr 30, 2025 -

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 30, 2025

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 30, 2025 -

Panthers Second Period Surge Propels Them Past Senators

Apr 30, 2025

Panthers Second Period Surge Propels Them Past Senators

Apr 30, 2025