China's Economic Response: Special Bonds To Counter Trump's Tariffs

Table of Contents

Understanding China's Special Bond Program

China's special bond program represents a targeted fiscal stimulus initiative designed to mitigate the negative consequences of the Trump tariffs and bolster economic growth. These bonds, unlike regular government bonds, are earmarked for specific sectors and projects deemed crucial for national economic development.

- Purpose: To inject capital into strategically important sectors, stimulating investment and counteracting the slowdown caused by the tariffs.

- Issuance: The bonds are issued by the Chinese government and channeled through designated financial institutions to specific recipients.

- Intended Recipients: The program prioritizes key sectors, including:

- Infrastructure: Funding large-scale infrastructure projects like transportation networks, energy grids, and communication systems.

- Technology: Supporting the development of high-tech industries and bolstering technological self-reliance.

- SMEs (Small and Medium-sized Enterprises): Providing crucial financing to SMEs, which form the backbone of the Chinese economy and are often more vulnerable to economic shocks.

- Scale and Significance: The scale of special bond issuance has been substantial, representing a significant injection of capital into the Chinese economy, influencing overall fiscal policy and impacting the China bond market. The precise figures vary year to year, but the sheer volume underscores the government’s commitment to this counter-strategy. Keywords: special bonds issuance, China bond market, infrastructure investment, SME financing, fiscal policy.

The Strategic Rationale Behind Special Bonds as a Countermeasure

The strategic rationale behind using special bonds as a countermeasure to Trump's tariffs is multifaceted. It's a targeted approach to fiscal stimulus designed to:

- Counteract Negative Impacts: By directly injecting capital into affected sectors, the government aims to offset the reduced export demand and investment caused by the tariffs.

- Support Domestic Demand: Investment in infrastructure and technological development creates jobs and stimulates domestic consumption, helping to cushion the blow of reduced export revenue.

- Stimulate Economic Growth: The increased investment and resulting economic activity are intended to boost overall GDP growth and maintain macroeconomic stability.

- Channel Funds to Crucial Sectors: The targeted nature of the program ensures that funds reach sectors vital for China's long-term economic goals, such as technological advancement and infrastructure modernization. Keywords: economic stimulus, fiscal stimulus, counter-cyclical policy, domestic demand, economic growth.

Effectiveness and Challenges of China's Special Bond Strategy

Assessing the effectiveness of China's special bond program requires a nuanced perspective. While it undoubtedly injected liquidity and stimulated investment in targeted sectors, challenges remain:

- Economic Impact: While the program successfully stimulated investment in certain sectors, the overall impact on mitigating the negative effects of the tariffs is complex and subject to ongoing debate among economists. Some argue it successfully cushioned the blow, while others point to other factors influencing the economic landscape.

- Debt Management and Fiscal Sustainability: The significant increase in government debt associated with special bond issuance raises concerns about long-term fiscal sustainability and debt management. Careful monitoring and effective strategies are required to mitigate potential risks.

- Resource Allocation and Efficiency: Ensuring efficient resource allocation and minimizing potential waste are crucial challenges. Effective oversight and monitoring mechanisms are needed to optimize the impact of the funds.

- Unintended Consequences: Potential unintended consequences include asset bubbles in certain sectors and increased regional economic disparities. Keywords: economic impact, debt management, fiscal sustainability, resource allocation, policy effectiveness.

Comparison with Other Economic Responses to Trump’s Tariffs

China's reliance on special bonds as a major element of its response contrasts with other countries' approaches to similar trade challenges. Some countries opted for broader tax cuts or direct subsidies to affected industries. While special bonds offer targeted support, other methods provide more widespread relief.

- Advantages: Special bonds allow for a targeted and focused approach, directing resources precisely to sectors deemed crucial for long-term growth and national strategic goals.

- Disadvantages: The targeted nature can lead to uneven development and may not be as effective in addressing widespread economic slowdowns as more generalized approaches like tax cuts. The increased debt burden is also a significant factor. Keywords: trade policy, comparative economic policy, global trade, international trade relations.

Conclusion: Evaluating the Long-Term Impact of China's Special Bond Response to Trump's Tariffs

China's utilization of special bonds to counter the economic fallout from Trump's tariffs represents a significant policy decision. While the program has undoubtedly stimulated investment in key sectors and aided in mitigating some of the negative consequences, concerns regarding debt sustainability and efficient resource allocation persist. The long-term effects require further analysis, but the strategy’s influence on shaping future economic policies and strategies in China is undeniable. The effectiveness in completely offsetting the impact of the tariffs remains a subject of ongoing debate. Learn more about how China uses special bonds to manage economic challenges and investigate the future implications of China's special bond strategy.

Featured Posts

-

Finding Sanctuary How Pope Francis Helped A Refugee Family

Apr 25, 2025

Finding Sanctuary How Pope Francis Helped A Refugee Family

Apr 25, 2025 -

India Trip Turns Usha Vance Into An Unlikely Celebrity

Apr 25, 2025

India Trip Turns Usha Vance Into An Unlikely Celebrity

Apr 25, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 25, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 25, 2025 -

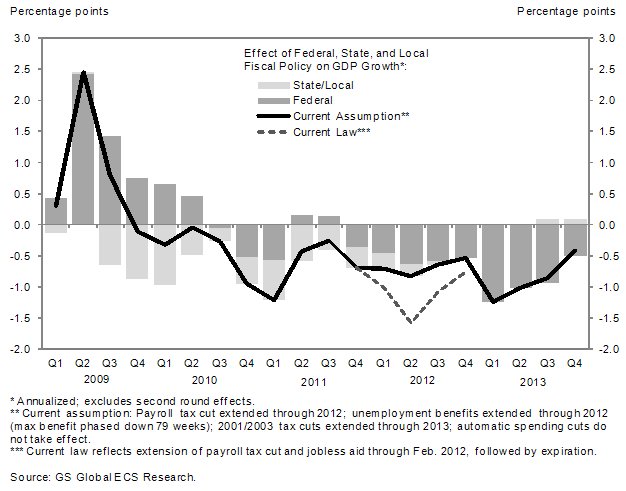

Goldman Predicts Looser Fiscal Policy From Australian Opposition Compared To Labor

Apr 25, 2025

Goldman Predicts Looser Fiscal Policy From Australian Opposition Compared To Labor

Apr 25, 2025 -

Harrogate Spring Flower Show Returns April 24 27 2025

Apr 25, 2025

Harrogate Spring Flower Show Returns April 24 27 2025

Apr 25, 2025

Latest Posts

-

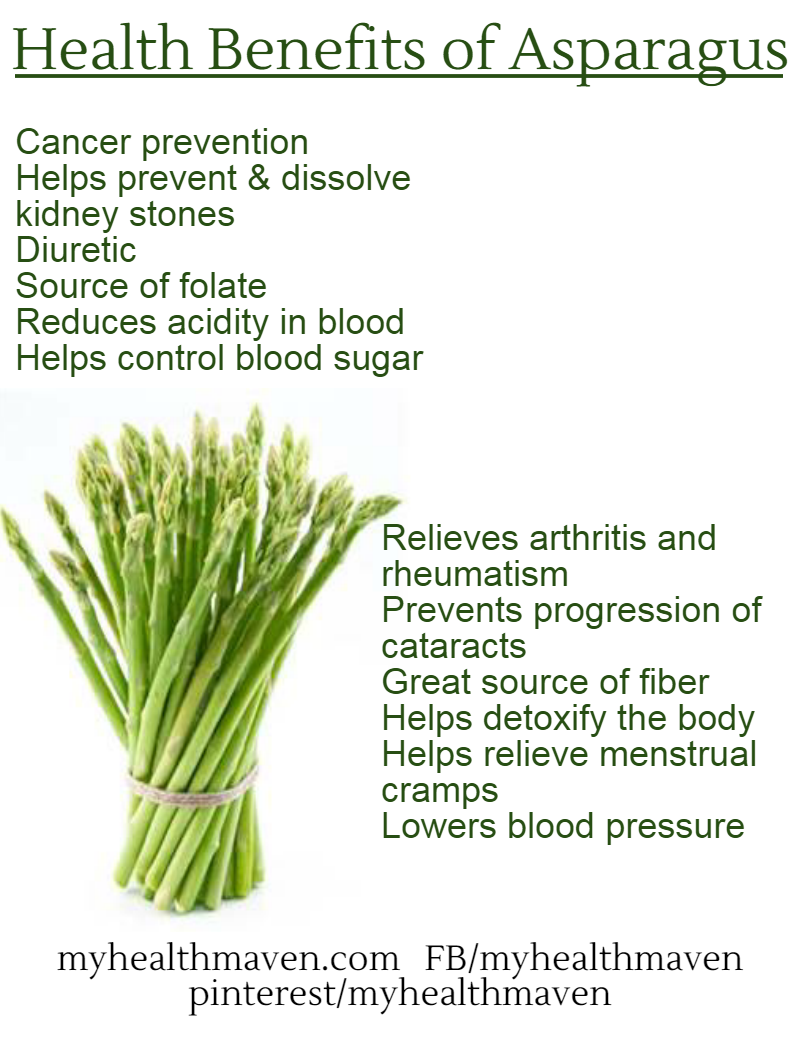

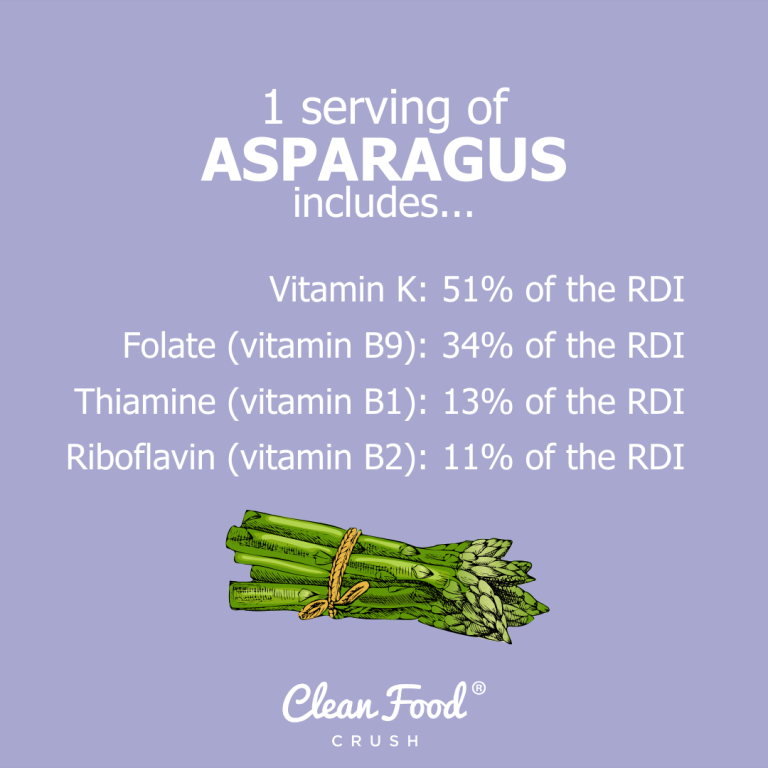

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025 -

The Complete Guide To Asparagus And Its Health Benefits

Apr 30, 2025

The Complete Guide To Asparagus And Its Health Benefits

Apr 30, 2025 -

Asparagus And Health Exploring The Positive Impacts

Apr 30, 2025

Asparagus And Health Exploring The Positive Impacts

Apr 30, 2025 -

Understanding The Nutritional Value Of Asparagus

Apr 30, 2025

Understanding The Nutritional Value Of Asparagus

Apr 30, 2025 -

Unlocking The Health Benefits Of Asparagus

Apr 30, 2025

Unlocking The Health Benefits Of Asparagus

Apr 30, 2025