Goldman Predicts Looser Fiscal Policy From Australian Opposition Compared To Labor

Table of Contents

Goldman Sachs' Key Predictions

Goldman Sachs' core prediction centers on a divergence in fiscal policy between the Labor government and the Australian Opposition. Their analysis suggests the Opposition, if elected, would adopt a less fiscally conservative approach than Labor's current strategy. This means potentially increased government spending and potentially different tax policies.

-

Specific examples of predicted differences in government spending: Goldman Sachs projects increased infrastructure spending under an Opposition government compared to Labor's planned investments. Areas like transport infrastructure and regional development may see a boost. Conversely, social welfare programs might see slightly slower growth in spending under the Opposition’s projected policies than under the current Labor government's initiatives.

-

Projected variations in tax policies: The forecast anticipates potential tax cuts or adjustments under the Opposition, potentially impacting income tax brackets or specific tax levies. Goldman Sachs hasn't specified the exact nature of these changes but suggests a generally lower tax burden compared to Labor's projected tax revenue strategies.

-

Goldman's rationale for these predictions: Goldman Sachs bases its predictions on an analysis of the Opposition's public statements, policy proposals, and historical spending patterns of similar governments. They've also considered economic modeling and projected revenue under different scenarios.

-

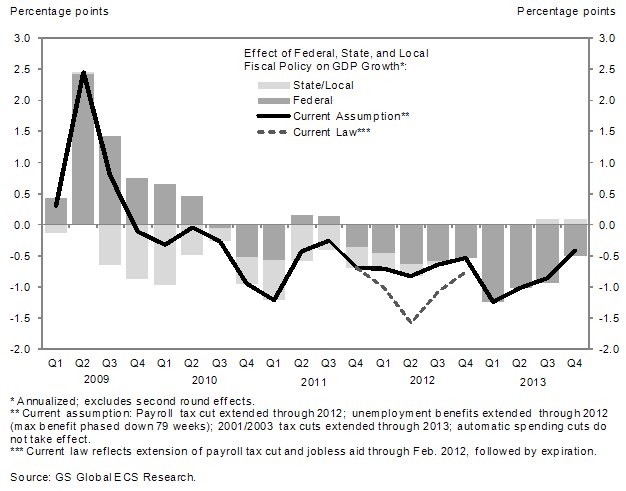

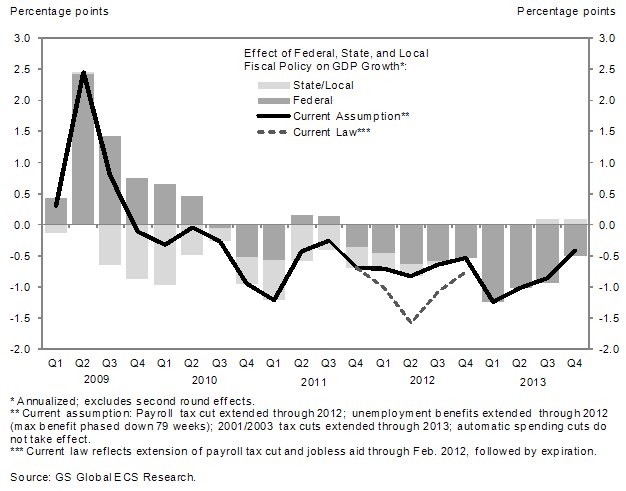

Quantitative data from Goldman Sachs: Goldman Sachs' report includes projected GDP growth figures under both scenarios (Labor's current policies and the Opposition's anticipated policies). While the exact numbers are subject to the full report, the prediction suggests slightly higher GDP growth in the short term under a looser fiscal policy, but potentially higher risks in the long term.

Implications for the Australian Economy

A looser fiscal policy, as predicted by Goldman Sachs for the Australian Opposition, could have several significant implications for the Australian economy. Understanding these potential consequences is crucial for investors and the general public alike.

-

Impact on inflation: Increased government spending could potentially fuel inflation if not managed carefully, putting upward pressure on the cost of goods and services.

-

Effects on interest rates: To combat potential inflation, the Reserve Bank of Australia (RBA) might increase interest rates, impacting borrowing costs for businesses and consumers.

-

Potential influence on government debt: Increased government spending without corresponding revenue increases could lead to a rise in government debt.

-

Potential impact on employment: Increased infrastructure spending could stimulate employment in the construction and related sectors, potentially leading to increased job creation.

-

Predicted changes to the Australian dollar's value: A looser fiscal policy might affect investor confidence and potentially lead to fluctuations in the Australian dollar's value against other currencies.

Comparison with Labor's Fiscal Policy

Labor's current fiscal policy emphasizes responsible fiscal management, focusing on targeted spending and revenue generation to address social issues and infrastructure needs. Goldman Sachs' analysis highlights key differences between this approach and the anticipated approach of the Opposition.

-

Specific examples of Labor's current fiscal policies: Labor’s policies include investments in renewable energy, childcare subsidies, and targeted social welfare programs, funded by a combination of taxes and government borrowing.

-

Key differences between Labor's and the Opposition's projected approaches: The primary difference lies in the scale and scope of government intervention. Labor advocates for more targeted spending and responsible debt management, while the Opposition's projected approach points to potentially broader spending and potentially different tax adjustments.

-

Potential long-term economic effects: The long-term economic impacts of these contrasting strategies remain uncertain. While a looser fiscal policy might lead to short-term economic boosts, it could also potentially lead to higher inflation and increased government debt in the longer term.

Analysis of Opposition's Stated Policies

Examining the Opposition's stated policies reveals the basis for Goldman Sachs' predictions.

-

Direct quotes from Opposition leaders: The Opposition has publicly stated intentions to review specific spending commitments and potentially implement tax cuts, although details are still emerging. These statements align with Goldman Sachs' projections of a less stringent fiscal approach.

-

Specific policy proposals: While detailed policy proposals are still being formulated, initial statements suggest a shift in emphasis towards specific areas of infrastructure and industry support.

-

Feasibility and potential impact of these proposals: The feasibility and potential impact of these proposals depend on various factors, including economic conditions and the Opposition's ability to secure sufficient revenue to support increased spending.

Conclusion

Goldman Sachs' forecast predicts a less tight fiscal policy under an Australian Opposition government compared to Labor's current approach. This means potentially higher government spending, different tax policies, and potentially different short and long-term economic impacts, including potential effects on inflation, interest rates, government debt, employment, and the Australian dollar. Understanding these potential implications is crucial for navigating the evolving Australian economic landscape.

Call to Action: Stay informed about the evolving Australian political landscape and its effect on fiscal policy. Follow our updates for further analysis on the Australian Opposition's fiscal policy and its comparison to Labor's approach. Continue to monitor the implications of these differing strategies on the Australian economy. Learn more about Goldman Sachs' economic forecasts and how they impact the Australian economy by subscribing to our newsletter.

Featured Posts

-

Dope Thief Episode 7 Review Ray And Manny Reclaim The Spotlight

Apr 25, 2025

Dope Thief Episode 7 Review Ray And Manny Reclaim The Spotlight

Apr 25, 2025 -

High Stock Market Valuations Bof As Argument For Investor Calm

Apr 25, 2025

High Stock Market Valuations Bof As Argument For Investor Calm

Apr 25, 2025 -

Top Official Coachella 2025 Merchandise From Performers Amazon Shopping Guide

Apr 25, 2025

Top Official Coachella 2025 Merchandise From Performers Amazon Shopping Guide

Apr 25, 2025 -

Backlash Mounts Against Newsom After Toxic Democrats Statement

Apr 25, 2025

Backlash Mounts Against Newsom After Toxic Democrats Statement

Apr 25, 2025 -

Record Inflows Into Japanese Assets As Funds Flee The Us

Apr 25, 2025

Record Inflows Into Japanese Assets As Funds Flee The Us

Apr 25, 2025

Latest Posts

-

2024 Nfl Draft Panthers Eighth Pick And The Pursuit Of Continued Success

May 01, 2025

2024 Nfl Draft Panthers Eighth Pick And The Pursuit Of Continued Success

May 01, 2025 -

Daisy Midgeleys Coronation Street Departure First Look

May 01, 2025

Daisy Midgeleys Coronation Street Departure First Look

May 01, 2025 -

Historic Charlotte Barn For Sale Former Farmers And Foragers Property

May 01, 2025

Historic Charlotte Barn For Sale Former Farmers And Foragers Property

May 01, 2025 -

Community Town Hall With Dr Victoria Watlington Moderated By Joe Bruno Wsoc Tv

May 01, 2025

Community Town Hall With Dr Victoria Watlington Moderated By Joe Bruno Wsoc Tv

May 01, 2025 -

Carolina Panthers Can The Eighth Pick Repeat Last Years Draft Success

May 01, 2025

Carolina Panthers Can The Eighth Pick Repeat Last Years Draft Success

May 01, 2025