Closure Of Point72's Emerging Markets Fund: Trader Exodus

Table of Contents

The Unexpected Closure of Point72's Emerging Markets Fund

The announcement of Point72's decision to shutter its emerging markets fund came as a shock to many. While the exact date of the announcement and the official statement from Point72 remain somewhat opaque (information will be inserted here once publicly available), the news quickly spread, causing significant market reaction. The fund's assets under management (AUM) prior to closure were substantial (insert AUM figure if available), making the closure even more noteworthy. The unexpected nature of the decision highlights the inherent risks and volatility associated with emerging market investments.

- Date of announcement: [Insert Date Here]

- Official statement from Point72: [Insert official statement or summary here once available]

- Market reaction to the news: [Describe market reactions, including stock prices, analyst comments, etc.]

The Exodus of Traders: Key Personnel Departures

Following the closure, a significant number of traders have left Point72. This "trader exodus" represents a considerable loss of expertise and institutional knowledge for the firm. While Point72 hasn't publicly disclosed a comprehensive list, several prominent individuals are known to have departed. [Insert names of traders here, along with links to their LinkedIn profiles if available, and a brief description of their roles and experience within the fund]. The impact of these departures is substantial, potentially weakening Point72's overall capabilities in emerging market analysis and strategy. Speculation abounds regarding their future destinations, with several likely candidates being other prominent hedge funds specializing in emerging markets.

- List of prominent traders who left: [Insert list here]

- Their roles within the fund: [Brief description of each trader's role]

- Their experience and expertise: [Highlight their specialization and years of experience]

- Potential future destinations: [Mention potential firms or speculate on future plans]

Underlying Reasons for the Fund's Closure and Trader Exodus

Several factors likely contributed to the closure of Point72's emerging markets fund and the subsequent departures. Poor fund performance is a strong possibility, although specific data may not be publicly available. [Insert performance data if available and analyze it]. Changes in market conditions, including geopolitical instability in several key emerging markets and a general economic slowdown in some regions, could also have played a significant role. Internal restructuring within Point72, or a broader shift in the firm's overall investment strategy, might have also led to the decision. The relationship between the closure and the trader exodus is complex. Were the departures voluntary, driven by the uncertain future of the fund, or were they prompted by Point72’s restructuring? Further investigation is needed to determine the exact circumstances.

- Detailed analysis of potential performance data: [Insert data analysis here]

- Explanation of relevant market conditions: [Detailed explanation of geopolitical and economic factors]

- Discussion of internal Point72 changes: [Speculation or information on internal restructuring]

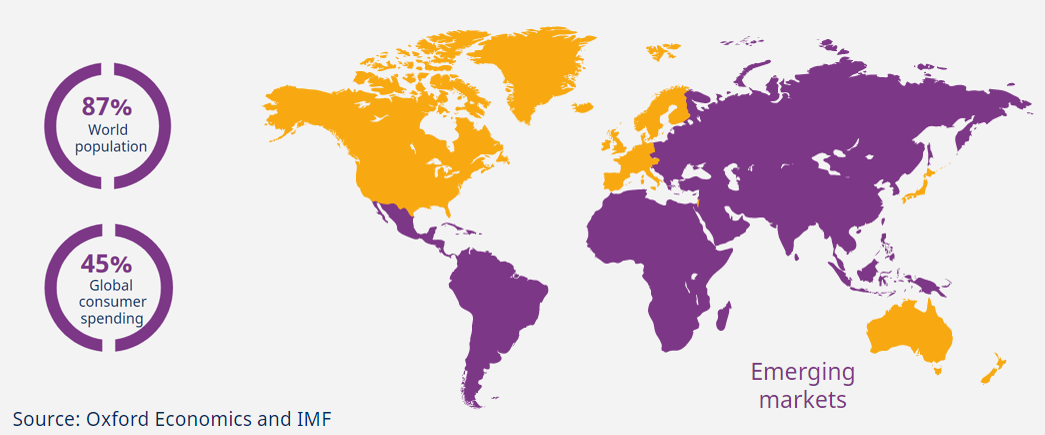

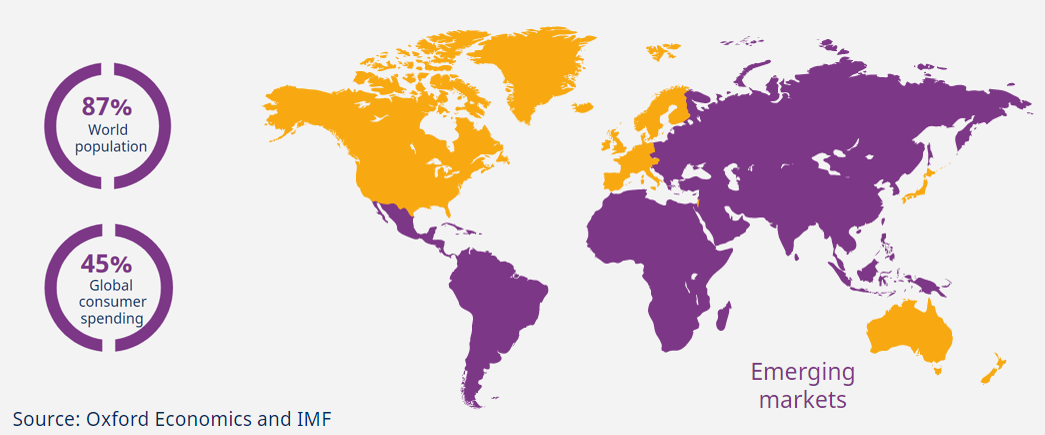

Impact on the Broader Hedge Fund Industry

The closure of Point72's emerging markets fund and the subsequent trader exodus have significant implications for the broader hedge fund industry. It highlights the inherent risks associated with investing in emerging markets and could potentially dampen investor confidence in similar funds. Competitors are likely to reassess their own strategies in light of Point72's actions, potentially leading to a more cautious approach to emerging market investments. The future of emerging market investments remains uncertain, with the potential for both opportunities and significant challenges.

- Potential impact on investor sentiment towards emerging market funds: [Discuss potential shifts in investor confidence]

- Analysis of competitor strategies: [Speculate on how competitors will adjust their strategies]

- Predictions for the future of emerging markets investment: [Offer informed predictions about the future of the sector]

Conclusion: Understanding the Point72 Emerging Markets Fund Closure

The closure of Point72's emerging markets fund and the resulting trader exodus mark a significant event in the hedge fund industry. While the precise reasons remain somewhat unclear, a combination of poor performance, changing market conditions, and potential internal restructuring likely contributed to the decision. The impact on investor confidence and the broader industry will unfold in the coming months. Understanding this situation requires close monitoring of the market and a thorough analysis of the evolving landscape of emerging market investments. To stay informed, continue following the developments and explore further resources on emerging markets investment and hedge fund performance. The implications of this Point72 Emerging Markets Fund closure are far-reaching and warrant continued attention from investors and industry experts alike.

Featured Posts

-

Dead Reckoning Part Two Mission Impossible Standee Makes A Statement At Cinema Con

Apr 26, 2025

Dead Reckoning Part Two Mission Impossible Standee Makes A Statement At Cinema Con

Apr 26, 2025 -

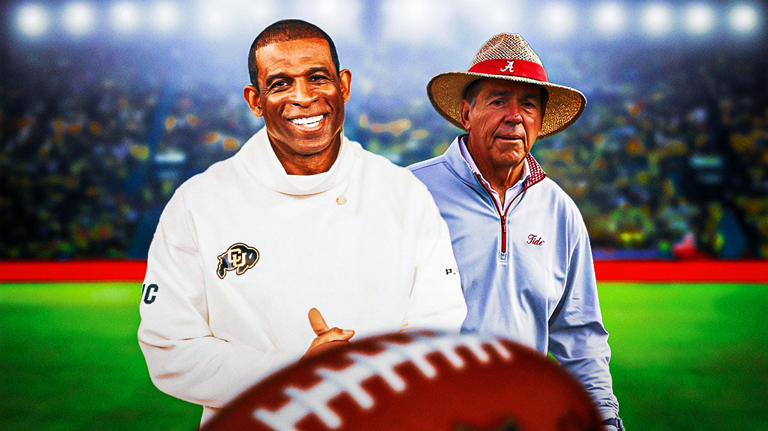

Deion Sanders Influence Shedeurs Recruitment And Nfl Connections

Apr 26, 2025

Deion Sanders Influence Shedeurs Recruitment And Nfl Connections

Apr 26, 2025 -

Are High Stock Valuations A Concern Bof A Weighs In

Apr 26, 2025

Are High Stock Valuations A Concern Bof A Weighs In

Apr 26, 2025 -

Open Ais Chat Gpt The Ftc Investigation And Its Potential Fallout

Apr 26, 2025

Open Ais Chat Gpt The Ftc Investigation And Its Potential Fallout

Apr 26, 2025 -

Sunken Wwii Warship Reveals Well Preserved Car

Apr 26, 2025

Sunken Wwii Warship Reveals Well Preserved Car

Apr 26, 2025

Latest Posts

-

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025 -

Pne Groups Wind Energy Portfolio Expansion Two New Additions

Apr 27, 2025

Pne Groups Wind Energy Portfolio Expansion Two New Additions

Apr 27, 2025 -

Two New Wind Farms Join Pne Groups Growing Portfolio

Apr 27, 2025

Two New Wind Farms Join Pne Groups Growing Portfolio

Apr 27, 2025 -

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025 -

Pne Group Adds Two Wind Farms Boosting Renewable Energy Capacity

Apr 27, 2025

Pne Group Adds Two Wind Farms Boosting Renewable Energy Capacity

Apr 27, 2025