Companies Under Scrutiny: Taiwan Regulator's ETF Sales Pressure Investigation

Table of Contents

Companies Facing Scrutiny: Who are the Key Players?

Several prominent ETF issuers in Taiwan are currently under investigation for alleged sales pressure tactics. While the SFB has not publicly named all the companies involved, preliminary reports suggest that several major players, responsible for a significant portion of the Taiwan ETF market, are facing scrutiny. This includes companies specializing in various ETF sectors, ranging from technology and finance to consumer goods and real estate.

- Specific Company A: A leading ETF issuer with a significant market share in technology-focused ETFs. Allegations against this company reportedly involve aggressive sales targets and potentially misleading information provided to clients.

- Specific Company B: A major player in the Taiwanese ETF market, focusing on diversified and broad market ETFs. The investigation into this company appears to be centered around allegations of pressuring financial advisors to prioritize their products.

- Specific Company C: This company specializes in smaller-cap and thematic ETFs. Reports suggest irregularities concerning the sales practices towards retail investors.

Understanding the roles of these companies in the Taiwan stock market and their specific ETF offerings is crucial to fully grasping the extent of this investigation and its potential consequences. These are not simply "suspect companies"; they represent a considerable portion of the Taiwanese ETF market. The investigation's impact on the wider "Taiwan ETF" ecosystem is therefore considerable.

Allegations of Misconduct: What are the Specific Charges?

The allegations against the companies under investigation primarily revolve around aggressive sales pressure tactics and potentially misleading sales practices. These practices may constitute violations of securities regulations. Specific accusations include:

- Misrepresentation of ETF performance: Exaggerating past returns or downplaying potential risks associated with specific ETFs.

- Inappropriate sales targets and incentives: Pressuring sales personnel to meet unrealistic targets, potentially incentivizing unethical sales behavior.

- Provision of misleading information: Providing incomplete or inaccurate information to clients about ETF characteristics and investment strategies.

- Churning: Excessive trading in client accounts to generate commissions.

These "misleading sales practices" and "sales pressure tactics" raise serious concerns regarding market manipulation and regulatory violations. The SFB is taking these allegations very seriously, indicating the gravity of the situation and the potential for significant consequences for those found responsible.

The Taiwan Regulator's Response: Investigation Details and Potential Penalties

The SFB's response to these allegations has been swift and decisive. The regulator has launched comprehensive investigations, involving detailed inspections of company records and interviews with employees and clients. This "regulatory action" demonstrates a commitment to maintaining market integrity and protecting investors.

- Investigations: Thorough reviews of sales records, marketing materials, and internal communications.

- Inspections: On-site inspections of company offices to gather evidence and assess compliance practices.

- Interviews: Interviews with company employees, financial advisors, and investors to gather firsthand accounts of sales practices.

The potential penalties for the companies involved are substantial, including:

- Heavy fines: Significant financial penalties proportional to the severity of the violations.

- Sanctions: Possible restrictions on business activities, including limitations on ETF issuance or distribution.

- Reputational damage: Significant harm to the company's image and credibility in the market.

The ultimate goal of the SFB's investigation is to maintain the integrity of the "Taiwan ETF" market, protect investors, and deter future misconduct.

Impact on the ETF Market in Taiwan: Short-Term and Long-Term Effects

The investigation is already having a discernible impact on the Taiwanese ETF market. Short-term effects include:

- Reduced ETF trading volume: Uncertainty surrounding the investigation may cause some investors to hesitate before trading ETFs.

- Negative investor sentiment: The allegations of misconduct can erode investor confidence in the market.

The long-term effects remain to be seen but could include:

- Increased regulatory oversight: The investigation may lead to stricter regulations and more robust oversight of ETF issuers.

- Improved transparency and disclosure: Companies might enhance their disclosure practices to build investor trust.

- Shift in investor preferences: Investors might re-evaluate their investment strategies and potentially shift towards different ETF issuers or asset classes.

This "market impact" underlines the importance of a transparent and well-regulated financial environment.

Investor Concerns and Protection: Guidance for Investors

Investors may be concerned about the implications of this investigation on their investments in affected ETFs. Here's some advice:

- Review your portfolio: Assess your holdings and identify any ETFs issued by the companies under investigation.

- Seek professional advice: Consult with a qualified financial advisor to discuss your investment strategy and potential risks.

- Stay informed: Keep abreast of developments in the investigation through reputable news sources.

- Diversify your investments: Diversification is always a crucial aspect of risk mitigation.

Remember, thorough research and "risk mitigation" strategies are key to navigating the complexities of the investment world. Utilize all available resources to protect your investment portfolio.

Conclusion: The Future of ETF Regulation in Taiwan – Learning from the Investigation

The Taiwan regulator's investigation into alleged sales pressure on ETFs is a significant development with far-reaching implications. This investigation underscores the crucial role of regulatory oversight in maintaining a fair and transparent ETF market. The outcome will likely shape the future of ETF regulation in Taiwan, leading to stricter rules, greater transparency, and enhanced investor protection. Investors must remain vigilant, informed, and proactive in managing their investments. Stay updated on the investigation and seek professional financial advice if you have concerns about your Taiwan ETF investments. Understanding the nuances of "Taiwan ETF" investing is critical in navigating this evolving market landscape.

Featured Posts

-

Analyzing The Performance Of Kim Outman And Sauer In The Dodgers System

May 15, 2025

Analyzing The Performance Of Kim Outman And Sauer In The Dodgers System

May 15, 2025 -

Erbakan In Kibris Mesaji Sehitler Anisina Kirmizi Cizgi Vurgusu

May 15, 2025

Erbakan In Kibris Mesaji Sehitler Anisina Kirmizi Cizgi Vurgusu

May 15, 2025 -

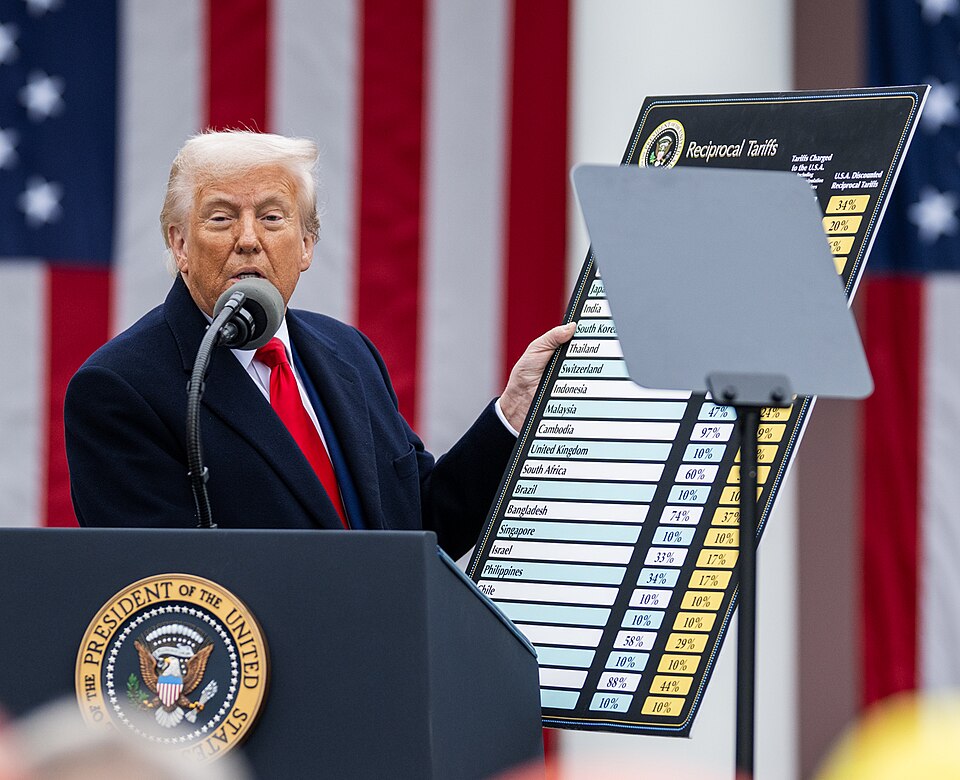

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025 -

R5 45 Crore Penalty Fiu Ind Actions Against Paytm Payments Bank For Money Laundering Lapses

May 15, 2025

R5 45 Crore Penalty Fiu Ind Actions Against Paytm Payments Bank For Money Laundering Lapses

May 15, 2025 -

Nhl Stars Top Ducks In Overtime Thriller Carlsson Scores Two

May 15, 2025

Nhl Stars Top Ducks In Overtime Thriller Carlsson Scores Two

May 15, 2025