CoreWeave (CRWV) Stock Plunge Thursday: Understanding The Market Reaction

Table of Contents

Analyzing the CoreWeave (CRWV) Stock Drop

The Impact of Recent News and Announcements

Several factors likely contributed to the negative movement in CoreWeave (CRWV) stock. Understanding these is crucial for assessing the situation's severity and potential long-term effects. Let's examine some potential culprits:

-

Earnings Reports: (Insert details about any recent earnings reports, including whether they met or missed expectations, and any significant changes in revenue, profits, or guidance. Link to the official report if available.) For example, a significant miss in earnings projections or a lowered future guidance could easily spook investors.

-

SEC Filings: (Mention any relevant SEC filings, such as an 8-K, that may have disclosed negative news, like a lawsuit, regulatory investigation, or accounting irregularities. Link to the filing.) Unexpected legal challenges or regulatory hurdles can severely impact investor confidence.

-

Partnerships and Contracts: (Discuss any recent news about partnerships or contracts, whether positive or negative. Did a major partnership fall through? Were there any unexpected contract delays?) The loss of a significant partner or a delay in a crucial contract could explain the drop.

The relationship between this news and the market's reaction is typically a matter of investor perception. Negative news, even if relatively minor, can trigger a sell-off if it challenges investor confidence in the company's future growth. The long-term effects depend on how effectively CoreWeave addresses the underlying issues and manages future communications.

Market Sentiment and Investor Confidence

The CoreWeave (CRWV) stock drop didn't occur in a vacuum. The overall market sentiment surrounding CoreWeave and the broader technology sector played a significant role.

-

Analyst Ratings: (Mention any downgrades from prominent analysts. What were their reasons? Links to analyst reports are crucial.) Negative analyst ratings often exacerbate sell-offs.

-

Trading Volume: (Provide data on the trading volume on Thursday compared to previous days. A significant spike in trading volume often accompanies a large price drop.) High volume indicates strong selling pressure.

-

Short Interest: (Discuss the level of short interest in CoreWeave stock. High short interest makes the stock more vulnerable to downward pressure.) A high short interest means many investors are betting against the stock.

These factors combined contributed to a significant erosion of investor confidence in CoreWeave's short-term and long-term prospects.

Competition and Industry Dynamics

CoreWeave operates in a highly competitive cloud computing and AI infrastructure market. Competitive pressures also played a role in the stock plunge.

-

Competitor Actions: (Mention any recent announcements or actions from competitors that might have negatively impacted CoreWeave’s market share or investor perception.) Aggressive pricing strategies or new product launches from competitors can put pressure on CoreWeave.

-

Market Trends: (Discuss any broader industry trends, such as economic slowdowns or shifts in customer demand, that might have negatively impacted CoreWeave's business.) A general downturn in the tech sector can affect even well-performing companies.

CoreWeave's ability to maintain its competitive edge and effectively navigate these dynamics will be crucial for future success and investor confidence in CoreWeave (CRWV) stock.

Understanding the Market Reaction to CoreWeave (CRWV)

Immediate Impact on Stock Price and Trading Volume

The CoreWeave (CRWV) stock plunge was dramatic. (Insert specific data: percentage drop, closing price, opening price, and trading volume. Include a chart or graph showing the stock price movement on Thursday.) The significant drop and high trading volume indicate a swift and forceful market response. The timing of the plunge likely coincided with the release of negative news or a change in investor sentiment.

Investor Behavior and Trading Strategies

Investor behavior during the CoreWeave (CRWV) stock drop reflected a mixture of fear and uncertainty.

-

Sell-offs: (Discuss the scale of sell-offs, indicating potential panic selling.) Rapid sell-offs are common during significant price drops.

-

Short-Selling Activity: (Note any increase in short-selling activity. Short-selling exacerbates downward pressure on stock prices.) Increased short-selling often amplifies the stock's decline.

-

Hedging Strategies: (Mention any evidence of investors using hedging strategies to protect against further losses.) Hedging strategies can help mitigate risk but may not prevent losses.

The divergence in investor opinions stemmed from varying interpretations of the negative news and differing risk tolerances. Some investors saw the drop as a buying opportunity, while others opted to cut their losses.

Potential Long-Term Implications for CoreWeave (CRWV)

The long-term implications of this stock plunge for CoreWeave remain uncertain.

-

Valuation: (Discuss how the drop impacted CoreWeave's market capitalization and valuation.) The stock's valuation may have been significantly affected.

-

Future Growth: (Analyze how the plunge could impact CoreWeave's ability to secure funding, attract talent, and pursue growth initiatives.) A lower valuation can make it harder for the company to raise capital or attract top talent.

-

Investor Relations: (Discuss the need for transparent communication and strong investor relations to rebuild confidence.) Effective communication is vital for reassuring investors and restoring confidence.

Conclusion

This analysis of the CoreWeave (CRWV) stock plunge on Thursday highlighted the influence of recent news, market sentiment, and competitive dynamics. Understanding these factors is crucial for investors seeking to navigate the volatility of the tech market. The swift and significant drop underscores the importance of staying informed and conducting thorough due diligence before making investment decisions.

Call to Action: Stay informed about CoreWeave (CRWV) stock and its performance by regularly checking reliable financial news sources and conducting thorough due diligence. Analyzing the factors affecting CRWV stock price fluctuations will help you make informed investment decisions regarding CoreWeave (CRWV) stock. Remember to diversify your portfolio and manage your risk appropriately when investing in volatile stocks like CRWV.

Featured Posts

-

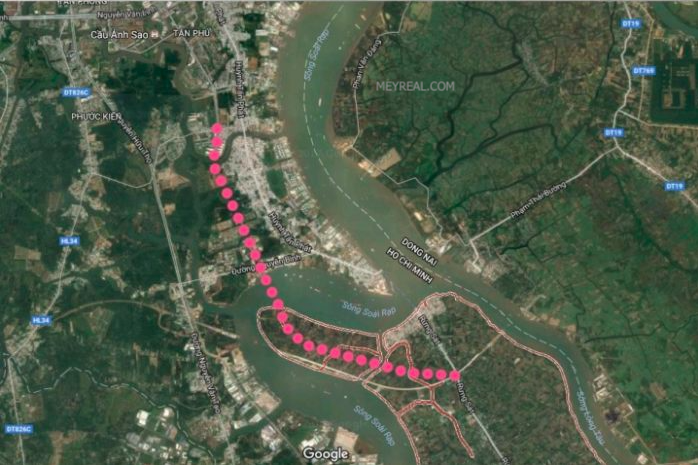

Thong Tin Du An Cau Ma Da Khoi Cong Thang 6 Ket Noi Dong Nai Binh Phuoc

May 22, 2025

Thong Tin Du An Cau Ma Da Khoi Cong Thang 6 Ket Noi Dong Nai Binh Phuoc

May 22, 2025 -

Warner Bros Eyes Reddit Post For Sydney Sweeney Film Adaptation

May 22, 2025

Warner Bros Eyes Reddit Post For Sydney Sweeney Film Adaptation

May 22, 2025 -

Core Weave Inc Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025

Core Weave Inc Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025 -

Ford Nissan Ev Battery Plant An Exclusive Analysis Of The Collaboration

May 22, 2025

Ford Nissan Ev Battery Plant An Exclusive Analysis Of The Collaboration

May 22, 2025 -

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Truc Giao Thong

May 22, 2025

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Truc Giao Thong

May 22, 2025