CoreWeave Inc. (CRWV) Stock Surge On Tuesday: Reasons Behind The Rise

Table of Contents

Increased Investor Confidence and Market Sentiment

The surge in CoreWeave's stock price can be partly attributed to a broader positive shift in market sentiment towards the tech sector, and cloud computing in particular. Positive market trends often fuel investor confidence, leading to increased buying pressure on promising companies like CoreWeave. Several factors contributed to this improved sentiment:

- Positive earnings reports from competitors: Strong performance from other major players in the cloud computing space boosted overall sector confidence, indirectly benefiting CoreWeave.

- Growing demand for AI infrastructure: The explosive growth of artificial intelligence continues to drive demand for powerful, specialized computing infrastructure, a market where CoreWeave holds a strong position. This increasing demand translates directly into higher revenue potential for CoreWeave.

- Increased institutional investor interest: Large institutional investors are increasingly recognizing CoreWeave's potential for growth, leading to significant capital inflows. This injection of capital further fuels the stock's upward trajectory.

- Positive media coverage: Favorable news reports and analyst commentary can significantly impact investor perception and drive increased trading activity, contributing to a stock price increase. Recent positive press surrounding CoreWeave likely played a role in Tuesday's surge.

Strategic Partnerships and Business Developments

CoreWeave's recent strategic initiatives also contributed significantly to the stock's rise. Successful partnerships and business developments often signal future growth and profitability, attracting investors and driving up stock valuations. Potential contributing factors include:

- New partnerships with major technology companies: Collaborations with industry giants can provide CoreWeave with access to new markets and technologies, expanding its reach and market share.

- Expansion into new markets or geographic regions: Entering new markets often signifies growth potential and diversification, reducing reliance on a single market.

- Launch of new products or services: Innovative offerings catering to the growing demand for AI and cloud computing solutions can significantly enhance CoreWeave's competitive advantage and attract new clients.

- Successful completion of a significant funding round: Securing substantial funding validates CoreWeave's business model and provides the resources for future growth and expansion, bolstering investor confidence.

The Role of Artificial Intelligence (AI) in CoreWeave's Growth

CoreWeave's focus on providing cutting-edge infrastructure tailored for AI workloads is a key driver of its growth and investor interest. The company's specialized infrastructure allows it to effectively cater to the booming AI sector's needs.

- CoreWeave's specialized infrastructure for AI workloads: The company’s infrastructure is designed to handle the computationally intensive tasks required for AI development and deployment, making it a highly attractive option for AI companies.

- Attracting clients in the booming AI sector: CoreWeave is actively attracting major clients in the rapidly expanding AI sector, solidifying its position as a key provider of AI infrastructure.

- Potential for future growth driven by AI advancements: As AI continues to evolve and its applications expand, CoreWeave is well-positioned to benefit from this growth, leading to significant long-term potential.

Short Squeeze and Momentum Trading

While fundamental factors played a role, the rapid increase in CoreWeave's stock price also suggests the potential influence of short-term trading dynamics.

- High short interest in CRWV prior to the surge: A high level of short selling before the price increase created a situation ripe for a short squeeze.

- Increased buying pressure from short-covering: As the stock price began to rise, short sellers likely rushed to cover their positions, further fueling the upward momentum.

- Potential for sustained upward momentum or a correction: The dramatic increase raises the possibility of either sustained growth or a subsequent correction as the market rebalances.

Conclusion: Understanding the CoreWeave (CRWV) Stock Surge and Future Outlook

The CoreWeave (CRWV) stock surge on Tuesday was likely a confluence of factors, including positive market sentiment, strategic business developments, the growing importance of AI, and potentially short-term trading dynamics. The company's focus on AI infrastructure positions it well for future growth within the rapidly expanding cloud computing and AI markets. However, it's crucial to remember that the stock market is inherently volatile. While CoreWeave's prospects seem promising, investors should always exercise caution and conduct thorough due diligence before making any investment decisions. Understanding the risks associated with investing in CRWV is paramount. Before investing in CoreWeave stock or any other stock, remember to conduct comprehensive research and consider consulting a financial advisor to assess your risk tolerance and investment goals.

Featured Posts

-

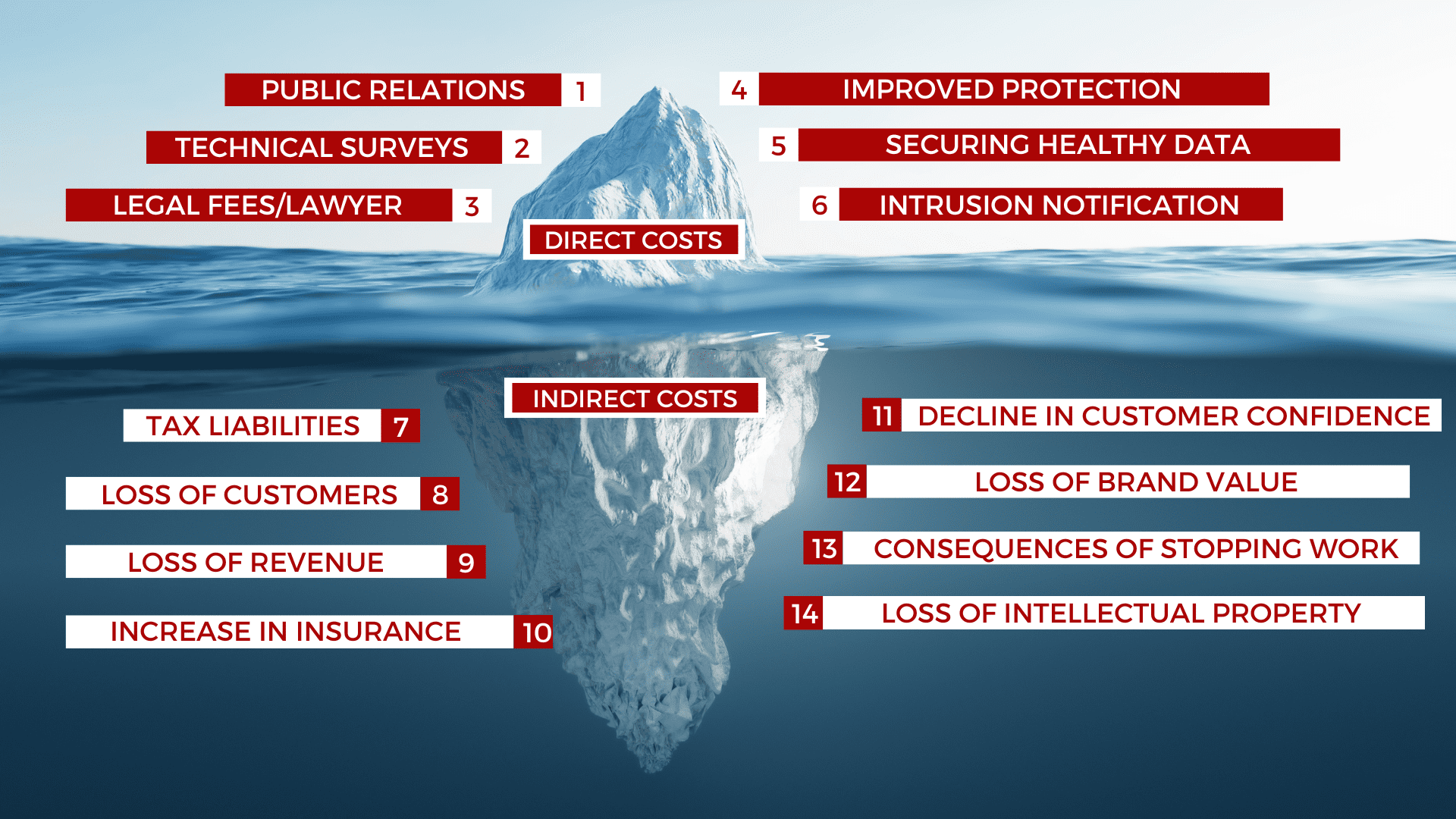

Cyberattack Costs Marks And Spencer 300 Million Full Impact Analysis

May 22, 2025

Cyberattack Costs Marks And Spencer 300 Million Full Impact Analysis

May 22, 2025 -

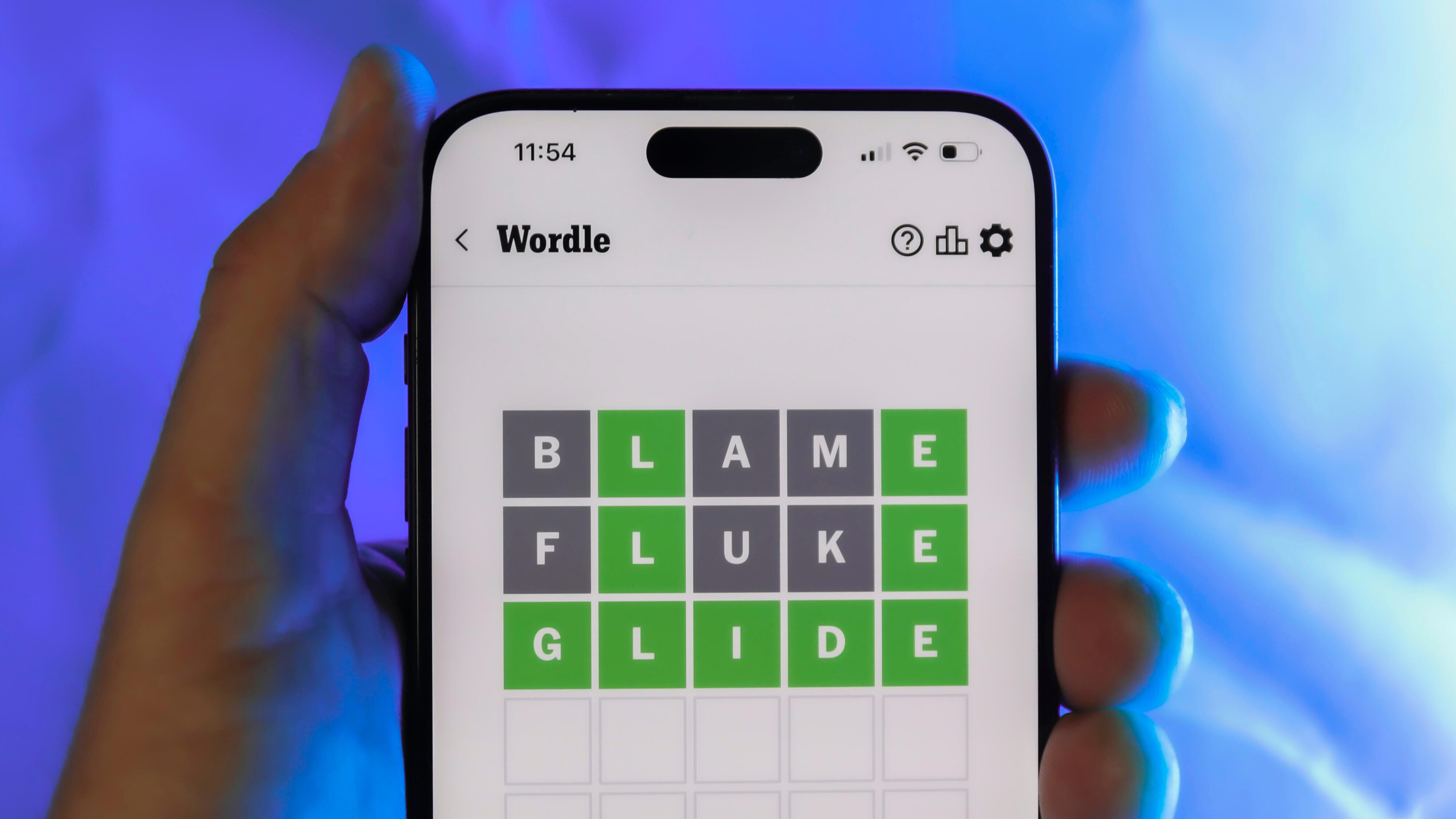

Wordle 1366 Hints And Answer For Todays Puzzle March 16th

May 22, 2025

Wordle 1366 Hints And Answer For Todays Puzzle March 16th

May 22, 2025 -

Abn Amro Dutch Central Bank Investigates Bonus Payments

May 22, 2025

Abn Amro Dutch Central Bank Investigates Bonus Payments

May 22, 2025 -

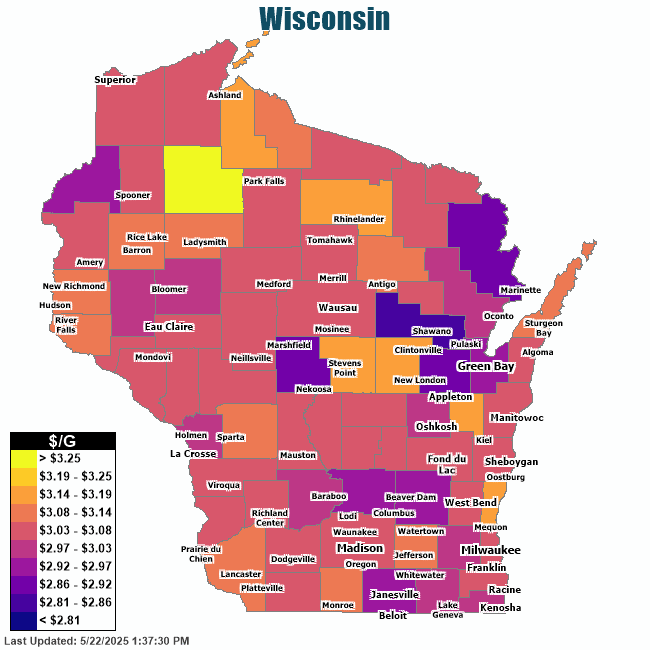

Gas Prices In Wisconsin Rise By 3 Cents Reaching 2 98

May 22, 2025

Gas Prices In Wisconsin Rise By 3 Cents Reaching 2 98

May 22, 2025 -

21 Year Old Peppa Pig Mystery Finally Solved Fans React

May 22, 2025

21 Year Old Peppa Pig Mystery Finally Solved Fans React

May 22, 2025